Summary

Waste Management Inc. (WM) is the largest collector and disposer of trash in North America.

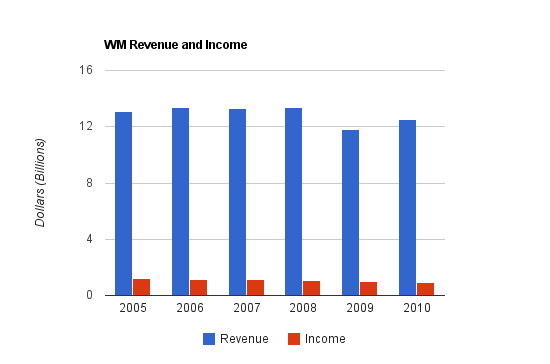

-Revenue and income have been fairly flat for the past six or seven years.

-Dividend Yield: 4.63%

-Five-year dividend growth: 9%

-Balance Sheet: Unimpressive, but reasonable and stable for the industry

WM has a great business model and a strong competitive advantage, but nonexistent growth and heavy debt should rightly weigh down the valuation. I think WM makes a decent dividend stock pick for current dividend yield and dividend growth at around $30/share.

Overview

Waste Management (WM) is the largest processor of waste in North America. With over 43,000 employees, WM collects tens of millions of tons of waste in a year, and recycled 8.5 million tons of material in 2010 They also generate energy via landfill gas and through burning waste.

Waste Management has a rather unappealing business to most: they deal with trash. But from an economic perspective, their business model is enviable.

-Customers pay Waste Management to remove their waste.

-Waste Management recycles the material that is recyclable and gains some cash flow.

-Waste Management can use a combustion process to turn waste into energy- enough to power about 650,000 homes which provides another stream of cash flow.

-Waste Management deposits a lot of trash into landfills, and generates additional cash flow by charging fees for lesser waste companies to also deposit trash into their landfills.

-Waste Management uses the methane that comes up from landfills to produce electricity for which they can generate more cash flow. They generate about 500 Megawatts of electricity this way, which can power about 400,000 homes.

Revenue breakdown

Waste Management’s $12.515 billion in revenue for 2010 came from the following ways:

Collection accounted for $8.247 billion in revenue.

Landfill accounted for $2.540 billion in revenue.

Transfer accounted for $1.318 billion in revenue.

Wheelabrator (waste-to-energy) accounted for $889 million in revenue.

Recycling accounted for $1.169 billion in revenue.

“Other” accounted for $314 million in revenue.

Intercompany accounted for ($1.962 billion) in revenue.

Collection

For commercial customers, WM typically makes a three year agreement and charges fees based on a variety of factors. They supply metal containers with their logo, and trash can usually be picked up by a truck with only one employee. For residential customers, WM typically makes a 1-5 year agreement with an organization like a municipality or homeowner’s association for exclusive collection rights in that area. They also charge some residents directly depending on location.

They have also launched a new product called Bagster, which is a strongly woven bag that can be purchased at certain stores. It can hold three cubic meters of material, and is more economical for medium sized trash projects than renting a metal dumpster. After purchasing and filling the bag, a customer calls WM to have the bag picked up for a fee. It’s useful for small home renovation, clearing out junk, and certain business applications.

Landfill

WM operates 271 landfills. They deposit most of their collected trash into their own landfills, which keeps the profit margins high. WM charges fees for other trash collectors to deposit into their landfills. After a landfill is full they cover it with earth so it can be used for other purposes. WM also operates 5 hazardous waste landfills.

Transfer

WM uses transfer stations to compact trash and then send it to a landfill. In more urban areas, landfills may be far away from the pickup site, so WM and other garbage collection companies deposit trash into the transfer station. WM charges fees for their services to other collectors.

Wheelabrator

WM owns or operates energy-to-waste facilities and independent power production plants. WM burns solid waste to boil water to produce steam that produces electricity, which they can sell into wholesale electricity markets.

Recycling

WM recycles plastics and commodities from their collection activities.

