photo credit: If time doesn’t exist, then you’ve never been late in your life. Think about that. lassedesignen/Shutterstock

Do you time your investments ?

After such an important rally on the stock market, we have come to the point of asking ourselves as an investor if the party is about the end. We read more and more articles about the next bubble to burst in front of us. The FED has printed too much money, the Chinese market is headed directly into a wall and the European Central Bank has started to mimic the FED and found their own money printer.

Has the stock rally been created from artificially low interest rates and easy access to money or is there a real economy churning behind all this?

Is the stock market is about to collapse?

Or are we going to go through an unprecedented bull market?

There is no need to answer all these questions

There is definitely an answer to all these questions and more. In fact, you definitely have your own opinion as I have mine. However, we will only be able to test our answers in a few years when we look back at the charts and say “see! I told ya! It was obvious!”. But trying to time the market and being right about everything that is going to happen in the next 6 months, next year, 6 years is like playing with magic; it happens in the movies but doesn’t quite do well in reality. However, there is something that is a lot more easier to predict and that will keep you happy at night: dividend payments.

Dividend Growth Investing prevents you from timing the market

The idea of investing in dividend growth paying companies is the point of buying and holding for a very long period of time, shares of a group of companies that will reward you with quarterly payments no matter what is the weather outside. In general, long term dividend growth companies are less affected by market crashes than the overall market. For example, I’ve pulled out 6 companies that I hold and that meet my 7 investing principles and compared them to the S&P 500 from August 1st 2008 till 5 years later (August 1st 2013):

Source: Ycharts

As you can see, beside Lockheed Martin (LMT), all companies performed better than the S&P 500 5 years after the crash. Also, only one company, Union Pacific (UNP), did worst than the S&P 500 during this period. I could have cherry picked all dividend growth stocks that performed better, but I wanted to pick among my own dividend portfolio (I didn’t hold all these back in 2008, but they are all part of my portfolio now).

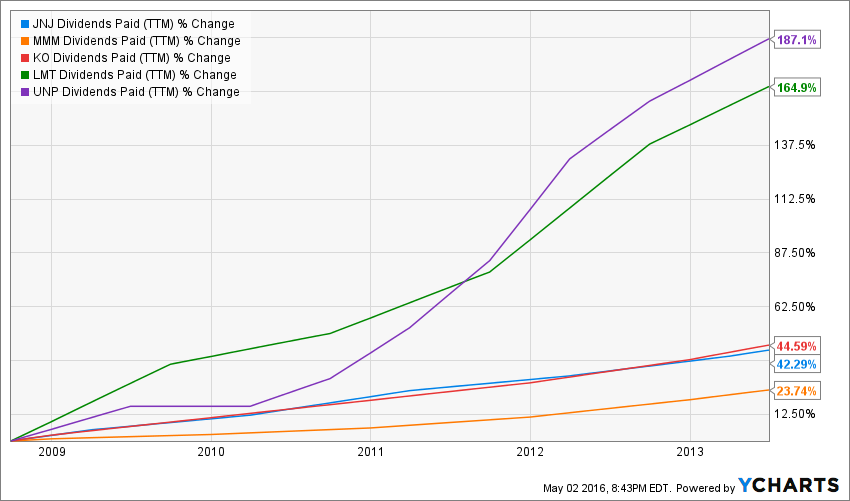

I can hear you saying already: “what’s the matter? DivMonk wants to prove us that he can cherry pick stocks that did better during a market crash? Anybody can do this”. You are right to think that. But that’s not what I want to show you. The important graph is the following one:

Source: Ycharts

The point is that during the market crisis, these companies didn’t only keep distributing their dividend payments, they increased them year after year. This means that while your portfolio recovered from the crisis somewhere between 2012 and 2013, you kept earning your quarterly payments. By the time your portfolio healed fully, your dividend growth portfolio is likely paying 1.5 times the dividend than it used to 5 years ago. You have here a great example of how the power of compounding income can help you weather any market crisis without affecting your investment goals.

Now, imagine if you select strong dividend growth companies and wait 15, 20, 25 years. Your portfolio will go through several storms but you will always earn more money year after year thanks to the ever increasing dividend payments.

If you invest by following a simple but effective set of dividend growth rules, you will successfully meet your investing goals.

Disclaimer: I’m long JNJ, MMM, KO, LMT, UNP

I see many of these as overvalued, especially JNJ, though it seems rocksolid. Should we continue racking our brains trying to get the right valuation, or is it more important to just go ahead and purchase the high quality company?

Dividends are paid from free cash flow. Without it, there is nothing to pay for investors. Therefore I only focus on companies which have for more than two decades been extremely (and still are) profitable from cash flow point of view (high FCF-to-sales, FCF-to-assets and FCF-to-equity).

Long: Amphenol, Atlas Copco, Hennes & Mauritz, Hershey, Nokian Tyres, Novo Nordisk, SAP, Svenska Handelsbanken, Varian Medical Systems

I love to own all of the stocks you mentioned. Only problem I have is price. It seems that those dividend growers are always pricey. Can’t wait for bad news to hit them hard! :)

BSR

Dividend or growth stock are always better bought after a recession than before.

One thing I don’t like about dividends is that I have to pay taxes, instead on capital gain not.