Johnson and Johnson is an extremely diverse pharmaceutical, medical device, and consumer products company that is approaching its 50th consecutive annual dividend increases.

-Seven Year Revenue Growth Rate: 4.6%

-Seven Year EPS Growth Rate: 2.9%

-Seven Year Dividend Growth Rate: 10.7%

-Current Dividend Yield: 3.56%

-Balance Sheet Strength: Very Strong

The company has had a string of problems that have resulted in underperformance, but the company does appear to be in a solid position going forward, with a reasonable valuation at under $70/share.

Overview

Johnson and Johnson (NYSE: JNJ) is a diverse global health care company with more than half of their revenue coming from outside the United States. Founded in 1886, the company has paid increasing dividends for 49 consecutive years and is therefore firmly among the dividend aristocrats. JNJ is further broken down into three main business segments. Each of the three segments are among the largest worldwide entities in their respective fields.

Consumer Segment

Johnson and Johnson’s Consumer Segment sells a variety of name brand products including Listerine, Dabao (China), Neutrogena, Band-Aid, Tylenol, Carefree, Splenda, and of course Johnson’s Baby Care. This segment was hit very hard in 2010 due to a string of serious recalls, and the result was that sales of this segment decreased 7.7% over the year. Ongoing production halts are still impacting sales from this segment.

| Aspect | Sales |

|---|---|

| Over the Counter | $4.4 billion |

| Skin Care | $3.7 billion |

| Baby Care | $2.4 billion |

| Women’s Health | $1.8 billion |

| Oral Care | $1.6 billion |

| Wound Care/Other | $1.0 billion |

Total Segment Sales: $14.9 billion

Pharmaceutical Segment

JNJ’s Pharmaceutical segment consists of a diverse and strong set of drugs.

| Drug | Sales |

|---|---|

| Remicade | $5.5 billion |

| Procrit/Eprex | $1.6 billion |

| Risperdal/Consta | $1.6 billion |

| Concerta | $1.3 billion |

| Velcade | $1.3 billion |

| Prezista | $1.2 billion |

| Aciphex/Pariet | $1.0 billion |

| Levaquin/Floxin | $0.6 billion |

| Other | $10.3 billion |

Total Segment Sales: $24.4 billion

Medical Devices and Diagnostics Segment

JNJ’s device and diagnostic segment has experienced fair growth, and houses Acuvue contact lenses, as well as diabetes care, endo-surgery products, and more.

| Aspect | Sales |

|---|---|

| DePuy | $5.8 billion |

| Ethicon Endo-Surgery | $5.1 billion |

| Ethicon | $4.9 billion |

| Vision Care | $2.9 billion |

| Diabetes Care | $2.6 billion |

| Cardiovascular Care | $2.3 billion |

| Ortho-Clinical Diag. | $2.2 billion |

Total Segment Sales: $25.8 billion

Ratios

Price to Earnings: 21.8

Price to Free Cash Flow: 16.7

Price to Book: 3.1

Return on Equity: 14%

In addition, Johnson and Johnson’s Synthes acquisition, which was valued at approximately $20 billion, will be integrated with DePuy.

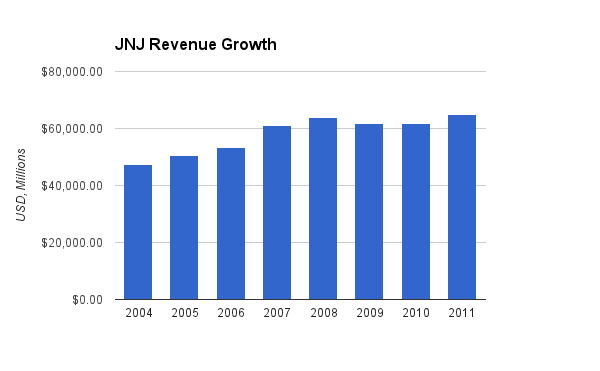

Revenue

(Chart Source: DividendMonk.com)

Johnson and Johnson grew revenue by an average 4.6% annual rate over the last 7 year period. The recession combined with internal quality control problems and some patent expirations resulted in several years of lackluster sales performance. Drugs such as Concerta, Levaquin, and Risperdal, have seen large sales decreases. Doxil had unplanned manufacturing problems that have resulted in a loss of sales.