Other

-WM manages the marketing of recycled materials for third parties.

-WM provides sustainability services to businesses.

-WM collects methane from their landfills and sells it to produce electricity.

-WM offers solutions for healthcare waste.

-WM invests in companies that are supplementary to their own industry.

-WM rents out portable restrooms and provides some street-sweeping work.

Revenue, Earnings, Cash Flow, and Metrics

Revenue, earnings, and cash flow have been lackluster for the last several years.

Revenue

| Year | Revenue |

|---|---|

| 2010 | $12.515 billion |

| 2009 | $11.791 billion |

| 2008 | $13.388 billion |

| 2007 | $13.310 billion |

| 2006 | $13.363 billion |

| 2005 | $13.074 billion |

WM has had nonexistent revenue growth over this period. The trailing-twelve-month revenue is up to nearly $12.9 billion.

Income

| Year | Income |

|---|---|

| 2010 | $953 million |

| 2009 | $994 million |

| 2008 | $1,087 million |

| 2007 | $1,163 million |

| 2006 | $1,149 million |

| 2005 | $1,182 million |

Income growth has also been nonexistent during this period. The 2010 net income is only 80% of 2005 net income. The 2010 EPS, however, is 94% of 2005 EPS because WM has been repurchasing shares.

Cash Flow

| Year | Cash Flow |

|---|---|

| 2010 | $2.275 billion |

| 2009 | $2.362 billion |

| 2008 | $2.575 billion |

| 2007 | $2.439 billion |

| 2006 | $2.540 billion |

| 2005 | $2.391 billion |

Cash flow follows the same unimpressive trend as revenue and income.

Metrics

Return on Equity: 15%

Price to Earnings: 15

Price to Book: 2.2

Price to Free Cash Flow: 12

Dividend Growth

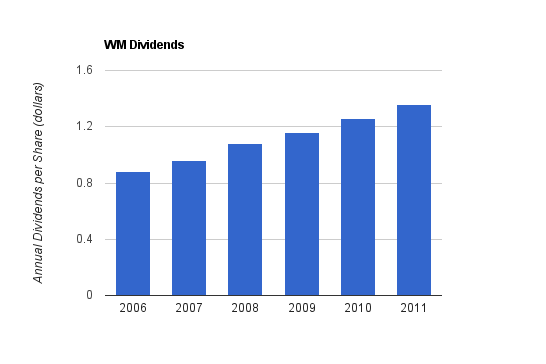

Based on the current dividend of $0.34 per share per quarter, WM has a dividend yield of 4.63%. WM has had a regular dividend history since 2004 where they began raising their quarterly dividend each and every year.

Dividend Growth

| Year | Dividend |

|---|---|

| 2011 | $1.36 |

| 2010 | $1.26 |

| 2009 | $1.16 |

| 2008 | $1.08 |

| 2007 | $0.96 |

| 2006 | $0.88 |

Waste Management has grown annual dividends by 9% on average for the past 5 years. The dividend is well covered by free cash flows. The most recent dividend increase was approximately 8%.

The payout ratio is increasing, since the dividend is increasing but the EPS is remaining fairly static. In 2006, the payout ratio was 42%. For 2010, the payout ratio is 64%.

Share Repurchases

WM has avidly repurchased its own shares. Between 2005 and 2010, WM had a net repurchase of stock of about $3.7 billion. This is more than a quarter of the current market capitalization of the company. This makes EPS grow faster than net income (or in WM’s case, decrease less than net income), and fuels dividend growth (the total dividend payout has grown much more slowly than dividends per share).

Number of Shares

| Year | Shares Outstanding |

|---|---|

| 2010 | 482 |

| 2009 | 494 |

| 2008 | 495 |

| 2007 | 522 |

| 2006 | 547 |

| 2005 | 566 |

WM has decreased the number of shares by 15% over this period. The lower the valuation of WM stock, the better use of WM’s capital it is to repurchase shares.

