Summary:

52 years of consecutive increasing dividend payment makes CL a strong dividend growth stock

Strong currency headwinds may reduce its double digit dividend growth trend

Dividend Discount Model used shows CL trading at a 30% discount

DSR Quick Stats

Sector: Consumer – Defensive

5 Year Revenue Growth: 2.42%

5 Year EPS Growth: 4.81%

5 Year Dividend Growth: 10.55%

Current Dividend Yield: 2.15%

What Makes Colgate-Palmolive (CL) a Good Business?

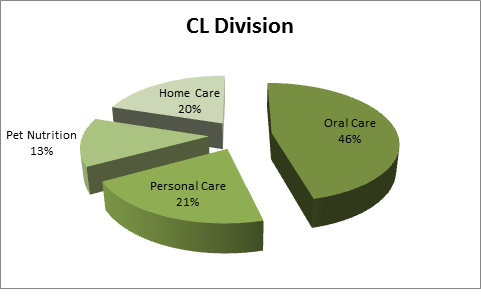

Colgate-Palmolive is a consumer products company. The Company provides products for oral care, personal care, home care and pet nutrition:

CL is the world’s leading producer & manufacturer of toothpaste with 44.8% of the worldwide market share. This is a very important competitive advantage as the world won’t stop brushing their teeth and toothpaste is a highly repetitive buy for any household. CL doesn’t only show a strong market share of toothpaste but it shows a similar profile with regards to toothbrushes with a 33.8% worldwide market share.

Colgate Palmolive is also focusing on employee equity and environmental concerns. They can also claim to promote health with their Oral and Personal care products (who would argue that they can’t help with hygiene in emerging markets through their toothpaste?). In their financial reports, they outline their “Sustainability Strategy” aiming at 5 principles:

- Promoting healthier lives

- Contributing to the community

- Delivering products that respect our planet

- Reducing water consumption

- Reducing impact on climate and environment

Ratios

Price to Earnings: 26.78

Price to Free Cash Flow: 58.86

Price to Book: 133.37

Return on Equity: 181.40%

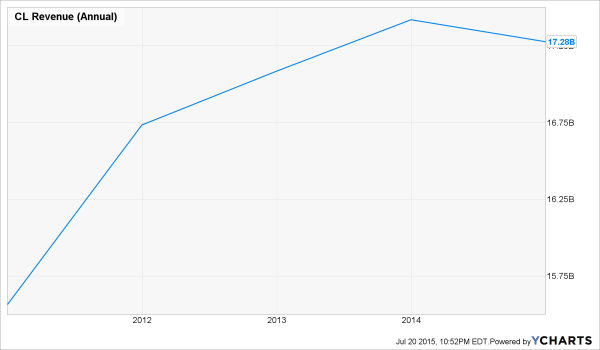

Revenue

Revenue Graph from Ycharts

CL revenue has been greatly affected by currency headwinds. However, the company continues to show strong emerging market sales growth in constant dollars with a +9.5% in 2014 and +6.5% for the first quarter of 20115.

How CL fares vs My 7 Principles of Investing

We all have our methods for analyzing a company. Over the years of trading, I’ve gone through several stock research methodologies from various sources. This is how I came up with my 7 investing principles of dividend investing . The first four principles are directly linked to company metrics. Let’s take a closer look at them.

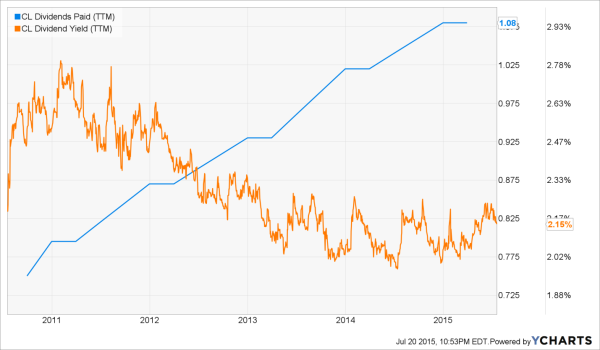

Source: Ycharts

Principle #1: High dividend yield doesn’t equal high returns

I’ve never been a big fan of high dividend yielding stocks. They usually show very small dividend growth as they are imprisoned with a high payout ratio. And if they don’t, their high yield is linked to higher risk (there is no free lunch in finance). Overall, I tend to look at companies with dividend yields between 2% and 4% historically, these are the ones which tend to perform the best.

Source: data from Ycharts.

While CL has aggressively increased its dividend payment over the past 5 years, the dividend yield has remained relatively low. However, the yield is high enough to fit my first criteria.

Principle#2: If there is one metric, it’s called dividend growth

According to my own experience and much financial research, dividend growth is the most important metric for a dividend investor. Strong dividend growth is a sign of a healthy business generating important cash flow.

CL is showing a strong dividend growth history of 52 consecutive years of increasing its payment. Therefore, the case is pretty much closed regarding this criteria.

