Kinder Morgan Energy Partners LP (NYSE: KMP) is one of the largest Master Limited Partnerships with a strong history of distribution growth and outperforming the market.

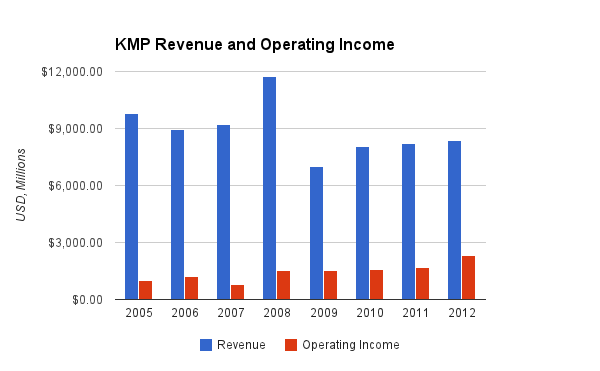

-Seven Year Revenue Growth Rate: Negative

-Seven Year Income Growth Rate: 12.4%

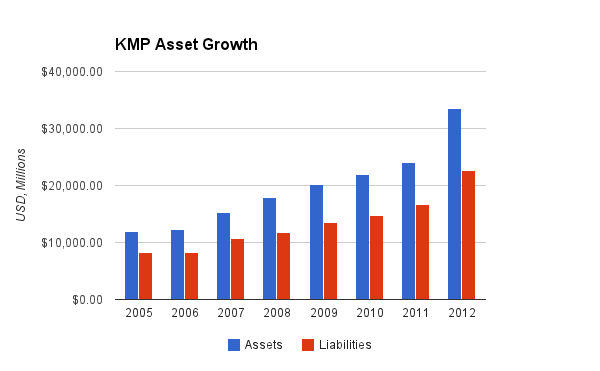

-Seven Year Asset Growth Rate: 15.9%

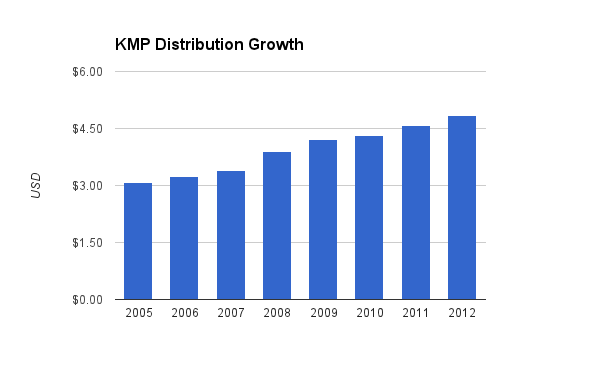

-Seven Year Distribution Growth Rate: 6.7%

-Current Distribution Yield: 6.32%

-Balance Sheet Strength: Leveraged, Stable

Based on the high distribution yield, moderate distribution growth, a strong and growing diversified asset base, I view KMP as a well-run Master Limited Partnership to purchase at the current price of around $80/unit.

Overview

Since the mid-1990’s, when under the operation of Richard Kinder, Kinder Morgan Energy Partners has grown to become one of the largest MLPs, and has produced annualized returns of over 25%.

The partnership owns interest in or operates 75,000 miles of pipelines and 180 terminals, making it one of the largest energy business, and the largest midstream business, in the United States.

The partnership has a variety of business segments:

Natural Gas Pipelines- buying, selling, transporting, storing, gathering, and processing natural gas

Segment earnings: 38%

CO2- transporting and selling CO2

Segment earnings: 27%

Terminals- transloading, storing, and delivering bulk (including steel and coal), petroleum, and chemical products

Segment earnings: 16%

Product Pipelines- transporting, storing, and processing refined petroleum products

Segment earnings: 15%

Kinder Morgan Canada- petroleum pipelines

Segment earnings: 4%

Revenue and Assets

(Chart Source: DividendMonk.com)

KMR has had volatile revenue in part due to buying and selling commodities.

