Over the past 12 months, Tractor Supply (TSCO) stock price has suffered greatly with a drop of 45%. At the same time, revenues, earnings and dividend payments are showing a very strong uptrend. As the stock now yields over 2%, the company caught my attention. The following analysis will tell you why I think TSCO is a buy. However, nothing is perfect, and there are also risks of catching a falling knife.

What Makes Tractor Supply a Good Business?

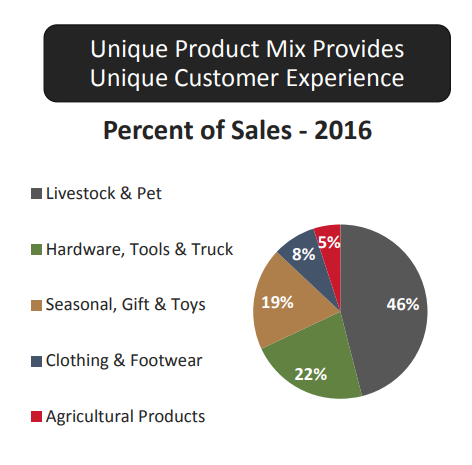

Tractor Supply is the largest rural lifestyle retailer in the U.S. Founded in 1938, it now shows nearly $7 billion in sales and operates 1,700 stores across 49 states. They offer a wide variety of products: (1) equine,(2) hardware, (3) seasonal products, (4) work/recreational clothing and footwear and (5) maintenance products for agricultural and rural use.

Source: TSCO 2017 presentation

While TSCO competes with other big box retailers such as Home Depot (HD), Lowe’s (LOW), and Walmart (WMT), the company differentiates itself by focusing on rural areas (vs urban and suburban like the others), offering higher-end products and targeting farm owners, ranchers, and horse owners to build their client base. TSCO also offers a wide variety of products specifically engineered for the “do-it-yourself” customers.

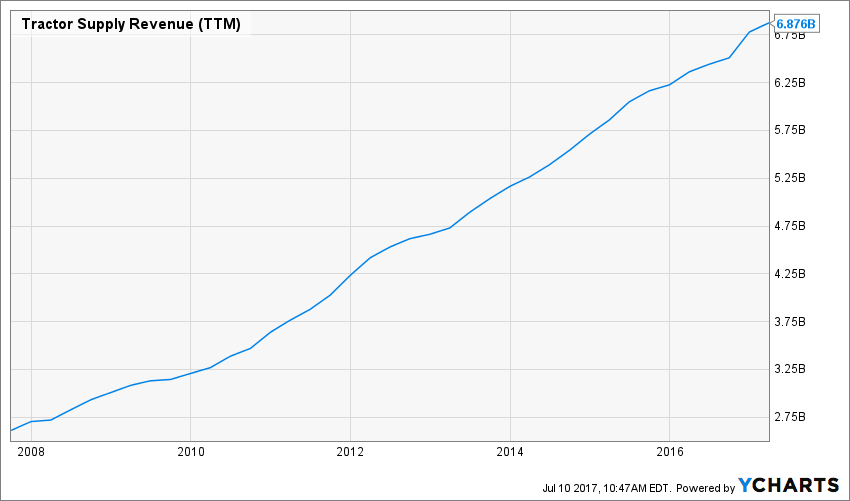

Revenue

Revenue Graph from Ycharts

TSCO shows a very impressive revenue growth rate over the past decade. However, it is important to differentiate total revenues and comparable sales growth. The latter is a lot less impressive as stated in TSCO most recent quarterly update:

“The decrease in comparable store sales was primarily driven by lower sales of seasonal merchandise and the impact of deflation. On a regional basis, sales were most challenged in the Northern regions, where weather had a more pronounced impact on sales for the quarter. The weakness in seasonal categories was partially offset by a positive comparable store sales increase in the Livestock and Pet category.”

