International Business Machines is a large provider of IT systems, software, and hardware.

-Seven Year Revenue Growth Rate: 1.5%

-Seven Year EPS Growth Rate: 14.9%

-Seven Year Dividend Growth Rate: 22.5%

-Current Dividend Yield: 1.64%

-Balance Sheet Strength: Rather Strong

Based on the history of steady growth, clear long term company targets, strong balance sheet, and defensive global position, I view IBM as a reasonable value at the current price of under $210.

Overview

IBM is a 100-year-old technology company, focusing on providing business technology. The company breaks away from the concept that tech companies aren’t built to last, by reinventing itself with each generation. The company has revitalized itself over the last two decades by moving away from commodity hardware to focus on mainframes, software, and services.

Ratios

Price to Earnings: 15

Price to Free Cash Flow: 15

Price to Book: 11.5

Return on Equity: 75%

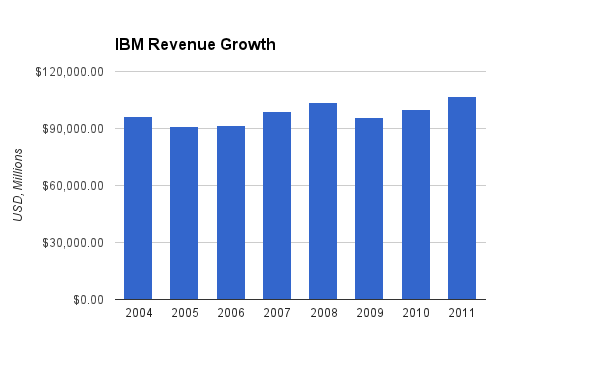

Revenue

(Chart Source: DividendMonk.com)

Revenue growth has been 1.5% per year on average over this seven year period. As the profitability growth shows, this isn’t due to flat performance, but is rather primarily due to the shift from hardware to software and services. Software and services typically have much higher profit margins than most hardware products, so by divesting hardware divisions and investing in a greater array of software and services, the company has strongly increased net income without providing much revenue growth.

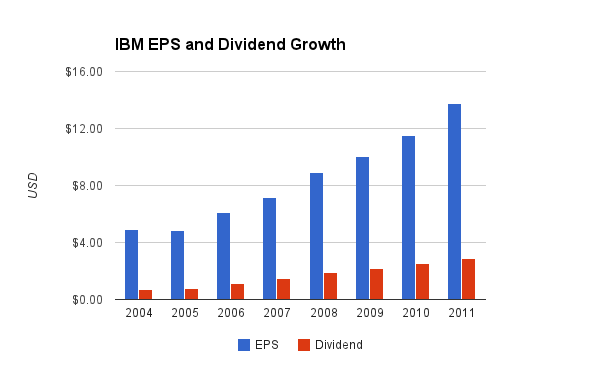

Earnings and Dividends

(Chart Source: DividendMonk.com)

That’s about the cleanest of charts I’ve published, up there with Walmart for consistency. That’s because both companies use share buybacks to smooth out and accelerate EPS growth (at the expense of having low dividend yields).

The EPS growth rate was nearly 15% per year over this period. Company-wide net income grew by around 9.5% per year over this period, with the difference between EPS growth and net income growth being due to share repurchases.

As a dividend stock, IBM falls a bit low with a yield of only 1.64%. In terms of dividend growth, however, IBM has been raising the dividend without fail each year since the mid-90’s. The payout remains low at less than 25%, but this has increased from being less than 15% at the beginning of this period.

Approximate historical dividend yield at beginning of each year:

| Year | Yield |

|---|---|

| Current | 1.64% |

| 2012 | 1.7% |

| 2011 | 1.8% |

| 2010 | 1.7% |

| 2009 | 2.2% |

| 2008 | 1.6% |

| 2007 | 1.2% |

| 2006 | 0.9% |

| 2005 | 0.7% |

How Does IBM Spend Its Cash?

For the fiscal years 2009, 2010, and 2011, IBM spent around $9.5 billion on dividends, nearly $38 billion on share repurchases, and around $8.5 billion on acquisitions.

Frankly, I’d prefer that the dividend portion grow so that the stock yields 3-4% or so and let buybacks be used for the rest of free cash flow, rather than this current situation of low dividends and enormous buybacks. Compared to large companies in general, IBM does make reasonably good use of buybacks by doing them consistently to accelerate EPS and dividend growth, but they are not without their flaws. For example, like most companies, when the stock price took a dip in 2008-2009, IBM slowed share buybacks, so they spent more money buying high than buying low.

Balance Sheet

IBM has a debt/equity ratio of a bit over 150%, which is rather high. Plus, there’s more goodwill than there is shareholder equity, so strip that away and the company has no physical net worth.

