Summary:

#1 PKG stock price has surged in 2017 compared to its competitors

#2 After 6 consecutive years with a dividend increase, PKG can be considered a dividend growth holding

#3 As the corrugated product industry is declining, we can wonder how PKG will find growth in the future

What Makes Packaging Corp of America (PKG) a Good Business?

Packaging Corp of America is a producer of container board and corrugated products in the US. Further, it also produces multi-color boxes and displays, as well as meat boxes and wax-coated boxes for the agricultural industry. The company is present across the U.S., thanks to the acquisition of Boise Inc in 2013:

Source: PKG investors presentation

PKG shows 85% of business in corrugated containers and 15% in white paper. Its main competitors are International Paper (IP) and Westrock (WRK). Both competitors show larger market cap (22.82B and 14.46B respectively).

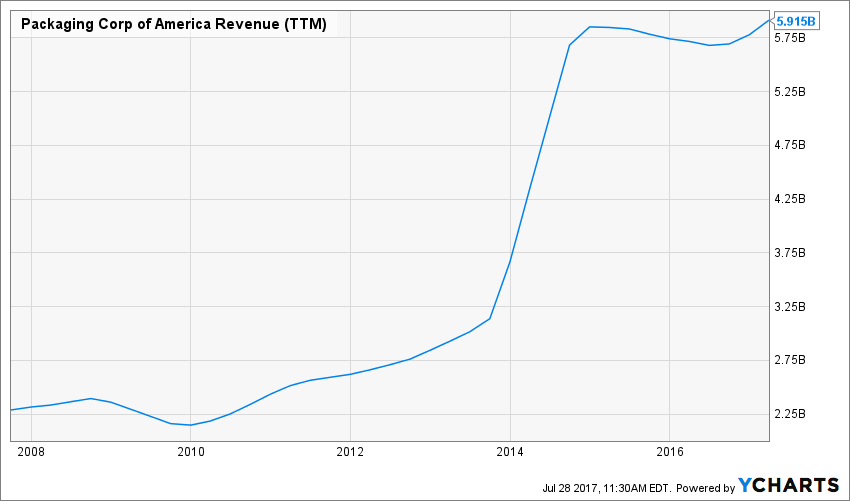

Revenue

Revenue Graph from Ycharts

The important revenue jump that happened between 2014 and 2015 is due to the acquisition of Boise inc for $1.995 Billion during the last quarter of 2013. This acquisition opened the territory of Pacific Northwest to PKG and boosted their container board capacity by 42% and their corrugated product volume by 30%.

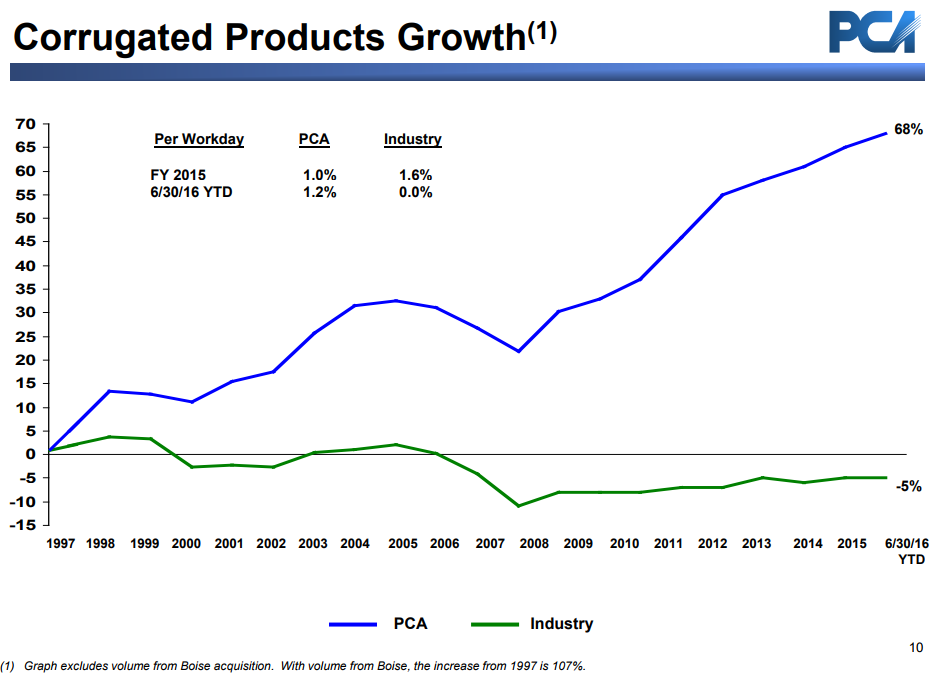

While we may think the industry of corrugated boxes may be one of the biggest winner of the “Amazon era” where everything is shipped using these kinds of products, the global industry is actually declining:

Source: PKG investors presentation

While PKG specializes in corrugated products and has gained serious market shares (roughly 10% of the market today), the company still evolve in a difficult environment.

