Double-digit growth. That’s what I think about when I look for the fastest growing dividend stocks. You won’t find the next Amazon (AMZN) here thought. While I’ve done my research to find the best stocks for 2020, I still kept my research among dividend payers. You will likely tell me that the three of them are overvalued and you will find out that I’ve heard the same song before. Two of the following companies shows more than 100% return in my portfolio and I bought them while they were “overvalued” according to many investors.

The following article will present 3 of the fastest growing stocks you can find for your portfolio in 2020. They just went through an amazing year in 2019 and I expect another strong year for 2020. You won’t find high yield here, but the stock price appreciation potential for the next 12 months is strong.

If you are looking for higher yield, I suggest you read about my top 3 retirement stocks for 2020.

The selection methodology of those companies is explained in this article:

What a Dividend Growth Investor Buys in 2020?

Let’s take a look at the fastest growing stocks for 2020:

Microsoft (MSFT)

Market cap: 1153B

Yield: 1.25%

Revenue growth (5yr, annualized): 7.70%

EPS growth rate (5yr, annualized): 13.98%

Dividend growth rate (5yr, annualized): 10.96%

I really wanted to talk about Microsoft once again. To be honest, I almost decided to write about Cisco (CSCO) as it saw a price drop in the second half of 2019. However, if there is one stock on my top 2020 list that you may think is overvalued and decide to ignore it is Microsoft. The stock is up almost 50% in 2019 and most experts agree that MSFT is overvalued. This is exactly the song I heard in 2017 when I bought shares at $75. Wait until it drops back to $55, they said…

Between 2012 and 2017, the stock jumped by ~180%. Then, the stock doubled since I bought it. When you look at Microsoft, keep one thing in mind: MSFT will always be overvalued by those who don’t own shares. Microsoft has done the smartest move ever by transforming its core business into a subscription model. You now pay yearly for windows and office without even thinking. No more big launch and marketing spent in convincing people to upgrade their system. You already paid for it! The company is now offering a full portfolio range of cloud-based SaaS solutions, including LinkedIn, Office 365, and Dynamics 365.

Then, it uses this money to fuel its real growth vector: Azure. Public cloud computing is one of the strong growth opportunities of the next decade and MSFT is right in the middle of it. Azure is not only growing at a crazy pace (more than 90% per year), but has secured major contracts with the Department Of Defense, Walgreens, AT&T, etc.

Disney (DIS)

Market cap: 264.8B

Yield: 1.20%

Revenue growth (5yr, annualized): 7.34%

EPS growth rate (5yr, annualized): 2.45%

Dividend growth rate (5yr, annualized): 5.92%

You already know my “love” for Disney, and I guess you can see why now. When Disney announced its intention to create streaming services after buying Fox assets, I started telling you how great this company will become. There are now several streaming services arriving on Netflix’s battleground. Disney has probably one of the most unique business models among them.

Disney shows an incredible track record when it comes to acquiring content and making something out of it. Robert Iger, Disney’s CEO, made a life changing deal when they purchased Pixar for ~8B. This is where the great story begins. The company transformed Pixar into a money-making machine. Since 1996, Toy Story, Nemo, Cars and their friends generated nearly $10B at the box office. Keep in mind, this is only money made in theatres. We don’t talk about the zillion derivative products created. But Pixar’s success story is dwarfed when compared to Marvel’s with their incredibly long list of block busters generating over $18B in box office revenue. You know the rest of the story as Disney did the trick again with the Star Wars franchise and is about to work its magic through its new streaming service.

Now I know what you are going to tell me: Mike, Disney is trading at its all-time high…. Drum roll…. It’s overvalued. (In all honesty, I chuckled in my coffee and spilled it on my notes thinking of this line.) Funny enough, you would have probably told me the exact same thing back in 2013 when I first bought DIS… it was trading at an all-time high.

