Wal-Mart Stores Inc (WMT) operates retail stores in various formats under various banners. Its operations are comprised of three reportable business segments, Walmart U.S., Walmart International and Sam’s Club in three categories retail, wholesale and others.

-Seven Year Revenue Growth Rate: 4.82%

-Seven Year EPS Growth Rate: 9.32%

-Seven Year Dividend Growth Rate: 16.23%

-Current Dividend Yield: 2.44%

-Balance Sheet Strength: Strong

Overview

Walmart, that’s 11,462 stores (as at February 2015), 71 banners, presence in 27 countries and over 2.2 million employees (1.3 million in the US alone). Did the title mention WMT was a giant? Let’s dig further to see what else we can find…

Business Segments

Walmart operates under three segments;

Walmart U.S. includes all Walmart stores in the US as well as the online segment. This represents 59% of the company’s net sales. It offers all kinds of sizes from the regular retail store to the supercenter opened 24/7. It pretty much offers everything you need in your home split into 6 segments: grocery, entertainment, health and wellness, hard goods, apparel and home.

WMT is currently investing massively in their online store in order to improve the customer experience and to provide faster delivery. In other words; they are finished with deferring the online market to another giant; Amazon (AMZN). This is a promising, but risky move as it could cost the Giant of savers lots of money. So far, the bet seems to be yielding rewards as online sales increased by 30% in 2014.

Walmart International serves 26 countries and count for 29% of its sales. It operates in a similar way as the US as it also offers a variety of retail store size and product offering.

Sam’s Club is the third division of WMT and operates as warehouse with membership programs. Sam’s Club counts for 12% of the company’s sales. Walmart definitely represents the US economy as similar to the global country’s GDP, WMT depends on US custumers for 71% of its business. Similar to what is happening with Walmart US, the company is shifting an important part of its sales on the internet. Traffic on Sam’s Club’s mobile platform nearly doubled during 2014.

The company is making huge effort to advertise itself as a good corporate citizen. It focuses on many aspects of sustainability as a company that buys local products, employs many Americans, offers environmental alternatives and helps customers save billions of dollars:

Source: Walmart investors relation site

Source: Walmart investors relation site

After all, Walmart promise is to offer any product in store at the lowest price… everyday!

Ratios

Price to Earnings: 16.19

Price to Free Cash Flow: 15.87

Price to Book: 3.183

Return on Equity: 20.11%

While the company is showing a strong profile, we can’t say it was the WMT of 90s where the company was severely overvalued with P/E ratio over 30.

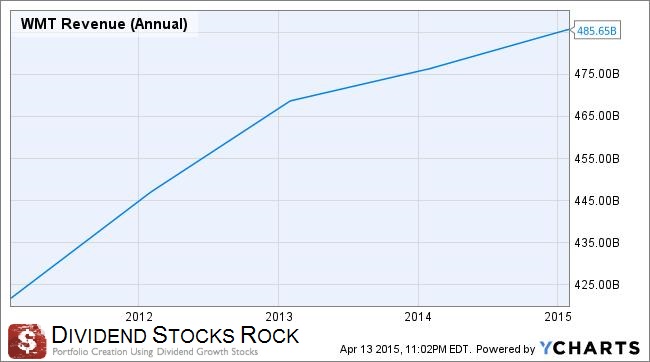

Revenue

WMT was greatly helped by a stronger economy in the US over the past 5 years. Its revenue has never been higher and we can keep our optimism up as the US consumer has more money in his pocket to spend this year due to low gasoline prices.

