Smooth growth can be a sought-after trait of a company, because it makes prediction easier and it inspires confidence in the strength and consistency of the business.

Smooth growth can be a sought-after trait of a company, because it makes prediction easier and it inspires confidence in the strength and consistency of the business.

For example, using the Gordon Growth Model is easier when you have a basis for determining long-term EPS growth, since dividends are ultimately derived from the core profits over time.

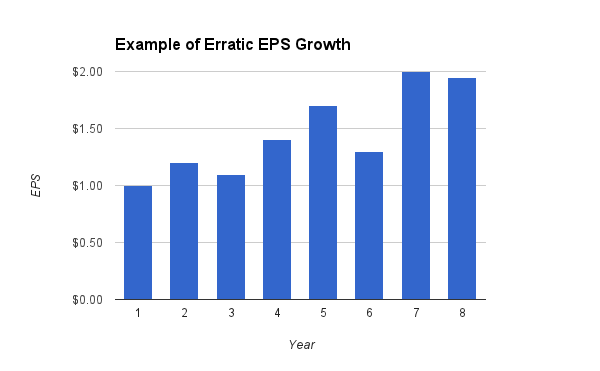

So when a company grows EPS like this:

then it can be tricky to estimate a forward growth figure, even though we can calculate that the annualized growth over this period was 10%.

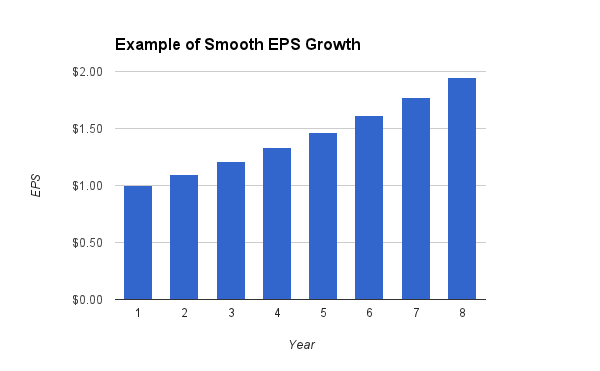

In contrast, when a company has growth that is smoother, like this:

then it can help make accurate estimates for future growth. This example had the same 10% annualized growth as the erratic example.

This doesn’t mean that smooth EPS growth is always preferable, though. In an era where clockwork business growth is expected, executives can be under pressure to manage earnings to provide an illusion of consistency where there is none. In addition, managed earnings aside, if a company focuses too much on meeting quarterly and annual expectations without developing a solid five-year plan (like IBM, for example), then long term growth can be sacrificed for short term consistency.

Still, identifying certain companies that seem to be particularly consistent can be a good entry point for looking for new investment picks, to see if they also shine in other areas. The following five companies have had at least five years of consecutive annual EPS growth.

Church and Dwight (CHD)

Church and Dwight is a consumer products company that owns brands like Arm and Hammer Baking Soda, Trojan Condoms, Nair, and Oxi Clean, and the company traces its roots back as far as 1847. The balance sheet is incredibly strong, and the company consistently generates more free cash flow than net income.

The consistency for the company has come due to smart acquisitions. While some companies destroy value by overpaying for other companies, the management at Church and Dwight have made smart, medium-sized purchases that broaden their brand portfolio and create strong shareholder returns. EPS grew at a 15% annualized rate over the last decade in a relatively low risk industry and with a very conservative balance sheet.

I frankly view Church and Dwight as the most well-run business in its category. This brings it to the only real issue I see: I previously owned the stock and made strong returns from it, but ended up selling when the valuation rose out of my reasonable zone. I do think this is a company to take note of on dips, but at a P/E of 23 I don’t view the current expected returns as optimal.

Another thing worth noting, although I wouldn’t recommend investing for this reason, is that with a market cap of under $8 billion and with much larger competitors, I wouldn’t be entirely surprised if the company were acquired at some point, which generally goes well for shareholders. This isn’t particularly probable, but for companies of this size it certainly is possible.

For more information on the company, see the Church and Dwight Analysis.

Darden Restaurants (DRI)

Darden Restaurants operates chains such as Olive Garden, Red Lobster, Longhorn Steakhouse, and others. While the weak economy may have presented headwinds, Darden has been consistently increasing both the EPS and the dividend over the last several years.

With a dividend yield of over 3.8%, consistent dividend growth over the last several years, and a P/E ratio of under 15, Darden is a company worth looking into. The company does have some leverage, and I view the balance sheet strength as moderate. This leverage combined with the highly competitive nature of the restaurant industry leads me to conclude that a modest P/E of under 15 is warranted in order to expect good risk-adjusted returns, so the current price appears to not be strikingly undervalued, but seemingly at a solid valuation.

