The Dividend Toolkit is now available, and it’s designed to emphasize practicality.

If you want to build exponentially growing passive income streams through dividend stocks, and you’re an investor that is willing to put in the time to make smart long-term investment decisions but you don’t want to spend hours and hours every day analyzing companies, then you’ll find this package useful. It’s specifically about how to maximize your time by using a streamlined stock analysis method to quickly get the most useful pieces of information about a company and find the best picks.

The Dividend Toolkit includes two components:

1) The 200 page PDF Stock Analysis Guide for individual investors, which describes the extremely efficient method to analyze a dividend stock, how to build and manage a dividend portfolio, and what you need to know about MLPs, REITs, and asset allocation. It offers plenty of content, but is divided into modular sections so that it’s easy to read through. The first chunk of the book is introductory content for new investors, and the later part of the book gets into the useful specifics. Even if you rely on newsletters or blogs for your stock ideas, this guide will give you a deeper understanding of your investments and will give you specific tools to check the accuracy of any stock ideas that you’re given.

2) The Valuation Spreadsheet File, which contains a streamlined and easy-to-use tool to instantly calculate the intrinsic value of a stock. Unlike many financial books that give equations without an efficient way to use them, this book comes with the the tool to apply the specific concepts in the book. It has a few different options, including the Dividend Discount Model, so that you can calculate the fair value to pay for any stock.

Available for instant download at the price of $19.95:

Time-Tested Financial Theory Folded down to Actionable Investment Strategies

Value investing fundamentals don’t change, even if the markets do. The importance of Discounted Cash Flow Analysis and the easier and more focused Dividend Discount Model have been around for decades and aren’t going away, but many individual investors do not fully understand them.

The Dividend Toolkit explains the valuation methods, including Discounted Cash Flow Analysis, in easy terms. They’re elegantly simple once they are understood. There’s an introductory section on the investing basics, and then it gets into more detail in the advanced sections. But for each topic, it brings everything back down to practical and actionable things to help make you a better and more efficient investor, right away.

Some of the key topics include:

The Straightforward Method to Quickly Analyze a Dividend Stock

Unlike many other investing books, I’ll show you my specific step-by-step method for analyzing a company. It’s based on the 80/20 rule to focus on the most useful information. The description of the method tells you exactly what to look for in each financial statement, and you can gather the information in a fairly short period of time. And yet, the result is quite complete; it covers growth, balance sheet safety, dividend metrics, qualitative information, and a fair value estimate. You can follow the method exactly as-is, or you can combine it with your own investing style.

Why “Buy and Hold” Investing Is Alive and Well (If You Do It Right)

The “Lost Decade” of 2000-2010 wasn’t nearly as lost as some people think, and using the principles of this toolkit, you can make sure you never make the same investing mistakes that people did in the beginning of that decade.

The Two Key Valuation Methods, and the Shortcut so You Don’t Need to Always Use Them

The dividend book covers two critical methods to determine the fair value of a stock:

1) Discounted Cash Flow Analysis (DCFA)

This bread-and-butter valuation technique is used by professional investors in many different forms, including by Warren Buffett.

2) The Dividend Discount Model (DDM)

This uses the same exact concept as DCFA, but it’s tailored for dividend stocks. So under the right conditions, it’s quicker, cleaner, and easier to use.

The book explains, in straightforward terms and with easy examples, why and how these methods work. But then it goes a step further, and shows you the simple shortcut equation so that you don’t necessarily have to use the full stock valuation methods every time. Plus, the streamlined stock valuation spreadsheet tool makes using those full methods easy, quick, and accurate for when you do want to use them. (The spreadsheet does it in seconds.)

The #1 Thing That’s Even More Important than Asset Allocation

What size of a bond component should you have in your portfolio? How much of an impact will it have on your total returns, and to what extent will it reduce volatility? People have wildly different opinions about asset allocation and modern portfolio theory, but how do we know what really works?

Specifically for this toolkit, I wrote a computer program to help me sort through raw market data from the last 35 years, and in the dividend book I present the clear results in simple, colored charts and explanations. If you’ve read my articles, you know I don’t just present opinions. I back things up with facts and numbers and present them with straightforward charts and explanations, and then provide a conclusion about the results.

-How much better would a 100% stock portfolio have done over the last 35 years compared to a rebalanced 75/25 stock/bond portfolio, or a rebalanced 50/50 stock/bond portfolio? If you want to maximize returns while building a sturdy portfolio, the answer may surprise you. This period covered the late-1970’s recession, the bull market in the 1980’s, the 1987 market crash, the huge bull market of the 1990’s, the popping of the tech bubble, the early-2000 recession, two long wars in the Middle East, the growth and the pop of the housing bubble, the financial collapse, the Great Recession, and the partial rebound. This program helped me organize information over this diverse period so I can show you what worked. Prepare your portfolio for whatever it is that comes next.

