Wal-Mart Stores Inc. (NYSE: WMT) is one of the largest retailers in the world, and is now 50 years old.

-Seven Year Revenue Growth Rate: 6.5%

-Seven Year EPS Growth Rate: 9.4%

-Seven Year Dividend Growth Rate: 16%

-Current Dividend Yield: 2.17%

-Balance Sheet: Leveraged but Strong

At the current time, while Walmart does have a large competitive moat and very consistent growth, I believe the stock has gotten ahead of itself. I’d look for dips back into the mid-$60’s before investing.

Overview

Founded in Arkansas in 1962 by Sam Walton, Walmart is now one of the largest companies in the world, with revenue of over $450 billion and with more than 2 million employees. They have stores under a variety of brands in 15 countries around the world. In addition to being a massive retailer, it’s the largest seller of groceries in the United States. Walmart also owns Sam’s Club, which is a membership warehouse much like Costco that offers bulk products for a reduced cost to people that pay for a membership.

Ratios

Price to Earnings: 15.7

Price to Free Cash Flow: 17.7

Price to Book: 3.6

Return on Equity: 24%

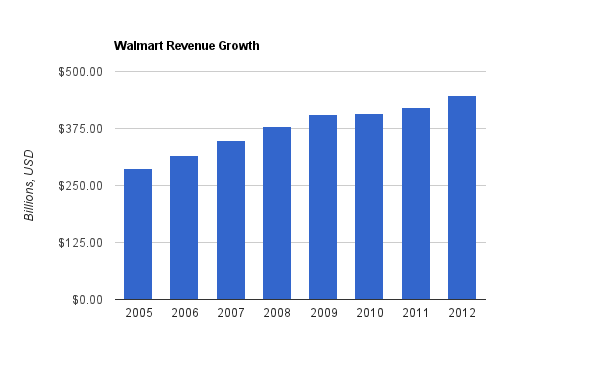

Revenue

(Chart Source: DividendMonk.com)

Walmart has maintained very consistent revenue growth of 6.5% on average per year over this period. This is strong revenue growth for a company of this size.

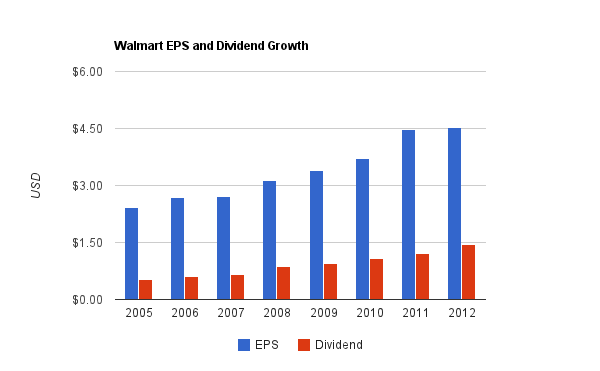

EPS and Dividends

(Chart Source: DividendMonk.com)

Walmart’s EPS growth has been very consistent, averaging 9.4% per year. Company-wide net income grew at a rate of 6.2% per year over this period, and the difference is due to share buybacks. Larger and larger income has been divided over a smaller and smaller number of shares.

The company pays a fairly small dividend, yielding only 2.17%. The payout ratio is fairly low, at under 35%, and the dividend growth rate is fairly high, at almost 16% annualized over the last 7 years. Walmart has grown the dividend every year since the mid 1970’s.

Walmart spends more money on share buybacks than on dividends. Over the last three years, the company has spent a total of around $13.7 billion on dividends and $28.3 billion on buybacks, which has reduced the number of shares considerably. If this money were spent on dividends instead, the dividend yield would be more than twice as high, but EPS would grow more slowly. Overall, I think that Walmart would do well by shareholders to increase the yield at the expense of reducing share buybacks, but as far as buybacks go, the company does at least do them decently by doing it consistently and doing it when the stock is at a reasonable valuation.

Balance Sheet

Total debt/equity is around 75%, which represents a degree of leverage but not an unusual amount. There is around $21 billion in goodwill on the balance sheet, which is less than a third of shareholder equity. Total debt/income is a bit over 3x, meaning that if the company directed all net income towards debt repayment, it would take a bit over 3 years to pay the debt off, which isn’t bad. The interest coverage ratio is over 11, meaning the company’s operating income can cover the interest expense more than 11 times over.

Therefore, I view Walmart’s balance sheet is leveraged but quite solid. They’re putting debt to work to get a good return on equity without jeopardizing their financial health.

