The composition of our portfolio influences how it reacts to a bear market, how quickly it bounces back, and how it protects us against inflation.

We talk a lot about sector allocation, i.e., having stocks in different economic sectors. While this is very important, there’s more to it than that. It is also important to look at how much of our portfolio is in holdings we consider to be core holdings, educated guesses, and falling knives, and the weight of each stock in the portfolio.

Portfolio composition: sectors

A quick review of sectors…

- Core sectors are likely less affected by a global recession. They are financial services, healthcare, consumer staples, consumer discretionary, information technology, and industrials.

- Income/stable sectors offer higher yields but less growth potential, and they tend to hurt in economic downturns. They include as REITs, utilities, and communication services.

- Volatile sectors depend on commodity prices that they don’t control therefore, they have volatile cash flow and earnings. They are the energy and materials sectors.

You want stocks in several sectors because in the different phases of an economic cycle, some sectors do well or are resilient while others struggle. In a recession, consumer staples, such as grocery stores, often do well. Consumer discretionary, such as leisure products, restaurants, and apparel, not so much.

You can also diversify your holdings within a sector:

- The industrials sector includes vastly different industries that are not affected at the same time or as much during an economic cycle. This sector includes companies as diverse as Canada National Railway (CNR.TO), Savaria (SIS.TO), Caterpillar (CAT) and Robert Half (RHI).

- Consumer discretionary companies include auto part manufacturers, fast-food restaurants, retail stores, furniture makers, etc.

Must you invest in every sector? No! Invest in sectors you understand. Invest in several sectors to make your portfolio recession-proof. Personally, I don’t like the materials and energy sectors, so I tend not to invest in them.

Want to learn more about getting the best in each sector? Download our Recession-Proof Portfolio Workbook.

