Maiden Holdings Ltd (MHLD) is organized to provide, through an insurance subsidiary, property and casualty insurance and reinsurance business solutions mainly to small insurance companies and program underwriting agents in the United States and Europe. The company is based in Bermuda.

-Seven Year Revenue Growth Rate: 3.07%

-Seven Year EPS Growth Rate: 5.98 %

-Seven Year Dividend Growth Rate: 18.70%

-Current Dividend Yield: 3.53%

-Balance Sheet Strength: Strong

Overview

MHLD is not the classic blue chip dividend payer you usually find in a dividend investor’s portfolio. The reinsurance business is a very stable business with predictable income. It’s a small cap with a low valuation (P/E around 15) and a reasonable yield (3.50%). This is probably one of the rare cheap opportunities on the market right now.

Founded in 2007, MHLD is born from what was previously the GMAC reinsurance platform. Most MHLD senior management are also former GMAC management team members.

This is not exactly the type of stock that shows up on my radar but it scored very high on my Dividend Stocks Rock Ranking and I thought about digging a little further.

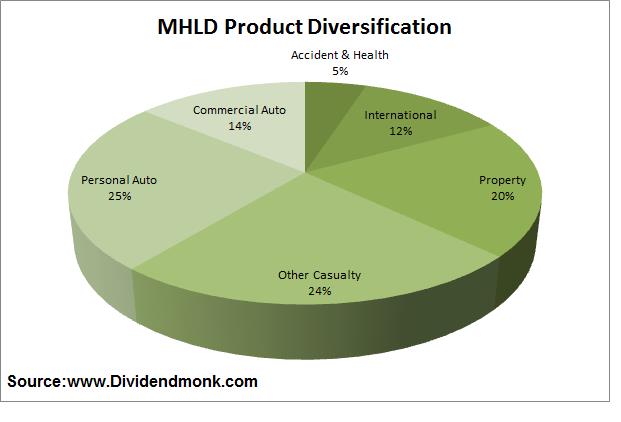

Diversified Reinsurance

The company operates in two different segments: Diversified reinsurance and AM Trust Reinsurance. The Diversified Reinsurance business consists of a portfolio of property and casualty reinsurance business focusing on regional and specialty property and casualty insurance companies located, primarily in the United States and Europe.

I’ll stop right here and provide you with additional information on what “reinsurance” means in the first place (definition coming from investorpedia):

“The practice of insurers transferring portions of risk portfolios to other parties by some form of agreement in order to reduce the likelihood of having to pay a large obligation resulting from an insurance claim. The intent of reinsurance is for an insurance company to reduce the risks associated with underwritten policies by spreading risks across alternative institutions.

Also known as “insurance for insurers” or “stop-loss insurance”.

Here’s how MHLD reinsurance products are split:

Ratios

Price to Earnings: 14.58

Price to Free Cash Flow: 1.55

Price to Book: 1.164

Return on Equity: 11.58%

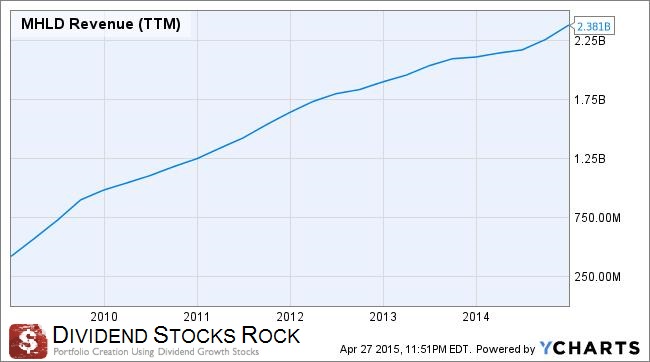

Revenue

The revenues are keeping a steady and clear line headed skyward. However, one must remember the core business of MHLD is car reinsurance and the automobile industry has been doing very well over the past few years and MHLD obviously benefits from a good position and timing in its business.