Balance Sheet

WM has a balance sheet that is not as clean as I would like. They have a total debt/equity ratio of 1.42 and an interest coverage of only 4.2. 90% of shareholder equity consists of goodwill.

This is a rather unattractive balance sheet by most standards, but for WM, it’s not too bad. For balance sheets, apples need to be compared to apples, rather than to oranges. WM’s balance sheet compares reasonably to its largest competitor. As far as the balance sheet is concerned, WM has the balance sheet of a utility. Utilities are expected to have high debt/equity ratios and low interest coverage ratios, because they require a lot of assets to operate, have low return on assets, and generate very consistent cash flows which allows them to take on leverage in order to increase return on equity while still remaining fairly conservative and stable. Because WM has extremely strong free cash flows, and has a very large competitive advantage with its necessary business, it can comfortably take on debt, and has maintained stable debt for a while now. However, I think WM would make a better investment if the debt/equity ratio was closer to 1, and the interest coverage ratio was over 5 or 6. The current amount of debt is acceptable, however, as long as the valuation justifies it.

Investment Thesis

The average person disposes of 4.5 pounds of waste every day. Trash is a fairly defensive business, because regardless of how the economy is, people are still throwing things away, and trash removal is absolute necessary. Still, a sluggish economy reduces the volume of trash, and modestly decreases profitability. Since WM has a lot of fixed, asset-heavy costs, a greater volume in trash results in better profits for WM. This is why the net profit margin hit a peak of 9% and then decreased to below 7.5%

I feel that the five-year periods of the quantitative aspects of WM don’t quite do the company justice. There was slow growth, and then the recession erased it and reversed it. I think that going forward, WM’s growth over the next five years will be better than their lack of growth over the previous five years. Even if the company can simply maintain static net income, the share repurchases would increase EPS at a reasonable rate, or the company can redirect some cash flows to reduce the debt, which would reduce the interest payments and increase net income and EPS. Stabilized net income and continuing share repurchases would stabilize the payout ratio, and lead to long term sustainability of dividend growth.

Waste Management is focusing on growing its recycling and renewable energy abilities. WM currently uses waste as an energy source to power 1 million homes. By 2020, they plan to double that number to 2 million homes. WM currently recycles over 8 million tons of material annually. By 2020, they plan to nearly triple that number to over 20 million tons. They have been making recycling easier for residents, and have also added new services like electronics recycling.

All things considered, I think there are some catalysts for growth. If the US economy heats up, volume should return and profitability should increase to the levels of previous years, at least. WM is focusing on powering its trucks with liquified natural gas rather than diesel, which can reduce exposure to volatile energy prices, and the company estimates it will save money. The company now has over 1000 LNG trucks, which is only a small part of the fleet, but quickly growing. WM’s increasing focus on generating renewable energy and recycling could continue to drive profits.

Risks

Waste Management’s core industry of trash is always going to be necessary, but WM does face risks. They are susceptible to energy prices for powering their vast army of vehicles and operations. While they are in a conservative industry, they are still susceptible to economic weakness because trash output decreases during times of economic recession. Waste Management also faces risks in the form of contract losses to competitors if they don’t manage their business well. Focuses on environmental sustainability, and business initiatives to produce less trash, can potentially reduce volume for WM. Nonetheless, they do have a strong, firmly entrenched business.

Conclusion and Valuation

When I analyzed WM in 2010, I considered the company to have a great business model, but that it was a bit overvalued, with a P/E of 16 and a price in the low $30s. Now that the valuation has been reduced, while most else has remained the same, I consider WM to be fairly valued.

Investors in WM get a 4.6% dividend yield and 9% dividend growth. I don’t think the 9% dividend growth is sustainable for the long term, but if WM stabilizes and slowly grows its net income, and if continued share repurchases begin increasing EPS, I think WM could grow the dividend at 4-5%. This is based on the fact that WM generates more than $1.1 billion in free cash flow, which represents 8% of the market cap, and uses all of this money to pay dividends and buy back shares.

