-Seven Year Average Revenue Growth Rate: 6.4%

-Seven Year Average EPS Growth Rate: 10%

-Seven Year Average Dividend Growth Rate: 10%

-Current Dividend Yield: 1.87%

-Balance Sheet Strength: Strong, Stable

At the current price of around $73, McCormick appears poised to offer reasonable long-term returns, but the lack of a margin of safety and the low current yield reduce the attractiveness of the stock unless or until the earnings multiple contracts a bit.

Overview

McCormick and Company (NYSE: MKC) is a 120+ year old spice and herb business. They produce and sell spices, herbs, and seasonings the world-over to both consumers and businesses. The company grows both organically, and through acquisitions, and sources product material from 40 countries and sells its products in over 110 countries.

The company is involved in multiple industries and areas, with 41% of their revenue coming from their “Americas Consumer” segment, 28% of revenue coming from their “Americas Industrial” segment, 14% from “EMEA Consumer”, 7% from “EMEA Industrial”, 5% from “Asia Pacific Consumer” and 5% from “Asia Pacific Industrial”.

Examples of industrial customers include Pepsico, McDonald’s, General Mills, Yum! Brands, Subway, Kraft Foods, Wendy’s, and Sysco.

Consumer brands include McCormick, Old Bay Seasoning, Lawry’s, Simply Asia, and many others. In addition to owning by-far the dominant market position in branded spices and herbs (more than twice as large as nearest competitors), McCormick is also a leading provider of private label spices and herbs.

Valuation Metrics

Price to Earnings: 24

Price to Free Cash Flow: 29

Price to Book: 5.5

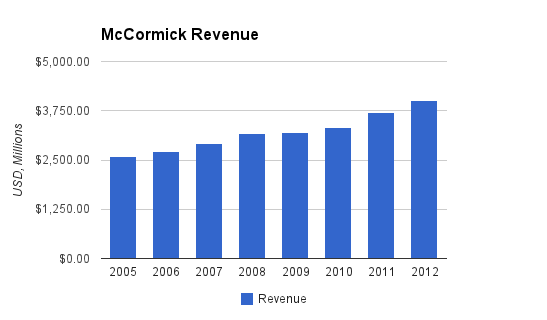

Revenue

(Chart Source: DividendMonk.com)

McCormick grew revenue by an average of 6.4% per year over this period, which is impressive. Notably, there was not a single year in 10+ years where revenue was not larger than the previous year. Much of this growth and consistency is due to McCormick’s strategy of making substantial acquisitions a core part of their growth strategy.

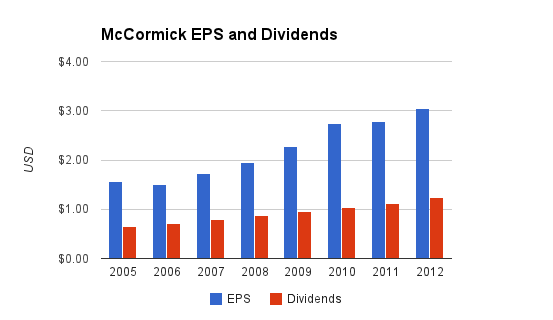

Earnings and Dividends

(Chart Source: DividendMonk.com)

The EPS growth rate and the dividend growth rate were both 10% per year, on average, over this period. The current dividend yield is fairly low, at only 1.87%, even though the payout ratio is reasonable for this type of company at over 40%. McCormick has raised its dividend for 27 consecutive years without a miss.

Approximate Historical Dividend Yield at Beginning of Each Year:

| Year | Yield |

|---|---|

| Current | 1.87% |

| 2013 | 2.1% |

| 2012 | 2.5% |

| 2011 | 2.5% |

| 2010 | 2.8% |

| 2009 | 3.0% |

| 2008 | 2.4% |

| 2007 | 2.1% |

| 2006 | 2.3% |

As can be seen, the yield has been dropping over the past few years even though the dividend is being consistently increased each year. This is because the valuation of the stock has inched upwards, and the result is that despite having a long history of consistent dividend growth and a reasonable payout ratio, the yield is unfortunately low.

How Does McCormick Spend Its Cash?

During the fiscal years 2010, 2011, and 2012, McCormick reported about $890 million in cumulative free cash flow. During the same time period, $450 million was spent on dividends, $300 million was spent on share buybacks, and $490 was spent on acquisitions.

Balance Sheet

The company’s total debt/equity ratio is under 0.8, but 100% of existing shareholder equity consists of goodwill. The ratio of total debt to net income is about 3.3x, and the interest coverage ratio is just over 10x.

Overall, McCormick is making moderate use of leverage while maintaining very healthy interest coverage and credit scores.

Investment Thesis

Developed countries are becoming increasingly health aware, and due to this, people will be looking for healthy yet flavorful foods more than in the past. Spices and herbs are a great way to add taste to food while keeping the meal healthy, or even increasing the healthiness of the meal with antioxidants.