(Chart Source: DividendMonk.com)

The partnership has maintained steady asset growth with consistent use of leverage.

Distribution Growth

(Chart Source: DividendMonk.com)

KMP has grown the distribution by an average of 6.7% per year over the past seven years.

A distribution yield of over 6% combined with distribution growth of over 6% can result in 12% or more annualized returns for as long as that growth continues. The distribution gets paid from incoming cash flows, as well as the continued issuance of new units to fund capital expenditures and investments.

Approximate historical distribution yield at beginning of each year:

| Year | Yield |

|---|---|

| Current | 6.35% |

| 2012 | 5.6% |

| 2011 | 6.3% |

| 2010 | 6.6% |

| 2009 | 8.6% |

| 2008 | 6.5% |

| 2007 | 6.8% |

| 2006 | 6.3% |

| 2005 | 6.5% |

As can be seen, Kinder Morgan has traded in a fairly tight valuation range compared to its distribution payouts. With exceptions for the stock dip in the beginning of 2009 near the market bottom and the early 2012 market rise, the units have traded at a price that results in a yield of around 6.5%.

Balance Sheet

Like all Master Limited Partnership, Kinder Morgan makes a large use of debt. The partnership carries approximately $17 billion in debt currently.

The interest coverage ratio is under 4x, which shows the degree of leverage that the partnership uses. Well-run partnerships can achieve above-average investment returns due to their tax-advantaged structure. Unlike many corporations that repurchase their shares, MLPs (and especially their general partners) benefit when they continually issue more units. By issuing units, they can raise capital to invest in robust long-lived assets such as pipelines that produce reliable cash flows, and they can issue debt on those assets due to their steady nature.

Investment Thesis

Kinder Morgan is essentially a large toll operator. By owning pipelines, terminals, and storage areas, they move various forms of energy around the country. In most of their business operations, they’re the largest in their industry in the United States. This includes being the larges transporter of natural gas, the largest independent transporter of petroleum products, the largest transporter of CO2, and the largest terminal operator. Their asset base is spread across most of the United States and into Canada, giving them access to most of the major shale plays.

Management identifies approximately $11 billion in capital investment opportunities for growth over the next 5 years. The largest area of investment is expected to be their Canadian segment, followed by their natural gas segment and CO2 segment. Their products and terminals segments are the smaller areas of expected capital investment. In addition, acquisitions can be made by the partnership or dropped down from KMI as part of their overall growth strategy.

In terms of controlling costs and producing growth, management has had strong performance. Richard Kinder owns approximately one quarter of Kinder Morgan Inc. (KMI), which is the general partner of KMP (Kinder Morgan Energy Partners) and EPB (El Paso Pipeline Partners), and represents billions of dollars of capital that aligns his interests with the interests of the unitholders of KMI.

Out of the past decade, when Kinder Morgan budgets an annual expected distribution payout, they’ve met that expectation every year except once, when they were $0.02 shy of the target. The 2013 distribution target for KMP is $5.28 per unit.

Risks

Master Limited Partnerships carry quite a bit of leverage. Low interest rates are useful for the business, whereas high interest rates can make capital more costly to acquire. More specifically, according to management’s December 2012 Wells Fargo presentation, for every 1% increase in floating interest rates, it costs KMP $55 million in additional annual interest expense. Damaging events or business downturns can result in failure to meet interest payments, which would affect the distribution to unitholders and the value of the business. It’s notable that the partnership was able to continue increasing the distribution through the 2007-2009 financial crisis.

Kinder Morgan has to pay high Incentive Distribution Rights (IDRs) to Kinder Morgan Inc. (KMI). As the general partner of KMP, KMI is entitled to a growing share of the total cash. Since the partnership has been active for a long time and has far surpassed its top IDR tier, it is paying a hefty percentage of its available cash to KMI. In 2011, this figure was 44% for the IDRs, plush distributions to the limited partnership units that KMI holds. The IDR payments approach but will not exceed 50%.

