Omega Healthcare Investors is a REIT that focuses on owning properties for skilled nursing facilities.

-Revenue Growth Rate: 6%

-FFO Growth Rate: 12%

-Dividend Growth Rate: 9%

-Current Dividend Yield: 5.82%

-Balance Sheet: Stable

For a decent combination of yield and growth, OHI may be a solid pick at the current price in the low $30’s.

Overview

As of the most recent quarter, Omega Healthcare Investors (NYSE: OHI) held a portfolio of 479 healthcare facilities located in 34 states and run by 46 third-party operators. Out of these 479 facilities, 418 are owned skilled nursing facilities, 16 are assisted living facilities, 11 are specialty facilities, and 2 are held-for-sale facilities. The remaining 32 facilities are skilled nursing facilities that Omega provides mortgages for rather than rental leasing agreements. They also hold a portfolio of secured loans to some of their facility operators.

Omega, as a Real Estate Investment Trust, focuses on owning the portfolio of properties or in some cases providing mortgages and loans, while the third-party operators run the day to day operations of the facilities as tenants. In 2012, Omega brought in $350 million in revenue, of which $315 million came from rental income, $30 million from mortgage income, a bit under $5 million from other interest income, and less than $1 million from other miscellaneous income.

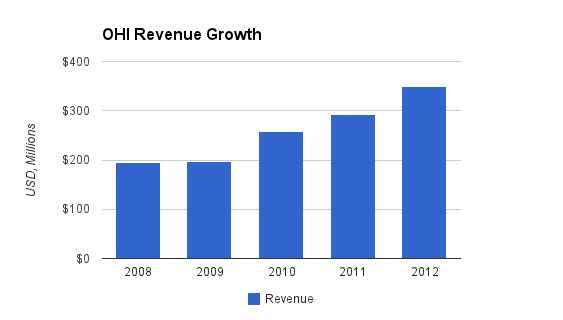

Revenue

(Chart Source: DividendMonk.com)

Total revenue grew by nearly 16% per year over this period on average. Much of this substantial revenue growth was fueled by the regular issuance of new shares, but revenue growth per share was still rather solid at nearly 6% per year.

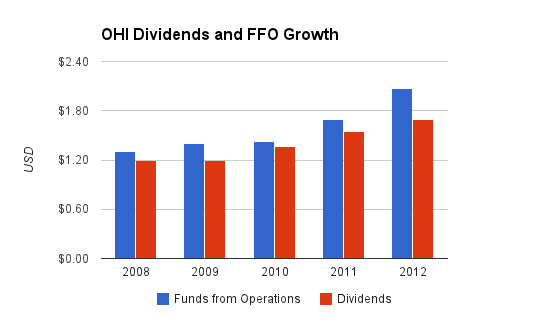

FFO and Dividends

(Chart Source: DividendMonk.com)

Because REITs have large amounts of depreciation on their statements, funds from operations (FFO) is the more useful metric than earnings for a REIT. FFO consists of earnings with depreciation and amortization added back in.

For Omega, FFO per share grew by over 12% per year on average over this charting period. The dividend growth over the same period was a bit over 9% per year. In 2012, the payout ratio of dividends from FFO was about 82%. The current dividend yield for Omega is 5.82%.

Approximate historical dividend yield at beginning of each year:

| Year | Yield |

|---|---|

| Current | 5.82% |

| 2013 | 7.1%% |

| 2012 | 8.2% |

| 2011 | 6.6% |

| 2010 | 6.0% |

| 2009 | 8.0% |

| 2008 | 7.0% |

| 2007 | 5.6% |

| 2006 | 6.8% |

Balance Sheet

Omega has $2.57 billion in assets and $1.47 billion in liabilities, including $1.18 billion in unsecured debt.

The REIT brought in $350 million of revenue in 2012, and among other expenses, $98 million was paid in debt interest. The reported FFO was $222 million.

According to a May 2013 investor presentation, Omega targets a debt-to-adjusted-EBITDA ratio of 4-5x. Omega has reported that they have stayed within that range during the 2005-2012 reporting period, and that the most recent ratio as of March 2013 is 4.4x. There is little in the way of debt maturity until after 2020.

Overall, Omega’s financial condition appears to be in good order.

Investment Thesis

Omega owns a portfolio of healthcare facility properties, and regularly issues new shares in order to fund new purchases of $100-$300 million per year or more. Over the last several years there has been a track record of profitable decisions that resulted in solid growth per share of revenue, funds from operations, and dividends while maintaining fairly consistent levels of leverage.

According to a report by the U.S. Census Bureau, the population of Americans aged 80+ is expected to expand from 11.5 million people in 2010 to 12.8 million people in 2020 to 18.9 million people in 2030, and continuing the growing trend thereafter. Both the absolute population of older individuals and the percent of the total populations that these individuals form, are expected to grow for the foreseeable future.

Research indicates that while inpatient rehabilitation facilities result in a better and faster recovery from illness or injury, skilled nursing facilities cost about a third as much for recovery of things such as strokes, hip fractures, joint replacements, and various other impairments. Omega Healthcare’s properties on average have maintained 80+% occupancy over the last decade.

Risks

Omega is diversified in terms of operators and geography, but concentrated in terms of industry. With a focus on skilled nursing facilities and to a lesser extent assisted living facilities, Omega’s operators are highly dependent for a chunk of their income on Medicare. Omega’s 2012 annual report points out that according to the Alliance for Quality Nursing Home Care, over 70% of residents in skilled nursing facilities rely on Medicare and/or Medicaid funding. About 6% of expenditures from Medicare are cited as going to skilled nursing facilities. Medicare, being one of the largest public expenditures in the United States, is widely viewed as being underfunded currently and increasingly so in the future compared to its expenditures. The United States has the highest per capita expenditure of health care in the world (including both private and public spending), which is a significant drain on overall economic development and the federal balance sheet.

