Pepsico Inc. is a leading international beverage and snack-food company.

-Seven Year Revenue Growth Rate: 10.5%

-Seven Year EPS Growth Rate: 7.3%

-Seven Year Dividend Growth Rate: 11.2%

-Current Dividend Yield: 2.84%

-Balance Sheet: Stable

Overview

Pepsico Inc. (NYSE: PEP) is one of the leading beverage and food companies in the world, and has been a particularly strong dividend payer over the last four decades and counting in terms of the combination of a moderate yield and fairly high dividend growth. Slightly over half (51%) of their revenue comes from food while the remaining comes from beverages. The company is divided into six reporting segments.

Frito-Lay North America (FLNA)

FLNA is the snack reporting segment in North America, and accounts for 21% of revenue and 35% of operating profit. It is therefore PepsiCo’s second largest source of revenue and first largest source of operating profit.

Quaker Foods North America (QFNA)

QFNA is the food reporting segment in North America, and accounts for 4% of revenue and 7% of operating profit.

Latin American Foods (LAF)

The LAF segment includes all PepsiCo food products in Latin America, and accounts for 12% of revenue and 10% of operating profit.

PepsiCo Americas Beverages (PAB)

The PAB segment reports for all PepsiCo beverages sold in North and Latin America, and accounts for 33% of revenue and 28% of operating profit, making it PepsiCo’s largest source of revenue and second largest source of operating profit.

PepsiCo Europe (Europe)

PepsiCo Europe includes all food, snack, and beverage sales by PepsiCo in Europe and South Africa, and accounts for 20% of revenue but only 13% of operating profit.

PepsiCo Asia, Middle East, and Africa (AMEA)

The AMEA reporting segment includes all food, snack, and beverage sales by PepsiCo in the rest of the world, excluding South Africa, and accounts for 10% of revenue and 7% of operating profit.

22 Billion-Dollar Brands

PepsiCo has 22 brands that each bring in over $1 billion in revenue.

This includes:

Pepsi

Lay’s

Mountain Dew

Gatorade

Tropicana

Diet Pepsi

7 Up

Doritos

Quaker

Cheetos

Mirinda

Lipton

Ruffles

Tostitos

Aquafina

Pepsi Max

Brisk

Sierra Mist

Fritos

Diet Mountain Dew

Starbucks

Walkers

Most brands are wholly owned by PepsiCo, while others (such as Starbucks and Lipton ready-to-drink products) are partnerships with PepsiCo and other companies. In addition to the 22 billion-dollar brands, PepsiCo controls another 40+ brands with revenue exceeding $250 million but under $1 billion, including Naked premium fruit smoothies which enjoyed 21% revenue growth last year.

Ratios

Price to Earnings: 20

Price to Free Cash Flow: 22

Price to Book: 5.5

Return on Equity: 27%

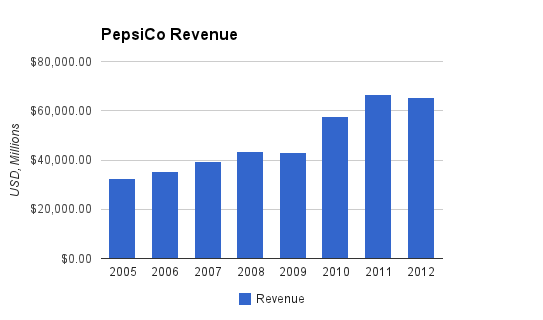

Revenue

(Chart Source: DividendMonk.com)

Revenue grew by a substantial 10.5% annual rate over this period, but a significant chunk of the growth was driven by the large bottler acquisition, and remaining revenue growth was not particularly consistent for a stable consumer company.

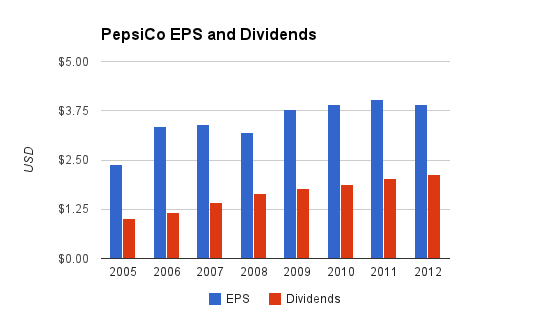

EPS and Dividends

(Chart Source: DividendMonk.com)

The EPS growth rate over this period was 7.3%. Consistency of growth was greatly lacking over this period.