Source: April 26th 2017 Press Release

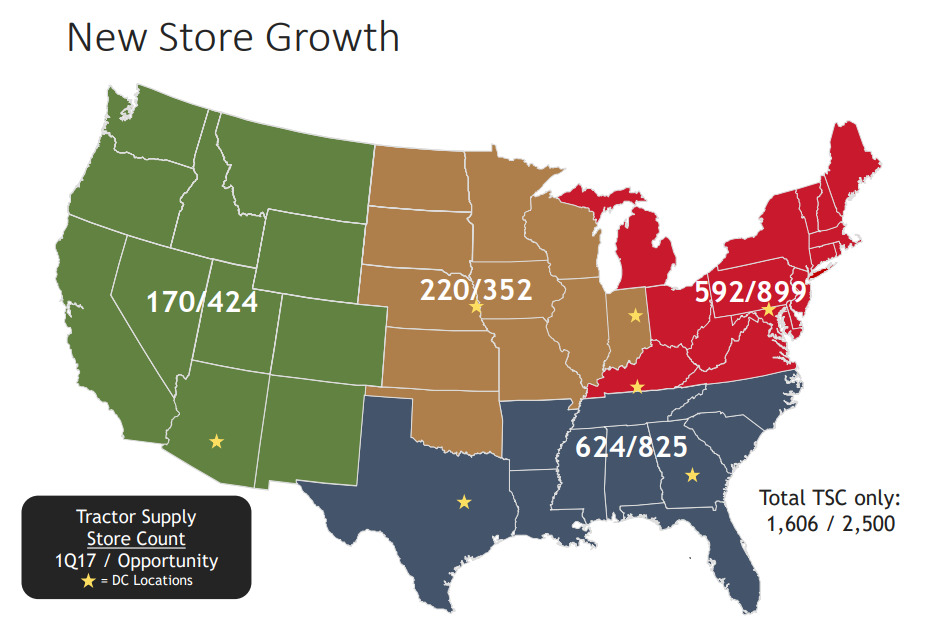

The thing is TSCO focuses massively on growing its number of stores across the U.S. to sustain its growth. Management objective is to grow from 1,606 TSC stores in 2017 to 2,500. You can imagine how fast total revenues will continue to grow in the upcoming years.

Source: TSCO 2017 presentation

Unfortunately, if comparable store sales growth continues to slow down, there is no point in getting excited by TSCO revenue trend.

How TSCO Fares vs My 7 Principles of Investing

We all have our methods for analyzing a company. Over the years of trading, I’ve been through several stock research methodologies from various sources. This is how I came up with my 7 investing principles of dividend investing. Let’s take a closer look at them.

