Cincinnati Financial Corporation is a large national insurer with a primary presence throughout the Midwest states.

-Seven Year Revenue Growth Rate: 1.2%

-Seven Year EPS Growth Rate: N/A

-Seven Year Dividend Growth Rate: 4.2%

-Current Dividend Yield: 3.41%

-Balance Sheet Strength: Fairly Strong

Personally, while there are a number of good things that can be said about the company, I’d stay away from buying CINF shares at the current price after this recent bull market. The combination of yield and growth is not currently appealing.

Overview

Cincinnati Financial Corporation (CINF) was formed in 1968, though its primary subsidiary, Cincinnati Insurance Company, was founded in 1950. CINF has 4,057 associates and operates in 39 states as of the end of 2012. CINF currently owns 100% of three subsidiaries: Cincinnati Insurance Company, CSU Producer Resources, Inc., and CFC Investment Company. They also own their headquarters property and a large investment portfolio.

The company sells its insurance products exclusively through independent insurance agents.

The premise behind an insurance company is that they spread risk out over a wide number of people and businesses. They collect premiums (payments) from clients and in return those clients are covered in case of a serious loss. From an insurance business standpoint, it’s ideal to collect more in premiums than you pay out for losses. This is not the primary form of earnings, though. An insurance business, after collecting all of the premiums, holds a great deal of assets that, over time, are paid out for client losses. An insurance company constantly receives premiums and pays out for losses, so as long as they are prudent with their business, they get to constantly keep this large sum of stored-up assets.

As any investor reading this knows, a great sum of money can be used to generate income from investments, and that’s how an insurance company really makes money. CINF invests its stored up collection of assets (a $12+ billion portfolio) in stocks and bonds. For example, in 2012, the company brought in $566 million in pre-tax corporate income, which includes the investment income of $531 million. As is typical, the insurance business barely broke even while the investment income represented the real profit of the corporation.

Commercial Lines Property Casualty Insurance Segment

Total net earned premiums for 2012: $2.383 billion

Change compared to 2011: +8%

This segment includes casualty insurance, property insurance, commercial vehicle insurance, worker’s compensation, executive risk, machinery and equipment, and specialty insurance. A total of $181 million in pre-tax income came from this segment in 2012.

Personal Lines Property Casualty Insurance Segment

Total net earned premiums for 2012: $868 million

Change compared to 2011: +14%

This segment includes homeowner insurance, auto insurance, and other insurance (marine, umbrella, etc). The company aims to insure customers that own both a house and a car. A loss of $43 million came from this segment in 2012.

Life Insurance Segment

Total net earned premiums for 2012: $178 million

Change compared to 2011: +8%

This segment provides a variety of life insurance products. A loss of $3 million came from this segment in 2012.

Excess and Surplus Lines Property Casualty Insurance Segment

Total net earned premiums for 2012: $93 million

Change compared to 2011: +33%

This segment includes commercial casualty and commercial property insurance for businesses that have unique risk profiles. A loss of $1 million came from this segment in 2012.

Investments Segment

CINF has a $12.466 billion portfolio which consists of 51.7% taxable fixed maturities, 26.0% tax-exempt fixed maturities, 21.4% common equities (including MLPs), and 0.9% preferred equities.

For the fixed maturities, about two-thirds of the portfolio is rated A or better, while the other third is rated BBB. A very small portion is rated below BBB.

The equity portfolio is sector-weighted similarly to, but not identical to, the S&P 500. There is a bit more emphasis on dividend stocks and MLPs.

$531 million in investment income was generated by the company in 2012, which is where the bulk of the profit comes from.

Ratios

Price to Earnings: 18.4

Price to Book: 1.4

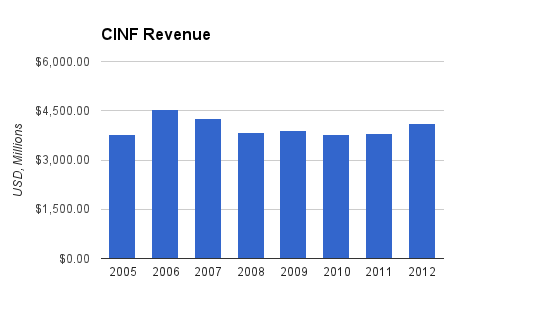

Revenue

(Chart Source: DividendMonk.com)

Revenue grew at a rate of a little over 1% per year over this period, and the premium portion of that revenue grew by over 2% per year. This has been a common trend among property and casualty insurers, and CINF held up fairly well with regards to premium growth compared to its peers. The years of 2006-2010 included realized capital gains that were larger than normal years, especially 2006 and 2007. Those capital gains are the reason for the bulge in revenue for that period.