PepsiCo has grown its dividend every year for over four consecutive decades, and over this seven year period averaged 11.2% in dividend growth per year. The dividend payout ratio out of earnings increased from about 42% to about 55%, which allowed the dividend to grow more quickly and consistently than EPS. Based on the payout ratios out of income and free cash flow, the divided is very safe, but over the long term dividend growth will have to slow down to the EPS growth rate to maintain a steady payout ratio. The current yield is 2.84%.

Approximate historical dividend yield at beginning of each year:

| Year | Yield |

|---|---|

| Current | 2.83% |

| 2013 | 3.1% |

| 2012 | 3.1% |

| 2011 | 2.9% |

| 2010 | 3.0% |

| 2009 | 3.0% |

| 2008 | 2.0% |

| 2007 | 1.9% |

| 2006 | 1.7% |

PepsiCo currently offers a moderate dividend yield; higher than the S&P 500 average but not as high as the company was offering over the last few years. Stock price growth in 2013 has driven the yield down below 3%, but it’s a much better deal than it was prior to the Great Recession.

How Does PepsiCo Spend its Cash?

During the three years of 2010, 2011, and 2012, PepsiCo brought in approximately $16.5 billion in free cash flow. Over the same period, $9.6 billion was spent on dividends, $10.7 billion was spent on share repurchases, and $7 billion was spent on acquisitions. This was an atypical period of large acquisitions which will not likely be repeated in the foreseeable future. As can be seen, these cash outflows greatly exceeded incoming free cash flow. PepsiCo paid for the acquisitions by leveraging its balance sheet.

Balance Sheet

PepsiCo’s debt/equity ratio is approximately 130%. About 75% of the existing shareholder equity consists of goodwill.

Total debt to net income is about 4.8x. The interest coverage ratio is just under 10x, indicating that the company very comfortably pays its debt interest.

PepsiCo has expanded its balance sheet greatly over the last several years, including its debt. Overall leverage has increased (in terms of a higher debt/equity, higher debt/income, and lower interest coverage ratio), and so the company no longer has a particularly impressive balance sheet. The existing balance sheet, however, is still comfortably leveraged, and by all indications, rather strong and stable.

Investment Thesis

The EPS growth over the seven-year reporting period that I commonly use in analysis articles (2005-2012 in this case) is a reasonable but not outstanding 7.3%. Combined with a 2.8% dividend yield, that’s not bad. Indra Nooyi became the CEO of Pepsi in mid-2006, and she has been a part of the company since 1994. The six-year annual EPS growth rate (2006-2012) of PepsiCo under Nooyi’s leadership is less than 3% per year. Revenue growth has also been lackluster with the exception of the boost that the acquisition of their North American bottler operations provided. PepsiCo management describes this period as one of transformation for the long-term as it has reported less-than-adequate growth on a per-share basis.

Indeed, one can say PepsiCo has taken the initiative in several areas over this period, such as working towards a healthier portfolio of brands with more focus than The Coca Cola Company (KO), and making the move to acquire their North American bottler operations, a move that Coca Cola quickly copied. These moves may reduce headwinds for the company caused by the changing eating trends in developed countries, but it remains to be seen if this period has truly set up the company for significant growth over the next decade.

Competitive Landscape

PepsiCo is the world’s second largest beverage and food company, and the largest one that’s based in North America.

On the beverage side, The Coca Cola Company is a larger competitor with a stronger overall market share and brand strength. Coca Cola’s flagship namesake brand outperforms PepsiCo’s, and their overall company-wide beverage portfolio of brands brings in more significantly revenue worldwide. There are some areas where PepsiCo has the edge, such as their Gatorade brand vastly outselling Coca Cola’s Powerade brand.

On the food side, the world’s largest player is Nestle, based out of Europe. In terms of salty snack food in particular, PepsiCo controls the world’s strongest position with their Lay’s brand and related chips and snacks such as Doritos, Cheetos, Tostitos, and others. Kraft is a major competitor in the snack food and overall food business, but PepsiCo has the leading position.

Good-For-You Branding

Several years ago the company began organizing its products into three categories.

