Leggett and Platt (LEG) is a modestly sized manufacturing company that nonetheless offers investors a 3.64% yield and 41 years of consecutive annual dividend increases.

-Seven Year Revenue Growth Rate: N/A

-Seven Year EPS Growth Rate: 3.7%

-Seven Year Dividend Growth Rate: 8.8%

-Current Dividend Yield: 3.64%

-Balance Sheet Strength: Fairly Strong

Despite the run-up in stock price, I believe Leggett and Platt stock is reasonably valued. This 2013 bull market, however, has reduced the margin of safety for investing in practically all dividend stocks on the market.

Overview

Leggett and Platt (NYSE: LEG) is a designer and manufacturer of a large number of engineered components for home, business, and automobile use. The company was founded in Missouri in 1883. The company operates 130 manufacturing sites in 18 countries with 18,000 employees.

The company is divided into four segments, and each segment is divided into a number of business units.

Residential Furnishings Segment

This segment contributes the biggest chunk of Leggett and Platt sales. It was Leggett and Platt’s original business, and is among their largest and strongest of areas. It consists of mattress springs, bed frames, ornamental beds, seat holdings, the various hardware mechanisms in furniture such as the system that allows for a recliner to recline, and other furnishings.

Commercial Fixturing and Components Segment

This segment produces shelving and display units for a very large number of retailers, and also produces office furniture components.

Industrial Materials

The industrial materials segment produces external sales but also provides materials for the other segments of the company. With hundreds of thousands of tons of steel wire produced annually, this segment is the largest producer of drawn steel wire in the country. The segment also produces steel tubes, and erosion-control products.

Specialized Products

The specialized products segment produces automotive systems (lumbar supports, control cables, seat suspension, and motor/actuation assemblies), machinery for sewing and wire shaping, and commercial vehicle products (van interior rack systems, trailers, and docking stations), and specialized tubes for aerospace applications.

Ratios

Price to Earnings: 19

Price to Free Cash Flow: 12

Price to Book: 3.2

Return on Equity: 18%

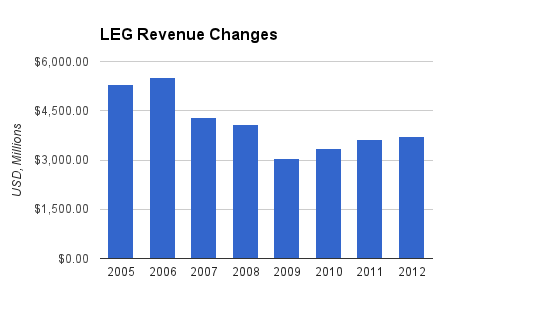

Revenue

(Chart Source: DividendMonk.com)

It’s important to know the history behind this revenue chart. For years, the company was having stagnant performance, and a new CEO came in and began divesting under-performing business units, significantly increased the dividend, began more aggressive share buybacks, and focused on this streamlined model of balanced shareholder returns. This occurred before the large recession.

The combination of these divestitures and the recession result in what appears to be a terrible revenue chart, even though total shareholder returns were substantial over this period. What’s most useful in this chart is looking at their 2009-2012 revenue performance, because during that period divestitures were not a significant part of the equation.

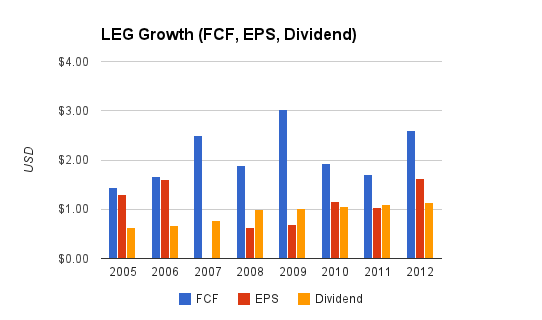

Earnings and Dividends

(Chart Source: DividendMonk.com)

Earnings went through a volatile period during the divestitures and recession. In some cases, the dividend was larger than earnings, which should be a red flag for dividend growth investors.

However, as a manufacturer, Leggett and Platt reports well over $100 million in depreciation each year, which reduces their earnings (and therefore their taxes), but leaves ample free cash flow. As can be seen on the chart, free cash flow (FCF) was solid every year, and covered the dividend every year.

The dividend currently yields 3.64% with an 8.8% seven-year dividend growth rate and a 41-year consecutive streak of annual dividend increases. Over the last four years, however, the dividend growth rate has only been around 3.3% on average because the company is looking to reduce their payout ratio. (Their issue was that they raised the dividend substantially right before being struck by the enormous recession). Currently, the payout ratio is approximately 70% of earnings and under 50% of free cash flow.

