Pepsico (NYSE: PEP) is a leading international beverage and snack-food company.

-Seven Year Revenue Growth Rate: 12.5%

-Seven Year EPS Growth Rate: 7.4%

-Seven Year Dividend Growth Rate: 13.2%

-Current Dividend Yield: 3.05%

-Balance Sheet: leveraged but solid

Overview

Pepsico (NYSE: PEP) is one of the leading beverage and snack food companies in the world. Although Pepsi-Cola is their largest brand, the company extends far beyond merely that single brand into a variety of beverages and snacks. 52% of total revenue comes from beverages while the other 48% comes from food. The company has 22 billion-dollar brands, which is up from 11 billion-dollar brands in 2000. Almost exactly half of revenue comes from the U.S. while the other half comes from international markets.

The biggest brand is Pepsi itself which has more than twice the amount of sales as their second largest brand, followed by Lays, then Mountain Dew, then Gatorade, then Tropicana, Diet Pepsi, 7UP, Doritos, Quaker, Cheetos, and continuing on for the rest of their billion-dollar brands.

Ratios

Price to Earnings: 17.4

Price to Free Cash Flow: 23

Price to Book: 4.8

Return on Equity: 28%

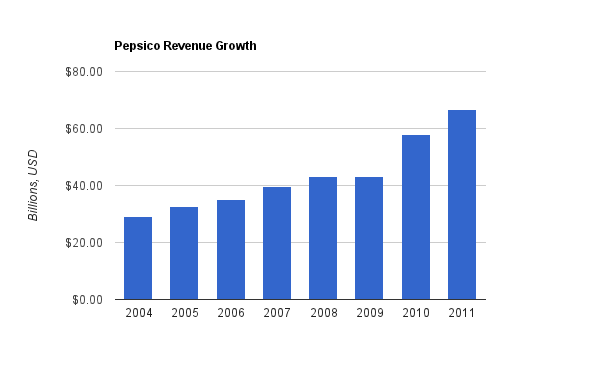

Revenue

(Chart Source: DividendMonk.com)

Revenue growth was almost 12.5% per year over this period, which is quite high for a large company. That’s not the whole story, though. In 2009 the company announced that it would acquire its two largest North American bottlers. These were rather large operations with rather low profit margins, meaning they were buying quite a bit of revenue compared to how much they were buying in terms of income. So as the chart shows, while Pepsico has indeed had decent “normal” revenue growth, the large 2010 and 2011 bump is due to the bottler acquisitions. Revenue for Pepsico jumped 34% in 2010 compared to 2009, while net income only jumped 6.3% over the same period.

Coca Cola went onto copy the same move, and bought their own North American bottler as well.

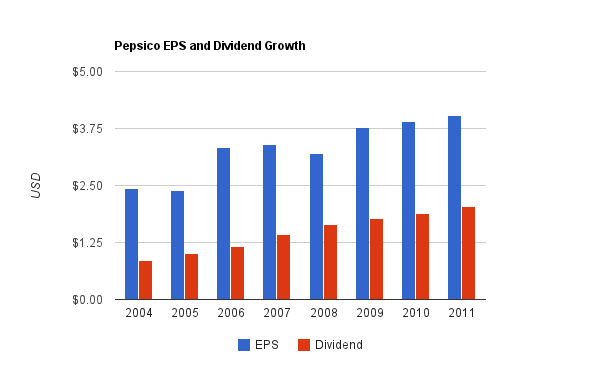

EPS and Dividends

(Chart Source: DividendMonk.com)

EPS grew at a fairly respectable but not outstanding average of 7.4% per year over the last seven year period, which is a solid rate of return when the dividend is considered as well.

The dividend over this period grew at 13.2% per year on average over this period, meaning that the dividend payout ratio has increased. The dividend yield was around 1.7% at the end of 2004, was around 1.9% during its stock price peak in late 2007, increased to around 3.5% during the market bottom of 2009, and currently rests at around 3.05%, which is higher than average over this period. The dividend payout ratio from earnings is a safe 50%. The company has almost four decades of consecutive annual dividend growth.

As far as share buybacks are concerned, up until 2009, the company spent more money on buybacks than on paying dividends. Between 2004 and 2011, net income grew by an annualized rate of 6.3% while earnings per share grew by an annualized rate of 7.4%, with the difference being due to the reduced share count from buybacks (at the opportunity cost of a larger dividend yield). In 2009, due to the bottler acquisition, they halted buybacks, and then resumed them in 2010 and 2011, but at a lower rate. In 2011, the company paid about $3.2 billion towards dividends and $2.5 billion towards buybacks. I always like to see more money spent on dividends than on buybacks, so I would like to see Pepsico boost the dividend payout ratio a bit, but overall, I think Pepsico makes solid use of shareholder cash.