As part of long-term budget control, any cuts to Medicare could trickle down and impact Omega’s portfolio of facilities by reducing the financial health of the operators within the industry. Alternatively, cost-saving strategies in public health care expenditures could conceivably benefit Omega by directing some patients away from higher-cost facilities. Over the last decade, the number of patients in skilled nursing facilities at any given time on average has declined slightly from 1.465 million to 1.383 million despite steady population growth. According to a 2009 article, the trend is away from skilled nursing facilities and towards assisted living facilities, which are cheaper than SNFs and with less care, and home care which is cheaper still. Omega does own assisted living property as a smaller subset of their portfolio, and with their rate of investments in new facilities per year, they can most likely keep up with any changing trends by balancing their portfolio of properties accordingly.

Conclusion and Valuation

Omega appears to have been a real gem in terms of dividend yield and dividend growth in 2008 through 2012. The stock price unfortunately really took off in 2013, topping out at around $37, before falling below $30 and then stabilizing around its current price of a bit under $32.

According to the Dividend Discount Model, the current price of Omega in the low $30’s is fair for investors targeting a 10% long-term rate of total return assuming that Omega can grow the dividend by just 4.5% per year for the long-term. A 5.5% long-term dividend growth rate would bump the fair price up to the low $40’s. To put that into perspective, Omega has recently averaged 9% dividend growth per year, so a margin of safety exists as long as the REIT continues to be well-managed.

Overall, Omega may not be as undervalued as it appears to have been throughout the 2008-2012 period, but after the recent plunge in the stock price in 2013 back down to this price in the low $30’s after an earlier rise, the REIT appears to be a solid bet for a 5.82% dividend yield and expectations of decent overall total returns from dividend growth as well.

Full Disclosure: As of this writing, I have no position in OHI.

You can see my dividend portfolio here.

Dividend Stock Newsletter:

Sign up for the free dividend investing newsletter to get market updates, attractively priced stock ideas, resources, investing tips, and exclusive investing strategies:

Thanks for the analysis on OHI. I’ve been trying to learn more about REITs and this was really helpful. Hopefully O will be finding its way into my portfolio soon but I wouldn’t mind a bit more exposure to some other REITs.

Thx for the analysis Matt. I appreciated this and your article on O a bit ago as I am looking to expand into REIT’s. Now that the “threat” of rising interest rates appears to be increasing, REIT’s seem to be coming down to at least reasonable valuations from their highs just a bit ago. I bought O about 2 weeks ago at 41 and am considering OHI and HCP. I was intrigued by DLR but as I already have fairly substantial positions in telecomm (T, BCE and VOD) and tech (INTC, MSFT), I wanted to avoid over exposure to this sector (w/ DLR as a quasi tech play leasing datacenters and the like).

So, thx again. In my humble opinion, your analysis are among the best out there.

Where do you get your data from re: revenue growth, dividend growth, etc? From Morningtar, I got a rev growth of 12% vs your 6% and a div growth of 7.7% vs your 9%.

Also, for your DDM & DCF spreadsheet, what source do you get data from?

TIA……Dave

Data for the reports tends to come from a few sources, including Morningstar, Google Finance, and directly from SEC filings. Usually I like to compare at least two sources for the primary data to look for anomalies (some sources report annual figures and keep them as is, while others report the restated figures).

The DDM and DCF spreadsheet don’t rely on external data other than what the user inputs. The user enters the discount rate and the estimated growth rate of either cash flow or dividends, and the spreadsheet outputs a fair value and a chart of related fair values based on a spectrum of related outcomes.

As for this report directly, I think I see where the discrepancy is coming from. First, if you look at the revenue section, I specified that total revenue grew by 16% per year while per-share revenue grew by 6% per year. At the top of the report, I chose to report revenue, FFO, and dividends all in terms of per-share data, which is most meaningful, especially for a REIT that issues so many shares to fund new investments.

Second, I think you’re using an extra year in your calculations from Morningstar, but I can’t know for sure unless I look at your calculations. I see investors do this sometimes. On the charts for this report, there are five years reported (2008, 2009, 2010, 2011, and 2012), but it’s a four-year charting period, not a five-year charting period.

If you were to compare 2009 data to 2008 data, you’re comparing two years but it’s only a 1-year change. If you compare 2010 data to 2008 data, you’re comparing three years (2008, 2009, 2010) but it’s only a 2-year change. If you compare 2011 data to 2008, that’s four years but it’s only a 3-year change. So, comparing 2012 data (which came 48 months after the 2008 data), is making use of five years of data to calculate results for a four-year period. If you use the 2012 and 2008 data and assume it’s a five-year period, you’ll get annualized dividend growth of around 7% and annualized revenue growth of around 12% like you said you got, but that wouldn’t be the correct number of years for the period, because it’s a four-year period.

For most reports, I use a seven-year period. I chose to use a shorter reporting period for this one because at the rate that this REIT issues shares and makes new investments to expand overall revenue, looking too far back is not a close comparison for the REIT as it is now and may skew the expected growth rate.

Stock has been on fire this week! Back on an upward trend. Wish I had bought at $29 a few weeks ago!

Just sold some PUTS on this today. Thanks for bringing it to my attention.