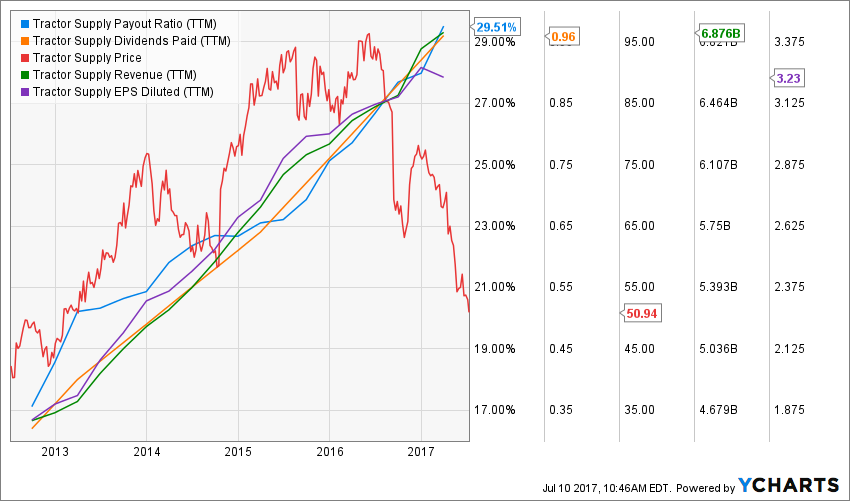

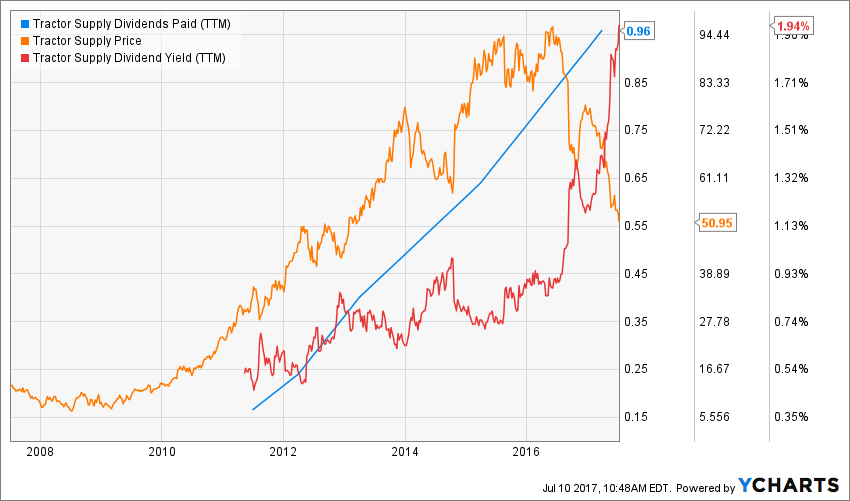

Source: Ycharts

Principle #1: High Dividend Yield Doesn’t Equal High Returns

My first investment principle goes against many income seeking investors’ rule: I try to avoid most companies with a dividend yield over 5%. Very few investments like this will be made in my case (you can read my case against high dividend yield here). The reason is simple; when a company pays a high dividend, it’s because the market thinks it’s a risky investment… or that the company has nothing else but a constant cash flow to offer its investors. However, high yield hardly come with dividend growth and this is what I am seeking most.

Source: data from Ycharts.

Considering a yield below 1% since the beginning of its dividend history, TSCO has always been flying under my radar until recently. At first glance, the recent stock price drop created an interesting opportunity for dividend investors as currently the yield is now around 2%. If the company shows it can sustain its dividend growth trend, it will certainly become a very interesting dividend play.

TSCO meets my 1st investing principles.

Principle#2: Focus on Dividend Growth

Speaking of which, my second investing principle relates to dividend growth as being the most important metric of all. It proves management’s trust in the company’s future and is also a good sign of a sound business model. Over time, a dividend payment cannot be increased if the company is unable to increase its earnings. Steady earnings can’t be derived from anything else but increasing revenue. Who doesn’t want to own a company that shows rising revenues and earnings?

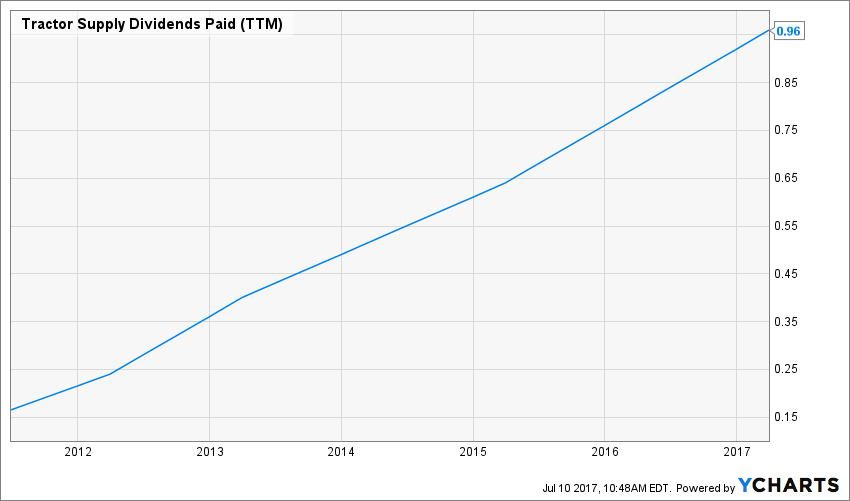

Source: Ycharts

Tractor Supply started paying a modest dividend in 2010. Each year, management has successfully increased its payout since then. 2017 is the 6th consecutive year with a dividend increase. While the company started with a small yield, it shows a strong uptrend since the beginning.

TSCO meets my 2nd investing principle.

Principle #3: Find Sustainable Dividend Growth Stocks

Past dividend growth history is always interesting and tells you a lot about what happened with a company. As investors, we are more concerned about the future than the past. this is why it is important to find companies that will be able to sustain their dividend growth.

