Summary

Medtronic Inc. (MDT), is a global medical technology company focusing on producing a broad set of medical products.

-Five year average revenue growth: 7.1%

-Five year average EPS growth: 6.5%

-Five year average dividend growth: 18%

-Current dividend yield: 2.90%

-Balance Sheet: Moderately Strong

Based on the valuation and the competitive advantages of the company, I consider MDT to be a reasonable buy for a dividend stock portfolio at the current price of around $33-$34.

Overview

Founded in 1949, Medtronic, Inc. (NYSE: MDT) is a medical technology company focusing on alleviating pain, restoring health, and extending life for people all over the world. With over 40,000 employees and a market capitalization of over $35 billion, Medtronic is the world’s largest independent medical technology company.

Approximately 43% percent of company revenue comes from outside of the United States. The company markets its products in over 120 countries.

Operating Segments

The company is divided into seven operating segments.

Cardiac Rhythm Disease Management

This segment accounts for 31% of total company sales. Products in this segment include pacemakers, implantable defibrillators, leads and delivery systems, ablation products, electrophysiology catheters, and other products.

Spinal

This segment accounts for 21% of total company sales. Products in this segment include thoracolumbar, cervical, neuromonitoring, surgical access, and more.

Cardiovascular

This segment accounts for 20% of total company sales. Products include coronary stents, delivery systems, heart valve replacement systems, and more.

Neuromodulation

This segment accounts for 10% of total company sales. Products include implantable systems for treatment of chronic pain and movement disorders, among other things.

Diabetes

This segment accounts for 8% of total sales. Products include insulin pumps and disposable products.

Surgical Technologies

This segment accounts for 7% of total sales. Products of this segment are used to treat ear, nose, and throat conditions.

Physio-Control

This segment accounts for 3% of total sales. Products in this segment include defibrillators and monitoring systems.

Revenue, Earnings, Cash Flow, and Metrics

The company has an impressive and consistent growth record.

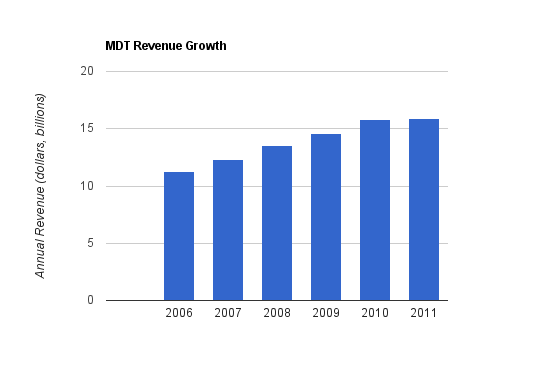

Revenue Growth

| Year | Revenue |

|---|---|

| 2011 | $15.933 billion |

| 2010 | $15.817 billion |

| 2009 | $14.599 billion |

| 2008 | $13.515 billion |

| 2007 | $12.299 billion |

| 2006 | $11.292 billion |

Over this five year time period, Medtronic has grown revenue by an average of 7.1% annually.

Earnings Growth

| Year | EPS |

|---|---|

| 2011 | $2.86 |

| 2010 | $2.79 |

| 2009 | $1.93 |

| 2008 | $1.95 |

| 2007 | $2.41 |

| 2006 | $2.09 |

Over this period, Medtronic has grown EPS by 6.5% annually, on average. Earnings are erratic, and 2006 was a particularly high year. If the calculation for EPS growth had been over a six-year period, the growth rate would have been over 11.6%. The EPS growth is realistically somewhere between those two figures. Some of this earnings volatility has to do with the relationship that the earnings statement has to the cash flow statement, and will be mentioned below.

Operating Cash Flow Growth

| Year | Cash Flow |

|---|---|

| 2011 | $3.741 billion |

| 2010 | $4.131 billion |

| 2009 | $3.878 billion |

| 2008 | $3.489 billion |

| 2007 | $2.979 billion |

| 2006 | $2.207 billion |

Over this five year time period, cash flow has grown by an average of 11.1% per year on average. If, instead, the calculation had been performed over a six year period, the cash flow growth would be less than five percent. So it’s an inverse situation to the EPS growth over these five and six year periods. Realistically, the cash flow growth is between these two figures.