“Good For You” includes the company’s products that it markets as healthful, including Naked, Quaker, Gatorade, and Tropicana. This is the group that PepsiCo has been attempting to actively grow in developed markets to stay on top of changing consumer trends. Naked super-premium fruit juice products have enjoyed particularly strong revenue growth, at 21% last year.

“Better For You” can be thought of as the company’s damage control set of brands. They’re marketed not as healthy, but less unhealthy than their other products. This is where the company markets a lot of its baked versions of chips, as well as Pepsi Next.

“Fun For You” is PepsiCo’s largest segments, and contains the brands that PepsiCo views as their least healthy items. This includes their namesake Pepsi brand, their valuable Lay’s brand, and many other major brands including Mountain Dew, Cheetos, Fritos, Doritos, and Tostitos. This is PepsiCo’s foundation for expanding total revenue and profit worldwide, but many of these brands, especially their carbonated beverages, face headwinds in the face of shifting consumer preferences in some developed markets.

Product Initiatives

PepsiCo has had several successful product launches.

-Ever since PepsiCo spun off Yum! Brands (operator of KFC, Taco Bell, and Pizza Hut), PepsiCo has kept strong ties as the beverage and snack provider for these restaurants. In 2012, Taco Bell launched Dorito Locos tacos, which are a set of tacos with Doritos flavored and branded shells. This has been Taco Bell’s largest product launch in history. In 2012, 325 million of these tacos were sold.

-Over the last few years, Gatorade has expanded its lineup of products. The brand already has a major edge over Powerade, and they introduced new divisions of beverage products as well as Gatorade-branded energy chews.

-Tropicana has introduced smaller products and new products such as Tropicana Farmstand and Trop 50.

Risks

Interest in carbonated drinks has been declining in North America, which has been a major headwind to both The Coca Cola Company and PepsiCo. Both companies have had to draw growth from other regions to compensate for this. Increasing awareness about health has made sugary drinks less appealing to certain demographics, and governments have in some cases desired to ban or tax these products. This will likely continue to be headwind for the foreseeable future.

Like all food businesses, PepsiCo faces the significant risk of commodity cost changes. As an international player, it deals with currency risk as well. Strategically, the company could lose beverage market share to The Coca Cola Company and smaller competitors, and could lose snack market share to Nestle, Kraft Foods, or smaller competitors.

Conclusion and Valuation

PepsiCo is among the most diversified of consumer brands. The key question for investors is whether this period of slower growth and restructuring is truly laying a foundation for future strong growth. With major restructuring behind them, PepsiCo can potentially achieve rather solid EPS growth of 6-9% if it grows sales volume by 2-4% per year as it continues to break into China and other developing markets, achieves global average pricing growth of 2% of per year, and buys back 2-3% of its shares per year. Analysts currently have a consensus estimate of 7.5% growth in adjusted EPS for 2013 and 8.6% adjusted EPS growth for 2014.

Based on the Dividend Discount Model, using a 10% discount rate, PepsiCo would be fairly priced today at $84 if it can grow its dividend by 8% per year over the next ten years followed by 7% thereafter. This would be a fairly ideal case to result in an expected 10% rate of return.

If one accepts a discount rate and target rate of return of only 9%, then 8% dividend growth over the next decade followed by 5.5% thereafter would be sufficient for an $80 fair value. Dropping the discount rate and target rate of return to as low as 8% would need only 7% dividend growth over the next decade and 4.5% thereafter to justify a $80 fair price.

Taking these ideal and less ideal scenarios into account, PepsiCo’s current price of about $80 appears fair if the company can maintain its global food and beverage empire to maintain mid-to-high single digit EPS and dividend growth for the long term.

Full Disclosure: As of this writing, I have no position in PEP and am long KO.

You can see my dividend portfolio here.

Dividend Stock Newsletter:

Sign up for the free dividend investing newsletter to get market updates, attractively priced stock ideas, resources, investing tips, and exclusive investing strategies:

I like that many good quality stocks started falling during this “crisis” on the market. It will be a great opportunity to add more shares.

You have to love all the strong brands PepsiCo has. I mean who wouldn’t want to make profits off of all the Doritos, Cheetos, Pepsi, Gatorade, etc.! These are well known brands that will continue to fly off the shelves of grocery and convenience stores for many many years. I think this is a a long term hold for any good dividend growth portfolio and I look forward to picking up some shares soon.