Earnings and Dividends

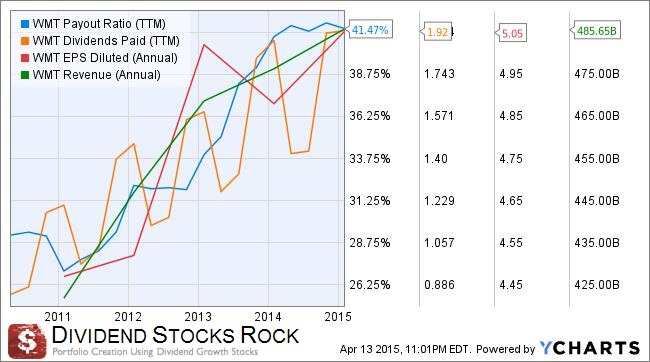

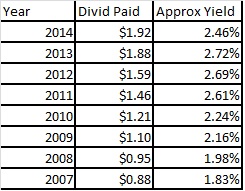

I like to use this chart to see how reliable the company’s dividend will be in the future. Since we are talking about a dividend aristocrat (over 25 consecutive years of dividend increase), I’m not too worried about WMT ability to increase its dividend. Plus, the dividend yield has become more interesting since the 2008 crash:

Approximate historical dividend yield at beginning of each year:

The company meets my requirements described in my 7 investing rules (interesting after the 2008 crash). However, the payout ratio is growing faster of late which leads me to think we might face smaller dividend increases in the future. On the other hand, it would be quite surprising to see a company in a mature market keep up a 16% annual dividend increase rate forever.

How Does WMT Spend Its Cash?

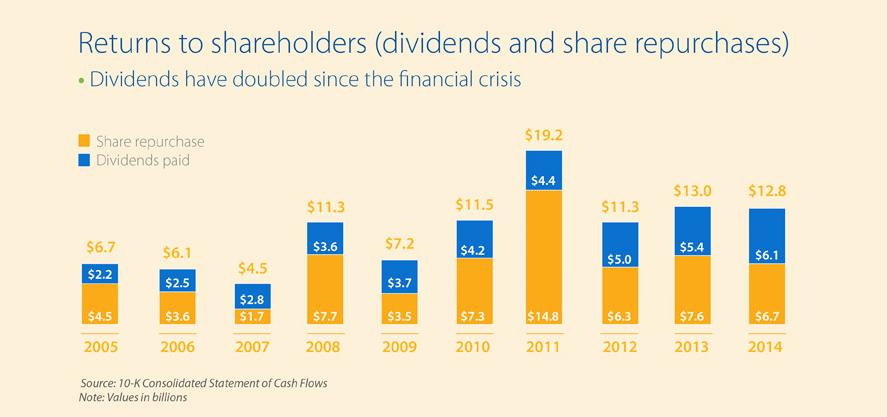

Walmart is a great example of a “perfect” dividend payer. Over the past 4 quarters, the company generated over 16 billion in free cash flow. In their last fiscal year, they returned 12.8 billion to shareholders via share repurchases ($6.7) and dividend distribution ($6.1). Each year, it tends to buy back more shares than increasing their dividend as the graph suggests:

While the company is using tons of cash to buy back their shares, dividend investors are not left in the cold. This February, it was their 41st consecutive annual dividend increase. In 2015, management expects to also use 12.4 to 13.4 billion to improve both physical and digital assets and open between 35 and 39 million square feet of retail stores.

Balance Sheet

Walmart shows a relatively strong balance sheet. WMT has a Debt to equity ratio of 1.503 but a current ratio of 0.9695. While this is close to reaching the psychological mark of 1, I’d like to see this ratio going up a bit. On the other hand, the long term debt is only 3 times the average net income.

Investment Thesis

While many other companies will post slow earnings growth due to currency headwinds, this should not hurt WMT too much. Their bread & butter still comes from the US where the economy is getting better and better right now. While it’s not perfect (new created jobs are usually paid less than the previous ones), as long as Americans earn a paycheck, they will spend it at Walmart.

The fact WMT doesn’t ignore the online industry reassures me for its future. It is true that going online is often like hiking Everest for a classic brick & mortar retail store, but Walmart seems to be up for the challenge. It benefits from great branding and people look to buy from Walmart. E-commerce is one of their three focuses in 2015 (along with making improvements to their overall supply chain and opening new stores). I like to see a company focusing on both cutting costs while using various paths for growth.