Approximate historical dividend yield at beginning of each year:

| Year | Yield |

|---|---|

| Current | 3.64% |

| 2012 | 4.4% |

| 2011 | 4.7% |

| 2010 | 4.9% |

| 2009 | 6.3% |

| 2008 | 5.8% |

| 2007 | 2.9% |

| 2006 | 2.7% |

| 2005 | 2.2% |

As can be seen by the table, the yield was modest during the middle of the last decade when stock valuations were high. Management then boosted the dividend, and the stock price fell during the recession, which resulted in a high dividend yield. The dividend yield remained fairly robust until the 2013 bull market increased the stock price of Leggett and Platt and most other stocks considerably.

How Does Leggett and Platt Spend Its Cash?

During the fiscal years 2010, 2011, and 2012, LEG brought in approximately $930 million in free cash flow. Over the same period, they spent over $500 million on dividends, over $300 million on net share repurchases, and approximately $200 million on the Western Pneumatic acquisition of 2012.

After business expenses, the company’s main priority is maintaining and increasing its 41 year streak of consecutive annual dividend increases. In 2010 and 2011 (as well as prior years), leftover cash was used for substantial share buybacks to reduce the share count, and in 2012 the buybacks were halted in order to make an acquisition. There are around 146 million shares currently compared to 187 million five years ago.

Balance Sheet

Total debt/equity is a bit over 70%. The interest coverage ratio is very comfortable, at nearly 8x. Over 70% of existing shareholder equity does consist of goodwill, however.

Overall, for a manufacturing business Leggett and Platt’s balance sheet is robust. Operating income covers debt interest several times over and goodwill is not excessive.

Investment Thesis

When one looks at the numbers over the last ten years, and sees lack of revenue growth, lack of EPS growth, and strong dividend growth but a high dividend payout ratio from earnings, many investors would understandably move on. Afterall, one does not want a declining business, and experienced dividend growth investors know better than to chase yield.

However, Leggett and Platt has transformed itself over the last five years, and now I believe the company will be a better-positioned business for shareholders. The revenue and income declines were due to divestitures, and now that they’ve been done for over a year, I’m interested in the company’s future.

The Transformation

Up until 2006, the company was doing ok, but could be said to be stagnating a bit. Their business model focused mostly on growth. The company wasn’t under serious pressure since they were still profitable, but their model of capital allocation wasn’t optimal anymore. The company had performed very well for so long, with decades of consecutive dividend growth (and only 8 CEOs between 1883 and 2006), but was temporarily under-performing.

In 2006, a new CEO, David Haffner, was appointed. In 2007, he announced a new strategy, which consisted of the following:

1. Divest low-performing business units, or units that do not align with LEG’s core strengths.

2. Return more cash to shareholders.

3. Improve margins and returns.

4. Grow the company at 4-5% annually.

And this is what he has done. He substantially boosted the dividend yield, started reducing the number of shares, and has divested some of the under-performing business units and seeks to acquire higher-margin businesses.

Before Haffner, Leggett and Platt was holding a collection of business units, allocating them capital, and expecting them to grow. Haffner, however, sold off numerous business units that were either under-performing, low-margin, or where Leggett and Platt simply didn’t have any competitive advantage (examples include coated fabrics, fibers, wood products, plastics, foam products, and certain other things). The remaining 20 business units are now managed much more intentionally: each business unit in the portfolio of business units is labeled as “Grow”, “Core”, “Fix”, or “Divest”. (Previously, they were all just “Grow”.) Growth business units are allocated capital and expected to grow. Core business units are healthy and profitable businesses where Leggett and Platt has economic advantages, but with less growth potential, where the company will withdraw large amounts of free cash flow and not need to invest much capital to maintain or modestly grow the unit. Most of the businesses are Core. Fix and Divest business units are self-explanatory; they’re business units that the company is looking to repair, or business units that they are actively marketing for sale to another company.

Overall, this is a much more intentional and streamlined Leggett and Platt. This process helps ensure optimal use of capital.

Leggett and Platt management states that their goal is to provide returns that fall within the top third of the S&P 500 companies.

They plan to do this through:

4-5% annual sales growth

3-4% dividend yield

2% improved margins

3-4% stock buybacks

Which is a total annualized target of 12-15%, but doesn’t take into account changes in stock valuation (since management has no control over that).

Now, whether they’ll reach those precise numbers or not is yet to be seen, but I love that split of areas of growth. The current CEO is an executive that dividend growth investors should love. And these targets provide a decent margin of safety, since even a rate of return that falls under 12% is very acceptable. Unfortunately, the margin of safety may come into play with stocks in general at unattractively high valuations currently.

Western Pneumatic Tube Acquisition

Leggett and Platt has a very specific list of things they are looking for in acquisitions. In summary, they want businesses that fit into their existing strengths, that have competitive advantages from patents, or processes, or differentiation, or special skills, and that meet certain quantitative criteria.