Together, the cash flow growth and the earnings growth show the growing profitability of this company. Cash flow was a bit low in 2006 while earnings growth was very strong. In contrast, over the 2008-2009 period, earnings were a bit low while cash flow growth was very strong. The average growth of EPS and cash flow over the last five years was around 8.8%.

Metrics

Price to Earnings: 11.5

Price to FCF: 10

Price to Book: 2.2

Return on Equity: 20%

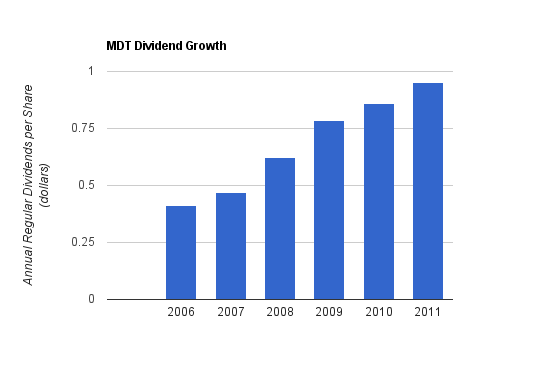

Dividends

Medtronic currently has a dividend yield of 2.90% and has a solid record of consecutive dividend increases that spans decades.

Dividend Growth

| Year | Dividend |

|---|---|

| 2011 | $0.9525 |

| 2010 | $0.86 |

| 2009 | $0.785 |

| 2008 | $0.625 |

| 2007 | $0.47 |

| 2006 | $0.4125 |

Over this five year period, Medtronic has grown its dividend by over 18% per year, on average. The most recent year’s increase was a bit under 8%, which is a more realistic figure going forward.

Looking at historical dividend yields and prices relative to EPS, this company was quite overvalued in the past. Indeed, throughout the past decade, Medtronic has had a high P/E and therefore a low dividend yield. The diminishing valuation combined with a continued increasing of the dividend has resulted in a yield that is approaching a healthy 3%.

Balance Sheet

The total debt/equity ratio of the company is 0.61, which is solid. However, 60% of equity consists of goodwill. This is not uncommon, but a bit higher than I’d like. The interest coverage ratio is nearly 9, which is rather good. Overall, the balance sheet for Medtronic is relatively strong.

Investment Thesis

Medtronic focuses on two main segments: developed countries and emerging markets. In developed countries, Medtronic focuses on cutting-edge innovation to increase the options of medicine to higher levels, while in emerging markets the focus is on building distribution, training, education, and other healthcare infrastructure. Between 2010 and 2011, the percentage of company sales that came from emerging markets increased from 7% to 9%. The company expects this to jump to 20% by 2015. Another target figure is that while the company currently has its products used for 7 million people per year, 25 million is the target for 2020. That would represent a nearly fourfold increase over current levels.

According to the 2011 annual report, the company currently has 350 current projects, received over 2000 patent awards in this year, and introduced a record 60 new products. A notable new product is the first pacemaker that is suitable for use in an MRI environment. While this wasn’t an easy year for the company (or almost any company, for that matter), MDT did spend a company record $1.5 billion on research and development, which shows a continued focus on the long term.

Medical devices should be in global demand over the next several decades as more and more people in emerging markets have access to them. Medtronic’s fast international revenue growth showcases this trend, and now 43% of sales are international.

If earnings grow at a 7-8% pace going forward, combined with a nearly 3% dividend yield, shareholders should be rewarded well over time. There’s also additional upside potential if, quite a while from now, the investment is sold at a higher valuation than 12x earnings. From both a potential capital appreciation viewpoint, and a growing income viewpoint, I consider MDT to be a reasonable purchase at the current levels.

I have health care purposely overweight in my portfolio, as health care is one key thing that emerging markets are going to demand as they increase their purchasing power over the next few decades. The valuations on these companies are generally low, as there are pricing and regulation risks, but I think it represents a good buying opportunity. To avoid too much risk from any one company, I spread my health care portfolio allocation over several blue chip companies.