Portfolio composition: classify your holdings

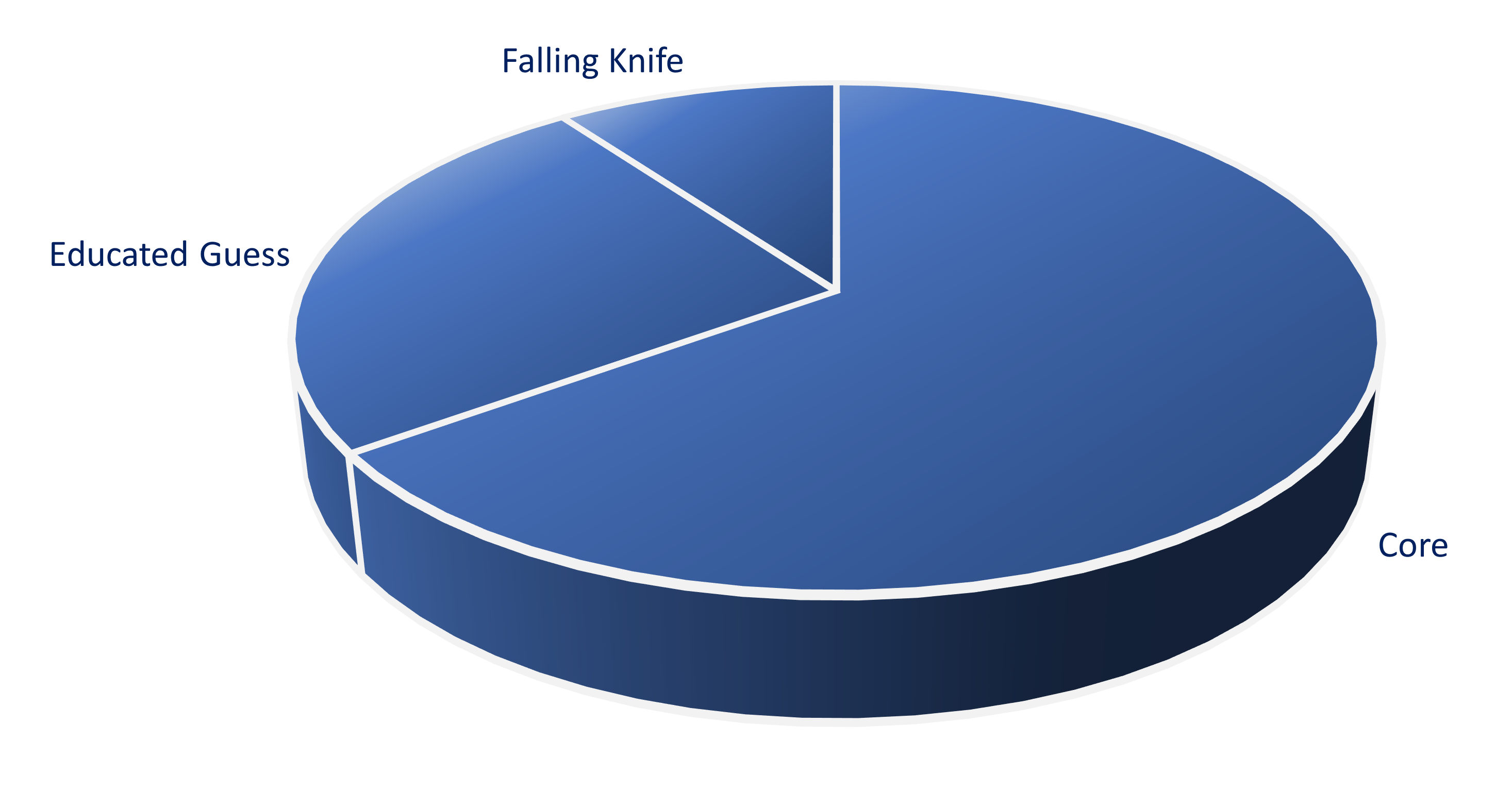

When reviewing the composition of your portfolio, classify each of your holdings as a core holding, educated guess, or falling knife, regardless of their sectors.

Core holdings

A core holding is a company that meets all your investment requirements. The holding period for these stocks is “forever” but, as always, with a quarterly review for good measure. This category should make up most of your holdings.

A core holding is a company that meets all your investment requirements. The holding period for these stocks is “forever” but, as always, with a quarterly review for good measure. This category should make up most of your holdings.

Educated guesses

An educated guess is a company that is almost perfect. Educated guesses usually come with price fluctuations and obvious risks. In other words, they show a strong business model and good metrics, but one thing is off. It could be the dividend triangle, higher debt, potential disruption, a strong competitor, a highly cyclical environment, etc.

Monitor your educated guesses with greater attention than core holdings because their status could change, for better or worse. Hold educated guesses in industries you understand and for which you know how to find information. You must be aware of the potential risks of educated guesses and willing to live with them while the investment thesis stands.

Falling knives

Falling knives, also called speculative plays, are investments that come with high risk and the real possibility of losing money. By definition, a falling knife is a stock that has dropped rapidly, 20-30% faster than the rest of the market. If the market is down 20%, falling knives are companies falling by 40-50%. Usually, a major event put unreasonable pressure on the stock. While catching a falling knife is always dangerous, picking the most resilient, best-performing company in a falling industry could pay off in the rebound.

Since we might be at different periods of our life, have different investment strategies and different risk tolerance levels, what I consider a core holding might be an educated guess for you. The classification you give your holdings is based on your knowledge and experience, and your comfort level with the sector, industry, or company.

After a few years, you might find that one of your core holding has become an educated guess or falling knife, due to changes in the market or environment. Another good reason to review your portfolio quarterly.

Do we need educated guesses and falling knives in a portfolio? For investors who are in the decumulation phase, I tend to agree that there is no need for them; it might be a good idea to not have them, but again, we’re all different.