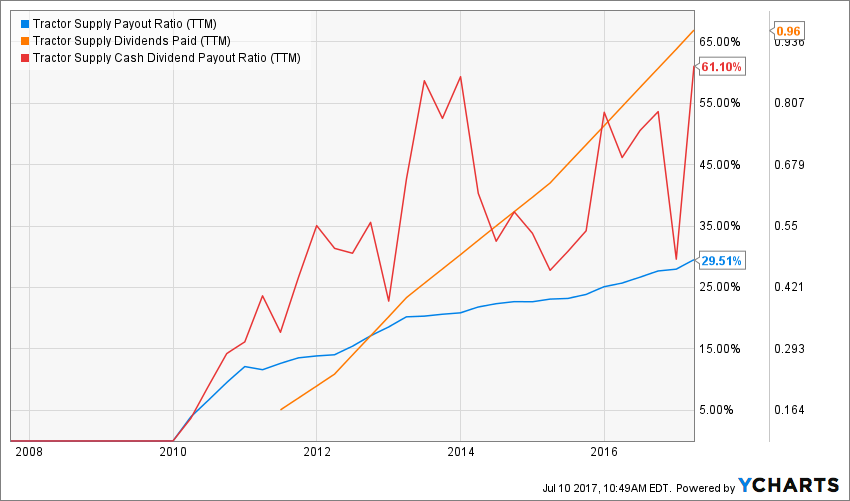

Source: data from Ycharts.

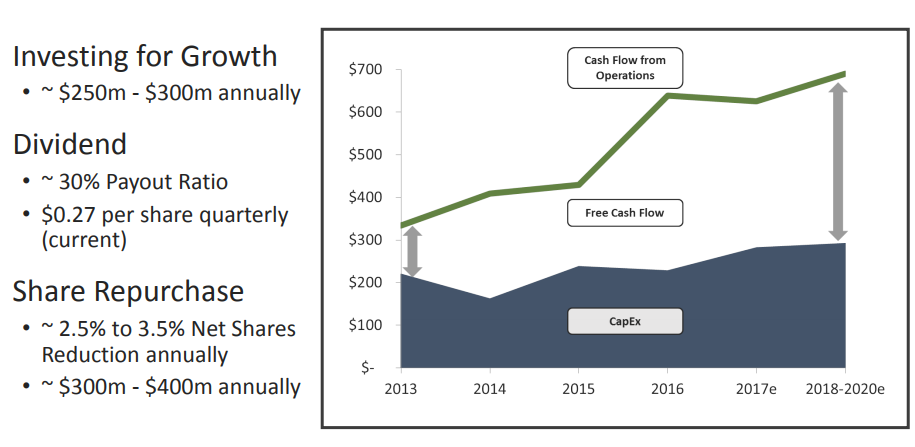

TSCO requires lots of cash flow to support its growth as management invests between $250M to $300M to grow its stores number (TSCO 2017 presentation). Still, the company has managed to control its payout ratio around 30% and its cash payout ratio between 35% and 65% since it has started to reward shareholders with dividends.

Management benefits from lots of room for future increase, opening the door for another decade of strong dividend raises. Dividend growth investors should not worry with TSCO for the next decade.

TSCO meets my 3rd investing principle.

Principle #4: The Business Model Ensure Future Growth

Past numbers are always interesting to analyze, but it doesn’t necessarily tell you what is coming up next. A company with a strong business model will be able to evolve accordingly and continue to provide value to its shareholders.

TSCO is also well aware of the Amazon (AMZN) wave that could hurt its future growth. For this reason, management has focused on improving their digital marketing by enhancing their website search capabilities, creating a mobile centric application and developing an “order online, pick-up in store” offer.

On the other side, TSCO is somewhat shielded from the online wave at the moment due to several products being too heavy to be shipped at a competitive price. By focusing on rural or do-it-yourself customers, TSCO benefits from a solid and loyal client base.

With the opening of a new distribution center in New York by 2018, the company will also be able to improve its margins with lower distribution costs.

Lastly, Tractor Supply is also protecting a part of its business against ecommerce giants by promoting private label and exclusive brand products. If you can’t find it online, then you have to come to TSCO to buy it.

TSCO still shows a strong business model and meets my 4th investing principle.

Principle #5: Buy When You Have Money in Hand – At The Right Valuation

I think the perfect timing to buy stocks is when you have money. Sleeping money is always a bad investment. However, it doesn’t mean that you should buy everything you see because you have some savings aside. There is valuation work to be done. In order to achieve this task, I will start by looking at how the stock market valued the stock over the past 10 years by looking at its PE ratio:

Source: data from Ycharts.

With the most recent stock price drop, TSCO looks like a very attractive buy. However, let’s keep in mind that TSCO sales per store aren’t growing at the moment and most of their revenues and earnings growth is directly attributable to new stores opening. At one point in time, TSCO risks market saturation and cannibalization of its own stores.

