Summary

Novartis (NVS) is one of the largest and most diversified health care companies in the world.

-Revenue Growth: 9%

-Income Growth: 10%

-Cash Flow Growth: 15%

-Dividend Yield: 4%

-Balance Sheet: Strong

Overall, I find NVS to be an attractive investment at the current price of approximately $61 on the NYSE. With a P/E of under 15, and other reasonably attractive valuation metrics, I find the stock to be at a decent value, with the strengths of the company considered. I consider Novartis to be a strong international investment choice.

Overview

Novartis (symbol NVS on the NYSE, also traded on the SIX Swiss Exchange) was created in 1996 as a merger between two companies, Sandoz and Ciba-Geigy, but the earliest foundations of the company (Geigy) go back all the way to 1758. Novartis is one of the largest and most diversified health care companies in the world, and is headquartered in Switzerland. The company began trading on the NYSE as American Depository Shares in 2000.

In 2010, the company had 50.624 billion USD in sales and 11.526 billion USD in operating income. The company consists of five divisions:

Pharmaceuticals

Pharmaceuticals is the largest division, and in 2010 accounted for 30.558 billion USD in sales and 8.798 billion USD in operating income. This represents roughly 60% and 76%, respectfully, of total sales and operating income.

Vaccines and Diagnostics

Vaccines and Diagnostics accounted for 2.918 billion USD in sales and 0.612 billion USD in operating income. This represents roughly 6% and 5%, respectfully, of total sales and operating income.

Sandoz

Sandoz Generics accounted for 8.518 billion USD in sales and 1.272 billion USD in operating income. This represents roughly 17% and 11%, respectfully, of total sales and operating income.

Consumer Health

Consumer Health accounted for 6.204 billion USD in sales and 1.153 billion USD in operating income. This represents roughly 12% and 10%, respectfully, of total sales and operating income.

Alcon

Alcon eye care only contributed to sales and income for a portion of the year, and accounted for 2.426 billion USD in sales and 0.323 billion USD in operating income. This represents roughly 5% and 3%, respectfully, of total sales and operating income.

Corporate

Corporate accounted for negative 0.632 billion USD in operating income, and makes up the balance of the percentage for operating income to bring it down to 100%.

The company has a diverse geographic footprint. Sales to Europe and the United States are fairly equal, and the company also draws in considerable revenue from elsewhere.

Sales, Income, Cash Flow, and Metrics

Novartis has a strong history of growth and performance.

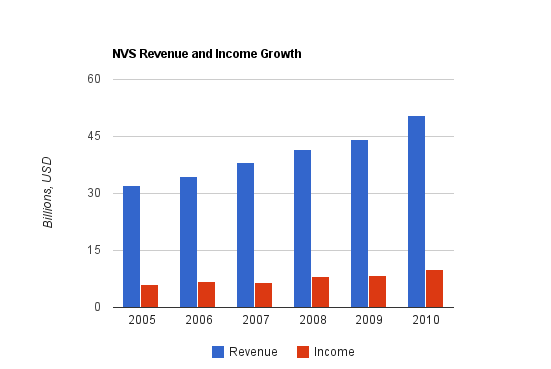

Sales Growth

| Year | Sales |

|---|---|

| 2010 | 50.624 billion USD |

| 2009 | 44.267 billion USD |

| 2008 | 41.459 billion USD |

| 2007 | 38.072 billion USD |

| 2006 | 34.393 billion USD |

| 2005 | 32.212 billion USD |

Novartis net sales have grown at a rate exceeding 9% per year, on average.

Income Growth

| Year | Income from C.O. |

|---|---|

| 2010 | 9.969 billion USD |

| 2009 | 8.454 billion USD |

| 2008 | 8.163 billion USD |

| 2007 | 6.540 billion USD |

| 2006 | 6.825 billion USD |

| 2005 | 6.141 billion USD |

Novartis has grown net income from continuing operations at an average compounded rate of over 10%.

