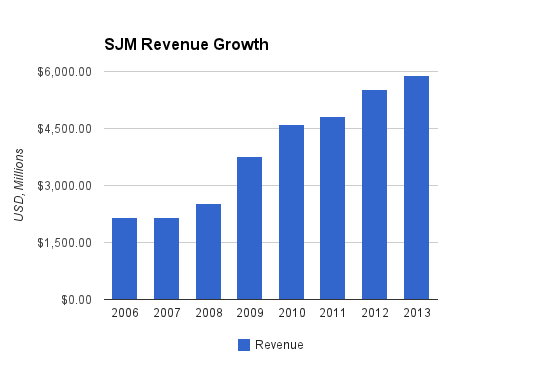

-Seven Year Average Revenue Growth Rate: 15.4%

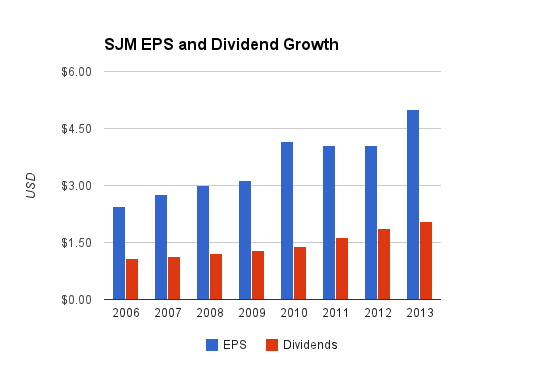

-Seven Year Average EPS Growth Rate: 10.7%

-Seven Year Average Dividend Growth Rate: 9.5%

-Current Dividend Yield: 2.29%

-Balance Sheet Strength: Strong

For solid if not impressive risk-adjusted returns, J.M. Smucker seems well-positioned and fairly valued.

Overview

The J.M. Smucker Company (symbol: SJM) was founded in 1897, is headquartered in Ohio, and is still run by the Smuckers family.

The company produces jam, jelly, preserves, peanut butter, sandwich products, ice cream toppings, baking products, oil, juices, and coffee. The company draws its revenue mostly from North America, but has international ambitions as well. The company focuses primarily on having the #1 brand in any given category.

Coffee

For coffee brands, Smuckers has gone on a buying spree. They acquired the large Folgers brand of coffee from Procter and Gamble, and they also sell Dunkin Donuts coffee for retail markets. They now sell Millstone, Cafe Bustelo, and Pilon coffee, with the last two being popular among Hispanic demographics, statistically speaking.

K-Cups are becoming more popular, and Smuckers has offerings in this area, including from their Folgers Gourmet Selections brand. Smuckers does face strong coffee competition from several brands, with Starbucks and Green Mountain Coffee Roasters being the two most worth mentioning.

Coffee contributes 39% of SJM sales.

U.S. Retail Consumer Foods

The company’s original flagship product is their line of Smuckers fruit spreads: jams, jellies, and preserves. They were smart to acquire the Jif peanut butter brand as well, and they also control or license other brands like Crisco, Pillsbury, and Hungry Jack.

This segment contributes 38% of SJM sales.

International, Foodservice, and “Natural” Foods

Some of the company’s largest brands compete internationally, and they also have brands dedicated to certain markets, like Canada. For “natural foods” in this category, they have Santa Cruz Organic and R.W. Krudsen Family. In fiscal year 2012, the company invested in Seamild, a leading provider of oats products throughout China.

This segment contributes the remaining 23% of sales.

Valuation Metrics

Price to Earnings: 19

Price to Free Cash Flow: 22

Price to Book: 2.1

Revenue

(Chart Source: DividendMonk.com)

The revenue growth rate is high at 15.4% per year averaged over the past 7 years. This is because the company issued new shares for capital to make acquisitions up until 2010.

Earnings and Dividends

(Chart Source: DividendMonk.com)

Over the same 7 year period, EPS growth was 10.7% per year while dividend growth was close behind at 9.5% per year. The most recent dividend increase was 11.5%.

The current dividend payout ratio from earnings is about 40%, so the dividend is well-covered and has room to grow.

Approximate historical dividend yield at beginning of each year:

| Year | Yield |

|---|---|

| Current | 2.3% |

| 2013 | 2.3% |

| 2012 | 2.5% |

| 2011 | 2.6% |

| 2010 | 2.3% |

| 2009 | 2.9% |

| 2008 | 2.4% |

| 2007 | 2.3% |

| 2006 | 2.3% |

As can be seen by the chart, except for certain points of volatility, Smuckers stock has maintained a fairly consistent mediocre dividend yield. The price of the stock has risen at almost exactly the same rate as the dividend growth.

How Does SJM Spend Its Cash?

Over the past three years combined, Smuckers brought in about $1,300 million in reported free cash flow. About half of that, or $630 million, was spent on dividends. Over $1 billion was spent to buy back stock, and the outstanding share count has decreased by nearly 8% cumulatively over the past three years. Approximately $730 million was spent on acquisitions.

Balance Sheet

Smuckers has a total debt/equity ratio of under 45%, although goodwill makes up about 60% of existing shareholder equity due to acquisitions. The total debt/income ratio is about 4x. The interest coverage ratio is just over 10x, indicating that Smuckers can easily pay all debt interest.

