Union Pacific Corporation operates the largest rail network in the United States, with track throughout the western half of the country.

-Seven Year Revenue Growth Rate: 6.3%

-Seven Year EPS Growth Rate: 22.6%

-Seven Year Dividend Growth Rate: 21.9%

-Current Dividend Yield: 2.24%

-Balance Sheet Strength: Moderately Strong

While not a particularly high-yielding or consistent dividend stock, Union Pacific has a robust competitive advantage, a moderate yield, and appears to be approximately fairly valued for a target of 10% annualized returns at the current price in the $120’s.

Overview

Union Pacific is headquartered in Omaha, Nebraska, and the origins of the company stretch back to the 1800’s. The company currently operates 32,000 miles of track across the western half of the United States, which makes it the largest freight rail system in the country.

2011 Freight Revenue Mix:

Energy: 22%

Intermodal: 20%

Agricultural: 18%

Industrial Products: 17%

Chemicals: 15%

Autos: 8%

Ratios

Price to Earnings: 15

Price to Free Cash Flow: 32

Price to Book: 3

Return on Equity: 20%

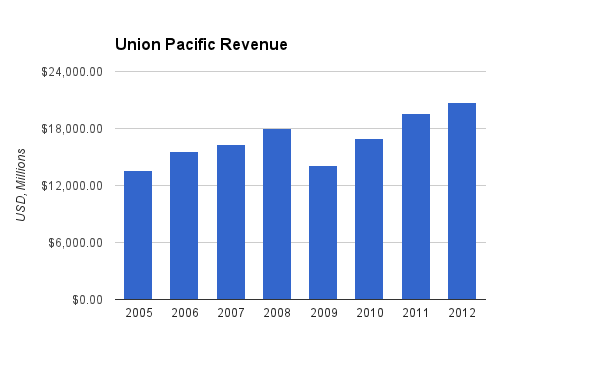

Revenue

(Chart Source: DividendMonk.com)

Revenue grew at a 6.3% annualized rate over this period. Freight volume was deeply impacted by the recession but rebounded solidly.

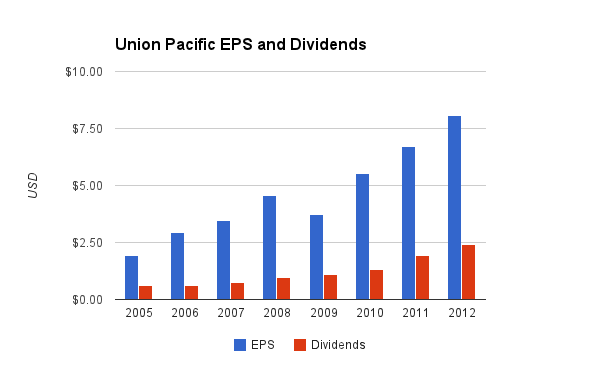

Earnings and Dividends

(Chart Source: DividendMonk.com)

Union Pacific had an enormous EPS growth rate of over 22% per year on average over this period, with the dividend growing at a similar rate.

This EPS growth was driven in part by revenue growth and share repurchases, but the extra driver of growth was the improvement in profit margins. Gross margins improved from 57% in 2005 to 72% recently, which allowed for operating margin improvement from 13% to 32% over that same period.

Now that margins are in line with the other Class I railroads, this extra growth will not be continuing. The shareholder returns going forward should be driven by mild revenue growth, dividends, and buybacks.

Dividend growth has been strong over the last several years, and the most recent dividend increase was 15%. The payout ratio is under 30%, and while this payout ratio is in line with other railroads, they yield is on the low side at only 2.24% because the stock has a healthy valuation at 15x earnings, which is higher than the other Class I companies.

While the current dividend is safe, the dividend historically has not been consistent, and UNP is not a particularly high dividend stock (compared to, say, NSC with its larger 3.26% yield due to the lower stock valuation). The company did not grow the dividend during the 2003-2005 period, and went seven quarters without a dividend increase during the 2008-2009 recession.

Approximate historical dividend yield at beginning of each year:

| Year | Yield | Payout Ratio |

|---|---|---|

| Current | 2.24% | 30% |

| 2012 | 2.3% | 30% |

| 2011 | 1.6% | 29% |

| 2010 | 1.6% | 24% |

| 2009 | 2.2% | 29% |

| 2008 | 2.9% | 22% |

| 2007 | 2.7% | 22% |

| 2006 | 3.0% | 20% |

| 2005 | 3.7% | 31% |

How Does UNP Spend Its Cash?

During 2009, 2010, and 2011, the company brought in approximately $5 billion in free cash flow. During this same period, the company did not spend capital on acquisitions, spent $2 billion on dividends, and spent $2.7 billion on share repurchases.

Like many companies, UNP buys back more shares when those shares are more expensive. The company bought back shares in each of the last 6 years, except for 2009. Their stock was cheap, but like many companies, they conserve cash during difficult times and spend generously when there is plenty of cash flow, which translates into buying back higher priced shares.

The company hit a peak share count of over 540 million in 2006 and has reduced that share count down to 480 million over the last six years.