Cash Flow Growth

| Year | Operational Cash Flow |

|---|---|

| 2010 | 14.067 billion USD |

| 2009 | 12.191 billion USD |

| 2008 | 9.769 billion USD |

| 2007 | 9.210 billion USD |

Novartis has grown operational cash flow by a compounded rate of 15% annually over this three-year period.

Metrics

Price to Earnings: 14.5

Net Profit Margin: 20%

Return on Equity: 17%

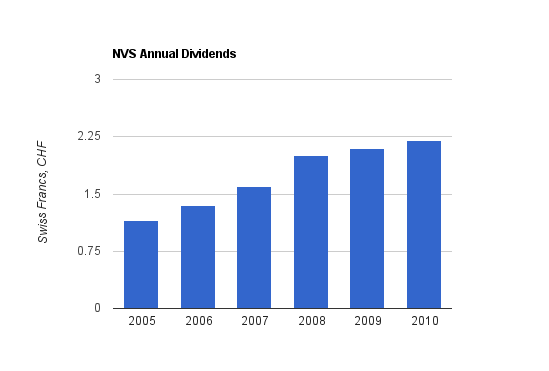

Dividend Growth

Novartis pays a large annual dividend. Unlike many American companies that pay quarterly dividends and strive to grow them each year regardless of operating results, European companies tend to pay fewer but larger dividends, and tend to have less focus on ensuring that the dividend grows each and every year (but the successful companies have good histories of growth regardless). Dividend information below is presented in Swiss currency CHF, and when paid is translated into USD for investors in the ADRs. The yield information is calculated based on the Swiss currency as well, on the Swiss exchange rather than the NYSE, in order to exclude currency exchange rates, but it’s worth noting that yields for shares on the NYSE tend to follow these yields very closely.

Novartis has increased its dividend for 14 consecutive years since the 1996 merger. The dividend payout ratio is approximately 55%.

Dividend Growth

| Year | Dividend | Yield |

|---|---|---|

| 2011 | 2.20 CHF | 4.20% |

| 2010 | 2.10 CHF | 3.70% |

| 2009 | 2.00 CHF | 4.20% |

| 2008 | 1.60 CHF | 3.00% |

| 2007 | 1.35 CHF | 1.80% |

| 2006 | 1.15 CHF | 1.60% |

The dividend has grown at a rate of almost 14% over the last five years, but at a rate of only 5% over the last two years. The dividend yield is currently approximately 4% on both exchanges.

Balance Sheet

Novartis has a strong balance sheet, with a long-term debt/equity ratio of only 0.22. The company does have a substantial amount of goodwill from acquisitions, but this amounts to only roughly half of total shareholder equity. The interest coverage ratio is very healthy, at around 15.

Investment Thesis

Novartis has made a series of successful acquisitions and investments. Over the last several years, the company acquired Roche, Lek, Hexal and EON labs, OTC business from BMY, Chiron, EBEWE, and Alcon. In addition, the company has been selling and spinning off parts of the company since 1996, with a notable example being the sale of Gerber baby foods to Nestle. In 1996, 45% of the company consisted of health care products, and now the company consists of 100% health care after selling their specialty chemicals, agribusiness, and nutrition products.

The company has many planned filings in their clinical pipeline, which can be found here, and acquisitions can help boost company size and shareholder return as well. The company has 147 products in the pipeline according to the most recent annual report. In 2010, Novartis spent over 8 billion USD in core research and development, which is higher than in previous years.

Their results have shown the capability to continue producing or acquiring valuable and lucrative products. In 2010, 21% of net pharmaceutical sales were from products launched since 2007, 31% of sales were from established products that were launched within the last 10 years (and before 2007), and the remainder came from mature products that were launched over 10 years ago, and from products that are not patented. Some recent approvals include Menveo (a vaccine to prevent meningococcal disease) and Gilenya (an oral medication for multiple sclerosis), as well as for new indications for other products. Successful new drugs over the last few years include Lucentis, Exforge, Exelon, Tasigna, and many others.