Overall, the balance sheet is in a strong position. Management has used leverage appropriately and conservatively.

Investment Thesis

Smuckers has substantially outperformed the market over the last 15 years due to a series of large successful acquisitions and good management of their capital. A diverse set of top brands gives the company a steady, defensive position while outperforming, and therefore the risk-adjusted returns have been particularly good.

Looking to the future, management aims for sales growth of 6% per year (organic growth of 3-4% and acquisition growth of 2-3%), and EPS growth of 8% driven primarily from that sales growth plus share buybacks. With the dividend, this would lead to total returns of 10-10.5% or so, which is higher than the S&P 500 historical average.

The internal strategic efforts appear to be a page out of Pepsico’s current playbook with their “Healthy for You”, “Good for You” and “Fun for You” levels of products representing the spectrum of how bad for you a given product is. Smuckers has “Good for You”, “Easy for You” and “Makes You Smile”.

Overall focus of the company includes concentrating on North America and China rather than expanding everywhere, focusing on health products such as ones with natural ingredients or special-diet options such as gluten free products, and continuing to look for bolt-on acquisitions to complement their previous transformational acquisitions.

Risks

Like any company, SJM has risks. Being a food company, they are a defensive stock, but they always face risk in two main forms: commodity costs and cheaper private label competition. In addition, in contrast to many large American companies, Smuckers has most of its sales and operations in North America, meaning it is geographically concentrated.

Packaged food is a competitive business, and Smuckers expects flat volume growth and a 1% sales reduction in 2014, but decent EPS and dividend growth.

Conclusion and Valuation

With the DJIA and S&P 500 continuing to hit new records, stocks at a decent valuation are difficult to find, and this is especially so for relatively stable blue-chips that you can buy and set aside for a while. In addition to increasing risk and reducing overall returns, this pushes dividend yields lower across the market, which reduces the amount of dividend income you can buy with any given amount of cash.

That being said, SJM neither appears to be a clear value or a clear overvaluation. While the markets soared upward throughout 2013, SJM actually fell over ten bucks from its mid-year high.

The earnings multiple approach should work well for valuating the company. If management is successful and raises EPS by 8% per year over the next 10 years, then the EPS figure will be $10.57 at that time. Putting an earnings multiple of 16 on that EPS figure in ten years (compared to an earnings multiple of 19 now) puts the stock price at about $169. If dividends continue to be paid with a payout ratio of 40%, that’ll be about $30 in cumulative dividends over those ten years, or about $42 if they are reinvested into the stock. So, $169 + $42 = $211 in value in ten years.

That’s an annualized rate of return of about 7.5% from the current price of $101, which is neither particularly appealing, nor particularly bad for a defensive company in a highly valued market, and assumes a significant drop in valuation. If instead the valuation remains constant at a P/E of about 19, the rate of return under the same conditions would be about 9% per year, which is in line with historical S&P 500 growth.

Excluding any major company missteps, it seems unlikely that investors would be disappointed having invested in Smuckers stock at the current price over the long-term, and so I view the company as a reasonable, if not appealing, buy. There is of course a large risk of near or mid-term stock price declines during a market correction.

Full Disclosure: As of this writing, I am long SJM.

You can see my dividend portfolio here.

Strategic Dividend Newsletter:

Sign up for the free dividend and income investing newsletter to get market updates, attractively priced stock ideas, resources, investing tips, and exclusive investing strategies:

I like the consumer staples for their reliable and steady nature. That’s why I picked up GIS last year. I like that SJM is focusing international growth in China first. That should be a good strategy instead of trying to expand everywhere at once. Looks like a blah stock right now because it’s not really at a great valuation. I’d look for better opportunities, but it wouldn’t be the worst place to invest if you want to put some money into the markets right now. Definitely one to keep in mind when the markets go a bit haywire, but I’ll hold off for now. Thanks for the analysis!

Matt,

Great to see you posting again, and doing what you do best. :)

Hope you had a great Christmas break.

Best wishes!

Matt,

I am also glad to see you have not abandoned the site. Keep up the good work!

Dividend Growth Investor

I think the overall market right now it overvalued. I definitely see the potential in JM Smucker but will wait on a pull back or market crash before picking up shares.

Welcome back Matt! I enjoyed reading your analysis on SJM.

In my opinion P/E is slightly high. Also the 5yr average dividend yield is 2.3% and the current yield is 2.3%, so this company is definitely not undervalued. Among other factors I look for companies where the current yield is higher than the average yield.

Hello Mr. Alden,

Was wondering when your next company analysis will be appearing. Miss reading new information on your excellent site. Thanks!

Hi Matt,

I am looking forward to your next article. You have been quiet for some time, is that because of highs the market is making?

-Mike

Thanks for the analysis and for putting SJM on my radar. Added it to my watchlist.

Monk where are you?

Amazing post. I loved your extensive and very well researched analysis. Keep up the great work.

BeSmartRich.

Any news about this site? Is Matt still working on it?

Hey man, thanks for bring this stock to our attention. I have to admit, I have only heard of this stock because I briefly lived in America, but I am back in my homeland of Britain right now. I always find it funny that brands which are so huge in the States are often completely unknown over here.

Cheers