If WM can grow net income at a rate that slightly exceeds inflation, and continues returning money to share holders in the form of dividends and buybacks, I think WM could grow the dividend by at least 5% annually for the long term, which when combined with the current dividend of well over 4%, results in a rate of return of around 9% or so as long as the valuation remains roughly the same. That’s a pretty solid risk-adjusted return potential for this business.

Full Disclosure: I do not own Waste Management stock at the time of this writing.

You can see my portfolio here.

Further Reading:

Pepsico (PEP) Dividend Stock Analysis

Energy Transfer Equity (ETE) Partnership Analysis

Emerson Electric (EMR) Dividend Stock Analysis

Thanks for yet another good post. I think you forgot to mention the current PE? Is their comparative advantage based on low cost provider? Their moat seems quite weak to me.

Hi defensiven,

I mentioned the current P/E in the “Metrics” section. As I published the article it was a bit under 15, but today the stock price went up two and a half percent, so the P/E is a bit over 15 now.

The competitive advantage is not based on being the low cost provider. Part of it is based on scale; they’re the largest in North America. Primarily though, it is difficult (both economically and legally) to open a landfill, so the fact that WM operates so many landfills is an advantage. Smaller trash haulers pay WM to use their landfills, and WM can also use their own landfills which keeps their profits higher.

Hello monk thanks for clarifying! I better put on my reading glasses next time..

Cash flow y/y is not very impressive, but their dividend payments are.

A little tricky to figure this one out long-term, although I like the thesis on this guy. Focusing on recycling and renewables is an excellent direction. They can become a powerhouse in this area if the model is executed correctly.

Are you tempted to add this one to your portfolio at some point?

I wouldn’t be unhappy with WM in my portfolio, but it’s not on my list to buy at this time. If I were to acquire it, it would be for some diversification. I think WM would likely make a fine conservative investment, but there are other places I’m allocating capital to in the near term.

Matt,

WM jumped over 6% today. The only reason I can think of is due to this article… right?

Is it possible? That you’re now so popular as a finance writer that you can swing the markets based on your articles?

Pey,

WM stock jumped nearly 2.5% on the day of my article. Today, the whole market is way up (S&P is up nearly 3.5%), and WM, which is usually not so volatile, is up nearly 6.7%.

I don’t see any news on Google Finance, Seeking Alpha, or Morningstar for WM.

Like many of my articles, this analysis of WM was republished on Seeking Alpha, Guru Focus, and Google Finance, so there is quite a bit of exposure. But if I were to wager, I’d say it’s correlation rather than causation. Although I don’t see any news, I don’t expect that one of my articles would move the stock of a $15 billion company by 7%.

Even if it were caused by this article, which I don’t think is the case, it wouldn’t be a regular thing. Of all the people that read articles like this, on my site and especially the larger sites that my material is republished on, some of them manage quite a bit of money and may be influenced by an article now and then. So if the right guy reads an article at the right time… who knows.

Regardless, this is why it’s important for all honest financial writers to disclose relevant holdings. Some people may do a “pump and dump” where you buy a stock, publicize good news and get some gains, and then sell. But that usually only works for very small companies that have little news, not a $15 billion company. Still, one can’t be too careful, and that’s why writers disclose positions.

Good points, Matt. Don’t sell yourself short though! I have a feeling you’re more influential than you think around our circles.

I suppose I should disclose I own WM, too, and I’m pretty happy about their killer dividend!

Great analysis! I agree with your valuation and thesis. I would also buy mostly for diversification, and the yield certainly isn’t bad. The numbers aren’t overly impressive, but I know this business isn’t going anywhere. It’s hard to figure WM out. They have an economic moat to be sure, but it seems to operate almost like a utility. Utilities usually don’t knock me out. I wouldn’t mind a utility in my portfolio for diversification, but I wouldn’t like it to be a core position. Perhaps WM would serve well as a smaller position. Good stuff Matt!

WM operates the landfill close to my city. In the last five years, they’ve raised the tipping fees for a pickup load more than 150%, from $10 to $26. Some of it no doubt is inflation, but I suspect some is pricing power too.