Summary:

Seaspan is the world’s largest major shipping line company with alternatives to vessel ownership.

Investors benefit from a generous 8%-9% yield, why would you ignore it?

The company’s fleet is increasing in size leading to higher revenues, but earnings are not following.

Regardless a nice business model, the company will have to bring more cash flow to the table to become interesting.

DSR Quick Stats

Sector: Industrial

5 Year Revenue Growth: 15.00%

5 Year EPS Growth: -0.68%

5 Year Dividend Growth: 26.71%

Current Dividend Yield: 8.94%

What Makes Seaspan (SSW) a Good Business?

Seaspan provides many of the world’s major shipping lines with alternatives to vessel ownership by offering long-term leases on large, modern container ships combined with industry leading ship management services.

The company owns over 100 ships with over 3,000 employees working. The company has successfully signed several long term contracts with major clients the size of Costco (COST) for example. Their role is to become the solution for transportation for many retail clients selling merchandising across the world.

Ratios

Price to Earnings: 12.74

Price to Free Cash Flow: N/A

Price to Book: 1.972

Return on Equity: 10.50%

Revenue

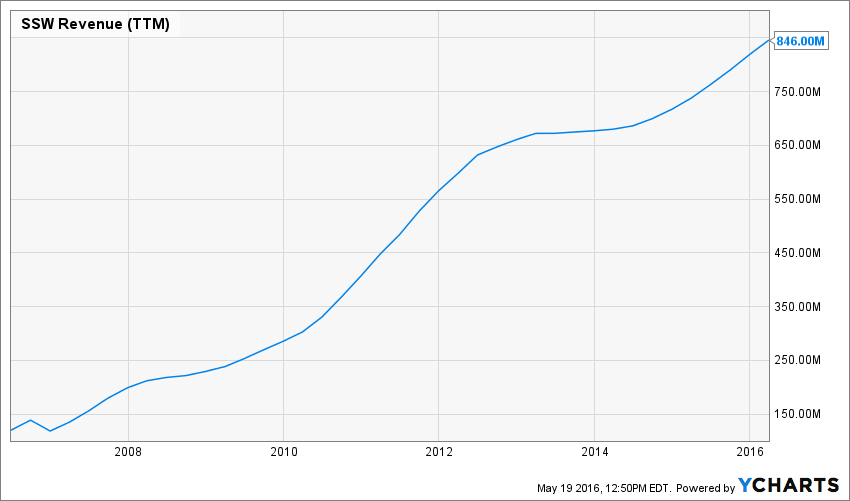

Revenue Graph from Ycharts

Seaspan revenues keep increasing year after year which is a good thing. Their fleet is expanding at the same rate (more on this later). So far, I like what I’m seeing.

How SSW fares vs My 7 Principles of Investing

We all have our methods for analyzing a company. Over the years of trading, I’ve been through several stock research methodologies from various sources. This is how I came up with my 7 investing principles of dividend investing. Let’s take a closer look at them.

Source: Ycharts

Principle #1: High Dividend Yield Doesn’t Equal High Returns

My first investment principle goes against many income seeking investors’ rule: I try to avoid most companies with a dividend yield over 5%. Very few investments like this will be made in my case (you can read my case against high dividend yield here). The reason is simple; when a company pays a high dividend, it’s because the market thinks it’s a risky investment… or that the company has nothing else but a constant cash flow to offer its investors. However, high yield hardly come with dividend growth and this is what I am seeking most.

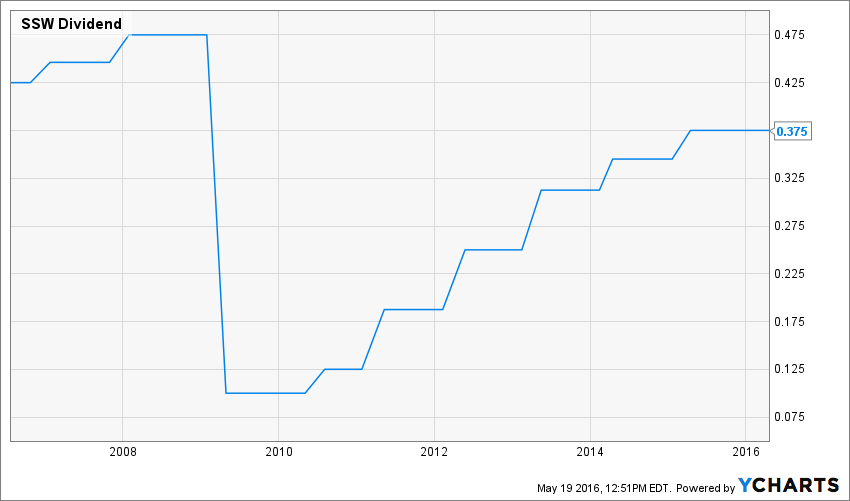

Source: data from Ycharts.

The company’s yield seem attractive to many investors, but you have to dig deeper to see what is happening behind it. As you can see, the company ran into some serious difficulties back in 2009 and cut their dividend significantly. Since then, investors have yet to receive a paycheck as big as it was prior to the dividend cut. This is the first warning signal right there. SSW doesn’t meet my 1st investing principle.

