Asset allocation, the practice of deliberately using several distinct forms of investments to accumulate or preserve wealth, has both obvious and subtle advantages. Various forms of investment include, but are not limited to, stocks, bonds, real estate, options, commodities, insurance, and currencies.

The Obvious Advantage

Most people readily grasp the obvious advantages of asset allocation. By spreading one’s wealth among a variety of investment types, one avoids “putting all of their eggs in one basket” and therefore reduces risk by reducing concentration. Sometimes stocks have bull runs and sometimes they have bear runs, sometimes bonds have solid returns, and other times they have low returns, and so diversifying between asset classes can reduce volatility and exposure to any particular risk. Fixed income investments have inflation risk, while equities are fairly resistant to inflation over the long-term. Equities are more volatile and have a more complex risk/reward profile.

The Subtle Advantage

Asset allocation is a bit more powerful than simply the obvious advantage. It allows one to, either actively or passively, take advantage of upturns and downturns in various asset classes.

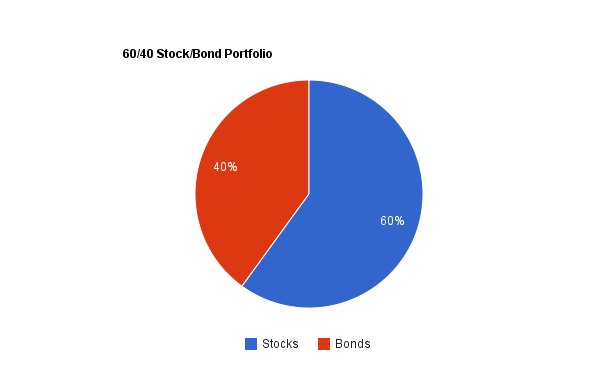

Consider the simplified example of a portfolio perpetually consisting of 60% stocks and 40% bonds. Stocks and bonds tend to have imperfect inverse periods of highs and lows. In other words, when stock indices are going up, bond indices are often going down, and vice versa.

If one keeps their portfolio consistently allocated according to the 60/40 distribution, then they will be buying and selling stocks and bonds as the markets go up and down. When stock indices go up, the stock part of the portfolio will increase, and that would lead to the portfolio no longer being balanced with a 60/40 distribution. So, to counter that, some stock would have to be sold, and bonds purchased, in order to bring the distribution back to 60/40. Then, at a later time, when stocks have a considerable drop, the stock part of the portfolio will decrease, and that again would lead to the portfolio no longer being balanced with the 60/40 distribution. So, to counter that, some bonds would have to be sold, and stock purchased, in order to bring the distribution back to 60/40. A similar effect can be done by choosing to put regular contributions into whichever side is under-balanced.

If one keeps this up, they are essentially forcing their self to buy low and sell high. When stock indices are high, they are selling stock and buying bonds in order to get back to the 60/40 distribution. When stock indices are low, they are selling bonds and buying stock in order to get back to the 60/40 distribution. This approach, almost robotic-like in nature, allows one to buy low and sell high without attempting to predict market movements or time the perfect highs and lows.

This example can be expanded to include multiple asset classes. For instance, the “stock” category can be divided between domestic large caps, domestic small caps, and foreign stocks, and as their various indices go up and down, the wealth will be continually distributed among them.

Asset Allocation Doesn’t Necessitate Passivity

Many forms of asset allocation involve passive investments, but asset allocation should not be understood to necessarily mean a strictly passive investment strategy, although that’s one possibility. In fact, while I do not argue with the usefulness of index funds, I promote individual active investing in addition to them.

Why? In this particular article, I’m not going to get into the debate about whether passive or active investment is more likely to produce better returns for a given individual investor. Passive investing is an excellent financial strategy in many cases, and active investing may or may not produce better returns than this low-maintenance, high-reward strategy. Instead, the reasons I encourage individual stock selection are:

-The ramifications of citizens not having control of their country’s corporations are unfortunate in my view. With so much index investing and mutual fund investing, where people are invested in the economy as a whole with little concern for individual investments or shareholder voting rights, corporations are in a position to operate in a way that does a disservice to society. When the masses give up their voting rights into the hands of a few, rather than take active interest in the economy of their society, I find the situation to be problematic. What more could a board ask for than for shareholders to indirectly provide capital while willingly giving up their voting rights and attention?

-Some people panic or get confused when their passive retirement accounts decrease. There’s a sense of lack of control when people don’t understand their investments. Some people view the stock market as a casino, and some people take money out during market bottoms out of fear. When you’ve thoroughly analyzed a company, and can observe the specific results of their operations, the strength of their balance sheet, and their continued ability to pay and increase their dividend, then one becomes virtually immune to worry about stock price movements. One begins to only care about company performance. Disciplined passive investors can, however, achieve similarly powerful mindsets.

-Many people are unfortunately financially illiterate. I encourage people to be well-rounded: literate in science, history, business, culture, and so forth. Although not everyone is suited for active investing, the excuse that people are too busy doesn’t hold much water in my opinion.

-Although some forms of passive investing allow one to be a dividend investor, many of them do not. I feel that acquiring robust streams of passive income from investments that one understands is an important aspect of wealth, and many forms of passive investment don’t focus on it.

