Summary:

- Bank of America benefited from the solid economic situation in the United States.

- The Consumer banking and Wealth Management Divisions are steady growth vectors.

- The bank has shown its ability to grow its revenue while controlling its expenses.

We started the most recent earnings seasons with several results coming from the financial sectors. Among them, investors had the chance to receive some substantial pay check raises. BlackRock (BLK) raised its payout by 8.7% and Wells Fargo (WFC) raised it by 12%. The most impressive increase came from Bank of America (BAC) with a 25% increase. Surfing on a strong US economy, BAC has posted a solid quarter. Is it time to buy some shares? Let’s take a deeper look!

Understanding the Business

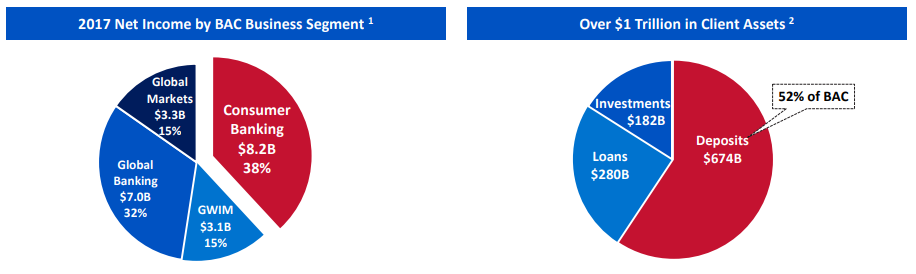

Bank of America Corporation is a bank holding and a financial holding company. The company provides financial products and services to people, companies and institutional investors. The company shows over $1 trillion in assets and has the most consumer deposit share in the U.S. BAC Consumer Banking division. It represents 38% of its net income, 32% for Global Banking, 15% for Global Markets and 15% for Global Wealth and Investment management.

Source: BAC investors presentation

A Look at Their Latest Quarter

On July 16th, BAC reported the following results:

Non-GAAP EPS of $0.63, up by +37%, beat estimates by $0.06.

Revenue of $22.61B, down by -1%, beat estimates by $340M.

Dividend of $0.15/share, +25% increase.

What the CEO said:

“Responsible growth continued to deliver as a driver for every area of the company. We grew consumer and commercial loans; we grew deposits; we grew assets within our Merrill Edge business; we generated more net new households in Merrill Lynch; and we supported more institutional client activity — all of this while we continued to invest in our businesses and began an additional $500 million technology investment, which we intend to spend over the next several quarters, due to the benefits we received from tax reform.”

Growth Vectors

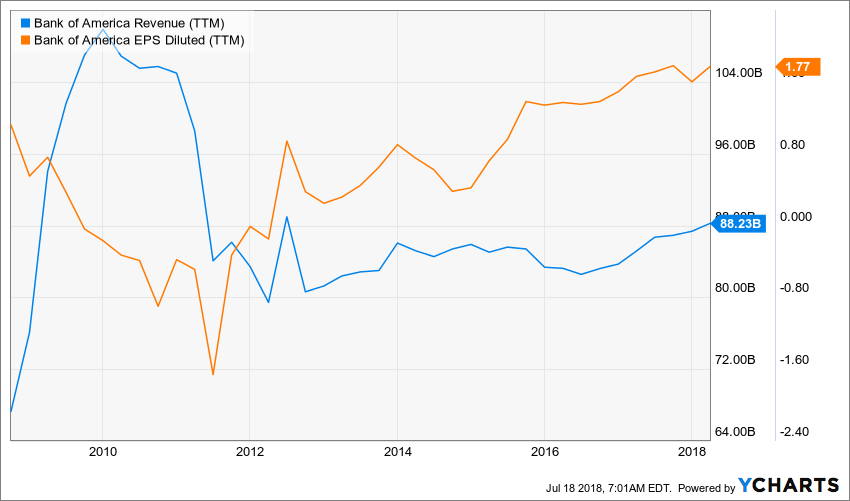

Source: Ycharts

Thanks to its size and strong customer service, BAC has a dominant position in the banking landscape in the U.S. As interest rates are rising, BAC deposits will earn additional income and the spread between loans and savings should improve its margins.

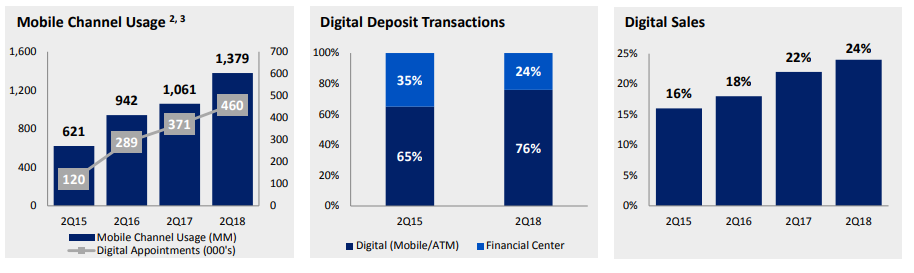

Another aspect I like about BAC is its growing presence in the mobile banking business. Pretty much everything we do is moving into our phone lately. If you can do your grocery shopping, buy a new swimsuit for your kid, and organize your wedding online, you might as well do all your banking. BAC is investing massively to position itself as a strong player in this new playground. With over 25 million clients in its digital sales, BAC is doing something good!