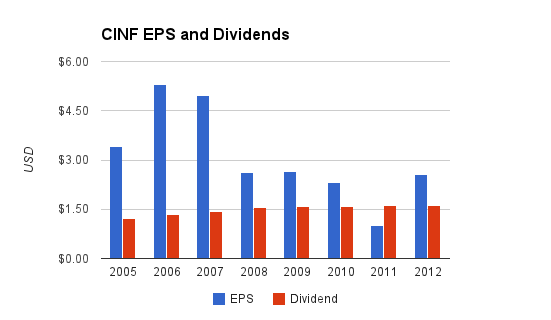

Earnings and Dividends

(Chart Source: DividendMonk.com)

EPS growth was negative over this period, but the core company performance isn’t as disastrous as the chart may imply. The high EPS figures in 2006 and 2007 were due to the aforementioned realized capital gains, and so the large reduction in earnings after those years are not due to actual profit deterioration. The 2008-2010 years also had substantial capital gains which were not present in 2011 and 2012. The year 2011 was particularly rough due to an increase in claims/benefits, and this improved for 2012.

Cincinnati Financial Corporation’s dividend has a streak of annual dividend growth that stretches back over 50 years. The company has, as far as I’m aware, the tenth longest streak of dividend growth out of any company in the United States. It also has one of the higher yields out of the 50+ dividend increase year group.

Unfortunately, while the average dividend growth over this seven year period is a respectable 4.2% (especially considering the 5+% yield the stock had for several years there), the dividend growth has slowed substantially starting in 2008. During the bottom of the recession in 2008-2009, the company held the dividend static for 6 straight quarters but raised it in time so that the calendar year 2009 dividend was higher than the 2008 dividend. Since then, the company has been increasing the dividend on schedule every 4 quarters, but only at a rate of around 1% per year.

Currently, the reasonable payout ratio over a business cycle leads to the dividend appearing fairly safe. Without more growth, the dividend income is not going to keep up with inflation.

Approximate historical dividend yield at beginning of each year:

| Year | Yield |

|---|---|

| Current | 3.41% |

| 2012 | 5.2% |

| 2011 | 5.0% |

| 2010 | 5.9% |

| 2009 | 5.4% |

| 2008 | 3.6% |

| 2007 | 3.0% |

| 2006 | 2.7% |

| 2005 | 2.5% |

During 2005-2008, the dividend yield was modest but the dividend growth rate was decent. During 2009-2012, the dividend growth slowed down to next to nothing, but the yield was decent at 5-6%. Now, in 2013 after this strong bull market, the yield has been pushed back down to modest levels at 3.41% while the dividend growth rate is still tiny.

Balance Sheet

CINF maintains a solid balance sheet. The company aims to maintain the debt-to-total-capital level at under 20% and they’re currently comfortably below that figure. The portfolio has more volatility than other insurers due to the equity exposure, but I consider this a positive thing and it is discussed below in the thesis.

Investment Thesis

The principle problem of an insurance company is that insurance is largely a commodity. Besides operating an all-round well-run business, the number of things that an insurance company can do to distinguish itself is small in number. That works the other way as well though; insurance companies don’t face problems from competitors that offer better technical products or have big brand mark-ups, which is the case in other industries.

That being said, there are a few things that CINF does focus on to make itself unique in certain ways.

1) Independent Agent Focus

The first thing is their focus on independent agencies, which is the core of their business model. CINF attempts to make it as worthwhile as possible for agents to recommend CINF insurance to their clients, even at the cost of reduced underwriting profitability. The strategy certainly pays off in terms of agency loyalty, according to the 2012 annual report. For agencies that have represented CINF for less than 1 year, only 1.2% of the insurance purchased through that agency is from CINF. But for agencies that have represented CINF for 2-5 years, this share jumps to 4.3%, and for agencies that have represented CINF for 6-10 years, it increases to 8.5%. Finally, the average for agencies that have represented CINF for more than 10 years give CINF an average of 17.7% share of the insurance that they write.

For agents that have represent CINF for 5+ years, CINF is generally the #1 or #2 insurer that they write premiums for in terms of volume. As can be seen in the overview section, some of CINF’s segments aren’t even profitable. That’s because premium growth is a focus for them, and making sure they offer diversified and competitive insurance products for agents is critical.

2) Equity Portfolio

Most insurance companies don’t have an equity portfolio, and instead invest entirely in fixed maturities. They do this because they money has to be conservatively invested. Historically, a stock/bond portfolio outperforms a bond portfolio, and this statement of comparable outperformance has been true over the long term for as long as the public market has existed. But, a stock/bond portfolio is more volatile.