Visa (V)

Market cap: 405B

Yield: 0.58%

Revenue growth (5yr, annualized): 12.59%

EPS growth rate (5yr, annualized): 19.75%

Dividend growth rate (5yr, annualized): 20.11%

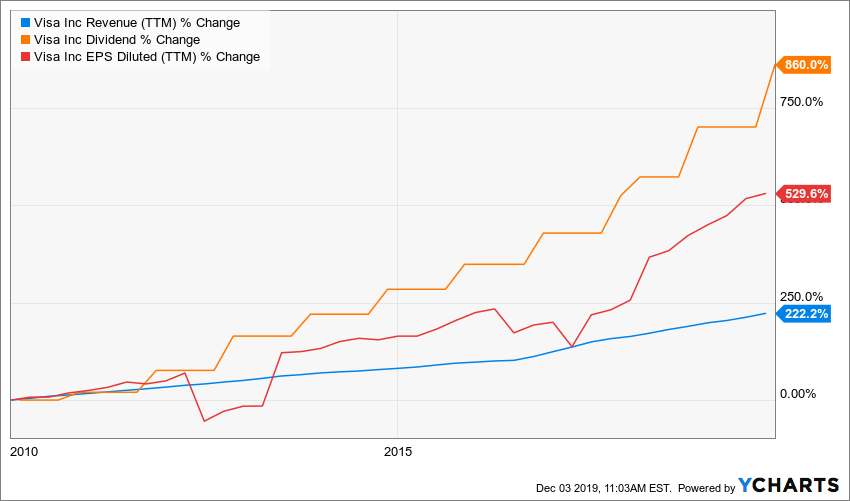

I’m going “safe” with this pick as Visa is a growth machine for years to come. The company has systemically posted double-digit growth for all three-triangle components for the past 10 years. This unique situation has been possible because Visa is the largest player in an environment where the quality and size of your network is primordial. Nobody wants a system payment that is “most of the time accepted”. We all want the system that is “always accepted”.

While you may suggest that Visa is overvalued and there are zillions of fintech firms ready to take over, I’d like to remind you of how the “bitcoin is going to dominate the world of payment” theory played out. Management doesn’t take competition lightly and Visa was among the first payment processors to offer a bitcoin card. The company has the network, the scale and most importantly in this field: the trust of all banks and consumers. As you can see on the graph, the more Visa increases its revenue, the more its margins grow. Visa is a leader in a naturally growing market where margins improve with volume. Do you see the pattern here? Even if you are expecting a recession in 2020, there will be more money transferred through cards and digitally than through cold hard cash. Finally, Visa can face pretty much any kind of competition by either making a partnership with them or simply buying them out.

Find out about 6 companies that will crush 2020

Each year, I compile 20+ stocks that are expected to do better than the market. In 2019, my US picks outperformed the market by 7% and my Canadian picks did 10% better than the TSX. You can download 6 of my top 20 for 2020 right here:

Disclaimer: I hold shares of MSFT, V and DIS

Hey Mike,

I agree with all 3, Visa is 4th in my portfolio behind Amazon, Imperial Brands and Facebook.

Disney I’ll have to wait for a pullback in the $115-120 range. Microsoft I really want but have no hope of owning until a crash. Its extremely overvalued at the moment and for good reason… Satya Nadella has done an amazing job thus far.

Hello Nick,

Be careful with valuation. I’ve read the exact same thing about MSFT in 2017 (it was greatly overvalued) and that I should wait for a pullback before entering. The stock was at $75. Do you think it will go back to $75 anytime soon? If it ever will, this will mean the company isn’t that great anymore and then, it won’t be a deal :-)

Cheers,

Mike

All three are really tempting. I think we’d all love for a pullback and better entry, but your point is well taken, that if they were to fall back to prices we saw a year or two ago, are they still healthy, growing companies. I was close to buying V and MSFT a few months back, but didn’t do it. Never too late I know, but still kicking myself a little. Thanks for the great post!

Never wait for a pullback, that’s one of the riskiest investing strategy I know. This strategy creates doubt and prevent you from picking some of the best companies there is.

Many told me to wait until MSFT trades at $55 before entering in a position. Apparently, $75 was way too much ;-)

Cheers,

Mike