-The results show that there’s one thing that’s far more important than your asset allocation. You may know the answer, but you may be surprised at how the specific numbers work out.

-I’ll show a specific market ratio you can check very simply that can tell you fairly accurately whether the market is overvalued or not, and I’ll provide data to show how it can be used.

The Perfect Type of Stock for a Lousy Market

With European debt problems, economic slowdowns in emerging markets, and American political uncertainty regarding tax changes and budget cuts, maybe you’re not too optimistic about the global economy and the potential stock market returns over the next 5 years. I’ll show you one of my favorite types of stocks for exactly this kind of market. They do fine in bull markets, and these types of stocks do especially well in flat markets, and their returns are among the most reliable you’ll find.

Streamlined Valuation Spreadsheet

In order to publish stock reports that are of quality and in decent quantity, I had to develop an efficient method for analyzing dividend stocks.

First, I use a straightforward and highly specific method for scanning and analyzing companies based on growth, balance sheet strength, dividend yield, dividend safety, and the strength of the economic advantage, and I’ll walk you through that process, as I’ve already described. Second, I needed a tool to calculate the intrinsic value of a stock quickly and accurately.

With this second part, I ran into a problem. There are freebie valuation calculators online that just don’t fit my needs. They basically work, but they don’t have high usability. For these freebie tools, I have to provide the inputs to get a single output, and if I want to tweak my numbers slightly, I had to re-do the inputs all over.

On the other hand, there are some high-end valuation calculators, software, and spreadsheets on the market. Although they may be powerful for professional investors that deal with deep-value or high-growth businesses, these tools are often cumbersome and slow. For all their quality, they just don’t serve dividend investors the best.

So I had to develop my own tool that falls in between those two extremes. Something robust, simple, and quick to use, and yet something that provides dividend investors with great results. Specifically, I wanted a spreadsheet tool that lets the user put in a single set of inputs, and then automatically calculates a range of fair values based on a few different scenarios.

See, all valuation methods rely on estimated inputs. The two main things you need are an estimate for the growth rate, and your discount rate. (Your discount rate should be your target rate of return.) But if those inputs are off even slightly, the whole valuation method will be off. With basic freebie valuation calculators, you need to put in more than one set of inputs if you want to see several output options, and you have no way of keeping track of the differences.

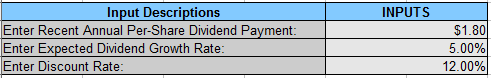

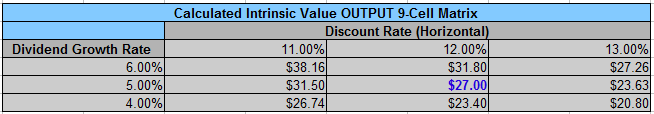

Suppose you want to calculate the fair value of a stock using the Dividend Discount Model (explained in the book), and you estimate that the dividend will grow by 5% per year, and you’re using 12% as your discount rate. First, you put the simple inputs into the Dividend Discount Model spreadsheet tool:

And the tool instantly updates the output chart to tell you the fair value of the stock:

This output chart will not only tell you the fair stock value based on those inputs, but will also tell you the fair stock value based on nearby inputs. In this example, in addition to calculating the results for 5% dividend growth and a 12% discount rate, it will automatically show what the fair value is if it turns out that the stock only grows its dividend by 4%, or if you use a discount rate of 11% instead.

This particular tool provides nine total output values, centered around the primary estimate. In this example, because I chose 5% for my estimated dividend growth, the output chart automatically adjusts to show the calculated fair values for 4%, 5%, and 6% growth. And because I chose 12% for my discount rate, the output chart automatically adjusts to show 11%, 12%, and 13% discount rates.

So there are nine total outputs. In this example, I was looking to estimate the value of this stock that paid $1.80 in dividends with estimates for 5% annual dividend growth and a 12% discount rate. The primary result is the $27.00 figure in the middle, which corresponds to 5% growth and 12% target rate of return. The result in the top left corner shows a related estimate, except that it shows the fair value for the same stock but with a 6% dividend growth rate and with a less aggressive 11% discount rate. The result in the bottom right corner shows another estimate, except that it shows the fair value if the stock only has a 4% dividend growth rate and if a 13% discount rate is used. The other cells show other combinations in between those two extremes.

This gives situational awareness. You can quickly calculate the primary estimate based on your inputs, but it also shows you a range of values, in an organized chart, so that you can quickly see other possible scenarios without having to re-enter any inputs. It shows you what type of returns you could reasonably expect given certain growth rates and entry prices, and helps you make an informed buying decision for your target rate of return.