Principle#2: Focus on Dividend Growth

My second investing principle relates to dividend growth as being the most important metric of all. It proves management’s trust in the company’s future and is also a good sign of a sound business model. Over time, a dividend payment cannot be increased if the company is unable to increase its earnings. Steady earnings can’t be derived from anything else but increasing revenue. Who doesn’t want to own a company that shows rising revenues and earnings?

Source: Ycharts

I have mixed feelings when I look at this graph. If I had only considered the past 6 years of dividend history, I would been thrilled to continue my analysis. Since 2010, the dividend is increasing like clockwork each year. However, it is after a huge dividend cut in 2009. SSW fails to meet my 2nd investing principle.

Principle #3: Find Sustainable Dividend Growth Stocks

Past dividend growth history is always interesting and tells you a lot about what happened with a company. As investors, we are more concerned about the future than the past. this is why it is important to find companies that will be able to sustain their dividend growth.

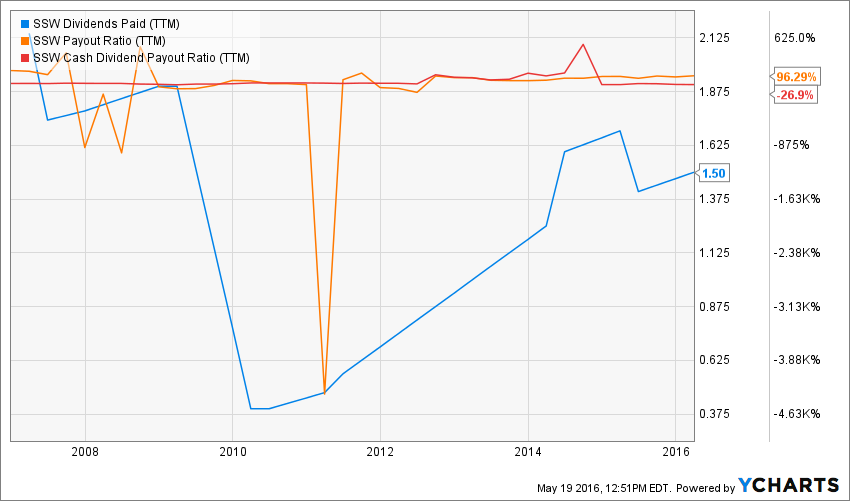

Source: data from Ycharts.

We are already at 2 strikes and are just starting to look into the company’s fundamentals. The payout ratio is set to the maximum and the company is still bleeding cash at the moment with a negative cash flow. I hope you start to understand why the company is paying such a high dividend yield by now. SSW doesn’t meet my 3rd investing principle.

Principle #4: The Business Model Ensure Future Growth

This is where is starts to get interesting. While the first principles are not met, there is still something interesting with this company. The thing is that maritime transportation is not going to slowdown in the future. Plus, the company shows the largest fleet of private vessels.

Seaspan’s business model is interesting as it is fueled by long term contracts with solid clients. This should translate in a strong cash flow generation in the future.

What Seaspan does with its cash?

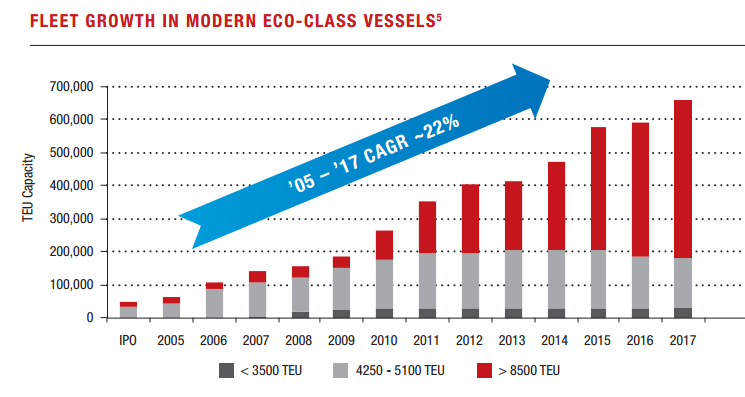

Source: SSW FACT sheet

So here’s the problem with SSW; the company is growing its fleet significantly, but it’s requiring lots of money. I’m not too worried at the moment because Seaspan’s fleet utilization rate is over 97%. In other words; the company is doing well to grab market share by increasing its fleet. Now is the time to generate higher margins to show more profits. Seaspan has a good business model and meet my 4th investing principle.