Balance Sheet

The total debt/equity ratio is under 50%, and the total debt/income ratio is 250%. Importantly, the interest coverage ratio is 12x.

Union Pacific therefore has a stronger balance sheet than other top railroads, such as Norfolk Southern and CSX Corporation. UNP did not leverage itself during this low interest rate environment to buy back shares to the same degree that Norfolk Southern (NSC) and CSX Corporation (CSX) did.

Investment Thesis

Railway assets are protected from new competitors due to the large amount of capital and regulatory work required to lay down new track. Consolidation, deregulation, and improved automation in the railroad industry have resulted in strong companies that compete with one another in a market that’s large enough for all of them to do well.

UNP is one of the strongest operators currently. The rail systems in the eastern U.S. recently took a big stock price hit due to reductions in coal volume, while UNP was not affected as strongly. Their October earnings call revealed that coal volume was indeed down 12%. but operating cash flow nonetheless remains strong. The company’s balance sheet is fairly strong among the top rail operators, and the geographic position of their system covering 2/3rds of the United States provides significant diversification in terms of both freight mix and geographic exposure to domestic and export/import markets.

Risks

All railroads are leveraged to the economic health of their operating region. Economic trouble means reduced freight volumes, but since many of the operating costs are fixed, a fairly mild or moderate volume reduction can mean very large reductions in net income and free cash flow.

More than one fifth of UNP freight revenue comes from their energy segment, and most of that energy segment consists of coal freight. Coal is currently facing headwinds due to reductions in use of it for electricity generation. This impacted the eastern railroads harder than UNP, but still took a 12% chunk out of their volume volumes according to their latest quarter.

Major crashes are an occasional risk for any large railroad, and UNP has experienced those events previously.

Conclusion and Valuation

Union Pacific deserves a valuation premium compared to NSC and CSX. While Union Pacific has a P/E of approximately 15, the P/E ratios of both NSC and CSX have dropped to approximately 11. This is because UNP’s revenue mix is currently holding up better due to have a smaller coal component, and also because their balance sheet is less leveraged.

For example, if UNP were to issue $4.5 billion in new debt and use that money to buy back shares next quarter, they’d be able to buy back 7.5% of their market cap worth of shares, boost EPS by 7.5%, and have a debt/equity ratio comparable to that of CSX Corporation. That’s not to say they should or would do that; but in an apples to apples comparison, a cleaner balance sheet means a higher fair value because they could convert some of that balance sheet strength into earnings growth like NSC and CSX have already done in the last few years due to buybacks.

Going forward, EPS growth and dividend growth are going to slow down, because the operating margin cannot continue to drastically improve over a short time period like it has in the last several years. If revenue increases by 5% per year on average, due to a combination of mild volume improvements and pricing adjustments, and the company continues to buy back 2-3% of its market cap each year, then EPS would grow by 7-8% per year assuming static margins. There is a significant amount of variation possible due to uncertain macroeconomic conditions.

Using the Dividend Discount Model, with a 10% discount rate as the target rate of return, and with the estimate of 8% average dividend growth going forward, the intrinsic value is $134. The current price of $123 therefore appears to be reasonable.

Full Disclosure: As of this writing, I have no position in UNP.

You can see my dividend portfolio here.

Strategic Dividend Newsletter:

Sign up for the free dividend and income investing newsletter to get market updates, attractively priced stock ideas, resources, investing tips, and exclusive investing strategies:

Nice analysis! I like UNP, but it still seems a little high at current levels. The dividend growth has been more than solid, but sometimes gets overlooked b/c of the low yield, which is a consequence of the share price run-up in recent years.

When calculating fair value using DDM, are you using the basic model? If I plug in current dividend of $0.69*4 / 0.02 = $138. Thanks!

Yes in terms of payout ratio, they’re being as generous with their dividend as other railroads.

The DDM here is the basic one, but there are a couple different ways to determine what the next 12 months of dividends will be.

The DDM calculation here uses the trailing twelve months of dividends multiplied by the estimated long-term dividend growth rate, which means the sum of three quarters of $0.60 and one quarter of $0.69, multiplied by 1.08.

So the DDM in the article uses next year’s dividend (which is estimated at $2.49*1.08 here) divided by 0.02. This would be very accurate if the dividend were actually currently growing at the long-term projected rate, but since it’s currently in a stage of higher growth, next year’s dividends are projected to be more than 8% higher than the trailing twelve months of dividends if their $0.69 in dividends holds out.

For example, we could estimate the next twelve months of dividends at $0.69 + $0.69 + $0.69 + X, where X would have to be estimated somewhere in the $0.70’s. This would boost the fair value to $140 or so.

If the dividend growth is projected to be elevated for quite a while, then I’d suggest using a two-stage DDM. But I don’t think the dividend growth rate will be at these high levels long enough to warrant a two stage DDM.

The main thing here is to determine an approximate fair value and then buy at a margin of safety. For example, if we assume 7% dividend growth instead, then the fair value jumps down to $88, but if we use 9%, it jumps up to $271, because the dividend growth rate is fairly close to the discount rate. So the real driving force for the accuracy or inaccuracy of the calculated intrinsic value is the accuracy of the estimate of the long-term dividend growth.