Summary:

#1 Altria is stuck with a highly profitable product with less and less consumers to buy it.

#2 Management is making serious effort in diversification.

#3 Philip Morris innovative heated tobacco products may become a serious growth vector.

9 years ago, Altria (MO) has made the decision of “unlocking” value for shareholders and spun-off its international division into Philip Morris International (PM). While the number of cigarette smokers is growing throughout most emerging markets, it’s the opposite situation happening in the U.S. where MO is active. While the company is making serious money, where could it go in ten years from now if its clients are disappearing one after the other? Its sister company may have found the solution. Let’s dig into Altria to discover if its worthy of your portfolio.

What Makes Altria (MO) a Good Business?

Altria is one of the largest producer and distributor of tobacco products. These products are highly profitable and lead to repetitive sales. Over the years, regulations around marketing and branding of tobacco products have somewhat protected MO major brands from erosion. Since then, MO benefits from a competitive advantage as its brand is very strong and no marketing can hit it.

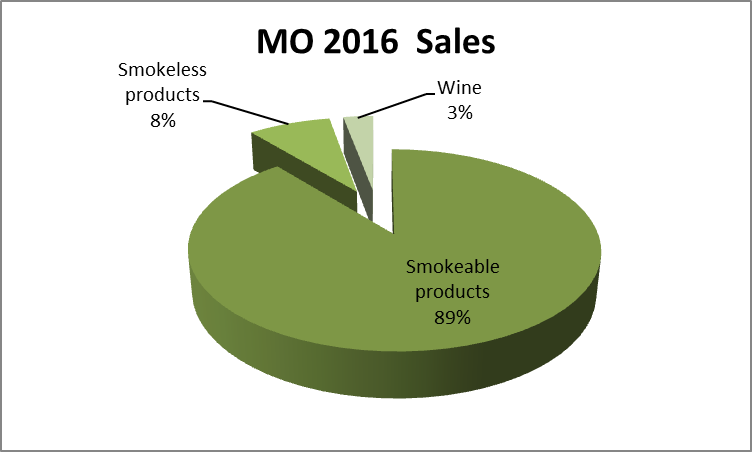

However, since the number of American cigarette consumers is decreasing, MO has been working on diversification. Their efforts resume into acquiring 10% of BUD, creating e-vapor brands and operating Ste. Michelle Wine Estates, their smallest but also fastest growing business segment.

Source: 2016 MO investors highlights

However, these efforts haven’t changed MO business model that much:

Author’s table, 2016 annual report numbers

Revenue

Revenue Graph from Ycharts

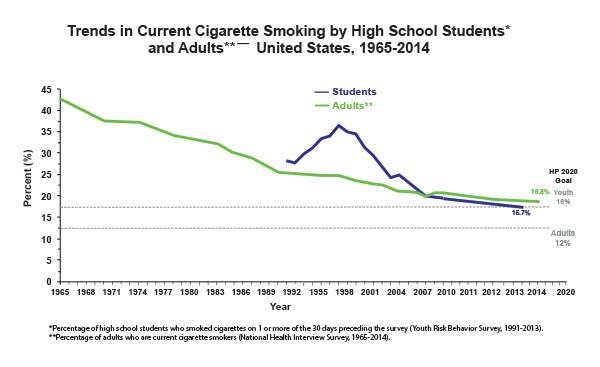

Since the spin-off, Altria is showing consistent growing revenues. The company benefits from strong pricing power to support this growth. Unfortunately, the reality will hit Altria sooner or later:

Source: Centers of Disease Control and Prevention (CDC)

The number of smokers is clearly decreasing in the U.S. Altria is well aware of this situation and this is why management is looking for diversification. A new hope has risen since PM has developed a new kind of product called IQOS system.

Instead of burning the tobacco, this innovative version of the e-cigarette is heating it. The product is currently being under FDA review to determine which kind of product regulations and taxes will apply to it. MO has the exclusive right on this technology in the U.S.

How MO fares vs My 7 Principles of Investing

We all have our methods for analyzing a company. Over the years of trading, I’ve been through several stock research methodologies from various sources. This is how I came up with my 7 investing principles of dividend investing. Let’s take a closer look at them.