How PKG fares vs My 7 Principles of Investing

We all have our methods for analyzing a company. Over the years of trading, I’ve been through several stock research methodologies from various sources. This is how I came up with my 7 investing principles of dividend investing. Let’s take a closer look at them.

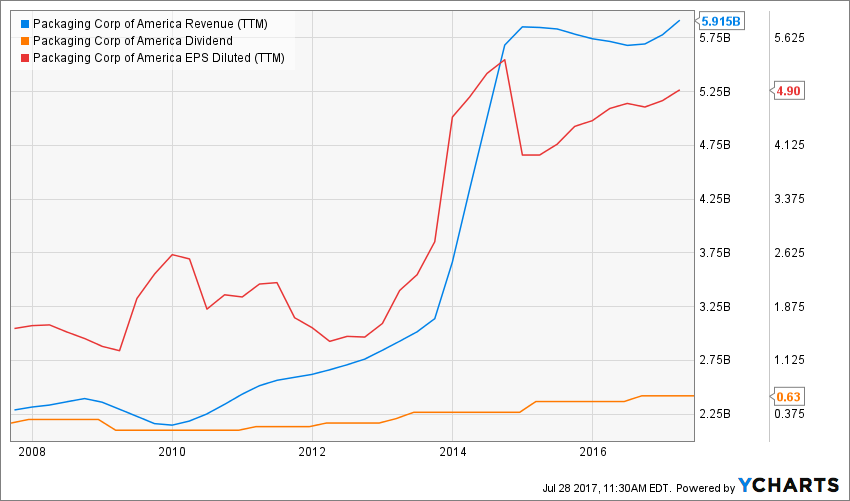

Source: Ycharts

Principle #1: High Dividend Yield Doesn’t Equal High Returns

My first investment principle goes against many income seeking investors’ rule: I try to avoid most companies with a dividend yield over 5%. Few investments like this will be made in my case (you can read my case against high dividend yield here). The reason is simple; when a company pays a high dividend, it’s because the market thinks it’s a risky investment… or that the company has nothing else but a constant cash flow to offer its investors. However, high yield hardly come with dividend growth and this is what I am seeking most.

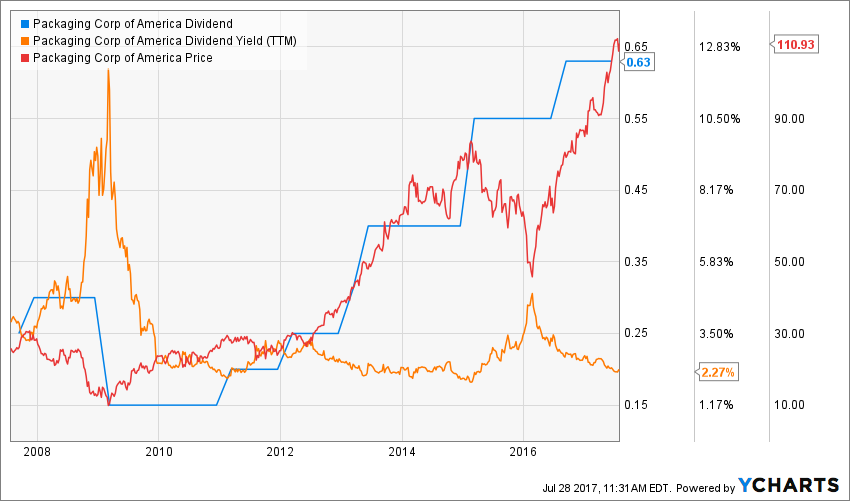

Source: data from Ycharts.

PKG dividend yield has been going between 2% and 3.5% for most of the past decade (besides 2 stock price dip in 2009 and 2016). At the current yield of 2.27%, nothing indicates the company is showing any problems.

PKG meets my 1st investing principles.

Principle#2: Focus on Dividend Growth

Speaking of which, my second investing principle relates to dividend growth as being the most important metric of all. It proves management’s trust in the company’s future and is also a good sign of a sound business model. Over time, a dividend payment cannot be increased if the company is unable to increase its earnings. Steady earnings can’t be derived from anything else but increasing revenue. Who doesn’t want to own a company that shows rising revenues and earnings?

