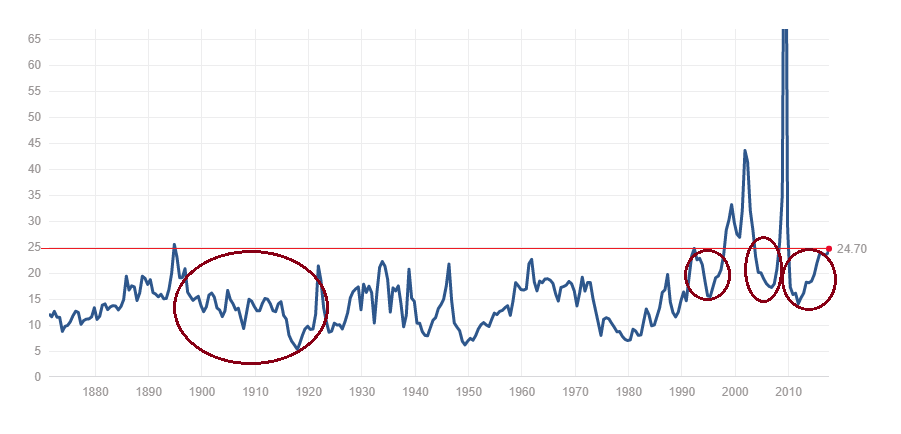

While I’m an eternal optimist, I must admit the current market value is making me a little bit uncomfortable. When you look at the S&P 500 average PE history, we rarely hit above our current PE average. Worst; each time it happened, valuation crashed not too long after.

Data: multpl.com

Should I stop investing? Should I wait? These are questions we all ask ourselves right now. But, in the end, I know something; the market always wins. Betting against the market is a bad idea. Waiting for the market to crash before investing would make me leave a lot of dollars on the table in the meantime (because we don’t know when the market will ever crash!). I have another question for you instead: where do you find value in this market? If you can answer this question, you will not have to worry about investing at an all-time high.

Where to start

Instead of trying to figure out when the market is about to crash, I rather work on finding value. The market is not on sale as it was a few years ago. The easy money is gone but it doesn’t mean you can’t find any interesting companies.

I always start my search with a focus on dividend growing stocks. I’m looking for companies that focus on increasing rewards for investors. Therefore, if I ever run into the bad luck of investing new money right before a market crash, I make sure that I will get well paid to wait until my portfolio recovers. A good start for my research is the dividend achievers list. The Dividend Achievers Index refers to all public companies that have successfully increased their dividend payments for at least ten consecutive years. At the time of writing this article, there were 265 companies that achieved this milestone. You can get the complete list of Dividend Achievers with comprehensive metrics here.

I like the Achievers as they count newer dividend growers in their list. Focusing on the Dividend Kings or the Aristocrats limits investors to “old” dividend growers that might now find many growth vectors within their mature business model.

I also pull out an equity search to find strong growers over the past 5 years. A long dividend growth history is nice, but companies that have been able to raise their distribution recently are better. There are currently great opportunities with younger dividend growers such as Disney (DIS), Apple (AAPL) and Starbucks (SBUX).

Beware of the fundamentals

I like to compare the high of bull market to a big wave. When the wave rises, it brings everything on top. If you are in the ocean, you can’t do anything else but follow this huge power. Fishes, shells and even garbage are taken from the bottom and raised to the top. When the economy is doing well, it often happens that even the worst companies show good numbers.

When we look at macroeconomics data, we see unemployment rate is low, inflation is low, rates are low and consumer confidence is… high! This could become a toxic cocktail as consumers have access to cheap money and they tend to buy more stuff since they have a good job and they are confident in the future.

Therefore, when you pull out 5 year history data for many companies, chances are you will find raising revenues and earnings. Debt payments won’t slow down companies as debts are cheap right now. For this reason, I tend to be more demanding and add stronger criterions. For example, I will not accept payout and cash payout ratio over 100%. Ideally, I will even consider only companies showing ratios under 80%. I want to make sure dividend payouts will continue to raise even if the market crash.

My Favorite places to find value right now

As I mentioned earlier, I found that DIS, AAPL and SBUX are currently trading at an interesting price. I’m also adding Lowe’s (LOW ) to this short list. While they are very different companies and are not in the same sector at all, they all share many similarities:

#1 Their dividend yield is low (under 2%) and ignored by many income seeking investors

DIS is paying 1.45% yield, AAPL 1.61%, SBUX at 1.80% and LOW recently passed the 2% mark at 2.09% since the stock lost 9% of its value over the past 3 months. In a low interest environment, income seeking investors are looking for investments to return low yield bonds. Investing in low yield stocks doesn’t really meet their criterion. This is why I feel these companies are being ignored in this bullish market.

#2 Double-digit dividend growths over the past 5 years

While their dividend yield is not impressive, their growth pace is. DIS shows a 15.77% annualized growth rate, AAPL 10.72%, SBUX at 24.08% and LOW at 26.68%. Besides AAPL, they all doubled their payments within the past 5 years.

#3 Their payout ratio is low (under 45%)

After showing such strong dividend growth, I would expect payout ratio to be relatively high. I was pleased to find out that the highest rate was SBUX at 44.40% followed by LOW at 41.62%, AAPL at 27.14% and finally DIS at 25.79%. No matter what happens in the upcoming years, I know those 4 companies will continue raising their dividend as they have lots of room to do so.

#4 Business model generating strong and increasing cash flow

These four companies don’t only show good earnings, but they also show their ability to grow their cash flow from operation year after year. More cash in the bank account also means more cash to be distributed as dividend payment!

#5 They all show strong growth vectors for the future

Disney has created an important growth vector through their movie division. The acquisitions of Marvel and Lucas Film (Star Wars) have created an unlimited box of blockbuster ideas. Their ability to multiply their revenue coming from those movies is quite impressive too. For each movie, there will be multiple gears, toys and apparel sold.

Apple has created a very sticky product ecosystem making Apple customers more fans than clients. While AAPL relies mostly on their iPhone sales to generate their cash flow, their service business (Apple Pay, Apple music, etc.) is growing rapidly.

Starbucks has lots of room to increase its store numbers. But management doesn’t stop there. Through their membership application, the company is able to know what its clients want and modify their offer accordingly. This is how SBUX has improved its menu, store sizes and business hours.

Finally, Lowe’s completed a major acquisition in Canada with Rona last year. I expect it will learn from this experience, generate synergy and eventually go for more acquisitions in the future. LOW has a solid business model in the U.S. and can export it to other countries.

After going through a deep analysis of each company’s business model, I also used a double-stage dividend discount model to value each stock. The idea is to give a value to the future dividend payments. Therefore, no matter what the market is doing, I keep my focus on increasing dividend payments and their value. Those four companies have proven to be traded at a discount value.

What about you? Have you found any undervalued companies right now?

Disclaimer: I own DIS, AAPL, SBUX, LOW in my DividendStocksRock portfolios.

Leave a Reply