Some MLPs, when they get to this stage, are unable to continue raising the distribution. For example, ETP has been unable to grow its distribution for four and a half years, as it’s a large partnership and the cost of capital is too high. Its GP, ETE, has had to temporarily waive IDR rights on drop down assets in order to make acquisitions work out for ETP. Other large partnerships have bought out their GP so that they are no longer burdened by the IDRs.

The problem lies in the fact that the partnership has to continue issuing units to grow. It issues units to fund new investments, but in order to continue growing the distribution for the growing number of unitholders, each infusion of new capital has to provide sufficient returns to lift all distribution payments. If IDRs reach a critical point where they take too big of a chunk out of the available cash to keep issuing units to grow the partnership, then distribution growth can quickly run into a wall. Many MLPs hit that point before the 44% mark that Kinder Morgan is currently at. Strong management and capital allocation have allowed the partnership to grow the distribution for a longer period than peers, but it’s always a risk that in the future, IDRs will prove too much for distribution growth to occur at this rate.

Conclusion and Valuation

Using the Gordon Growth Model, if KMP can continue raising the distribution by 6% annually, and a 12% discount rate (the target rate of return) is used, then the intrinsic value of the units is up to $85. If the forward-looking distribution growth is estimated at 5% instead, then the intrinsic value drops substantially to $72, unless the discount rate is adjusted down to 11%, which brings the intrinsic value up to $85 again.

Overall, to justify the current price of around $80/unit, only 4% long-term distribution growth is required for low double digit returns, which I believe provides a sufficient margin of safety as part of a diversified portfolio.

Full Disclosure: As of this writing, I am long KMI. I have no direct position in KMP or EPB, but have an indirect position in them through KMI.

You can see my dividend portfolio here.

Strategic Dividend Newsletter:

Sign up for the free dividend and income investing newsletter to get market updates, attractively priced stock ideas, resources, investing tips, and exclusive investing strategies:

Like you I have no direct ownership of the partners but own the GP KMI. I think siding with Richard Kinder is going to be a great move! Thanks for the analysis on Kinder Morgan group of investments. This was something that I needed to learn more about.

Thanks for the comment.

In most cases, I’d rather own the GP for a publicly traded partnership rather than the limited partner.

So I pick KMI over KMP, and ETE over ETP. An exception is that I own BIP rather than BAM, but that was because BAM is not a pure play or even mostly focused on BIP, and I liked BIP for the specific assets they had/have.

(In hindsight that sentence reads like a description of a boxing match or something with all the tickers. BIP BAM BOOM.)

Any thoughts on KMI vs OKE?

The natural gas pipelines alone are very valuable in the coming decade. I believe and agree that America will be the new “Saudi Arabia” of energy.

Yeah I’m pretty bullish on natural gas as well. KMI has more natural gas pipeline exposure as a percentage of its total pie chart than KMP, due to its holding of EPB in addition to KMP.

I wish you are right. Hopefully our politicians won’t mess it too much. Our president is not much supporting America and IMHO he will do all it takes to prevent America becoming a new Saudi.

Very nice analysis of KMP.

I’m pretty bullish on energy and have been considering a position in KMP or KMI for a while. The nice thing about a toll bridge is that it doesn’t matter how cheap natural gas or oil extraction gets. It still has to be moved around in order to be used.

PS: You forgot to mention KMR, kind of the red headed step child of the KM family.

This article is specifically about KMP for the most part; not meant to be an overview of the whole structure. I’ve got an article on KMI coming up.

One thing to note about KMR is that insiders prefer it to KMP; they buy it in much larger quantities overall.

I think insiders prefer KMR because it has consistently traded at a discount to KMP. Also, you receive distributions in the form of “free shares”, and thus have no tax implications. They are also great to hold in ROTH IRA’s.

I own both KMI and KMR, and am happy for both.

Btw, that was a very good analysis. Keep them coming Matt!!

The data on the buying and selling of KMP/KMR sounds like it would make for a great study on the aspects or limitations of market efficiency.

Hola! I’ve been following your web site for some time now and finally got the courage to go ahead and give you a shout out from Lubbock Tx! Just wanted to mention keep up the great job!