One of the reasons for Darden’s consistent growth is their use of share repurchases during most years. They have considerably reduced the outstanding share count over the last decade.

Wal-Mart Stores (WMT)

Walmart is an enormous retailer, and they’ve used their scale to maintain a competitively priced large set of products, positioning their stores as the “go to” place for everyday shopping for a lot of people in the U.S. and elsewhere. They’re the largest grocer in the country, but also a large supplier of just about every sort of household item available.

While their Sam’s Club arm has not been as successful as rival Costco, the overall company has experienced strong performance over the last several decades, including the last several years.

Much like Darden, Walmart consistently buys back shares and reduces the share count, which is a key reason for smooth EPS growth. This is how Walmart has maintained EPS growth every year without missing a beat over the last decade and beyond. However, their core net income growth (which is unaffected by buybacks) is nearly as consistent, as they’ve only had a down year once in the last decade.

At a P/E of under 16, while Walmart is not at the top of my list, I’d be comfortable owning shares at these levels. I think the stock got a bit ahead of itself for a while, but over the last several months it has settled a bit.

For more info, see the full Walmart Stock Analysis.

Infosys (INFY)

Infosys has had consistent growth in EPS in the U.S. dollar, but in native currency there was a slight decrease in 2009. The company is headquartered in India, has over 150,000 employees, and provides outsourcing and various technology services to over 700 (mostly large) clients in countries around the world.

While many metrics show the company to have consistent growth, the share price was cut in half over the last two years and the dividend has not been consistent at all. Competitors like IBM have been strengthening their position in India, and personally in this industry I’d stick with IBM as an investment over Infosys. Still, Infosys does have an outstanding balance sheet, and Morningstar currently awards a 4-star rating to their stock.

Yum! Brands (YUM)

Yum Brands owns profitable restaurant chains including Taco Bell, Kentucky Fried Chicken, and Pizza Hut, and it has been an independent company since the late 1990’s after being spun off from Pepsico. It maintains a relationship with Pepsico and offers their drinks and snacks at most locations.

While the company is not as large as McDonald’s and the profitability margins are not as high, the company is nonetheless quite successful and has aggressively expanded into China.

Over the last decade, company-wide net income growth has been extremely consistent. This combined with share repurchases which have reduced the number of shares outstanding has resulted in annualized EPS growth of over 13% over the last ten years.

While the debt/equity ratio is high, by all other metrics the balance sheet is rather strong, and the company pays a growing modest dividend. I’m not excited about the current P/E of over 20 and am therefore not buying at this time, but I’d nonetheless be rather satisfied holding stock in this company for the long term.

Full Disclosure: As of this writing, I am long MCD. IBM is on my watch list.

You can see my dividend portfolio here.

Strategic Dividend Newsletter:

Sign up for the free dividend and income investing newsletter to get market updates, attractively priced stock ideas, resources, investing tips, and exclusive investing strategies:

Matt,

Great stuff here.

I looked at DRI a while back when it was in the mid-$40’s. I passed because they have no international exposure, and apparently no plans to really rectify that. They are strictly North American. I view that as a significant downside. Any thoughts on this?

CHD is an incredible company, but like CL always seems to trade for a premium. It’s hard to account for that when the dips never really come.

I passed on YUM a while back due to the high debt/equity ratio and I regret that a bit. Strong brand names and they’re guns blazing in China.

Best wishes!

I’m not as directly familiar with the workings of Darden as I am with some of the others. I don’t view having 100% exposure to North America to be inherently bad for an individual holding as long as my portfolio as a whole has considerable exposure outside of the continent.

I bought CHD back in 2009, which presented an opportunity. Ironically, I even remember stating that it was a boring stock and that this is good for consistent returns, not a quick double. The funny part being that it did quickly go on to double in stock price within a few years, which I did not expect. I sold after a large gain because the valuation seemed overly generous.

Yum looks pretty solid. They’re high up on my list to do a stock analysis on.

Matt

CHD has never been on my radar. Thank you for the breakdown, I will look to purchase on a market pull back.

One of the first things I look at when evaluating a potential company to invest in is the EPS trend and it’s consistency. Like you I would much prefer to invest in companies who have upward trending earnings and preferably it is smooth rather than erratic. Usually if it is too erratic I will move on because their are plenty of other great opportunities available. Glad to see one of my favorite companies, MCD, on your list!