Vodafone Group Plc (NASDAQ: VOD) is the second largest provider of mobile telecommunication services in the world, and has a global set of operations.

-Seven Year Annual Revenue Growth Rate: 4.5%

-Seven Year Annual Dividend Growth Rate: 14%

-Current Dividend Yield: 5.89%

-Balance Sheet Strength: Fairly Strong

I believe that Vodafone represents one of the better telecommunication investments at the current time, with global exposure and a strong dividend. Prices for the ADR in the mid to high $20’s look quite reasonable.

Overview

Vodafone Group Plc (NASDAQ: VOD, for the ADR) is a British telecommunications company that provides mobile services to customers around the world. They buy licenses for spectrum bands, and then build networks to provide voice communications, messaging communications, and data usage, to customers. Currently, the company operates 238,000 base stations for wireless transmission.

The company has:

36 million mobile customers in Germany (a 100% stake)

30 million mobile customers in Italy (a 77% stake)

57 million mobile customers in Africa (a 65% stake)

19 million mobile customers in the UK (a 100% stake)

18 million mobile customers in Spain (a 100% stake)

150 million mobile customers in India (a 64% stake)

93 million mobile customers in the USA (a 45% stake in Verizon Wireless)

Plus other interests.

Ratios

Price to Earnings: 13

Price to Free Cash Flow: 18

Price to Book: 1.1

Return on Equity: 8.5%

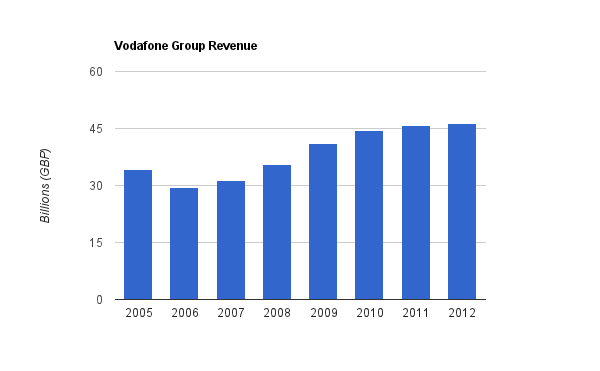

Revenue

(Chart Source: DividendMonk.com)

Vodafone has experienced revenue growth at 4.5% per year, which is quite solid. When I analyzed AT&T last week, I pointed out that their strong wireless and business growth was being offset by decreases in their legacy fixed-line voice business. Vodafone has a much purer focus on wireless services, and so revenue growth has been more consistent over this period. The company has, however, divested some holdings which has impacted revenue.

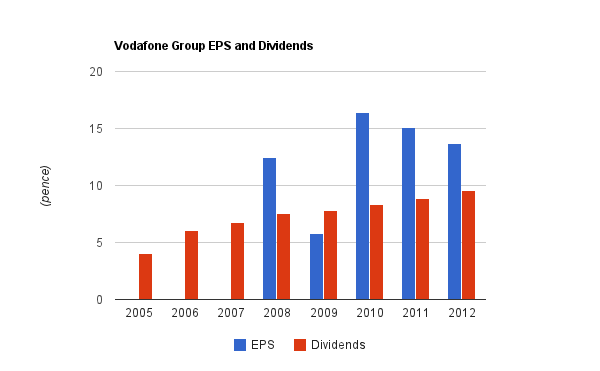

Earnings and Dividends

(Chart Source: DividendMonk.com)

Note: EPS for 2005, 2006, and 2007 were negative, not zero. To preserve the usefulness of the chart (otherwise scale would be quite skewed), those years are displayed as zero. Vodafone has written off goodwill in several years, which can have large impacts on financial reports for those years.

Free cash flow has remained consistently positive, but has not grown. The reasons for this primarily are that Vodafone has divested some of their assets to streamline the business. The company has sacrificed growth in exchange for better profitability and a focus on shareholder returns.

Dividend growth has remained solid. Even in years where EPS was negative due to goodwill reductions (an accounting loss), free cash flow remained solid and paid for growing dividends. The dividend grew at an annualized rate of more than 14% over this period, although more recent growth is in the mid to high single digits. The current dividend yield based on the dividend payments over the last fiscal year is 5.89%, which excludes the special dividend.

In fiscal year 2012 (which ended in early 2012), the company paid a special dividend of 4 pence which is not included in the chart or in the dividend yield calculation. For that fiscal year, the company paid out nearly 7 billion GBP in dividends and used 3.5 billion GBP for share repurchases.

Balance Sheet

Vodafone has a total debt/equity ratio of around 45%. Approximately half of equity consists of goodwill. Interest coverage is over 5, which is solid for the industry. Overall, Vodafone’s balance sheet is quite strong for the stable industry it operates in.

Investment Thesis

A newsletter issue I published a couple months back focused on cloud computing and the effects it can have on lower-tech industries that aren’t on the cutting edge of cloud software. In short, the world is hungry for data. Mobile internet requires vast amounts of data for apps, movies, browsing, and rich media. Software-as-a-Service requires robust data usage and reliability. Enterprises have growing mobile needs. The need for data results in enormous capital expenditures, but also increases in revenue. Wireless services in particular have grown exponentially.