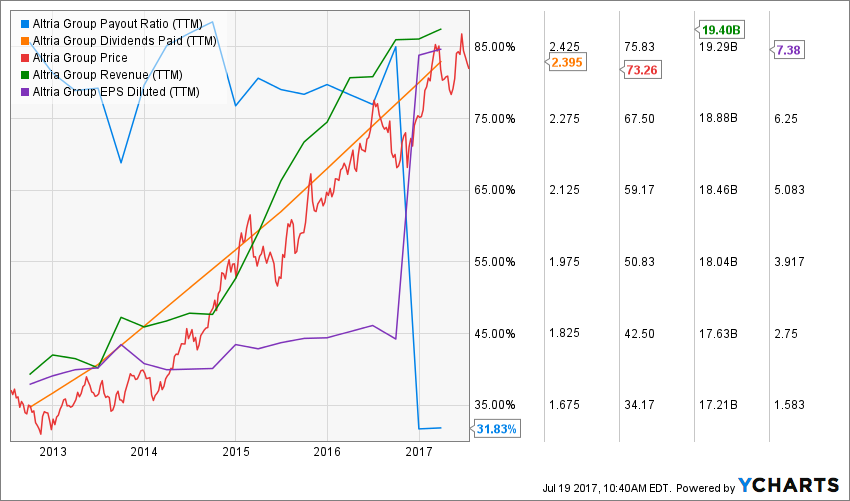

Source: Ycharts

Principle #1: High Dividend Yield Doesn’t Equal High Returns

My first investment principle goes against many income seeking investors’ rule: I try to avoid most companies with a dividend yield over 5%. Very few investments like this will be made in my case (you can read my case against high dividend yield here). The reason is simple; when a company pays a high dividend, it’s because the market thinks it’s a risky investment… or that the company has nothing else but a constant cash flow to offer its investors. However, high yield hardly come with dividend growth and this is what I am seeking most.

Source: data from Ycharts.

MO has always been generous with its shareholders. You can see that as the dividend grew over the past 5 years, MO yield tend to go down. This is because the stock surged by 105.78% over the past 5 years (as at July 19th 2017). At over 3%, MO remains a very interesting stock.

MO meets my 1st investing principles.

Principle#2: Focus on Dividend Growth

Speaking of which, my second investing principle relates to dividend growth as being the most important metric of all. It proves management’s trust in the company’s future and is also a good sign of a sound business model. Over time, a dividend payment cannot be increased if the company is unable to increase its earnings. Steady earnings can’t be derived from anything else but increasing revenue. Who doesn’t want to own a company that shows rising revenues and earnings?

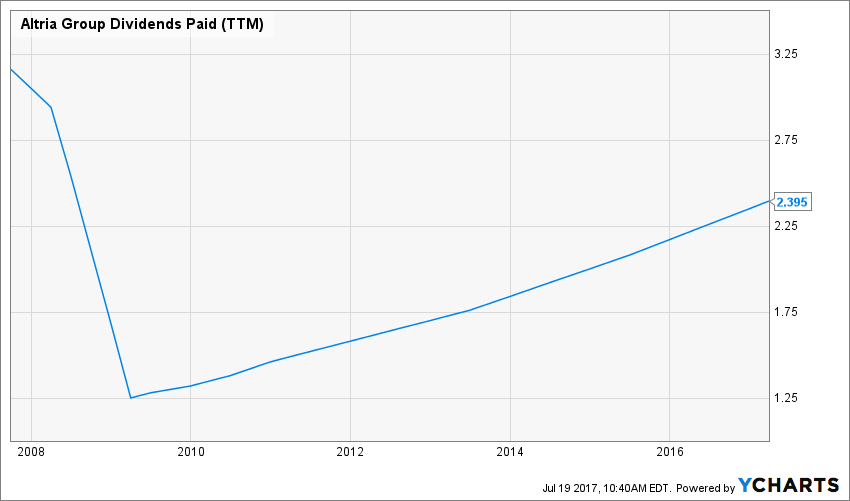

Source: Ycharts

Altria has increased its dividend 50 times in the past 48 years. This make the company part of the dividend achievers lists. The Dividend Achievers Index refers to all public companies that have successfully increase their dividend payments for at least ten consecutive years. At the time of writing this article, there were 265 companies that achieved this milestone. You can get the complete list of Dividend Achievers with comprehensive metrics here.

MO meets my 2nd investing principle.

Principle #3: Find Sustainable Dividend Growth Stocks

Past dividend growth history is always interesting and tells you a lot about what happened with a company. As investors, we are more concerned about the future than the past. this is why it is important to find companies that will be able to sustain their dividend growth.

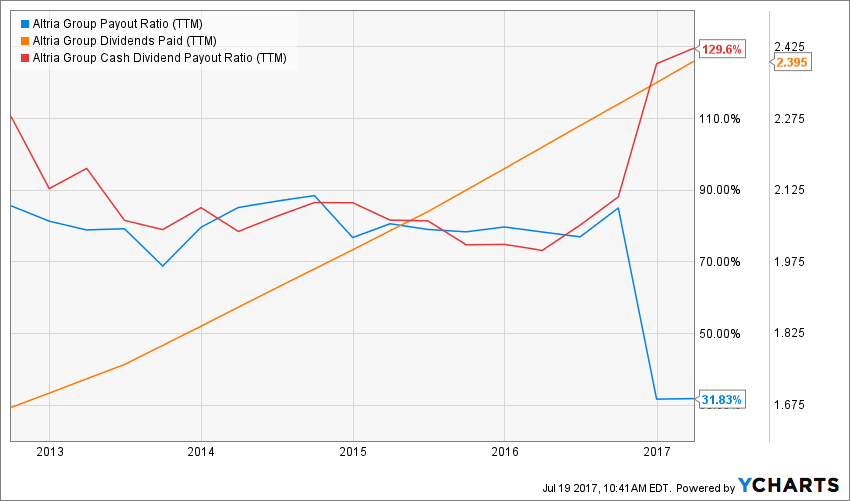

Source: data from Ycharts.