Conclusion

Regardless of whether you’re a passive or active investor, realize the obvious and subtle advantages of asset allocation, and use them to your advantage by understanding that asset allocation is more than just the sum of the parts. Keep your wealth growing and safe, and utilize approaches to buy at good prices without trying to predict market highs and lows.

Nice post. I would also add on the side of buying stocks versus indexing that buying stocks is fun! I am comfortable with clients actively trying to beat the market with individual stocks or trading with up to 20% of their investable assets. I believe at least 80%, especially of retirement money, should be invested to capture the market return at minimal cost. I also ask my clients to limit investing in any single stock to 5% of total investable assets. You never know!

Advisors will tell you also that many clients have an account they don’t tell you about on the side that they actively manage. They like to beat the pros!

While I understand the concept of asset allocation working in this manner, I believe this is more pertinent in theory than in actual use…at least during the early accumulation years. I am 30 and have a decent amount invested in a dividend growth style portfolio. However, with regular large cash infusions, I always have excess cash lying around to invest. In my case, I don’t actually sell high, but I do invest new cash to maintain allocation balance.

I also am running into an issue in convincing myself to purchase bonds to balance my allocation given the risks currently inherent in bond pricing due to interest rates and the threat of inflation.

So while in theory I agree with your article, I find it difficult to implement in the real world. Perhaps once my portfolio has grown to a certain size, the allocation will dwarf the cash infusions and make this principle more pertinent??

Hi Chemkrafty,

I recommend reading this article:

http://andrewhallam.com/2011/03/amazing-investment-returns-earned-by-prudent-americans/

Out of the sites on my blogroll, Andrew Hallam focuses particularly on index investing

Another great post Matt. I was curious to see what you thought about Target Retirement funds?…seeing how the asset allocation is essentially set for you. Thanks!

Great post Matt.

Personally, I like the “traditional” stock/bond split, it makes sense although I’m a little higher % in stocks since I have a defined benefit pension plan. I can be more aggressive.

On the topic of buying and selling stocks and bonds as the markets go up and down, why sell anything at all? Buy bonds when equities are high and buy more stocks/equities when the markets are low. That’s my strategy. I’m not selling unless I have to and hopefully that doesn’t happen very often.

How about you?

@Chemkrafty – agreed, you’ll enjoy Andrew’s articles and also many posted here on the merits of balanced, indexed investing, albeit with a Canadian-investor focus, but the principles are the same:

http://canadiancouchpotato.com/

Furthermore stocks are expected to have higher returns variability than bonds. Historically correlations were low between stocks and bonds domestic and foreign stocks stocks bonds and alternative investments commodities hedge funds VC funds etc .

It’s definitely important to remember that asset allocation can create safety, especially when mixing in assets that are considered “less risky.”

100% bonds would seem to be 100% safe, but statistical models show that at least some stock allocation makes the portfolio actually LESS risky in terms of standard deviation, while also generating greater annual returns.

Daniel,

I think Target Retirement Funds make a lot of sense for many people, and particularly in retirement accounts.

JT McGee,

Yep. Going 100% bonds would consolidate all risk into interest rate risk and credit risk.

My Own Advisor,

I would say it depends on several factors. I prefer individual stock investing combined with widespread bond investing. For my 401k which consists entirely of indexes, I keep it balanced to where I want it to be, both by changing the percentages of new capital, and by rebalancing if necessary.

For the rest of my portfolio, I do not sell stocks to rebalance. I only sell stocks if I no longer consider them to be a good investment (typically either they have become significantly overvalued or because they no longer meet my investment thesis). I put fresh capital (along with dividend streams), into investments that I feel are undervalued, or to bring up my stock or bond portion.

Whether selling is needed or not will likely depend on the size of the portfolio compared to what the regular amount of fresh capital is, and on how strict the investor is with regard to their percentages.

Good post, I believe asset allocation is a crucial part of succesfull investing. Back in the day Graham recommended a steady portion between stocks and bonds with atleast 25% in each asset class. Stocks do seem a lot more attractive then bonds these days though..

Have you considered analyzing AT&T? I would be interested in that!

I’d also like to see your analysis on AT&T. I own Verizon Communications, so evaluating the competition is always a great thing.

I’ll see what I can do about an AT&T analysis.

I plan on posting fully updated analysis articles for BIP and JNJ, and I also have plans for NVS, and I can hopefully post an analysis on T somewhere in there.

In other words your selection of individual securities is secondary to the way you allocate your investment in stocks bonds and cashand equivalents which will be the principal determinants of your investment results.Asset-allocation mutual funds also known as life-cycle or target-date funds are an attempt to provide investors with portfolio structures that address an investors age risk appetite and investment objectives with an appropriate apportionment of asset classes.

Great post!

To sum it up, asset allocation + disciplined rebalance = investment success!

@DIY investor, nice to see you here.

@Chemkrafty, the bond market is as unpredictable as the stock market. If you are concerned about interest rate might go up, use short bond instead of long bond. If you are in your 30s and have good stable job and good saving habit, you are like your own bond. You can increase your stock allocation.

@Daniel, target retirement funds are a great invention, second only to index fund. This is according to Jack Bogle. I highly recommend Vanguard’s target retirement funds. Don’t mix it with other funds though. I saw investors having a target retirement fund and a few bond funds here and a few stock funds there, what’s the point other than defeating the purpose of the target retirement fund.