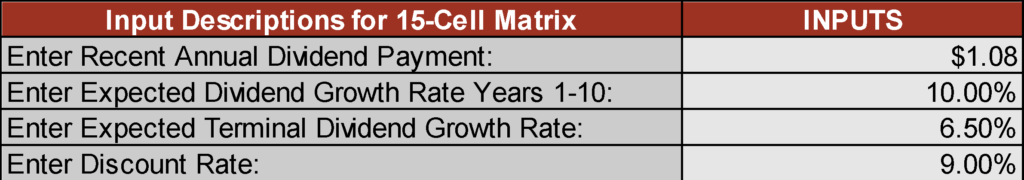

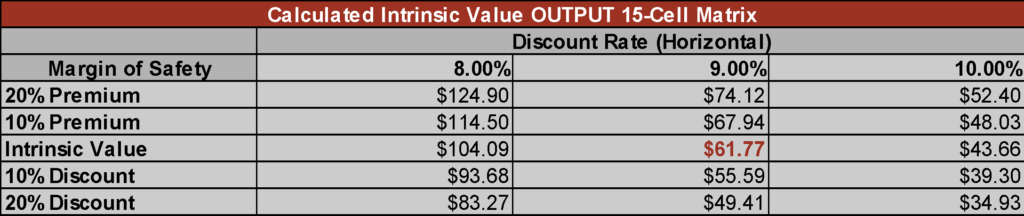

Digging deeper into this stock valuation, I will use a double stage dividend discount model. As a dividend growth investor, I rather see companies like big money making machines and assess their value as such. I expect a strong dividend growth rate for the next 10 years reflecting the company’s store expansion across the U.S. Then, I think TSCO will have to go back to a more conservative growth rate. Since the company is well established and it is a leader in its industry, I use a discount rate of 9%.

Here are the details of my calculations:

Source: Dividend Monk Toolkit Excel Calculation Spreadsheet

Using the DDM, I get a fair value at $61.77. I think it makes sense as there is definitely a wind of panic around TSCO that is not justified at the moment.

TSCO meet my 5th investing principle with a potential upside of 20%

Principle #6: The Rationale Used to Buy is Also Used to Sell

I’ve found that one of the biggest investor struggles is to know when to buy and sell their holdings. I use a very simple, but very effective rule to overcome my emotions when it is the time to pull the trigger. My investment decisions are motivated by the fact that the company confirms or not my investment thesis. Once the reasons (my investment thesis) why I purchase shares of a company are not valid anymore, I sell and never look back.

Investment thesis

An investment in TSCO is a statement of confidence in management’s ability to reverse same store sales growth trend while pursuing their ambitious growth plan. Management shows a steady usage of its cash flow rewarding shareholders with growth and dividend payouts:

Source: TSCO 2017 presentation

I think TSCO is a strong player in their narrowed niche which makes it very difficult for other competitors (HD, LOW or online giants) to grab their market shares. While other online companies will have a hard time competing due to shipment costs of heavy items, TSCO offers a great solution to their customers with their “order online, pick-up at a store” feature. There is room for improvement in margins and this is why management will open a new distribution center in 2018.

The only thing missing for TSCO stock to rise again is stronger same store sales growth. This could be achieved through a good product mix and improvement to their loyalty program.

TSCO shows a solid investment thesis and meet my 6th investing principle.

Principle #7: Think Core, Think Growth

My investing strategy is divided into two segments: the core portfolio built with strong & stable stocks meeting all our requirements. The second part is called the “dividend growth stock addition” where I may ignore one of the metrics mentioned in principles #1 to #5 for a greater upside potential (e.g. riskier pick as well).

In ten years from now, it will be hard to find aggressive growth potential for Tractor Supply as all rural areas will likely be covered. In the meantime, I think the company will benefit from a strong stock price uptrend the minute their sales are going back into positive territories. This play incurs additional risks due to the current situation, but I believe TSCO has enough cards in its hand to win its bet.

TSCO is a growth holding.

Final Thoughts on TSCO – Buy, Hold or Sell?

Catching a falling knife is always a tricky operation. However, after reviewing the company’s fundamental and growth potential, I believe TSCO has reached the bottom and offers an interesting play for dividend growth investors. TSCO is a BUY.

Disclaimer: I do not hold TSCO in my DividendStocksRock portfolios.

The opinions and the strategies of the author are not intended to ever be a recommendation to buy or sell a security. The strategy the author uses has worked for him and it is for you to decide if it could benefit your financial future. Please remember to do your own research and know your risk tolerance.

I hate tractor supply. I live in northern indiana and have Big R and Rural King stores that kick TRC’s butt …if you are into horses TRC is okay but that’s about it in my neck of the woods.