Risks

Like any company, Medtronic faces risk. The business faces regulatory risks and device approval risks, commodity cost risk, political risk, and currency risk. Since the company develops complex products for millions of people worldwide, innovation and new product development is important and reliant on beneficial research and development. In addition to this, due to the complexity and reach of their products, and the fact that they drastically affect patient lives, MDT faces various litigation risk. There is pricing risk in some of their segments, as well as risks due to recalls, or studies that show certain treatments aren’t as effective as once thought.

Conclusion and Valuation

In conclusion, I find Medtronic stock to be attractive at the current price of around $33 per share. It’s got a great growth history and great future prospects. The valuation is quite low with a P/E of under 12. This company was overvalued for a while, and now that the shine has worn off, the market is left with a great company that is potentially undervalued. Its revenue growth and dividend growth won’t be quite as high as previous years, but should be substantial, and higher than the valuation would imply.

Full Disclosure: I own shares of MDT at the time of this writing.

You can see my portfolio here.

If this article was valuable to you, consider subscribing to get my articles delivered to your email or reader.

Dividend Stock Newsletter:

Sign up for the free monthly dividend investing newsletter to get market updates, attractively priced stock ideas, resources, and investing tips:

Monk,

Your presentation of the analysis you have conducted on Medtronic, as well as the other stocks you have reviewed, is very well put together. I have started to include aspects of your method into my own system in order to keep me from just comparing numbers on a spreadsheet.

And I bought some MDT a couple of weeks ago. If it starts to become a 3% yielder its going to be very hard to not back up the truck on it!

Great analysis. Question…you have a link to your portfolio. Are all of your holdings in a retirement account (ira/401k, etc), a taxable account or a mix? If a mix, do you have any special criteria as to where you hold the stock (except availability of funds, obviously). Thanks in advance.

Medtronic is an excellent value stock. Nice analysis Matt!

Excellent analysis as usual.

The valuation has been much more attractive on this one than in the past. This is definitely on my watch list!

I like that Medtronic isnt exposed to expiring patents. Dividend aristocrat is a good sign.

It has weeker finances than id like. Been raising debtburden as interest coverage is down from 16 in 2007 to 8 in 2010 (despite decreasing interest rates). In the same time goodwill has doubled and the investments going to acquisitions more then doubled that of “normal” capex. So i believe Medtronic will have difficulties keeping up the current growthrate.

Marc,

To answer your question, my portfolio is a mix. My 401(k) is all index funds. My individual holdings are split between IRA and a taxable account, with the bulk being in the taxable account (due to the limits that one can put into an IRA each year). Basically, I put quite a bit into a 401(k), and then after that I’m sure to max out my IRA contribution for the year, and all extra investable income goes into a taxable account.

My criteria is fairly straightforward. I keep partnership and international holdings in a taxable account. Everything else is fair game for my IRA. Some of these investments can be in an IRA, but I try to keep things simple and keep some of the more complex stuff outside of an IRA. In theory, I’d like to keep higher-yielding selections in my IRA, but in practice, it doesn’t really work out that way.

Defensiven,

Good points. The balance sheet is still pretty good, with moderate goodwill and an interest coverage ratio of 8. Not as high as some of my other picks, but all things considered, very stable. But yes, they’re doing acquisitions which brings on goodwill, and I prefer to see an interest coverage ratio of over 10 (depending on the industry).

Which picks are appealing to you these days? Anything in particular on your radar?

My favourite stock atm is Philip Morris. Tobacco seems to be a lovely business (economically).

From what ive read most countries use a volume-based taxsystem (not price). In Sweden this actually makes lowprice competition impossible. It also means that every little extra penny you can add to the price means a lot to the revenue (as the tax is primarly volumebased). So a premiumbrand like Marlboro is gold. Especially since marketing is forbidden in many channels. Forbidden marketing is actually another factor limiting competition. New entrance is so much harder when you cant market your new brand.

US tobacco has been doing fine over the decades despite rabidly decreasing and increasing taxes and regulation (thanks to price increases).

Matt,

I’ve had a buy order in for MDT at $30.05 a share. Cross your fingers for me.

Matt – Thank you much. Very helpful. I am in a similar situation and just wanted to confirm that I wasn’t doing anything wrong with my allocation.

Keep up the great work.