Balance Sheet

In order to do the bottler acquisition, Pepsico took on some additional debt. Total debt/equity is now around 120%, and total debt/income is approximately 4.3x. Around three quarters of existing shareholder equity consists of goodwill. These ratios show some leverage but not an irresponsible amount.

The interest coverage ratio that is above 10 shows the comfort of the balance sheet. With operating income covering interest expense more than 10 times over, the balance sheet remains quite robust. The balance sheet is an area to keep an eye on, though, and it can affect the amount of money that’s free to spend on share repurchases and therefore EPS growth, or on the dividend.

Investment Thesis

Pepsico’s large distribution network and significant brand diversification provide it with a solid economic moat. The company leads the U.S. salty snackfood market and comes in at second place in the U.S. beverage market.

Earlier this month, a joint venture was announced between Pepsico and the Muller Group to enter the quickly growing U.S. dairy market with premium yogurt products, which looks like a solid growth area in my view, and can compliment the Quaker breakfast line of products.

Pepsico and The Coca Cola Company have both been undergoing transitions towards healthier products, at least in a relative sense compared to the nutritional value of their colas. The U.S. cola market has been softening in demand, being replaced by demand for juices, sports drinks, teas, and so forth, which both companies have expanded into.

After seeing Pepsico take an earlier adoption towards somewhat healthier products, and after seeing Pepsico initiate their bottler acquisition for which Coca Cola later emulated, it seemed to me as though Pepsico was on a stronger course. Nonetheless, I have been invested in KO stock and not PEP stock, due to their broader global reach and their focus on beverages. And in a somewhat surprising outcome to me, Coca Cola has indeed performed better in terms of controlling the global beverage market, and consequently, EPS growth, dividend growth, and stock price appreciation.

I’ll be holding my position in KO. However, considering that Pepsico stock trades at a lower valuation and that their relatively mediocre performance as of late seems to have been taken into account in their stock price, I view Pepsico stock as being on at least equal terms of value as Coca Cola stock, if not slightly better. The market gives KO a nearly 20% stock valuation premium over PEP.

Risks

Pepsico has underperformed Coca Cola in recent years. It could be a temporary lull for longer-term positioning, or it could be too much diversification and not enough focus, or it could be less than optimal leadership. The company has, however, made large moves which Coca Cola has followed.

The company also faces more general risks with currency, commodity costs, and political risks, which it shares with KO. A more specific risk to both companies is the declining interest in sodas in the United States, which is offset by international interest in those drinks. But this means that Pepsico’s primary market faces headwinds and they must perform well internationally to have strong growth.

Conclusion and Valuation

Pepsico lands right about in the middle of whether it’s attractively valued or not, in my view. It doesn’t look as promising to me as some MLPs, telecoms, blue chip tech companies, or engineering firms, but the dividend remains safe and growing and the valuation is towards the top of what I consider fair considering their recent level of performance and overall diversification and risk.

If the company can grow EPS and the dividend by an approximately 6% rate of return going forward, which is lower than their historical average, and if dividends are reinvested, then a 9% annualized rate of return can be expected at the current stock price of around $70, based on the dividend discount model. Comparatively, a 7% EPS and dividend growth rate should lead to a 10% long-term growth rate at current prices.

Given 1-3% annual pricing growth and 2-4% volume growth, 3-7% top line growth would occur. Assuming constant profit margins for this revenue growth, this would also translate into 3-7% long term net income growth. After share repurchases are taken into account that could add another 1% or more, that’s 4-8% long term EPS growth. This growth figure centers on the 6% growth rate that’s needed to justify the current price at a 9% desired rate of return. Dividend growth may continue to outpace EPS growth but for the payout ratio to remain reasonable, must eventually slow down to match long term EPS growth.

I therefore view the company as currently offering a reasonable potential for a high single digit rate of return, but without any margin of safety for this figure. Improved margins or better-than-expected growth would likely outpace this estimate, while declines in market share or stronger-than-expected American soda headwinds, or any major missteps, could result in lower returns than this estimate.

Full Disclosure: As of this writing, I have no position in PEP. I am long KO.

You can see my dividend portfolio here.

Dividend Stock Newsletter:

Sign up for the free dividend investing newsletter to get market updates, attractively priced stock ideas, resources, investing tips, and exclusive investing strategies:

Very good article and yet another reason to increase my position in PEP if the P/E ratio drops a bit since 17 is quite high for my gusto. However, you should not take press releases as given. The “The Muller Group of Germany” doesn’t mean anything until you know that this is the Mueller Diary company, one of Europe’s largest diary producers. I am a German living in the US and couldn’t figure what you meant by Theo Mullen, including the typo which doesn’t make it easier ;-)