Texas Instruments is the world’s third largest semiconductor company, and has the largest market share of analog components.

-Seven Year Revenue Growth Rate: 0%

-Seven Year EPS Growth Rate: 1.6%

-Seven Year Dividend Growth Rate: 30%

-Most Recent Dividend Increase: 23.5%

-Current Dividend Yield: 2.80%

-Balance Sheet Strength: Moderately Strong

Based on estimates of slow revenue growth, strong analog and embedded performance, significant dividends and buybacks, I estimate Texas Instruments stock to be fairly valued with a modest margin of safety at $32, compared to the current price of $30.

Overview

Texas Instruments (NASDAQ: TXN), often referred to as “TI”, is one of the largest and oldest tech companies. The business has been using its current name for over 60 years, and is currently the third largest worldwide semiconductor company and the largest producer of analog components.

2011 Revenue Breakdown

| Segment | Revenue |

|---|---|

| Analog | $6.375 billion |

| Embedded | $2.110 billion |

| Wireless | $2.518 billion |

| Other | $2.732 billion |

| Total | $13.735 billion |

Analog Segment

Analog components convert real-world signals into digital representations, and the other way around.

Texas Instruments is the world’s leading analog producer, especially after their acquisition of National Semiconductor. The analog business is a desirable one in the tech world, or at least to Texas Instruments CEO Rich Templeton, due to the high profit margins. Economic advantages, or “moats”, are often difficult to obtain in the tech industry, but analog is an area where one exists.

Analog designs have rather long product lifecycles and do not require cutting edge manufacturing processes like every new cycle of CPU processor does. Instead, analog designs are difficult and require considerable expertise and resources to design, but have staying power once they’re produced. TI has the broadest range of analog devices out of any manufacturer, with an extremely diverse customer and product base, and therefore has a high profit margin and defensive position in the industry.

The Analog segment is further divided into four operating areas:

High-Volume Analog and Logic (HVAL)

These are application-specific and custom components, used in a very diverse range of industries from automobiles to consumer electronics. TI produces over 45,000 products in this area.

High-Performance Analog (HPA)

These are catalog/standardized products that are also used in a broad range of industries, from military applications to consumer electronics. TI produces over 17,000 products in this area and has over 70,000 customer relationships, with the top customer only accounting for 5% of sales.

Power Management

Consumer, industrial, and military systems require power management. Texas Instruments has 9,000 products in this category, and has more than three times the market share of their closest competitor.

Silicon Valley Analog (SVA)

This division is the acquired National Semiconductor company, and is a diverse set of components for several industries. With the thousands of components produced by SVA, the largest product only accounts for 1.3% of sales for this area.

Embedded Segment

The embedded division of Texas Instruments is their smallest segment, but it’s one of their core operating areas, since they’re the second largest business in this industry. The products consist of microcontrollers and digital signal processors. The two largest industries that use these products are communications infrastructure and automobiles.

Wireless Segment

The main product in this category is TI’s OMAP application processors. The company used to have heavy involvement in baseband products, but they’ve exited that industry and are winding down those products to negligible portions of revenue. Now, they’re also pivoting away from their applications processors. They’re shrinking that business to focus on products with longer lifecycles rather than cutting-edge consumer devices. The wireless segment has been the source of almost the entirety of TI’s revenue and earnings problems over the last few years.

Other

Texas Instruments is rather well-known by the general public for their calculators, despite the fact that this is a rather small element of their overall business. They also produce some custom products in this area and receive royalties. It’s a high profit margin, low growth segment.

Ratios

Price to Earnings: 20

Price to Free Cash Flow: 13

Price to Book: 3

Return on Equity: 16%

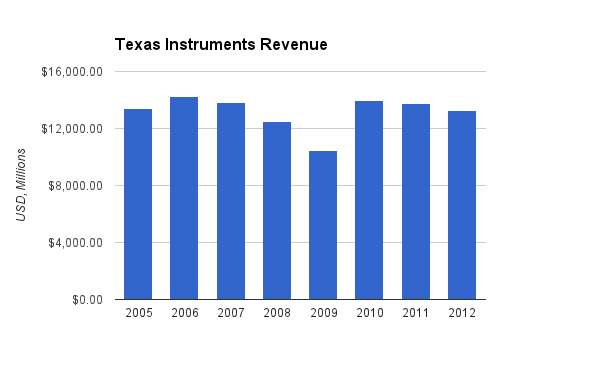

Revenue

(Chart Source: DividendMonk.com)

For these two charts, “2012” figures refer to the last 3 months of 2011 and the first nine months of 2012, due to the date of this article.