That being said, in 2012 they made their first major acquisition since 2007. They acquired Western Pneumatic Tube for $188 million in January. This company brings in about $60 million in revenue, and makes specialty titanium and nickel tubes for the aerospace industry. Leggett and Platt listed numerous reasons for the acquisition, including:

-The company has higher margins than is the average for Leggett and Platt business units, so it will have a positive impact on margins.

-The company produces specialized (non-commodity) products, and there are high barriers of entry due to the certification process that’s needed for such mission-critical systems in the aerospace industry.

-It fits directly into one of Leggett and Platt’s core competency areas of metal tubing, and the quality and timeliness requirements are facilitated by Leggett and Platt’s large scale and logistics competencies.

-Systems in this industry have very long produce lifecycles; suppliers generally are not switched out very often.

The key risks are a) exposure to cyclical aircraft industry and b) customer concentration.

The company has other growth areas for the specialized tubes as well, ranging from solar energy to chemical processing.

Economic Moat

I view Leggett and Platt, as well as numerous other businesses in its peer group including Dover Corporation (DOV), Emerson Electric (EMR), and Illinois Tool Works (ITW), as having a decent, if not huge, economic moat.

First, after the strategic divestitures, Leggett and Platt is the largest producer in most of its areas of operation, despite only having a market capitalization of a bit over $3 billion. They sold off business units that were distractions for them to focus on their core competencies. Their competitors are generally small and not publicly traded. Plus, the company is rather vertically integrated, meaning that as previously mentioned, their own industrial materials segment provides for most of their steel material needs. So their whole process is difficult to replicate by a competitor.

Second, the company has a substantial patent shield, with 1,100+ issued patents and another 400+ patents in process.

So between scale and patents, they have considerable economic advantages. They look for similar attributes in acquisition targets.

Risks

Leggett and Platt is a substantial manufacturing business that relies on macroeconomic strength to perform well. Practically all of its sales are to other businesses, which means that during times of economic contraction, businesses may cut costs, reduce inventory, and halt orders, which can mean erratic earnings changes for Leggett and Platt. Consumer companies often have smoother earnings changes than this.

Their business is concentrated towards the United States, which ties their performance to this country’s economy.

A large portion of Leggett and Platt’s sales are for wire frame mattresses. Newer mattress types that do not use as much wire can be considered competition for LEG, but they tend to be more expensive and have a small market share currently.

Conclusion and Valuation

I last analyzed Leggett and Platt slightly over a year ago when the stock price was in the low $20’s. The detailed stock report strongly pointed out that although quantitative information like the revenue reductions and the high dividend payout ratio seem problematic at first glance, the deeper quantitative and more importantly the qualitative information as to why those numbers were like that fully explained those “issues”. Rather than a business on the decline, it was a business rebounding from a smart transformation.

Fortunately or unfortunately, the stock is around $10 higher today at nearly $32, which when combined with the dividend was nearly a 50% rate of return over this past year. For investors that enjoy buying low and selling high, it’s an excellent return on investment. For investors that would prefer to continue accumulating underpriced or fairly priced shares of dividend growth stocks, this magnitude of an increase is disappointing.

Based on the Dividend Discount Model, Leggett and Platt would have to boost its dividend growth rate to 6% or 6.5% per year in order to justify the current stock price of a bit under $32, assuming a 10% discount rate. If the stability of the business is considered and a 9% discount rate is allowed, then the required dividend growth rate falls to under 5.5%.

Currently, Leggett and Platt is increasing its quarterly dividend by a penny a year, or around 3.3% per year on average over the last few years. This is likely temporary, because the company is relieving some pressure from its payout ratio. In addition, last year the company made an acquisition which means they spent a lot less on share buybacks, and share buybacks directly fuel dividend growth by reducing the share count. Over time, I do believe that the dividend growth rate will get up to 6% or higher, because the free cash flow yield tends to be higher than 6% and the company tends to use all of its free cash flow for dividends, buybacks, and occasional acquisitions.

So, I view the stock as reasonably valued currently. In this market, after the early 2013 bull market, there aren’t a lot of values in the dividend space, and for stocks that are reasonably valued, the margins of safety are small or nonexistent.

Full Disclosure: As of this writing, I am long LEG.

You can see my dividend portfolio here.

Strategic Dividend Newsletter:

Sign up for the free dividend and income investing newsletter to get market updates, attractively priced stock ideas, resources, investing tips, and exclusive investing strategies:

I like the company in principle, but the dividend growth is slow and the payout ratio is high. That, coupled with the current low entry yield (low for the risks) means that I’ll be avoiding LEG for a while.