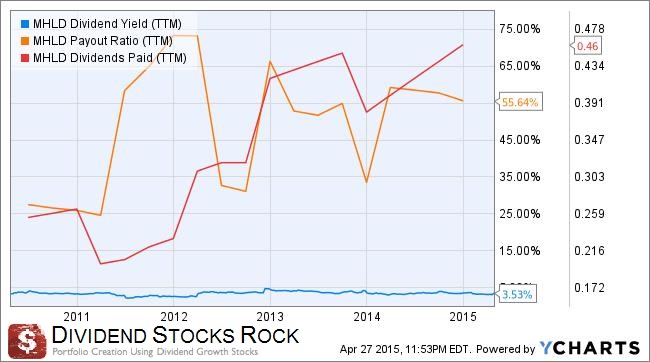

Earnings and Dividends

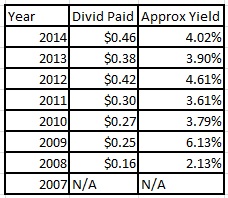

I like the fact the dividend yield was relatively stable and the dividends paid keep increasing. Also, the payout ratio is relatively stable since 2013. This is quite a feat considering the important dividend payment increases since MHLD’s creation.

Approximate historical dividend yield at beginning of each year:

What catches my attention from the previous graph is how the dividend tripled in only 7 years. I know it’s impossible for the company to keep hiking its dividend at this rate, however, since the payout ratio has stayed relatively low, we could see other strong increases over the next few years.

How Does MHLD Spend Its Cash?

The company used some serious debts to buy GMAC RE back in 2007. Since then, MHLD’s focus was to repurchase this junior debt in order to reduce its cost of capital and eventually be able to give more to shareholders. Last year, the company repurchased all of the outstanding Trust Preferred Securities (the “TRUPS Offering”), with a face value of $152.5 million

In 2014, the board approved a 75 million budget for share repurchases while management keeps hiking dividend payments year after year since its creation.

Investment Thesis

MHLD is evolving in a relatively stable and predictable market. The company focuses on building strong partnerships with insurance companies that constantly require MHLD services to pursue their business.

The management team shows very strong experience with the previous GMAC RE background. The company continues to post solid results quarter after quarter and is well positioned to gain more business in Europe as MHLD provides solutions for new risk base regulations coming to Europe.

Therefore, we should see revenues continue to grow in the upcoming years.

Risks

There are possible conflicts of interest as MHLD’s founding shareholders own and control 53.9% of the outstanding shares of AM Trust Financial Services which is MHLD’s main client since 2008. There are also several short sellers around this stock due to these possible conflicts of interest. This is the reason why we will use a higher discount rate to value the stock

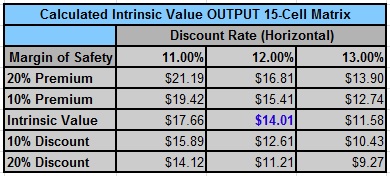

Conclusion and Valuation

The first step for stock valuation is to look at its historic P/E ratio to see how the market values MHLD.

There have been several ups and downs in the valuation. To be honest, I’m not a big fan of companies without a steady valuation. Could MHLD be worth as little as 7.5 times the earnings or as much as 26? This is hard to tell at the moment and I will use the Dividend Discount Model to give a better value to the stock.

Because MHLD has a client generating the bulk of its income and MHLD’s management controls this client, I will use a discounted rate of 12%. This is higher than my usual discount rate for a solid dividend stock. I usually consider a discount rate between 9 and 11%, but MHLD shows higher risk in my opinion. I use the two stages DDM calculation from The Dividend Toolkit as I think the dividend growth can continue increasing by 10% for the next 10 years but will reduced to 7% afterward.

Source: Dividend Toolkit Calculation Table

Source: Dividend Toolkit Calculation Table

As you can see, the stock is slightly over valued using these metrics. For someone who is willing to take additional risk in their portfolio, he will most likely be rewarded with this company as I was quite severe in my valuation. Still, I almost get to the current value.

In other words, if you have a strong portfolio including several blue chips, adding MHLD to your portfolio will probably be a good trade.

Full Disclosure: As of this writing, MHLD is part of our DSR Portfolios.

Great find and thanks for the analysis! I’ll add this to my watch list.

Hello DE,

thx! I’ve watched this company for a while and decided to add it to our DSR portfolios at the beginning of the year. It was a great addition to our portfolios!

Cheers,

Mike

Interesting company. Well-timed analysis too, as I was looking for a new insurer to keep an eye on :) I wasn’t all that happy with what I saw with the standard dividend growth mainstays, so seeing other, less well-known insurers is good. My only real complaint here is actually a moral one. If by GMAC you mean the former General Motors subsidiary, I don’t trust them. Never have, never will. And if most upper management are former GMAC acolytes, I can’t say this is a sleep well at night stock. Thanks for the writeup.

Hello DD,

yes, it was General Motors Subsidiary… They know what they do… but they maybe know too well!