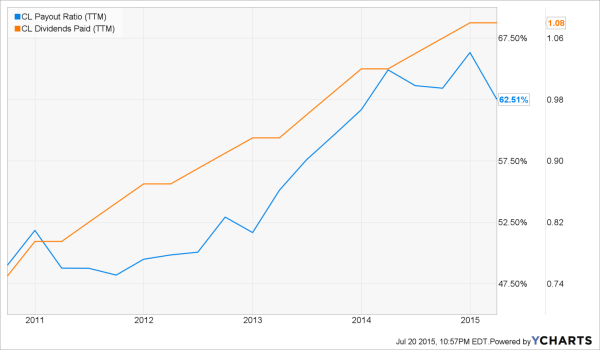

Principle #3: A dividend payment today is good, a dividend guaranteed for the next ten years is better

Past dividend growth is very important, but not as important as future dividend growth. In order to determine if a company is able to continue increasing its dividend in the future, I look at the dividends paid and payout ratio trend over the past 5 years:

As you can see, the payout ratio has increased by 10% over the past 2 years while the dividend payment consistently increased. A part of the reason why the payout ratio is higher today is the strong currency headwinds CL has faced since 2012. However, the payout ratio is far from being a source of concern at the moment. There is plenty of room for the company to continue increasing its payment. The only thing that might change is that it may become a challenge to maintain double digit growth.

Principle #4: The Foundation of a dividend growth stock lies in its business model

I like a company that has a solid economic business model with a relatively wide moat. This is the case with CL where the oral care segment that generates near 50% of its sales is well secured. CL is a leader in this industry and is present across the globe with an even more dominant presence in high growth countries in emerging markets.

This dividend aristocrat shows the perfect profile of a steady money making machine with positive free cash flow each quarter. There is no doubt CL has its place in a dividend growth portfolio.

What Colgate-Palmolive Does With its Cash?

Since 2009, CL has been generating over 2 billion in cash flow each year. More recently, its yearly cash flow is around 2.5 billion (for 2013 and 2014). The first thing management does is to make sure it doesn’t break its 52 years streak of increasing dividends.

Along with a juicy dividend increase each year, the company also spends lots of money on advertising and brand-building activities. Their main focus is emerging markets since there is plenty of room for them to keep growing.

Finally, a good portion of the money is dedicated to improve the current brand portfolio and enhance existing products. This is how CL created its “whitening mega brand” from Colgate products.

Investment Thesis

CL sells primarily consumable products that continually reappear on the buy list of any household. The company is working hard to gain market share in its dominant market and makes sure it offers a variety of products reaching all price points. For example, Colgate toothpaste product is offered in 5 different package/options from the cheapest to the priciest in order to block all entry for possible competitors. Finally, the company makes additional efforts to partner up with dentists to improve dental care awareness around the world. It ensures two complementary goals; to have dentists on their side and to increase the number of individuals caring for their mouths.

Since 1998, the company gross margin has been superior to 50% and has been consistently over 58% since 2011. This is a huge money making machine that has found a way to be highly profitable over the years. The gross margin is even better in emerging markets where its growth rate is the most important.

Finally, the company is present in over 200 countries and has a major leadership position in all fast growing markets. CL is well positioned to benefit from its vast distribution channel in order to penetrate any market.

Risks

CL is making several efforts to develop new products but its range of knowledge is highly limited. Since 46% of its sales come from oral care, there is a limit of numbers of different toothpastes and toothbrushes a household will buy. Chances are the new products within the Colgate brand will only serve to cannibalize a part of their sales + earn a few bps in the market share battle. Their long term growth opportunity is limited by the size of the population at the moment.

Since 80% of CL sales are made outside the US, the company is highly vulnerable to currency volatility. Lately, this has been a major challenge since the US dollar seems to gain more strength each day.

Should You Buy CL at this Value?

In order to determine CL’s value, I will use 2 different methods. The 10 year PE ratio history will tell me how the company has been perceived by the market recently:

As you can see, there is a growing interest for the company lately. The strong dividend payment increases doubled with miserable bond interest rates might have seduced more than one income seeking investor. So far, the stock seems overpriced but let’s use a more detailed way to value the company.

The dividend discount model (DDM) is often used by dividend investors as it helps to ascertain a value considering the dividend payment potential of a company. Since the company is evolving in a defensive industry and shows strong cash flow, I will use a discount rate of 9%.

Due to strong currency headwinds and the volatility that comes with emerging markets, I will use a dividend growth rate that is lower than what the company has shown more recently. I will conservatively use a 9% growth rate for the first 10 years and reduce it to 7% after. With these numbers, I think I can’t go wrong in the company valuation:

| Calculated Intrinsic Value OUTPUT 15-Cell Matrix | |||

| Discount Rate (Horizontal) | |||

| Margin of Safety | 8.00% | 9.00% | 10.00% |

| 20% Premium | $233.21 | $115.82 | $76.73 |

| 10% Premium | $213.77 | $106.17 | $70.34 |

| Intrinsic Value | $194.34 | $96.52 | $63.94 |

| 10% Discount | $174.90 | $86.87 | $57.55 |

| 20% Discount | $155.47 | $77.22 | $51.15 |

Source: Dividend Toolkit calculation spreadsheet.

Wow… 30% discount rate for a company that currently trades over 26 PE… I’ve played around with the numbers and the model gives me a fair value of $64.75 with a 6.50% dividend growth rate. This is far below what has been offered to investors for the past 10 years. Therefore, there is definitely a bargain to be had on CL at the moment.

Final Thoughts on CL – Buy, Hold or Sell?

After doing the DDM calculation, it seems obvious that CL is a good buy for any dividend growth portfolio. The compounding strength of dividend growth will be expressed within these shares and will reward the investor.

The margin of safety is big enough for most investors for anyone to enter in a position even if the PE ratio seems high.

Disclaimer: I do not hold shares of CL at the moment.

Leave a Reply