Texas Instruments was hit by the worldwide recession in 2007-2009, and then faced separate problems with their wireless segment which will be discussed below in the Thesis section.

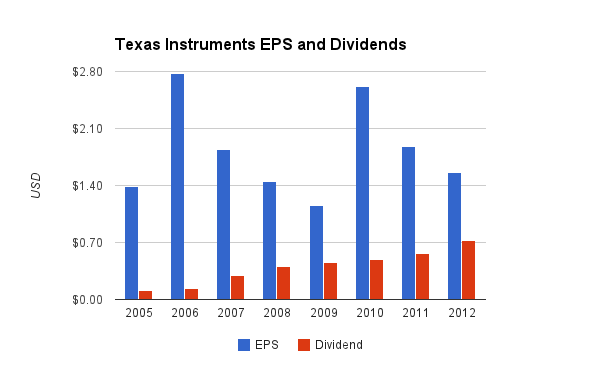

Earnings and Dividends

(Chart Source: DividendMonk.com)

Texas Instruments has had erratic EPS growth over this period. This is due to a combination of the recession and their wireless setback, which is discussed in the Thesis section below.

Texas instruments has become a dividend tech stock over the last several years, with a fairly high dividend yield for the tech industry of 2.80% and a regular dividend increase every four quarters. The dividend has an annualized growth rate of over 30%, but this is due to starting from a very low initial payout ratio. The most recent quarterly boost was from $0.17/share to $0.21/share, which represents a 23.5% increase.

The dividend is currently well-covered by both earnings and free cash flow, but dividend growth is ultimately capped by growth of EPS and FCF/share. The dividend growth rate will have to slow down even if normal EPS growth resumes.

Approximate historical dividend yield at beginning of each year:

| Year | Yield |

|---|---|

| Current | 2.80% |

| 2012 | 2.0% |

| 2011 | 1.5% |

| 2010 | 1.8% |

| 2009 | 2.8% |

| 2008 | 1.3% |

| 2007 | 0.5% |

| 2006 | 0.3% |

| 2005 | 0.4% |

How Does Texas Instruments Spend Its Cash?

Texas Instruments brought in approximately $7 billion in free cash flow cumulatively over the years 2009, 2010, and 2011.

Over this same three year period, the company repurchased $5.4 billion worth of shares, and issued $1.2 billion (which is rather high compared to most companies I cover), for a net repurchase value of around $4.2 billion. The company has reduced their share count from 1.77 billion in 2004 to 1.15 billion today due to share repurchases.

The company paid only $1.8 billion in dividends over this time period.

The only noteworthy acquisition over this time period (or over the entire last decade for that matter), was the acquisition of National Semiconductor by Texas Instruments for a huge $6.5 billion sum. The premise of this acquisition is that it dramatically increases the size of the analog segment of Texas Instruments which is the main area they wanted to be the dominant player in, and more specifically, it allows the large sales staff of Texas Instruments to have a larger and broader base of products to sell from. Texas Instruments is known for having an immense sales staff compared to any other business in this industry, so operational efficiencies may occur due to selling more of National’s components than National would have sold themselves. Due to the recency of the acquisition it is yet to be seen whether the company has overpaid.

Balance Sheet

Up until 2011, Texas Instruments had zero debt and plenty of cash, so their balance sheet was flawless. The company took on substantial debt in order to pay for the $6.5 billion National Semiconductor acquisition in cash, so now the company has some leverage.

The total debt/equity ratio is 50% as of the most recent quarter. Total debt/income is around 3x. Over 40% of the existing shareholder equity now consists of goodwill.

The most important metric, the interest coverage ratio, is over 25x, which is very strong.

Overall, Texas Instruments still has a very strong balance sheet in general, but a bit leveraged for the tech industry, and far more leveraged than their pristine financial state from 2010 and earlier.