Principle #5: Buy When You Have Money in Hand – At The Right Valuation

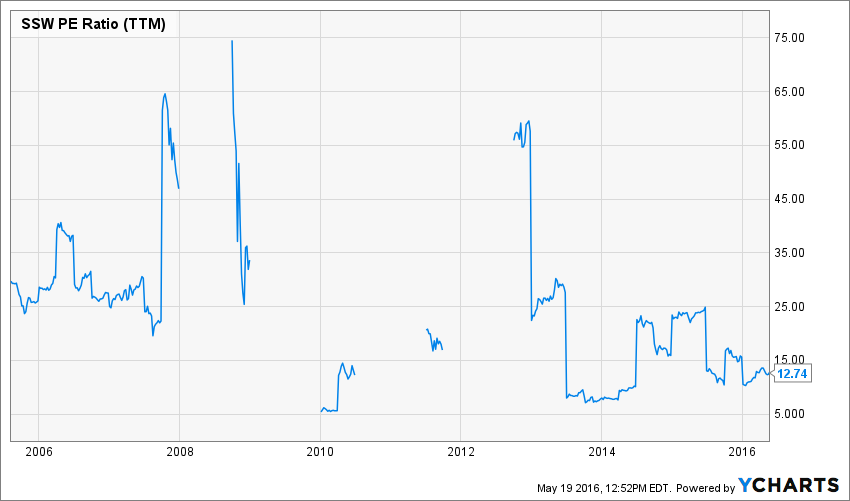

I think the perfect time to buy stocks is when you have money. Sleeping money is always a bad investment. However, it doesn’t mean that you should buy everything you see because you have some savings aside. There is evaluation work to be done. In order to achieve this task, I will start by looking at how the stock market valued the stock over the past 10 years by looking at its PE ratio:

Source: data from Ycharts.

This is one of the hardest PE ratio trends to analyze that I’ve seen in recent years. The company goes from extremes and often doesn’t generate a profit to even show a valid PE ratio. Right now, the PE ratio seems interesting for an entry point.

By using the dividend discount model, we will see if the dividend payment is worth what you pay for. Since payout ratios are very high, I’ve used a small 3% dividend growth rate and an 11% discount rate:

| Input Descriptions for 15-Cell Matrix | INPUTS |

| Enter Recent Annual Dividend Payment: | $1.52 |

| Enter Expected Dividend Growth Rate Years 1-10: | 3.00% |

| Enter Expected Terminal Dividend Growth Rate: | 3.00% |

| Enter Discount Rate: | 11.00% |

| Calculated Intrinsic Value OUTPUT 15-Cell Matrix | |||

| Discount Rate (Horizontal) | |||

| Margin of Safety | 10.00% | 11.00% | 12.00% |

| 20% Premium | $26.84 | $23.48 | $20.87 |

| 10% Premium | $24.60 | $21.53 | $19.14 |

| Intrinsic Value | $22.37 | $19.57 | $17.40 |

| 10% Discount | $20.13 | $17.61 | $15.66 |

| 20% Discount | $17.89 | $15.66 | $13.92 |

Source: Dividend Monk Toolkit Excel Calculation Spreadsheet

Considering the DDM, the stocks seems quite undervalued. I guess this is linked with its risk level. SSW meets my 5th principle.

Principle #6: The Rationale Used to Buy is Also Used to Sell

I’ve found that one of the biggest investor struggles is to know when to buy and sell his holdings. I use a very simple, but very effective rule to overcome my emotions when it is the time to pull the trigger. My investment decisions are motivated by the fact that the company confirms or not my investment thesis. Once the reasons (my investment thesis) why I purchase shares of a company are not valid anymore, I sell and never look back.

Investment thesis

An investment in SSW is an investment in future profitable growth. The company has successfully grown its business and their revenues. It is now time to generate stronger margins to make sure the company can continue to pay its generous dividend.

I like their business model around long term contracts with important clients. As they are growing their fleet, it makes it difficult for their clients to switch and use another vessel provider. SSW is able to answer important workload needs and can support a growing global economy.

Risks

Speaking of growing global economy, this is probably one of the biggest risks SSW could face. It sells well when you show that your fleet is growing faster than the grass in your background, but it’s another story if the economy stalls and your fleet stays at port. Without making bad jokes, this could sink the company.

Therefore, I would remain cautious about this company and the investment thesis is not strong enough to support a strong buy.

Principle #7: Think Core, Think Growth

My investing strategy is divided into two segments: the core portfolio built with strong & stable stocks meeting all our requirements. The second part is called the “dividend growth stock addition” where I may ignore one of the metrics mentioned in principles #1 to #5 for a greater upside potential (e.g. riskier pick as well).

Having both segments helps me to categorize my investments into a “conservative” or “core” section or into a “growth” section. I then know exactly what to expect from it; a steady dividend payment or higher fluctuations with a greater growth potential.

In the light of my analysis, SSW would fit in a conservative portfolio as long as the other holdings show very strong fundamentals. This is the kind of company that can do well and pay a high yield if it is blended into a solid asset allocation portfolio. A big position in this company and you would be at risk.

Final Thoughts on SSW – Buy, Hold or Sell?

Overall, I think SSW can be attractive for income seeking investors. It is a good example of a company that looks attractive at first sight (interesting business model, steady revenues, high dividend yield), but is the kind of company that implies a certain amount of risk too. I think there are other very interesting companies with less risk you could pursue.

Disclaimer: I hold SSW in my DividendStocksRock portfolios.

Disclaimer: The opinions and the strategies of the author are not intended to ever be a recommendation to buy or sell a security. The strategy the author uses has worked for him and it is for you to decide if it could benefit your financial future. Please remember to do your own research and know your risk tolerance.

Leave a Reply