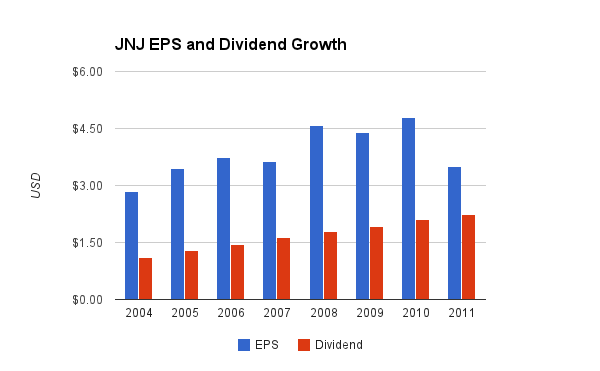

Earnings and Dividends

(Chart Source: DividendMonk.com)

Over the same period, EPS grew by less than 3%, and the trailing twelve month figure is even lower than the 2011 figure. However, rather than a fundamental reduction in profitability, this reduction was due to the consequences of litigation and other temporary and significant internal quality control problems and a few patent expirations.

The dividend, on the other hand, continued to grow at a brisk pace of 10.7% over this period. The most recent increase, in early 2012, was 7%. The payout ratio over the trailing twelve months is nearly 75%, but much of this is due to temporary impacts on EPS figures.

Approximate historical dividend yield at beginning of each year:

| Year | Yield |

|---|---|

| Current | 3.56% |

| 2012 | 3.5% |

| 2011 | 3.5% |

| 2010 | 3.0% |

| 2009 | 3.0% |

| 2008 | 2.5% |

| 2007 | 2.2% |

| 2006 | 2.1% |

| 2005 | 1.8% |

| 2004 | 1.9% |

The yield for Johnson and Johnson is currently at a fairly high point. It’s worth noting that the payout ratio doubled over this period, and it’s also worth noting that excluding for temporary EPS effects, the payout ratio only had a mild increase.

Balance Sheet

Total debt/equity is only around 30%, and one third of equity consists of goodwill. Total debt/income is approximately 2x, and the interest coverage ratio is over 25. Overall, JNJ’s perfect AAA credit rating is well deserved based on these important debt ratios, and the company has a stronger balance sheet than most businesses I cover.

Investment Thesis

Johnson and Johnson has had a difficult period. In particular, quality control issues regarding over the counter drugs and hip recalls (!) have resulted in sales decreases and litigation expense. The acquisition of Synthes has meant restructuring charges.

A few patent losses have negatively impacted sales and earnings as well, but the key reason to invest in JNJ has always been their diversification. Rather than being a pure pharma investment, it’s a pharma, medical devices, and consumer health business. The medical device segment has performed well, with an exception of the continued poor sales performance of the cardiovascular segment. The consumer products segment has had major quality control issues which resulted in halts to production. Their production ability for several over the counter drugs is said to be impacted through 2012 and into 2013.

So even with the diversification, they have had multi-year issues due to certain problems in all three main areas of their business. Patent expirations are normal, but large recalls of this nature are not. The previous CEO has retired and the new CEO, Alex Gorsky, has a priority of fixing the OTC production problems and continuing to strengthen the overall business.

