The company operates in mainly 2 segments: Utility (1.1M electricity customers. Power is generated via coal & natural gas) and Non-Utility (consists primarily of generating plants constructed). However, the non-utility segment generates less than 5% of WEC revenues.

-Seven Year Revenue Growth Rate: 2.12%

-Seven Year EPS Growth Rate: 9.83%

-Seven Year Dividend Growth Rate: 19%

-Current Dividend Yield: 3.52%

Overview

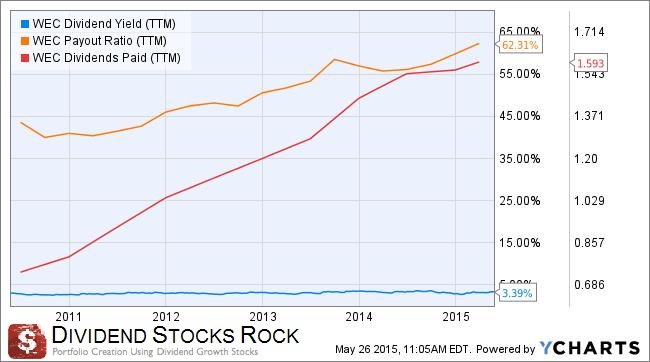

The company benefits from a very solid business model and continuously raises its dividend. Over the past five years, the company has been relatively aggressive with its dividend growth payment showing a 5yr growth of 21.76%. Nonetheless, the payout ratio remains under 60%. The Wisconsin economy is now growing stronger, pushing WEC to new highs. All three sectors (residential, industrial and commercial customers) are consuming more energy and the forecast for the upcoming years looks promising.

Then again, it’s always the same story; WEC’s main energy source is coming from coal. Stricter regulations will definitely hit companies such as Wisconsin Energy sooner or later. This should reduce their margin as additional cost may be required to continue to run coal energy plants.

Ratios

Price to Earnings: 18.94

Price to Free Cash Flow: 28.14

Price to Book: 2.399

Return on Equity: 13.04%

Revenue

WEC declared lower than expected revenues in its most recent quarterly update (May 5th). While the company beat analysts’ estimates for earnings, revenues were hit due to a harsher winter and higher spot price for natural gas.

In order to generate future growth, WEC has entered into a deal to buy Intergrys Energy Group for $9.1 billion, including $3.3 billion in assumed debts. With this acquisition, we expect WEC to generate EPS growth between 5 and 7%. The acquisition price wasn’t cheap, but many analysts think it was the fair price to pay to insure future growth.

Earnings and Dividends

As with many utilities, WEC’s payout ratio remains around 50-60%. Most recent dividend growth brought the ratio to slightly over 60%. As the stock price grew, the dividend yield remained stable around 3.50%.

We don’t expect such high (19%) dividend growth in the future but the recent acquisition should keep the future increase around 7-8%.

How Does WEC Spend Its Cash?

Between important dividend payouts and its recent acquisition, Wisconsin Energy uses most of its cash flow. The company was able to control cost efficiently reducing its operating expenses by 19% last quarter. Some analysts fear return on investment on the recent acquisition might not be as good and represents a regulation risk over the long haul. WEC must always use part of its cash to maintain its investment and make sure they keep up with new regulations.

Investment Thesis

The investor looking for a steady dividend payment will be interested in WEC. The fact that WEC is operating in a monopoly in Wisconsin confirms a minimum level of cash flow annually, leading to a solid dividend distribution.

The company is well managed and focused on distributing an important part of their profits to investors. Cost control seems to be at the center of their attention at the moment.

Risks

Relation with regulators is the main source of uncertainty for a utility such as WEC. If their relations with regulators turn sour, WEC will lose their ability to increase rates as they wish. This would put pressure on their margins and limit profitability.

Borrowing inflation might also be a concern in the future. At the moment, utilities benefit from low rates on both sides; companies can borrow money at a very cheap rate for their investment and many income seeking investors moved their money towards this sector. With interest rate on the edge of rising, WEC may not be that interesting in the future from a stock price growth perspective. However, the dividend payment is sustainable and should continue to increase over time.

Conclusion and Valuation

Looking at the past 10 years of PE history, we can see how lower earnings affected the recent PE ratio.

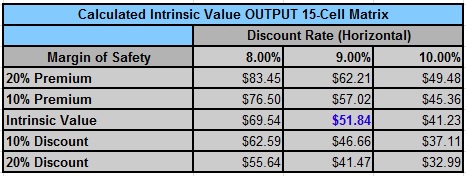

The stock seems currently overpriced compared to its valuation history. Let’s use the dividend discount model to see how the company is priced considering its dividend.

Source: Dividend Toolkit Excel Spreadsheet

Source: Dividend Toolkit Excel Spreadsheet

I’ve used a 9% discount rate since utilities are evolving in a very stable portfolio. I’ve used a 7% dividend growth for the first 10 years and drop it down to 5% to make sure it’s sustainable. Past growth was impressive but I don’t expect the company to continue boosting its dividend as it has before. Their most recent acquisition will help WEC to keep increasing their dividend by 7% for a few years, and should reduce their growth to 5% to reflect the new economic environment (higher interest rates, slower consumption growth).

Nonetheless, the company seems to trade at a 10% discount. The stock lost almost 9% since the beginning of the year, it’s like saying it was fairly valued at the beginning of the year and it may become an interesting play for dividend growth investors.

Full Disclosure: As of this writing, I WEC is part of our DSR Portfolios.

Nice summary. WEC is one of the few utilities I own; I just bought a very small amount a few days ago. I like it quite a bit, but I actually think it’s pretty overvalued today. I’d rather layer in over time, especially then interest rates raise a bit. Expect utilities and REITs to underperform, which means it’d be time to load up for me.

Hello DD,

If you consider WEC as a long play in the dividend stock world, I don’t think WEC is overvalued. However, for short term investment, WEC is definitely not a bargain as many income seeking investors jumped in the utility train when bond rates dropped. They will leave as soon as bonds are back to normal.

Cheers,

Mike