Investment Thesis

It’s important to invest in companies that have durable competitive advantages over their rivals, and WMT is that sort of company. Due to Walmart’s immense size, they can purchase products in enormous quantities for very low prices, and then pass those low prices to their customers, thereby beating the prices of most rival retailers. This creates a catch-22, or a negative loop, for rival companies, because in order to grow in size they need customers, but Walmart draws customers away from them with their lower prices, and these rivals can’t usually match those prices because they aren’t large enough.

In order to compete with Walmart, companies have to find new ways to offer low prices. Online retailers can cut costs by eliminating many expenses associated with a brick-and-mortar business. Costco derives most of its income with its membership fees, and therefore sells its products at nearly the same price it purchased them in order to try to keep prices low and grow over time. A company like Costco can put up with very low profit margins over a significant period of time in order to gradually grow and pierce the competitive shield of Walmart. Still, Walmart is indeed in a very strong and difficult-to-shake position among retailers, and comparable store sales were positive over the last calendar year.

The main growth area for WMT will rely on countries other than the United States. Walmart has 3,909 retailer locations in the United States (up from 3,595 in 2008) and 5,781 locations in other countries (up from 3,093 in 2008), along with 613 Sam’s Club locations (only up from 600 in 2008). Non-US stores are typically smaller, so the U.S. segment represents 60% of total sales, the international segment represents only 28% of total sales despite a larger number of locations, and Sam’s Club represents 12% of total sales.

Although ethical or economic questions may arise as to whether something like Walmart should continue to grow, there is basically nothing stopping it from doing so. Their business is straightforward, they generate tons of cash, and they can use that cash to open or acquire new locations in places around the globe. The scalability of this industry is nearly limitless as long as a competitive advantage is established and maintained.

Another form of growth is for Walmart to offer different services in the US. It is growing its online retail business to offer alternatives to competitors like Amazon, and now that it has acquired Vudu, it’s in the business of offering streaming videos. If Walmart can apply the same scale to other businesses as they can their brick and mortar retail business, then they may be able to expand revenue and income in the United States for a great deal of time to come. Alternatively, these side businesses may fail, or distract, from the core business, or may cannibalize from primary store sales.

In addition, WMT is recession-resistant. In some ways, it even does well in a recession as consumers flock to cheaper options. The company has also been improving the quality of some of its stores to cater to a different demographic group.

Walmart constitutes much of the wealth of the Walton family, so shareholder growth is aligned with management objectives. For companies that are in large part family-owned, management is likely to be especially aligned with the interest of shareholders.

Risks

Walmart, like any other company, has risks. When all is said and done, Walmart is really just a middle-man, buying products of others and selling them to you. They are vulnerable to changes in consumer demand.

Walmart’s international business operations have not enjoyed the same consistency and success as the early expansion in the US. Growth is robust, and should continue to post good numbers, but the company hasn’t been able to generate the domestic efficiency on a worldwide basis. And on the domestic side, over the last few years, comparable same-store sales have gone down and up.

Online competitors threaten to undermine the business model, at least to a certain extent. Continued growth for the company will have to come from successful international expansion and defensive positioning in the US, such as through strengthening of the online business and keeping physical locations as relevant as possible. Side businesses like video streaming, if performed well, can add some profitability, but they aren’t the growth drivers.

Conclusion and Valuation

When I analyzed Walmart a little under a year ago, I stated that the stock looked to be a reasonable value in the low-to-mid $50’s. The company has continued to grow, but also increased in stock valuation, and so share prices are now around $73.

Based on discounted cash flow analysis, using a 10% discount rate and 4% annual long-term free cash flow growth, I believe the company is modestly overvalued. While I don’t think Walmart stock would be a bad investment at current prices, I think there are better options out there until either the price dips back into the mid $60’s in the next year or until earnings catch up with the stock price and reduce the valuation a bit.

Full Disclosure: As of this writing, I have no position in WMT.

You can see my dividend portfolio here.

Dividend Stock Newsletter:

Sign up for the free dividend investing newsletter to get market updates, attractively priced stock ideas, resources, investing tips, and exclusive investing strategies:

Agreed, great post and analysis.

I’m looking at EMR right now. I think anything under $40 would be great.

Back to WMT, how high is this guy going to go before a stock split? $80? $90?

I like EMR at this price. I both hold stock directly and also sold some puts to acquire more to keep cost basis low.

Hi, I am long in WMT, I bought at 52$, I am thinking to sell just now, but I have doubts, would do you sell it?

Personally, if I owned Walmart stock right now, I would be holding. Neither selling nor buying. Probably selling covered calls to generate more income from the position.

That’s just me.

Thanks for your opinion.

Great stuff as always Matt.

Completely concur with your overall thesis and valuation.

I, like My Own Advisor, have been interested in EMR lately and recently added to my position below $45. Solid company at an attractive long-term price.

Best wishes!

Thanks for the comment Mantra.

Glad to hear you picked up some EMR at these prices.