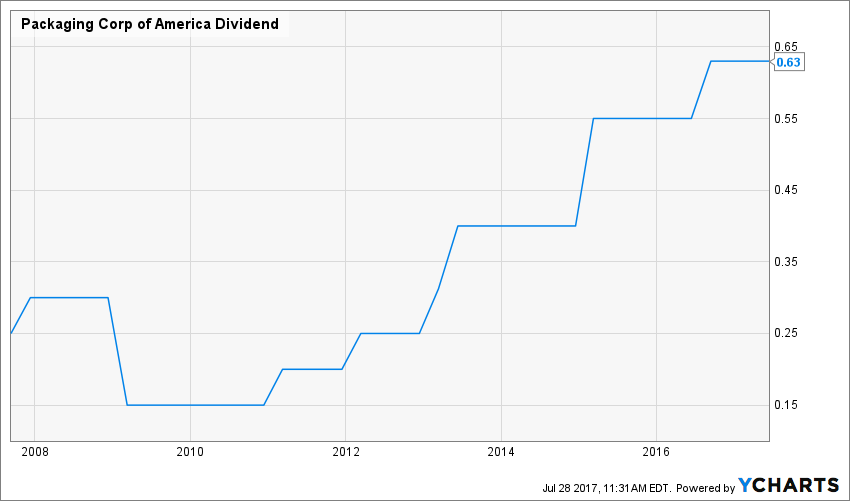

Source: Ycharts

Packaging Corp of America made a surprising decision of cutting their dividend in 2009. At this time, the economy was in a deep recession and unemployment rate kept hiking higher each quarter. Management made a courageous decision to cut their dividend upon darker economic outlook for the future. Since then, the company has compensated shareholders with 6 consecutive years with a dividend raise. A further analysis of the company payout ratios will tell us if history will repeat itself or if this was just a smart move considering the previous headwinds’ management was facing.

PKG meets my 2nd investing principle.

Principle #3: Find Sustainable Dividend Growth Stocks

Past dividend growth history is always interesting and tells you a lot about what happened with a company. As investors, we are more concerned about the future than the past. This is why it is important to find companies that will be able to sustain their dividend growth.

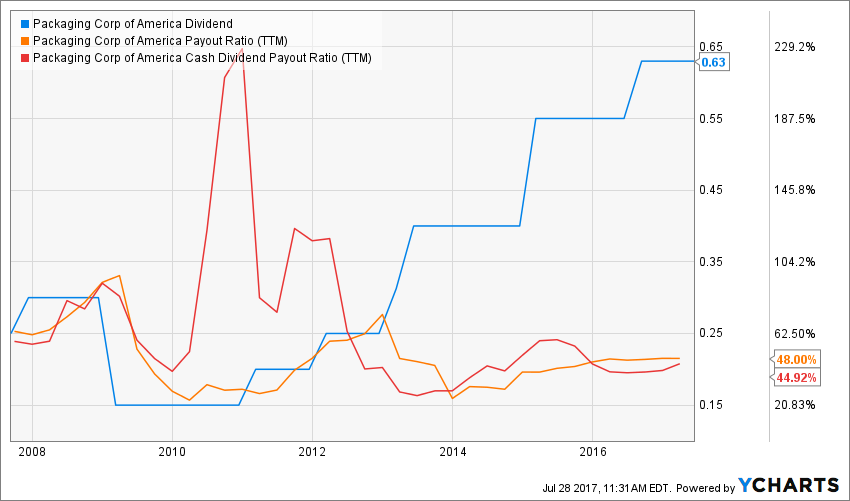

Source: data from Ycharts.

We can now understand how they company cut their dividend as the cash payout ratio rose over 200% the following year. This means the company was burning significant cash and hasn’t enough to pay their shareholders. However, the situation has greatly improved since then.

With low payout ratio and already 6 consecutive years with a dividend increase, PKG is well on its way to become a Dividend Achiever in a few years. The Dividend Achievers Index refers to all public companies that have successfully increased their dividend payments for at least ten consecutive years. At the time of writing this article, there were 265 companies that achieved this milestone. You can get the complete list of Dividend Achievers with comprehensive metrics here.

PKG meets my 3rd investing principle.

Principle #4: The Business Model Ensure Future Growth

I’ve given some thoughts about PKG business model and I’m not sure where the company advantages will ensure growth in the future. Let’s put it this way: a card box is a card box. The world may need them, but they don’t need PKG’ specific card boxes…

The company has been able to ensure growth through acquisitions over the past decade and enjoyed relatively high margins as the industry is controlled by a handful of players. However, I doubt PKG can find “bargains” to acquire in this industry in the upcoming years.

