Novartis (NVS) is one of the largest and most diversified health care companies in the world.

-Seven Year Revenue Growth Rate: 11.2%

-Seven Year EPS Growth Rate: 7.1%

-Seven Year Dividend Growth Rate: 11.5%

-Current Dividend Yield: 4.42%

-Balance Sheet: Strong

Although the company’s blockbuster drug’s patent expiration will result in a reduction in growth this year, and the company’s consumer health manufacturing arm suffered a meaningful setback early this year due to recalls of its product, I believe that the current valuation of Novartis stock along with their diversification and robust pipeline, makes for a reasonable buy for a dividend growth investment at the current price of around $56/share on the NYSE.

Overview

Novartis (NYSE: NVS) was created in 1996 as a merger between two companies, Sandoz and Ciba-Geigy, but the earliest foundations of the company (Geigy) go back all the way to 1758. Novartis is one of the largest and most diversified health care companies in the world, and is headquartered in Switzerland. The company began trading on the NYSE as American Depository Shares in 2000.

In 2011, Novartis sales and operating income were broken down by segment as follows:

-Branded Pharmaceuticals accounted for 56% of sales and 61% of operating income.

-Alcon (eye products brand) accounted for 17% of sales and 21% of operating income.

-Sandoz (generic pharmaceuticals) accounted for 16% of sales and 12% of operating income.

-Consumer Health accounted for 8% of sales and 5% of operating income.

-Vaccines and Diagnostics accounted for 3% of sales and 1% of operating income.

Described another way, in 2011, Novartis sales were broken down by geography as follows:

-Europe accounted for 37% of sales.

-The United States accounted for 33% of sales.

-Asia/Africa/Australia/Asia together accounted for 21% of sales.

-Canada and Latin America together accounted for 9% of sales.

As can be seen, the core operation of Novartis is to produce branded pharmaceutical drugs. The generics segment helps the company retain revenue when their drugs go off patent, and captures revenue from other patent expirations. The Alcon division is from a recent acquisition, and has greatly extended the size and diversification of the overall company.

Ratios

Price to Earnings: 15.8

Price to Free Cash Flow: 11

Price to Book: 2.2

Return on Equity: 13%

Revenue

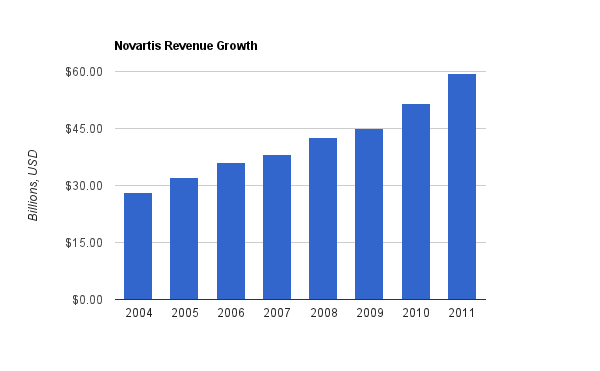

(Chart Source: DividendMonk.com)

Novartis experienced strong revenue growth of 11.2% annualized over this period as a result of both decent organic growth and large acquisition activity. Revenue growth of this scale is impressive, but investors should not expect this to continue, as the company’s largest drug going off patent will result in a revenue hole this year. Growth from other segments and from the strong pipeline will need to fill the gap and continue the growth.

Earnings per share were more erratic and only resulted in little more than 7% annualized growth over the same period, which is reasonable when paired with their substantial dividend yield. The strategy of using acquisitions to fuel growth is good at producing revenue growth, but generally doesn’t provide the same sort of robust earnings growth that organic growth would. Acquisitions tend to be an expensive growth strategy.

Dividends

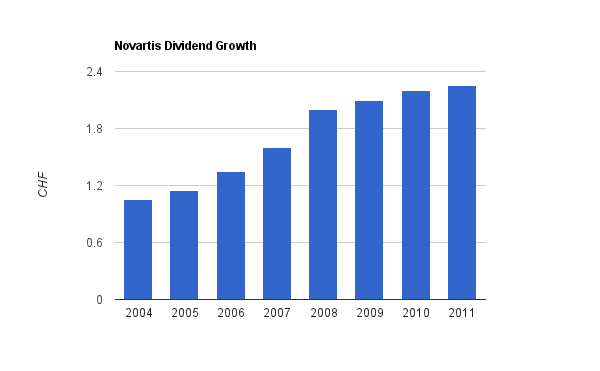

(Chart Source: DividendMonk.com)

Novartis pays a large annual dividend. Unlike many American companies that pay quarterly dividends and strive to grow them each year regardless of operating results, European companies tend to pay fewer but larger dividends, and tend to have less focus on ensuring that the dividend grows each and every year (but the successful companies often do have long streaks of consecutive dividend growth). Dividend information above is presented in Swiss currency CHF, and when paid is translated into USD for investors in the ADRs.

The company has grown the dividend for 15 consecutive years (since their inception as a public company in their current form), and the dividend growth rate over the last 7 years has been substantial, at an 11.5% annualized rate. However, with the patent loss and other detractors, as well as a generally weak global economic and strong Swiss currency, dividend growth has slowed substantially. The most recent annual increase was a paltry 2%, and the previous two increases were only around 5% each year.

The dividend appears to be quantitatively safe, with a payout ratio from earnings of under 70%, and a payout ratio from free cash flow of lower than that. And this is during a year of a major patent loss and large manufacturing problem, so the numbers remain reasonably safe even in a difficult year.

