This is the ninth and last in a series of articles elaborating on the 9 Steps To Build and Manage a Dividend Portfolio.

Asset allocation is more important for your portfolio than individual selections. Dividend stocks are not a replacement for bonds, and shouldn’t usually be treated as such. A dividend portfolio with a reasonable allocation towards fixed income securities is important for long-term stability and growth.

Dividend stocks, although often less volatile than the market as a whole, still go up and down with economic fluctuations. This isn’t necessarily a problem for long-term investors, but if you want to fully take advantage of these fluctuations, fixed income securities are useful. Bond indices tend to move inversely in respect to stock indices, so when stocks are going down, bonds are often remaining steady or going mildly up. Interest rates tend to be higher during periods of economic strength, which keeps bond prices reduced. When interest rates fall (typically during a period of economic weakness), bond prices increase.

Think of fixed income securities as your “war chest” for recessions or flash crashes.

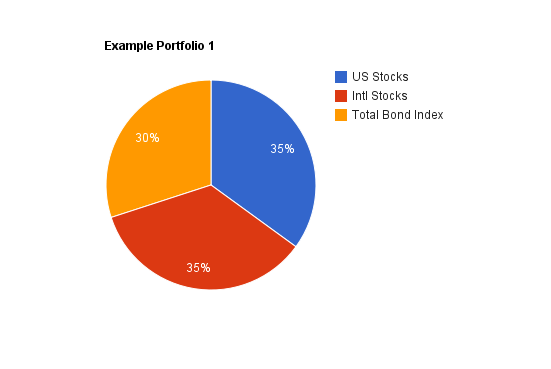

If you keep, say, a 70/30 allocation of stocks and bonds at all times, then you’ll be prepared for many market conditions. During periods of economic booms, when stock prices are rising fast and perhaps becoming overvalued, your stock percentage of your portfolio will increase to over 70%, and to keep the 70/30 allocation, you’ll either have to sell some stocks and buy some bonds, or preferably, keep the stock holdings you have and use your fresh capital that you regularly put in your portfolio to buy bonds. This is good, because when stock markets are highly valued and you have trouble finding good selections, you’ll instead be putting capital into bonds with solid interest rates.

Then, when a recession comes, and stock prices fall to attractive valuations, your percentage of stock holdings in the portfolio will decrease to under 70%, so you’ll naturally direct new capital towards buying stocks, and perhaps even sell some of your appreciated bonds to take advantage of the undervalued market depending on how big the stock drop was and how imbalanced your portfolio has become from your target asset allocation.

Keeping a consistent allocation of stocks and bonds naturally results in buying at fairly attractive prices, for both bonds and stocks. And note that none of this necessitates market timing. A 80/20 or 70/30 or 60/40 allocation of stocks to bonds can be maintained in all market conditions, so your buying habits are dependent on what your current allocation is rather than directly based on your market predictions.

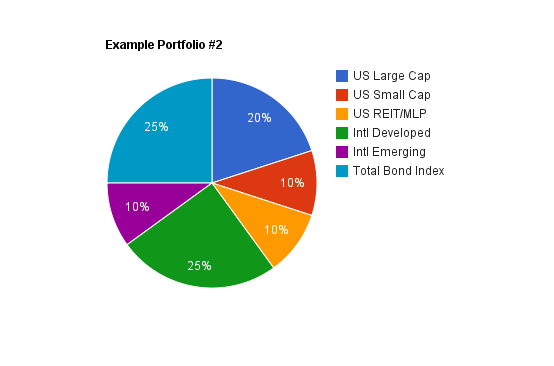

Suppose I have a total portfolio with the following balance: 20% US Large Cap, 10% US Small Cap, 10% US REITs, 25% International Developed, 10% International Emerging, and 25% Bonds. As they go up and down relative to another, and you rebalance with fresh capital or with annual rebalancing, you harness that volatility by mechanically buying on dips or mechanically buying low and selling high. It can work whether it’s purely indexed or whether substantial portions consist of individual stock selections. Sometimes particular segments might move substantially apart from each other; for instance you could have an emerging market bubble and a US real estate slump, which means you’ll mechanically be selling your emerging market holdings when they are highly valued and buying lowly valued US REITs.

It’s important to pick portfolio segments that have low correlation. It’s useful to have both stable and volatile elements in a portfolio, such as stocks and bonds. Having a bunch of segments that all typically move in the same direction limits diversification. Spreading your assets among geographic locations, market sectors, and asset classes keeps your exposure to a catastrophic loss as low as possible and helps keep a lack of correlation between your portfolio segments. Some rather serious problems can bring down almost all asset classes, but careful selection (certain types of equities, certain types of bonds, real estate, infrastructure, perhaps commodities and cash, etc.) can reduce this possibility.

It’s often reasonable advice to gradually increase the percentage of bonds as you age, so that a large market drop that occurs right when you plan to retire won’t derail your plans, but this would depend on your individual situation and goals. For the most part I agree with the common advice; young people would do well to have a lot of equity exposure, since equities have historically offered the best returns, and those nearing retirement would do well to focus on capital preservation and moderate growth.

Although it can be tempting to think of assets that produce cash flows, such as dividends or interest, as being in the same group, dividend stocks are not a pure replacement for bonds in a portfolio. Maintaining diversification keeps your options open, your risks reduced, and improves the chances of attaining solid long-term returns.

Great post, asset allocation is crucial. Graham suggests that one one should always keep a bond share of 25-75% (with stocks taking the rest). I have broke that rule a bit lately by switching bonds for stocks (more then the market correction demanded).

Great post Matt!

I don’t have much to offer, only to say I keep about 30% of my portfolio in bonds, all the time. As I age, that % will increase. If I didn’t have a defined benefit pension at work, my RRSP probably would be closer to 40% bonds. It probably will be anyhow in another 10 years, in my mid-40s.

I love dividend-paying stocks, they provide me with a war-chest of a different kind, but dividend stocks are definitely not a replacement for bonds. I think for 98% of investors, that would be the case.

Cheers,

Mark

Great information, Matt. I’m not yet 30, but have begun researching bonds fory portfolio. You make a compelling case for strict allocation of stocks and bonds. Thanks again for this article.

Hi

Diversification is a false sense of security under the theory that different asset classes move up at different times. Dividend stocks with a reputation of paying and growing dividends over YEARS and even decades during all types of economic situations will be safer. Keeping your portfolio with limited number of stocks so you can keep tabs on them and be sure to keep tabs on them is the only safe way.

Steve