Overall, CINF’s portfolio looks like what some financial advisers state that a retiree’s portfolio should look like, with a heavy emphasis on fixed maturities and a small segment of equities. For CINF at the end of 2012, equities made up less than 25% of the total portfolio but after the bull market should have risen a bit. Specifically, CINF’s equity portfolio looks much like what a typical dividend investor’s portfolio would look like, except on much larger scale. They hold stock in most of the well-known blue-chips, they have a bit of a slant towards dividend-paying companies, and they include preferred shares and MLPs in their portfolio.

This willingness to invest in stocks opens CINF up to some additional portfolio risk compared to its peers, but if managed decently is statistically expected to produce better returns.

Risks

Insurers have practically no moat. Some of the biggest and best may be able to have a narrow moat, but in general as mentioned in the investment thesis section, it’s mostly a commodity business and they compete on price.

CINF’s geographic area of focus is the Midwestern United States region including their home state of Ohio, and this region is among the most economically disadvantaged regions of the country. Their risks from this region include insurable catastrophes as well as general economic weakness.

Their portfolio will be more volatile than their peers. While I consider it a good move for them to invest a portion of their portfolio in equities, it does mean the portfolio is more volatile. Plus, there’s greater risk for financial mismanagement. Prior to the financial crisis, over 50% of the equity portion of the portfolio was in financial stocks, which proved to be an unwise allocation. Now the portfolio is more diversified and similar to the S&P 500, but this is an area that investors in the company should occasionally observe.

I’m a bit concerned about the management of the book value of the company over time. Between 2005 and 2012, the book value per share went from $34.84 to $33.45, which is a small reduction over a substantially long seven year period. In comparison, Chubb Corporation (CB), which actually had revenue reduction over this same period, doubled their book value from $31.03 to $60.46 per share. For a slow growth company, it’s important that every dollar maximizes shareholder value in as close to an optimal manner as possible. This management of shareholder money is why I featured Chubb as an example in the Dividend Toolkit, and CINF represents somewhat of a contrast to that ideal.

Conclusion and Valuation

Cincinnati Financial does have an impressive streak of over 50 years of consecutive dividend growth, and I believe their portfolio strategy of using equities is a strong move compared to their peers, but the desired ratio of dividend yield to dividend/earnings growth just doesn’t get over the hurdle.

Over the long term, earnings and dividend growth drive the share price. If the valuation is constant and dividends are reinvested, then the sum of dividend yield and earnings/dividend growth is the expected rate of return. With a yield of 3.41% and current dividend growth of 1.2% per year, we’re looking at numbers that should result in a rate of return of below 5% per year if that dividend growth rate keeps constant. Then if we remove the assumption that valuation is constant, the results may be worse, because after this bull market the P/E is over 18 and the Shiller P/E of the market is currently above average, so we may be primed for a mid-term reduction in valuation. Obviously, a value investor would prefer to purchase undervalued stocks.

With the Dividend Discount Model (DDM), a typical 9% discount rate (target rate of return) and a 2% dividend growth rate (which is higher than their 2009-2013 dividend growth rate) results in a fair value of only around $24, or half of the current market value.

Looking at it another way, a long-term dividend growth rate of at least 5.3% is required for the DDM to produce a fair value estimate assuming a 9% discount rate (target rate of return) that is equal to the current stock price of over $47. CINF would have to begin growing the dividend at a decent rate again in order to produce these favorable yield/growth characteristics.

Given the fact that the market and this stock have had a major run to a fairly high valuation, I’d want to see the company producing better dividend growth before investing in the company, rather than making expectations about a return to better dividend growth. I believe there are better stocks on the market currently, and CINF may be a stock to revisit in the future.

Full Disclosure: As of this writing, I have no position in CINF and am long CB.

You can see my dividend portfolio here.

Strategic Dividend Newsletter:

Sign up for the free dividend and income investing newsletter to get market updates, attractively priced stock ideas, resources, investing tips, and exclusive investing strategies:

Great analysis of CINF. I sold out my position in early 2013 for a nice gain, and reinvested proceeds in the big five canadian banks. Investors have certainly pushed CINF to levels at which it doesn’t make sense. Of course, that doesn’t mean the stock can’t go higher from here, but without EPS growth, it would be very difficult to continue raising distirbutions in any meaningful way.

Nice analysis! This pretty much confirms my thoughts on CINF. The dividend growth is just too low at this point for me to consider purchasing it.