McCormick expects Herbs and Spices to be the third-fastest growing flavor category after Soy-Based Sauces and Stock Cubes through 2017 (with 10+% total industry growth during that time period), and they have the leading worldwide market share in that industry. By maintaining their existing market share, increasing market share with organic growth or acquisitions, riding the growth of the whole industry, and maintaining decent pricing power, revenue growth can continue to be substantial. In 2012, the company introduced over 250 new products.

The company is also aggressively expanding into emerging markets and China. Asia/Pacific currently accounts for only 10% of McCormick revenue, but it’s growing at a rate that exceeds overall company growth, so there is a tremendous growth opportunity there and they are keen on continuing to tap into it.

I consider McCormick to be in a strong position compared to other food companies because their products are rather expensive per unit of weight and volume. Spices and herbs only make up a tiny part of a meal. Like most of the food industry, the company faces headwinds from commodity costs, transportation costs, packaging costs, and so forth, but I believe their operations in the spice business may buffer them to some extent from these problems compared with companies that sell cheaper, larger, heavier foods in bigger packaging. The company also has private-label products to capture some of the lower-margin spice purchases.

Risks

Like any company, McCormick has risks. McCormick is a large global company and is subject to international political and currency risks. Generally the largest risk that companies in the food industry face is rising commodity costs.

McCormick is fairly diverse overall, but has sensitivity to a few large customers. Pepsico is the largest customer for McCormick’s industrial segment, and accounts for 11% of total McCormick revenue. The top three customers for the industrial segment account for over half of the revenue generated by that segment. Wal-Mart is the largest customer for McCormick’s consumer segment, and also accounts for 11% of total McCormick revenue.

Conclusion and Valuation

The company’s long-term goals, as of this writing, are to increase sales by 4-6% per year, increase EPS by 9-11% per year, and maintain a dividend yield of around 2%, although of course they have control of the payout ratio but not the actual yield. This is in line with, and slightly conservative compared to, their historical performance. The result is that the company aims for 11-13% annual shareholder returns, which is higher than the historical S&P 500 average growth rate.

Investor returns, however, are based on two variables. The first is the company growth during the holding period, and the second is the change in valuation between the times when the stock is bought and sold. The longer the stock is held, the less relevant the second variable is, but it always has an impact. Buying an over-priced stock can undermine performance for investors even if the company continued to perform well by steadily reducing the valuation over the holding period. This is what happened to companies like Walmart and Coca Cola over the last decade, where they had strong fundamental performance but flat stock performance because long-term reductions in their earnings multiples were precisely enough to offset the steadily increasing EPS.

If, for example, EPS increases by 9% per year over the next 10 years, and the earnings multiple at the end of the period is only 15 compared to the current figure of 24, then the stock price would be about $108, not adjusting for stock splits. The investor would have also received about $20 in dividends per share, plus approximately $10 in additional value if those dividends were reinvested. Therefore, the rate of return from today’s price of about $73 to the value of roughly $138 ten years later would represent a rate of return of around 6.5%. This would be a less than ideal rate of return, but those are fairly pessimistic estimates about a reduction in earnings multiple from 24 to 15, and company EPS performance of 9% annually, which is on the low end of their 9-11% long-term target.

Repeating the estimate but using 10% EPS/dividend growth, and assuming an earnings multiple of 18 at the end of the ten year period, results in a ten-year stock price of $142, $21 in dividends, and another $11 in value if dividends are reinvested, for a total of $174. The result is a rate of return of over 9%, even though there was a hypothetical reduction in earnings multiple from 24 to 18.

The conclusion I draw is that McCormick is not particularly attractively priced currently because it has no margin of safety. It’s also not likely attractive to many dividend investors even though it has the characteristics of a dividend stock (fair payout ratio, a quarter century of consecutive dividend increases, overall stability) primarily because the high valuation pushes down the current yield. Quantitatively, however, a reasonable positive rate of return can be expected on the current price even if the valuation falls substantially and if the company’s performance clocks in at the low end of its estimated range, and this expected return increases as the estimates become more generous for ending valuation and fundamental performance.

For a defensive company, I view the company as a “hold” at this time.

Full Disclosure: As of this writing, I have no position in MKC.

You can see my dividend portfolio here.

Strategic Dividend Newsletter:

Sign up for the free dividend and income investing newsletter to get market updates, attractively priced stock ideas, resources, investing tips, and exclusive investing strategies:

If the stock price falls below $63, which is 20 times earnings, I might consider it. If it drops below $55, I would actually buy it.

Otherwise, I agree it is a good long-term hold. Margin of safety is important however, because you don’t want to overpay and end up spending 5 – 10 extra years waiting for improving fundamentals to “bail you out”.