His remarks in the Q2 earnings call discuss the current state of the pipeline:

Our core products such as REMICADE and PREZISTA continue to be drivers of growth. Meanwhile, with successful launch results for products like ZYTIGA, INCIVO, XARELTO, STELARA, SIMPONI, INVEGA, SUSTENNA, Johnson & Johnson led the U.S. and Europe in new pharmaceutical products sales in 2011 according to IMS and we see continued momentum this year. Also over the past several months we made additional progress for the number of important filings; U.S. and EU filings for canagliflozin for type-2 diabetes; ZYTIGA for chemo naïve indication for prostate cancer in the U.S. and EU; XARELTO for VTE treatment in the U.S.; TMC 207 for multi-drug resistant TB in the U.S.

While this has not been a good period for JNJ, and investment in company stock over the last few years has been disappointing, a change of CEO positions and a reasonable drug pipeline allow for improvement.

Risks

The company’s recent problems showcase risk. Quality control issues with OTC drugs have resulted in long-term sales decreases from certain products, and possibly some brand damage. Recalls on artificial hips have meant litigation problems (speaking from a purely financial perspective), and while JNJ’s drug pipeline is robust, all pharma companies face the ongoing challenge of replacing expiring drugs with new drugs either through internal R&D or through acquisitions.

There are also risks from currency changes, political/macroeconomic risks associated with the huge medical costs that U.S. citizens pay for, and integration risks for Synthes and other acquisitions.

Conclusion and Valuation

Overall, JNJ has not been a particularly impressive investment over the last several years. I do think that, going forward, there is a base to rebound from, and that with a new direction from management and with problems now apparently in the resolution phase, JNJ remains a solid dividend investment. The strong balance sheet and solid diversification have acted as large sources of stability for the company.

Based on the current dividend growth rate of 7% coupled with a discount rate of 10%, the fair value is a bit over $84 according to the Gordon Growth Model. Using a more conservative 6% growth rate would bring the fair value down to a bit over $62.

Based on these values, along with a promising pipeline, new CEO, strong balance sheet, large and diverse operations, a 3.56% yield and 49 years of consecutive dividend growth, I’m cautiously optimistic about an investment in JNJ at the current price of a bit over $68.

Full Disclosure: As of this writing, I am long JNJ.

You can see my dividend portfolio here.

Strategic Dividend Newsletter:

Sign up for the free dividend and income investing newsletter to get market updates, attractively priced stock ideas, resources, investing tips, and exclusive investing strategies:

It seems to me if you’re cautiously optimistic here you’d have to have been more optimistic at pretty much any point in the past 3 years when the company was available cheaper.

Yes, throughout the last few years in JNJ reports I’ve stated that the company appears to be at a decent value.

Excellent analysis. I love this site. I like JNJ for the long-haul. I plan to own my shares for the next 30+ years.

I wouldn’t be buying a ton of shares at $68, but I am comfortable letting it DRIP in my account every quarter.

Mark

Thx for the analysis Matt. I’m glad you pointed out JNJ’s diversification as one of reasons to invest in the company. The combination of pharma, consumer and med devices makes for a strong business model and provides a compelling investment thesis.

I think it’s instructive to contrast it with the way in which Abbott choose to deliberately destroy this model by splitting into two separate companies. Although this effort to “unlock shareowner value” was beneficial for stock traders, I think it undermined income investors’ thesis behind owning the stock.

For that reason, I recently sold my position in ABT to purchase other dividend paying stocks while JNJ remains one of the core positions in my portfolio.

Wow, great review! I’m in Canada and haven’t invested in any US companies yet (I’ve only been do-it-yourself investing for less than 2 years) but JNJ has been on my watch list for a while. I’m still waiting for the right entry point, but your analysis helps a lot. Thanks. :)

I was able to get into JNJ after the 2008/2009 crash at a really good price. I haven’t been 100% satisfied with its performance either. However, I will say that I am extremely optimistic with their 5/10 year outlook. As the baby boomer generation moves into retirement I believe all pharmaceutical will start raking in record profits.

Is there any concern that Warren Buffett has sold off a portion of his JNJ holdings?