There’s a spreadsheet tool for the constant-growth Dividend Discount Model, which is what you see here. There are also three others: one for a two-stage Dividend Discount Model (which is useful for companies with fast dividend growth), one for constant-growth Discounted Cash Flow Analysis, and one for two-stage Discounted Cash Flow Analysis. The tools are all contained in one spreadsheet file for easy use.

The Dividend Toolkit includes this spreadsheet file along with the PDF dividend investing book, and the file contains all four spreadsheet tools. The book explains how to use them (they’re easy), describes why and how they work, and describes in simple terms how to come up with solid input estimates. The spreadsheet can help you quickly calculate the fair range of values to pay for a stock. It can also be used to understand the shortcuts that allow you to avoid having to use them too often if you don’t want to. It comes in Open Office and Excel versions, so you can open it in Microsoft Excel, or Open Office, or many other spreadsheet types. You can even load the file into Google Docs and use it in your browser.

About the Writer, M. Alden

I’ve been publishing free stock research online that has been read over a million times since early 2010. The investing research from this site has appeared on Seeking Alpha with 15 Editor’s Picks, as well as on Morningstar, Guru Focus, the DIV-Net, The Motley Fool, Google Finance, and the Daily Crux.

I’m an engineer by profession, and this guide is specifically written by an individual investor for individual investors. It was created with practicality as the primary focus: It focuses on the tried-and-true fundamental value investing strategies and then folds them down into an easy-to-use analysis method that is specifically tailored for individual investors that have full time jobs or other time commitments, and want the most use out of their time.

I also publish a dividend newsletter at no cost that has thousands of subscribers, with readers ranging from students to retirees to physicians to professional money managers.

Here Are The Reviews

Producing investment material is a competitive business. Superficial “me too” material gets discarded by the market, and overly cluttered and tedious material gets ignored by all but the most devout readers.

The Dividend Toolkit offers a completely unique perspective about investing in companies that pay quality dividends, and correctly balances detail vs. readability. Look at what other financial writers have had to say:

“This is not your average investing E-book! I’ve never read an E-book filled with such detailed and genuine information in my life. Whether you are just starting out or you think you know everything there is about dividend investing, The Dividend Toolkit will take you through the basics as well as advanced chapters on finding the right companies to invest in and create a dependable flow of passive income.”

-The Loonie Bin

“The price is BEYOND reasonable just for the spreadsheets and this one chapter.”

-My Journey to Millions

“Matt Alden, the man behind the curtain over at Dividend Monk, has produced something very rare in the blogging world: an E-book that is actually worth reading.”

-Dividends for the Long Run

“In summary, this book is an excellent guide for dividend growth investors. It covers basic and advanced topics in a comprehensive yet readily understandable manner. I recommend the book to anyone who is interested in becoming a successful investor by building a sustainable and growing stream of income from dividends.”

-Dividend Growth Machine

You can read all the reviews here. These are full-article reviews by some of the top investment bloggers.

Get Your Copy Today

The price is $19.95, which includes both the electronic PDF guide on how to efficiently analyze a dividend-payer and the spreadsheet tool that allows you to quickly calculate the fair price of a stock. There are well over 1,000 satisfied customers and counting.

The Stock Analysis Guide is 200 pages, consists around 68,000 words, and is sent in PDF electronic format. It comes in a dense but easily readable layout, and is divided into clear sections, so it’s easy to focus on the parts that interest you the most.

The Spreadsheet File complements the Dividend Book and comes in three file formats (Excel .xls and .xlsx, and Open Office .ods), and contains four valuation tools: two for regular Discounted Cash Flow Analysis and two for the Dividend Discount Model. You can even upload the spreadsheet file as a Google Doc and use it without a spreadsheet program on your computer. The book explains how to analyze dividend stocks, and how to find the intrinsic value of a stock, and the spreadsheet lets you apply the knowledge in practice. I personally use this tool every time I publish a stock report.

Instructions

You can get your copy with your Paypal account or any major credit card, and the payment is securely processed by Paypal. After checkout, you’ll receive an email with your download link for the Dividend Toolkit zip file. You need to remove the folder from the zip file once you have it, and you’ll be able to read the PDF and use the spreadsheet valuation tool. You can purchase the Dividend Toolkit for $19.95 here:

Best Regards,

M. Alden S. & Mike McNeil

Disclaimer: M. Alden S. is the author of the Dividend Toolkit and Mike McNeil is my pen name used on The Dividend Monk and The Dividend Guy Blog.

ClickBank is the retailer of products on this site. CLICKBANK® is a registered trademark of Click Sales, Inc., a Delaware corporation located at 917 S. Lusk Street, Suite 200, Boise Idaho, 83706, USA and used by permission. ClickBank’s role as retailer does not constitute an endorsement, approval or review of these products or any claim, statement or opinion used in promotion of these products.