The diverse operations in the areas of vaccines, generics, and eye care help to balance out the branded drug portion of the company. Patent protection provides substantial competitive advantage for this company, although successful research and development and/or successful acquisitions are required to keep this competitive advantage intact.

Novartis is quite shareholder friendly, paying large dividends and growing them for 14 consecutive years. The payout ratio for 2010 was approximately 55%.

Risks

Novartis like any company does have risk. It is prone to the standard risks of the health care industry, including government regulation (and increasingly aggressive plans to control health care costs), litigation, and pipeline volatility and risks. As a large multinational company, there is also currency risk, and for dividend investors, the dividend is paid in CHF and converted to USD, which carries another layer of currency risk (although CHF has been strengthening compared to USD over the last several years).

Patent Risk:

Diovan will go off patent in 2012, and this represented slightly over 6 billion USD in 2010 net sales for Novartis (12% of the total). Glivec will go off patent in 2015, and this represented more than 4.2 billion USD in 2010 net sales, although Tasigna is a replacement drug for this. Although several other branded drugs represent more than 1 billion USD in net sales for Novartis, none of them are at nearly the level of sales of these two drugs, so the rest of the drug portfolio can be considered fairly diversified. Zometa, accounting for 1.5 billion USD in net sales, expires in 2012 as well. Novartis has a strong pipeline but these expiring patents, especially Diovan, represent a significant risk and are likely a factor in the currently moderately low stock price.

Conclusion

In conclusion, I think Novartis represents a reasonable investment at the current price. The company is large, diversified, and yet has become quite streamlined due to divestitures of non-health care divisions over the years. The dividend yield of roughly 4% with 5% recent dividend growth is decent, although I’d like to see the sum of these numbers a bit higher than 9; perhaps 10-12 is preferable. The balance sheet is very strong, with the one drawback being a moderate amount of goodwill. The valuation of the company, while somewhat higher than industry peers, is pretty low by absolute standards, and I would consider this stock to in the “value” range. The expiration of Diovan is a risk worth noting, and definitely worth factoring into a fair price estimate, but based on the number of projects, the number of future listings, the amount spent on R&D, and the history of Novartis, I do expect considerable portfolio rejuvenation coupled with acquisitions.

Full Disclosure: As of this writing, I have no position in NVS. Later Edit: I own NVS stock at the current time now.

You can see my full list of individual holdings here.

Dividend Newsletter:

Sign up for the free monthly dividend investing newsletter to get market updates, attractively priced stock ideas, resources, and investing tips:

Good post. Maybe the generic segment is worth mentioning a bit more, good growthpotential.

I think Novartis patentline looks stronger then J&J looking at expiration years. Then again patent expiration doesnt have to be devasting for various reasons. Two of J&Js biggest drugs, Remicade and Concerta, have expired patents but still grow sales. For Remicade its “strong overall market growth” while the FDA hasnt approved any competitors for Concerta yet.

As im certainly no expert in this field I like J&J and Novartis for their diversity.

Great analysis as always!

I have thought from time to time about Novartis, but with so many excellent U.S. health care stocks, I find it hard to fit this one on my watch list. Seems like an excellent opportunity, I will have to add it to the likes of Medtronic and Becton Dickinson on my watch list. Very healthy yield and an attractive valuation. Thanks!

Nice analysis (again :) Matt.

Love the diversity. They are a big machine and they have the potential to acquire many smaller companies over the next few years. Couple this with their generics line of business; this will eventually be a HUGE part of their operations. An again population is most certainly going to demand it IMO.

Great Analysis… To me, NVS is a good alternative to JNJ.

One thing worth noting is that the Swiss impose a tax on dividends paid to foreigners (Swiss dividend withholding tax is ~35%)…

Great analysis! You never leave a single rock unturned.

I’m glad to see that you touched on currency exposure seeing as the CHF has become a premier currency after concerns about a Euro default. I think CHF might be overvalued given concerns in Europe have pushed people into CHF as it is effectively a European exposure play without political risk.

Notice that you just added NVS to your portfolio… Nice Move!