Portfolio composition: stock weight

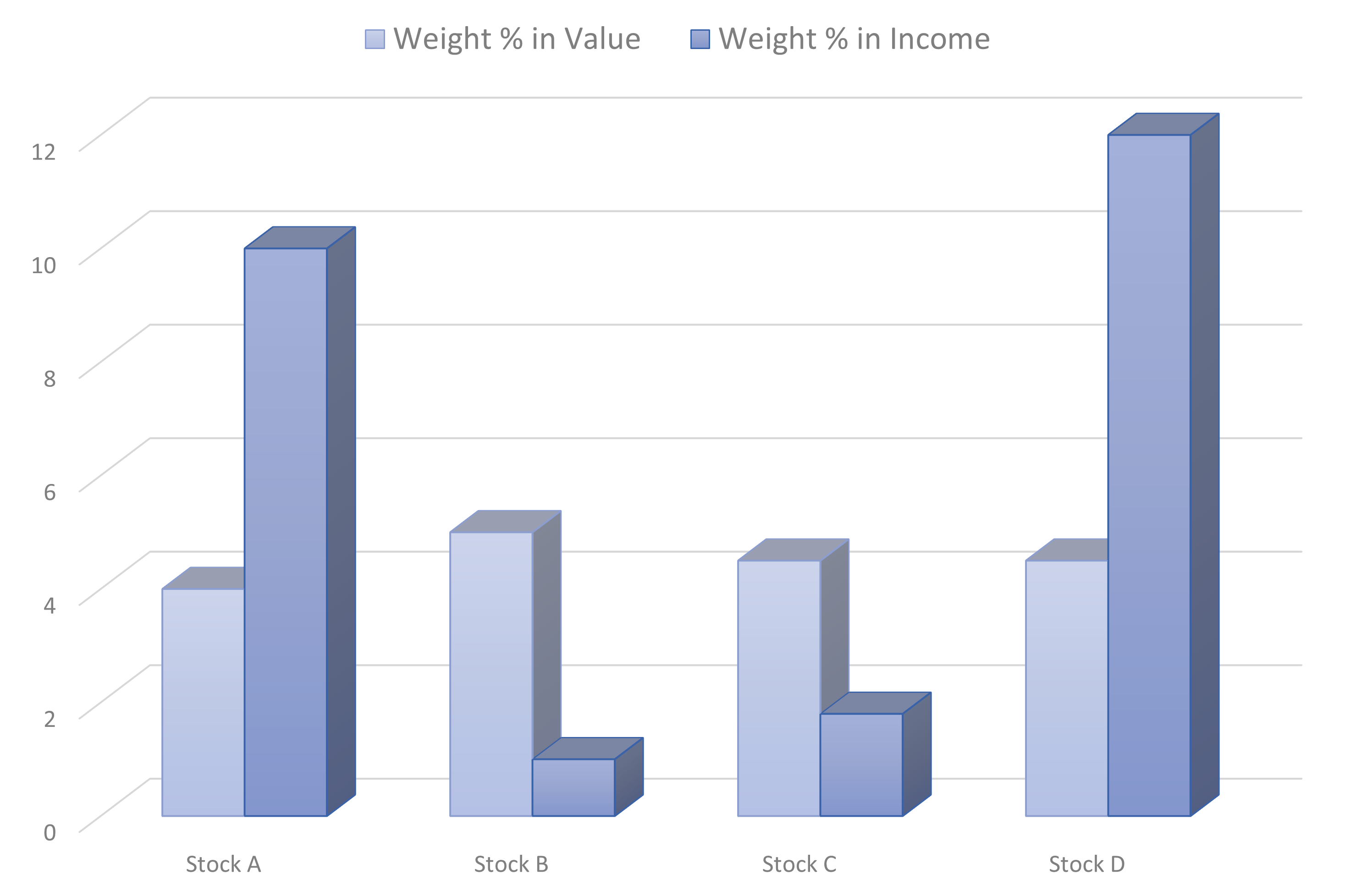

I like each stock to matter so I lean towards granting each one equal weight in my portfolio. If I have 40 stocks, each one has 2.5% weight in portfolio (100/40). In a portfolio of 30 positions, each has a weight of about 3.33%.

You can adjust the weight according to what you consider a core holding vs. an educated guess. Depending on your risk tolerance, you might want a higher weight for core holdings and smaller weightings for non-core holdings. For example, give RY a 5% weight and reduce AAPL to 2.5% if you are concerned about AAPL dropping in value; it has less impact at 2.5% than at 3.33%.

If your focus is the income your portfolio generates, you might also want to identify your stock weighting by the amount of income they generate instead of their value.

Example: $200,000 invested in Apple generates $1,200 in dividends/year (0.6% yield), and $100,000 invested in Enbridge generates $6,500 in dividends/year (6.5%). In value, the exposure to Enbridge is half that of Apple. As a source of income though, the Enbridge exposure is more than 5 times that of Apple.

A portfolio well diversified by weight and by weight of income is very important at retirement.

Final thoughts

The next time you review the composition of your portfolio, look at sector allocation, of course, but also at the nature you attribute to each holding (core, guess, knife), and the weight of each stock in terms of value and income.

[…] The best way to protect your portfolio against whatever happens is to ensure that you have very strong businesses with solid metrics. Review all your stocks, looking at the dividend triangle; ensure they show trends of growing sales, profits, and dividends, and have the business model and growth vectors to continue doing so. You might also want to review the composition of your portfolio. […]