Vodafone is strongly positioned for mobile, because unlike some telecom providers that have legacy businesses that are being cannibalized by their growing mobile revenues, Vodafone is a newer business that lacks much of those legacy businesses. The company focuses on four areas for growth: increasing mobile data usage, emerging market mobile usage, enterprise and total communications, and new services.

Increasing Mobile Data Usage

-European smartphone penetration increased from 10% to 19% to 27% for 2010, 2011, and 2012 respectively.

-The percentage of the European network with 3G or better increased from 66% to 82% between 2011 and 2012, with the goal of 99% by early 2015.

-Revenue from data usage has grown at more than a 20% annualized rate over the last three years, and the number of data users on the network has doubled in the last two years.

Emerging Markets

-Vodafone management expects the world to have 1.5 billion more mobile phone users four years from now, according to the most recent annual report.

-Vodafone’s revenues from emerging markets are growing at a low double digit annualized pace.

-As the latest annual report describes, in areas that don’t have widespread internet infrastructure, many users have experienced the internet for the first time on a mobile device rather than a fixed device. As mobile data becomes more and more commonplace around the world, Vodafone and other companies have the opportunity to provide more and more mobile data coverage for developing markets where people can become accustomed to mobile internet usage early.

-Although Vodafone’s largest national customer base is in India, this region is not as proportionally profitable as their operations in mature markets. If they can keep and grow a strong customer base and become more profitable over time, the growth potential is meaningful.

Enterprise and Total Communications

-Vodafone’s business customers increased from 26 million to 30.3 million over the last two years.

-The company offers integrated wireless and fixed services to provide whole communication packages.

-Companies continue to require more mobile data usage and assurance of data security.

New Services

-Vodafone has several newer areas of potentially significant revenue, including machine-to-machine communication and mobile payments.

-The number of machine to machine (M2M) connections doubled over the last two years.

-The number of customers using Vodafone’s financial services for paying with their phone doubled over the last two years.

-An increasing number of software apps were paid on Vodafone bills over the last year.

So overall, while the industry is highly competitive, the whole pie is growing. A diversified investment such as Vodafone can provide focus on wireless communications along with the breadth of geography.

Risks

Vodafone must continually invest capital to keep its communication system up to par with competitors. Many aspects of the business are a commodity; people want affordable and fast data packages, since it’s just the middle-man between customers and the data they want to consume. Differentiation comes from having solid and growing infrastructure, from offering the right mix of data packages and phone contracts, and from meeting business data/voice needs. There is indeed at least a limited economic moat, as spectrum is limited, and capital expenditures are enormous. However, Vodafone faces considerable competition in all markets it operates in.

Vodafone faces risks of European economic weakness, especially in Spain and Italy, regulatory/tax risks in India, and has global currency risks due to the global scale of its operations.

Conclusion and Valuation

Telecommunications companies typically pay larger than average dividends with their reliable infrastructure businesses. Vodafone has tailwinds from increasing mobile data usage around the world, although the stock price has been flat for the last two years. The company has divested certain interests in non-core businesses and has improved the balance sheet, while continuing to grow the dividend and also while paying a special dividend and buying back a considerable number of shares at reasonable prices.

Based on the dividend discount model, using a 10% discount rate and 6% long term dividend growth, I calculate that the company could be fairly valued up to $40/share for the ADR. However, with widespread economic weakness, a margin of safety is warranted. At the current price of under $28/share for the ADR, I find the stock to be at a good value. With only 4% long term dividend growth and using a 10% discount rate, this price would be justified.

Full Disclosure: As of this writing, I have no position in any stocks mentioned.

You can see my dividend portfolio here.

Dividend Stock Newsletter:

Sign up for the free dividend investing newsletter to get market updates, attractively priced stock ideas, resources, investing tips, and exclusive investing strategies:

Matt,

I’m glad you’re doing some analysis reports on the telecoms. Good to see. I remember you mentioning a little while back that you were going to take a look at T and VOD. I completely concur with you that VOD is the better buy in this space, and probably the best buy out of them all. Solid balance sheet, growing revenue, lack of legacy costs, exposure to just about everywhere and a large, and growing, dividend should provide investors ample returns over the long haul.

Thanks so much for taking a look at this one. As a shareholder, this is an awesome piece of research.

Best wishes!

Hi Mantra, good to see you around.

I’ve been a bit more interested in telecoms recently because I view the market as being fairly valued, and so high-yielders like telecoms and REITs are nice (and I’m already strongly in MLPs, and not too impressed with current REIT valuations). Especially because some like Vodafone stock have been flat. Several articles including yours on Vodafone and others helped me determine which ones I should publish a report on.

Good to hear from you D. Mantra. Hope all is well. Agree w/ you and Matt on VOD. I’m thinking of adding to my position.

In the teleco space, I also have T and RCI. I think T is somewhat overvalued right now and I would consider selling some if it approaches 40. Thoughts?

I agree that VOD looks like the best buy in the telecomm space right now (for the reasons D. Mantra listed plus it has a very reasonable P/B ratio). I have T, RCI and VOD. I am considering adding to my VOD holdings.

Any thoughts Matt on the Canadian Telecos?

I’m looking at this one and also Total SA. What would be the tax implications of holding these in an RRSP? Would US withholding tax apply to the dividends? Your comments would be appreciated.