Risks

The company is a money making machine for any patient dividend investor. However, the constant pressure on margin related to WMT’s business model remains an important risk for any investor. It doesn’t mean that because it has worked in the past, it will always work in the future.

As WMT is going to play in Amazon’s online playground, there is nothing to improve the business’ margin. This war could cost lots of cash flow and it doesn’t mean it will gain any important market share. Looking at AMZN business model, many investors complain profits are not at the center of the company’s focus. Offering low prices all the time is a tough business model to make profitable.

Another point of concern is the rising interest rates waiting on the doorstep. The market is currently concerned about how fast the FED will increase its rate and this could affect US economy. Therefore, WMT may be hit by these measures.

Finally, there is lots of pressures on increasing minimal wages for Walmart employees. The company announced a first raise in February 2015 and it may only be the beginning for the years to come.

Stock Valuation

Let’s start with the 10 year P/E ratio history:

Besides a dip near 2012, we can see that WMT is currently trading at a relatively low price compared to its history. The recent dip in the PE ratio may be a sign of a good entry point. Let’s take a look at the DCF and DDM to make sure we are right.

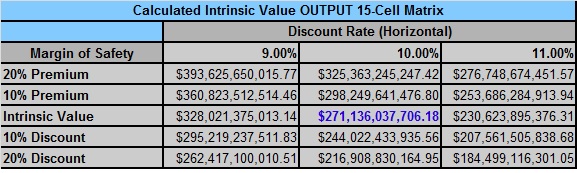

Using the Discounted Cash Flow Analysis, we look at WMT as a simple money making machine. The point is to assess the value of the company by considering its cash flow generation capacity. Considering a FCF to grow by 7% for the next ten years and then by 4% and a discount rate of 10%, we have a market capitalization of $271B while the current market cap is at $260B. I used a 7% growth rate for the next 10 years because I expect the company to benefit from a long term healthy economy in the States. Then, I dropped it to 4% to reflect a more sustainable growth. As for the discount rate, I use a 10% as the company is slightly more at risk than McDonald’s for example due to smaller margins.

Source: Dividend Toolkit

Source: Dividend Toolkit

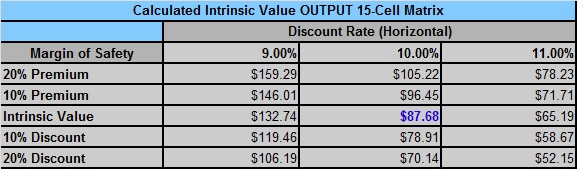

The Gordon Growth Model can be used to estimate ranges of fair value for the stock. The dividend growth rate averaged 16% over the last seven years and but I don’t think we can expect such impressive results forever.

Using an expected 10% dividend growth rate for the first 10 years and then 7% and a 10% discount rate, the fair value is only $87.68, which is over the current share price of around $80.

It seems WMT is currently trading with a 10% discount. Just for fun, I’ve looked at the Morningstar valuation and it stands at $83. Therefore, I can say I’m not too far out in left field with my estimates.

Conclusion

Margins will remain a concern and even the market drops the business valuation after February announcement on increasing wages. Nonetheless, we are currently looking at a very strong company showing the will to shift a part of its business online to explore more paths to growth.

For this reason and the fact the stock recently dropped, I think WMT is a good buy right now.

Full Disclosure: As of this writing, WMT is part of our DSR Portfolios. We do not hold AMZN.

Appreciate those graphs. Walmart is a solid dividend growth pick. Their revenues are growing and their moat is very large. There is always a ton of people at our local WMTs even if the service and stocking is terrible. They really need more active checkout counters. Compared to other companies I’m thinking of buying, WMT has an attractive PE ratio in this inflated market.

Hello Young Dividend,

I’m glad that you stopped by :-)

You are right, WMT is one of the rare stock that doesn’t show a huge premium right now. It will continue to pay some great dividend in the future too!

Cheers,

Mike.