Is the classic buy & hold investing strategy dead? Is it just a fairy tale invented by an old generation of investors such as Buffett and doesn’t work anymore? You may read several articles telling you the buy & hold theory is dead. I don’t agree with this statement.

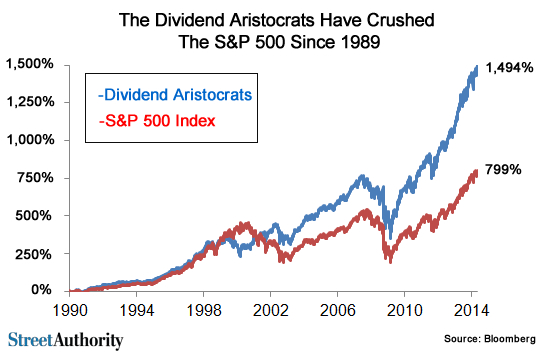

The main idea around dividend growth investing is to benefit from the compounding effect of the dividend growth in your portfolio. You can’t benefit from the compounding growth if you sell your stocks every 4-5 years. The following graph should show you the result of the buy & hold strategy:

As you can see, during the first ten years of this graph, both the S&P 500 and the aristocrats were bringing about the same return. However, the compounding effect of dividend growth started to bring more return after the techno crash. Patient investors have been rewarded handsomely.

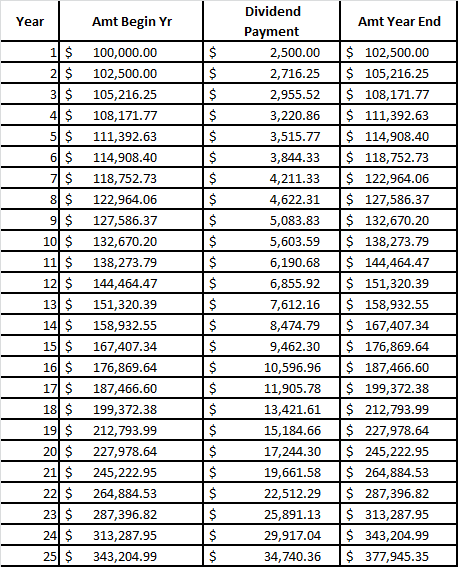

The rationale behind this theory is simple. Imagine you use $100,000 to invest in 3M Co (MMM). Let’s assume the current dividend yield is 2.50%. Your money will then generate $2,500 per year. Now, imagine you keep MMM for 25 years and you reinvest their dividend payments during this period. For the sake of the calculation, let’s assume a 6% dividend growth rate. Here are the results of my calculations:

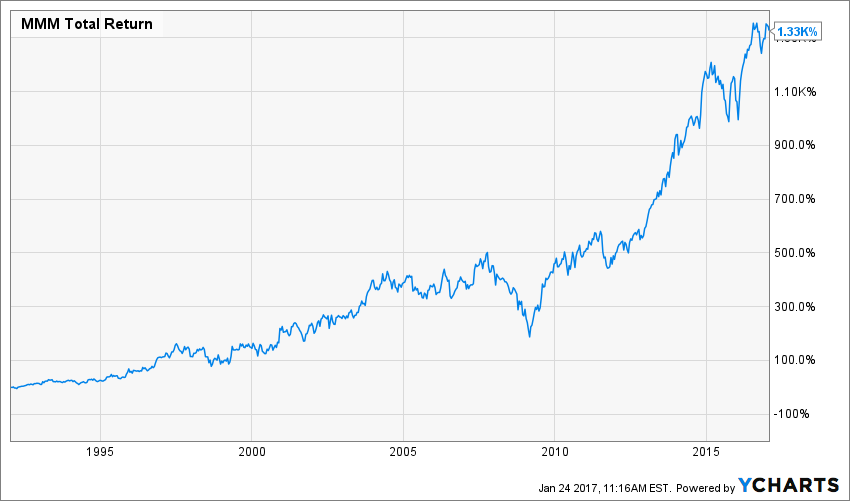

In the span of 25 years, your $100,000 investment has become $378,000 purely through the process of reinvesting the dividend payouts. Imagine now if MMM stock price is also growing in value… yup, you would probably get close to 1M$ in 25 years with an investment of $100,000. I know, those numbers defy our imagination, but they are real nonetheless. You doubt it? Here’s the real number showing MMM stock return over the past 25 years:

You read it right; over 1,330% return over the past 25 years.

It doesn’t mean you should keep all your holdings forever

The problem with the buy & hold strategy is that not every company produces MMM’s results. Therefore, you could be holding shares of companies that will not bring much to your portfolio over the next 10-25 years. I’m pretty sure you want to avoid that. While there are no magical secrets to determine if one company should be part of your nest egg forever, I can identify a few key elements:

- Dividend payment growing each year

- Payout ratios under control

- Company is a leader in its market

- Revenue and earnings on a growing trend

- Company showing clear competitive advantages

By monitoring each company you invest in on a quarterly basis, you will be in a position to make sure each of the above mentioned criteria are in place. These companies should be held in your core portfolio forever. This is how you will unleash the full power of dividend growth investing.

Great chart! I’m easing back into the stock market after avoiding it the past 5+ or so years. I’ve previously been mostly invested in precious metals and real estate. I still have concerns about the stock market at such a high level, so am patiently waiting for a correction.

@DividendMonk I am fairly new to DGI investing. My question is what to do when a DGI stock increases in value immensely. I own CSX. I bought it for the dividends but it is up 85% from my entry point. If that had been organic growth over a long period of time then I would just keep holding it. This has shot up unexpectedly over the last few months due to a change in CEO and board. The dividend yield in now pitifully low and the valuation is out of proportion. In other words I would not invest in CSX now. What is your thought on a situation such as this?