PKG doesn’t meet my 4th investing principle.

Principle #5: Buy When You Have Money in Hand – At The Right Valuation

I think the perfect timing to buy stocks is when you have money. Sleeping money is always a bad investment. However, it doesn’t mean that you should buy everything you see because you have some savings aside. There is a valuation work to be done. To achieve this task, I will start by looking at how the stock market valued the stock over the past 10 years by looking at its PE ratio:

Source: data from Ycharts.

Wow…. Looking at PKG PE ratio is like looking at a roller coaster. Is this company should trade an 8 PE or 28? There is one thing this graph is telling us: the recent stock surge is 100% links to Mr. Market thinking PKG is a great company. Earnings didn’t support such rise.

Digging deeper into this stock valuation, I will use a double stage dividend discount model. As a dividend growth investor, I rather see companies like big money making machine and assess their value as such.

| Input Descriptions for 15-Cell Matrix | INPUTS |

| Enter Recent Annual Dividend Payment: | $2.52 |

| Enter Expected Dividend Growth Rate Years 1-10: | 8.00% |

| Enter Expected Terminal Dividend Growth Rate: | 5.00% |

| Enter Discount Rate: | 10.00% |

Here are the details of my calculations:

| Calculated Intrinsic Value OUTPUT 15-Cell Matrix | |||

| Discount Rate (Horizontal) | |||

| Margin of Safety | 9.00% | 10.00% | 11.00% |

| 20% Premium | $101.15 | $80.23 | $66.33 |

| 10% Premium | $92.72 | $73.55 | $60.80 |

| Intrinsic Value | $84.29 | $66.86 | $55.27 |

| 10% Discount | $75.86 | $60.17 | $49.75 |

| 20% Discount | $67.43 | $53.49 | $44.22 |

Source: how to use the Dividend Discount Model

While the company raised their dividend 14.5% in 2016, I don’t think this type of dividend growth is sustainable over the long haul. For this reason, I’ve taken an 8% dividend growth rate for the first 10 years and then reduced it to 5% as I don’t see how the business of packaging could possibly surge in the future. PKG seems highly overvalued.

PKG doesn’t meet my 5th investing principle

Principle #6: The Rationale Used to Buy is Also Used to Sell

I’ve found that one of the biggest investor struggles is to know when to buy and sell his holdings. I use a very simple, but very effective rule to overcome my emotions when it is the time to pull the trigger. My investment decisions are motivated by the fact that the company confirms or not my investment thesis. Once the reasons (my investment thesis) why I purchase shares of a company are not valid anymore, I sell and never look back.

Investment thesis

You can expect I’m not too keen on formulating an investment thesis on PKG. I don’t see any competitive advantage that can’t be replicated by its larger competitors. The company evolves in a slowing down industry where we use less paper and where even the Amazon era can’t boost the usage of corrugated products enough to cope for other segment decline.

Potential Risks

After a decade of consolidation in this industry, I don’t see how PKG could possibly purchase cheap competitors. In fact, pressure could come from WRK and IP in a potential price war leading to smaller margins for everybody.

Also, I think it’s important to remember what happened last time the economy entered in a recession: PKG slashed its dividend. While I think it was the right decision at that time for the company, this is definitely not something I want to see as a shareholder. The last dividend cut teaches us two things: #1 management is cautious and responsible (which is a good thing), #2 PKG evolves in a fragile industry where economy cycles have a big impact on their results (bad thing).

PKG doesn’t show a solid investment thesis and doesn’t meet my 6th investing principle.

Principle #7: Think Core, Think Growth

My investing strategy is divided into two segments: the core portfolio built with strong & stable stocks meeting all our requirements. The second part is called the “dividend growth stock addition” where I may ignore one of the metrics mentioned in principles #1 to #5 for a greater upside potential (e.g. riskier pick as well).

Unfortunately, while there was an interesting opportunity to buy PKG during the dip in 2016, I don’t see where this company would fit in my holding. Their industry is slowing down and there isn’t much growth potential elsewhere.

Final Thoughts on PKG – Buy, Hold or Sell?

In short: PKG is a sell. If you were lucky enough to buy it in 2016, cash your profit and find a better holding that will pay you growing dividend for several years to come.

Disclaimer: I do not hold PKG in my DividendStocksRock portfolios.

The opinions and the strategies of the author are not intended to ever be a recommendation to buy or sell a security. The strategy the author uses has worked for him and it is for you to decide if it could benefit your financial future. Please remember to do your own research and know your risk tolerance.

Leave a Reply