Investment Thesis

Texas Instruments has been forced to make two major pivots over the last three years, and both of these changes are part of their wireless segment.

First, as baseband products became more of a commodity and Nokia decided to multisource them, Texas Instruments took a large hit, and decided to completely exit that business. They began focusing on analog, embedded, and their OMAP applications processors. But, OMAP applications processors ran into strong headwinds as well. They secured some strong design wins, such as in the Kindle Fire, but fell short elsewhere. Specifically, Samsung (the second largest semiconductor producer after Intel) and Apple are going with in-house processor designs for their products, and Qualcomm has been a stronger competitor than Texas Instruments in the remaining tablet and smart phone market. Therefore, Texas Instruments has decided to reduce their wireless segment and avoid competing with their OMAP processor space in the highly competitive smart phone and tablet markets. Instead, their OMAP processors will likely find a smaller, more profitable home in products with longer product lifecycles.

As Texas Instruments has been facing these headwinds in their wireless business, their other areas have remained strong. Their analog and embedded segments produce strong margins with significant shares of these highly fractured markets. Whereas the wireless segment has/had lower numbers of large customers, where a design win was critical, the analog and embedded segments have a much larger base of customers where no individual customer has a material impact on Texas Instruments.

As a design and systems engineer that works in a field where system robustness and reduced development costs are the key focus, analog and embedded products have very long product cycles. Organizations I’ve worked with have used products that were designed over a decade ago and that are still mass produced. A good analog component can serve its function in numerous products for quite a while. With embedded systems, once code is written, it’s undesirable to change the code until an entirely new design is used, which generally means sticking with the same microcontroller.

A quote by Freeman Dyson represents the analog and embedded industry well:

“A good scientist is a person with original ideas. A good engineer is a person who makes a design that works with as few original ideas as possible. There are no prima donnas in engineering.”

-Freeman Dyson

That’s essentially why analog designs live on for quite a while. Texas Instruments has a library of tens of thousands of products and only comes out with hundreds per year because this existing library of products continues to be relevant.

Risks

Despite having products with long product lifecycles and high margins, Texas Instruments does have risk. This has been clearly demonstrated over the past few years as their wireless segment faced tough competition and ultimately lost out. The diversity of the company has absorbed this impact, but the tech industry remains highly competitive with the need for continued research and development and new products.

The company now utilizes leverage after their National Semiconductor acquisition, and it will be seen over the next several years whether they paid an appropriate price for the company or not. The semiconductor industry is cyclical, so even if Texas Instruments maintains or gains market share, the industry as a whole does experience expansions and contractions.

Conclusion and Valuation

The three stated financial objectives of Texas Instruments are to grow revenue at a faster pace than the semiconductor market, to increase EPS faster than revenue, and to continue paying dividends and reducing the share count.

Once these headwinds from their wireless segment wear off, and the company resumes a post-acquisition stability, Texas Instruments appears to be primed for at least low single digit revenue growth, higher margins, larger share buybacks, and continually increasing dividends per share.

If real revenue growth is 2%, on top of 2% inflation or so, then that’s 4% revenue growth. Assuming the company spends $2 billion per year on buybacks, that’s 5-6% of the market cap per year. This would result in high single digit earnings growth, possibly higher, coupled with a yield that’s a bit under 3% currently.

Using a Two Stage Dividend Discount Model, with $0.72 in trailing twelve month dividends, a 10% discount rate (the target rate of return), an estimate of 11% average dividend growth for the first 10 years followed by 7% average dividend growth thereafter, would result in a fair price of $35.68. Buying with a 10% margin of safety would lead to a fair value of $32/share.

At the current price of $30/share, Texas Instruments stock appears to be in a good position to earn low double digit annualized returns. Alternatively, an investor could sell put options for January 2014 at a strike price of $30 or $35 to lower the cost basis to under $30.

Full Disclosure: As of this writing, I have no position in TXN.

You can see my dividend portfolio here.

Strategic Dividend Newsletter:

Sign up for the free dividend and income investing newsletter to get market updates, attractively priced stock ideas, resources, investing tips, and exclusive investing strategies:

Leave a Reply