Balance Sheet

The acquisition of Alcon, which is now the second largest segment of Novartis, added debt and goodwill to the balance sheet, but the numbers remain fairly strong. The total debt/equity ratio is under 35%, and the interest coverage ratio, which I view as the most important ratio of financial strength, is over 13. A bit less than half of the existing shareholder equity consists of goodwill.

So overall, I view Novartis as having a reasonably strong financial condition.

Investment Thesis

Novartis isn’t having an easy 2012 as far as growth is concerned.

The expected part of this difficult year was the expiration of Diovan, the blockbuster drug that has been a multi-billion dollar contributor to the bottom line of the company for years. The company and the market saw this coming, and the strong drug pipeline and set of existing growing drugs is currently doing a solid job of offsetting these reductions led by growing sales from Gleevec (over $4.6 billion in annual sales) and Lucentis (over $2 billion in annual sales), as well as a strong portfolio of other drugs. A larger and larger share of Novartis pharmaceutical revenue comes from recently developed products (up to over 28% now), compared to previous years, showing success in turning the pipeline into profitability.

The unexpected part of this difficult year was the quality control problem that occurred in their Nebraska facility early in 2012, which led to the voluntary recall of several brands of over-the-counter health care products. Some products were said to contain chipped fragments of other drugs and potentially mislabeled products. This has resulted in revenue and profit declines, and the facility is still not in full operation.

Strong points for the company include:

-The company is known to have one of the stronger pipelines in the industry, with over 130 potential products in the pipeline. Submissions of several drugs are expected in 2013, 2014, and 2015, along with a host of submissions listed for 2016 and after. The company had six billion-dollar drugs at the end of 2011, and management has indicated that this could potentially exceed 9 by the end of 2012 as some of their promising drugs continue to grow at robust rates.

-Sandoz appears to be poised for a strong future. It’s the second largest generics company, but also the largest company in the biosimilars market, with over 50% of the market share. Company management in the Q1 earnings call stated that the biosimilars market could be a $15-$20 billion market by 2020.

-The company continues to push for expansion into emerging markets, and several of those markets including China are showing solid growth.

-The Nebraska plant that suffered the recalls is expected to come back online in this second half of 2012.

-The sales figures for Alcon, which now represents the second largest segment for the company, are up 10% in the last year, which is very solid performance.

Risks

Novartis like any company does have risk. It is prone to the standard risks of the health care industry, including government regulation (and increasingly aggressive plans to control health care costs), litigation, and pipeline volatility and risks. As a large multinational company, there is also currency risk, and for dividend investors, the dividend is paid in CHF and converted to USD, which carries another layer of currency risk.

The company’s largest geographic segment is Europe, which currently has considerable economic uncertainty.

The hearing with India’s Supreme Court is expected to begin in July of this year. Novartis is attempting to get patent protection for its blockbuster drug Gleevec in the nation, which was previously denied. In addition to a profitability issue, it has turned into a bit of a public relations issue, as arguments from opponents assert that the patent shields like those of Novartis in this case diminish medicine exposure for the third world.

Conclusion and Valuation

Novartis is facing headwinds, but the longer-term scenario looks favorable. The issues with their OTC operations may resolve later this year, and the Diovan patent expiration should work itself out over time as existing drugs and the strong pipeline replace the loss. The company is extremely diverse, with a robust pharmaceuticals segment, the largest eye care business in the world, among the largest of generics companies, as well as smaller supporting segments, all spread out over a wide geographic area.

Based on discounted cash flow analysis, I calculate that with an estimated 4% long term free cash flow growth rate for the company and a 10% discount rate, Novartis is currently fairly valued.

The dividend discount model is another valuation option to use here. This model is a bit more sensitive to growth estimates, and with the slowing dividend growth of Novartis, a reliable estimate is difficult to acquire. Dividend growth over the last 7 years was over 11%, but was only a bit over 2% in the last year. However, with the major patent expiration working itself out, and the company’s OTC operations expected to rebound, I expect that the dividend growth rate should return to a decent 5-6% rate or so. On a currency-neutral basis, using the dividend discount model with a 5% long-term dividend growth estimate and a 10% discount rate yields a fair value of $52, while a 6% growth rate with the same 10% discount rate yields a fair value of $65.

Therefore, at the current price of a bit over $56/share, I believe that while Novartis does not have a spectacular margin of safety, it does likely represent a solid place to put capital in this market. With a dividend yield of around four and a half percent currently, and with the estimation of a dividend growth rate that is better than last year but not nearly as strong as their previous years, Novartis stock does appear to have potential rewards that outweigh the risks.

Full Disclosure: As of this writing, I own shares of NVS.

You can see my dividend portfolio here.

Dividend Stock Newsletter:

Sign up for the free dividend investing newsletter to get market updates, attractively priced stock ideas, resources, investing tips, and exclusive investing strategies:

Excellent piece! Fully agree:

“The strategy of using acquisitions to fuel growth is good at producing revenue growth, but generally doesn’t provide the same sort of robust earnings growth that organic growth would. Acquisitions tend to be an expensive growth strategy. “

Nice job on the analysis. Just curious, how do you think Novartis compares to Pfizer? I was considering adding Pfizer to my portfolio.

Thanks for the analysis. Do US investors end up paying any withholding tax on Novartis ADRs (15% or so)?