Please note the reason the payout ratio goes went down dramatically is because of the gain realised on AB InBev/SABMiller business combination. In other words, this is a one-time adjustment that should not be considered.

Therefore, the “real” payout ratio is more about 80%. While I’m satisfied with a 80% payout ratio, I will pay a close attention to it in the future.

MO meets my 3rd investing principle.

Principle #4: The Business Model Ensure Future Growth

The core business of MO has been and will remain tobacco products. While Altria benefits from a strong branding and the pricing power that comes with it, its number of clients is decreasing year after year. Additional growth vectors must be added to the equation before it’s too late. The 10% participation in ABInBev, the increasing wine segment and the potential of heated tobacco are enough factors for me to consider Altria a growing company for now.

MO still shows a strong business model and meets my 4th investing principle.

Principle #5: Buy When You Have Money in Hand – At The Right Valuation

I think the perfect timing to buy stocks is when you have money. Sleeping money is always a bad investment. However, it doesn’t mean that you should buy everything you see because you have some savings aside. There is a valuation work to be done. In order to achieve this task, I will start by looking at how the stock market valued the stock over the past 10 years by looking at its PE ratio:

Source: data from Ycharts.

If you ignore the recent PE drop due to special item in their most recent quarter, MO is being traded at an ever increasing PE ratio. While I understand the attractive perspective of MO cash flow generation abilities, I start to think it is overpriced.

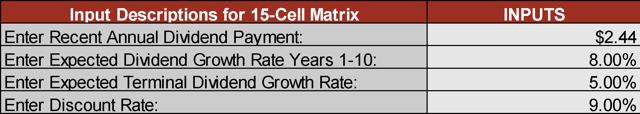

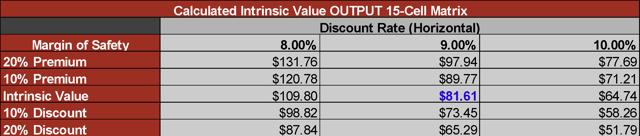

Digging deeper into this stock valuation, I will use a double stage dividend discount model. As a dividend growth investor, I rather see companies like big money making machine and assess their value as such. I think MO is able to maintain a 8% dividend growth rate for the first 10 years as MO is generating lots of cash flow and has the possibility to market IQOS (pending FDA approval). However, I reduced the terminal rate to 5% as I don’t think revenue growth will be that strong in the future. Since MO revolves in a very stable and mature market and future cash flow are relatively predictable, I used a discount rate of 9%.

Here are the details of my calculations:

Source: how to use the Dividend Discount Model

MO is showing a 10% upside potential at the moment. However, this is assuming a FDA approval for the IQOS system.

MO meets my 5th investing principle with a 10% upside potential

Principle #6: The Rationale Used to Buy is Also Used to Sell

I’ve found that one of the biggest investor struggles is to know when to buy and sell his holdings. I use a very simple, but very effective rule to overcome my emotions when it is the time to pull the trigger. My investment decisions are motivated by the fact that the company confirms or not my investment thesis. Once the reasons (my investment thesis) why I purchase shares of a company are not valid anymore, I sell and never look back.

Investment thesis

A leading company in a well-protected market is always a good source of cash flow. Altria can continue generating cash for shareholders for several years to come. While growth factors are interesting but not incredible, the outcome of the IQOS system on the market will be crucial. However, regardless of this option, MO is still a solid dividend payer that will continue increasing its payout for the next decade.

MO shows a solid investment thesis and meets my 6th investing principle.

Principle #7: Think Core, Think Growth

My investing strategy is divided into two segments: the core portfolio built with strong & stable stocks meeting all our requirements. The second part is called the “dividend growth stock addition” where I may ignore one of the metrics mentioned in principles #1 to #5 for a greater upside potential (e.g. riskier pick as well).

Altria evolves in a mature market with highly predictable outcome. Considering its strong dividend payout history, MO could be part of a core holding for income seeking investors.

MO is a core holding.

Final Thoughts on MO – Buy, Hold or Sell?

While Altria meets my 7 dividend growth investing principles, I’ve decided not to pull the trigger on this one. I’m not too keen about the tobacco industry and sales could erode faster if the company doesn’t come with new products in the next decade. I respect its dividend growth potential, but I will leave MO to other investors.

Disclaimer: I do not hold MO in my DividendStocksRock portfolios.

The opinions and the strategies of the author are not intended to ever be a recommendation to buy or sell a security. The strategy the author uses has worked for him and it is for you to decide if it could benefit your financial future. Please remember to do your own research and know your risk tolerance.

Leave a Reply