Souce: BAC Q2 2018 Investors Presentation

Dividend Growth Perspective

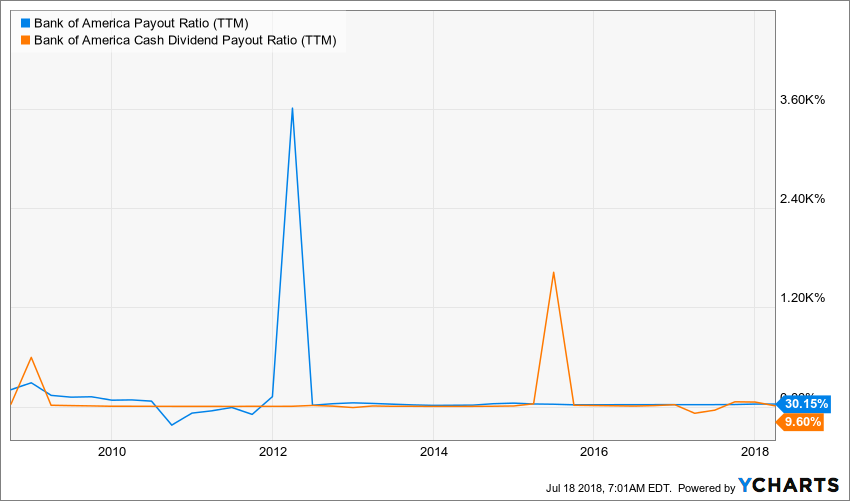

We all know what happened in 2008 and what it did to banks across the world. This is how BAC had to cut its dividend back then and it is slowly coming back on the dividend investors radar. The stock is pretty far away from making the Dividend Achievers List.

Source: Ycharts

After what happened in 2008, there has been a complete revolution in the US banking system. The Government saved banks but added more regulations. BAC is still very far from its $0.64/share policy back in 2008, but we can see a strong growth in the past 5 years. While not an Achiever yet, BAC is making our list of the top financial dividend stocks.

Source: Ycharts

Now that the Government is restraining the bank’s dividend policy, you can count on sustainable payouts for several years to come.

Potential Downsides

When a bank becomes too big, loopholes start to appear, and management could quickly lose grip on its business. We can think of what happened at Wells Fargo not too long ago.

Also, BAC has gone through a serious cost cutting program that boosted earnings for a while. Now that the company is leaner, management will have to find other ways to improve their bottom line.

While BAC puts lots of emphasis on its digital services, other Fintechs are growing rapidly to grab big banks’ market shares in various sub-sectors.

Valuation

After its stock more than doubled between 2016 and 2018, BAC shares are relatively stable since the beginning of 2018. Is it time to pick some shares while it is stuck in a plateau?

Source: Ycharts

As you can see on the PE graph, the right timing to catch some shares was in 2016 while the stock was trading at its lowest PE ratio in 10 years. While BAC doesn’t seem too overvalued right now, it doesn’t like a bargain either.

I’ve used the Dividend Discount Model to establish a fair value. I’ve used a 12% dividend growth rate for the first 10 years as I believe the bank will continue to surf on a strong economy and other raises similar to 2018’s will happen in the next few years. After that, I reduced the growth rate at 6% which is more in line with what a classic bank (notably Canadian banks) are doing.

| Input Descriptions for 15-Cell Matrix | INPUTS | |||

| Enter Recent Annual Dividend Payment: | $0.48 | |||

| Enter Expected Dividend Growth Rate Years 1-10: | 12.00% | |||

| Enter Expected Terminal Dividend Growth Rate: | 6.00% | |||

| Enter Discount Rate: | 9.00% | |||

| Discount Rate (Horizontal) | ||||

| Margin of Safety | 8.00% | 9.00% | 10.00% | |

| 20% Premium | $50.99 | $33.41 | $24.65 | |

| 10% Premium | $46.74 | $30.62 | $22.59 | |

| Intrinsic Value | $42.49 | $27.84 | $20.54 | |

| 10% Discount | $38.24 | $25.06 | $18.48 | |

| 20% Discount | $33.99 | $22.27 | $16.43 | |

Please read the Dividend Discount Model limitations to fully understand my calculations.

Unfortunately, a great entry point would be between $25 and $28. As BAC trades around $30, there is no deal here.

Final Thought

While BAC is a strong play in the U.S. banking industry, I think investors missed the boat that passed a few years ago. Right now, whether you pick JPM, BAC or WFC, you will be paying about 10% over their value. Better keep them on your watch list!

Disclosure: I do hold BLK and WFC in my DividendStocksRock portfolios.

Additional disclosure: The opinions and the strategies of the author are not intended to ever be a recommendation to buy or sell a security. The strategy the author uses has worked for him and it is for you to decide if it could benefit your financial future. Please remember to do your own research and know your risk tolerance.

Leave a Reply