Debt/income is under 2x, which is very strong. The interest coverage ratio is around 45x, which is one of the strongest figures of any company I cover.

Overall, IBM’s balance sheet is rather strong.

I’ve seen some commentors on articles suggest that IBM has too much debt, but that conclusion does not take into account the fuller picture of all of these ratios. Based purely on a debt/equity standpoint, IBM does appear to use considerable leverage. However, debt/income and interest coverage ratios show that their actual use of debt is rather conservative. The company could have its profitability cut in half and its debt interest double, and yet the company would still be able to pay its debt interest ten times over from operating profits, which is in line with most of the companies I cover.

The reason for the skewed debt/equity figure lies with the equity portion rather than the debt portion. It’s not that the company has a considerable amount of debt relative to its size; it’s that equity is unusually low. And the reason equity is so low is that IBM is now primarily a software and services company; the profits they generate are not from physical balance sheet assets but instead are from worker talent and the accumulation of patents, systems, and organization. On the balance sheet, there is less value in net property, plant, and equipment than one year’s worth of net income.

So when taking into account what the company does and how it operates, and looking primarily at interest coverage as the standard of balance sheet strength, IBM is well above average. As a tech company it should keep its balance sheet strong and nimble, which is the case. Overall, I view IBM as making good use of leverage with steady and strong financials.

Investment Thesis

A key aspect to investing in IBM is looking at their 2015 road map. Their 2010 road map successfully projected where the company would be several years ahead, and the 2015 road map has sought to do the same for this period.

The most important and concise goal of the 2015 road map is to reach at least $20 in operating EPS, up from $13.44 reported for fiscal year 2011. This would be at least 10% average annual EPS growth from this point, which is aggressive and yet below their performance over the last seven year period.

Other goals by 2015 consist of increasing geographic exposure to geographic growth areas to 30% compared to around 22% now, giving back $70 billion to shareholders as dividends and buybacks, spending $20 billion on acquisitions, and leading their overall software income to reach about half of total IBM income.

The four areas of growth IBM looks forward to are “Growth Markets” (expansion of geographic exposure to developing countries), “Business Analytics” (tools to organize inconceivably large amounts of information), “Cloud” (server-based systems rather than client-based), and “Smarter Planet” (systems to organize all forms of operation or production to enhance efficiency).

-With their Business Analytics segment, they have acquired over two dozen companies in the past seven years, developed hundreds of patents, and have nearly 9,000 consultants. The most public example from this area of IBM was “Watson”, the program that beat the best Jeopardy players at Jeopardy.

-With their Cloud segment, IBM is looking to strengthen its cloud offerings specifically to enterprises, in the form of enabling the creation of private clouds and also with clouds hosted by IBM as a service. Lockeed Martin is an example of a client for this segment.

-The Smarter Planet concept is mainly about software prediction and integration. For example, utility infrastructure can potentially be monitored at every point of change in the system, with predictive processing looking for probabilities of upcoming faults before they happen in order to reduce their actual occurrence. Complex systems of multiple variables (weather patterns, traffic flow, etc.) represent enormous amounts of data, and with enough processing power and software sophistication it can be organized and understood for effective results.

IBM has ranked #1 for annual patents awarded every year for the past 19 consecutive years. The company spent $6 billion on average per year over the last three years on research and development. The company also spends a considerable amount of cash on strategic acquisitions as a consistent part of its overall growth strategy. A useful overview of their last 10 years of acquisitions can be found here.

Risks

The company faces significant global competition from other large and diverse companies such as Oracle, Microsoft, Infosys, and others. There is no individual company that directly competes with all areas of IBM, but these and other large competitors each compete with significant chunks of IBM.

Like any technology company, IBM must continually reinvent itself, and it’s only as profitable as its last few years of developments.

Global macroeconomic issues present a headwind to IBM, and every other company. American federal budget issues, European debt problems, Asian slowing in growth: all of these things can weigh down on profitability growth.

Conclusion and Valuation

When I analyzed IBM in December 2011, the stock was a bit under $190, which I stated appeared to be a reasonable value. Over these last 10 months, the stock has produced low double digit returns and is now priced at nearly $208. Since EPS has continued to increase, the valuation itself has remained fairly static, and my overall conclusion remains the same: that IBM stock is at a reasonable value.

Due to the low yield, the Dividend Discount Model which I analyze most stocks with is not optimal. Using the 2015 roadmap presented by the company serves as probably the best method of valuation. If the company hits $20 in operating EPS by 2015, and the earnings multiple stays fairly moderate at 15x earnings, then the stock price could hit $300 by the end of that year while paying $15 in dividends over the period between now and then. This would comfortably result in double digit returns.

Since IBM can only control its performance, and not the stock valuation, we can’t know for sure what the stock will do over the next 3-4 years. The good news is that if the stock price behaves irrationally, it can be a good thing for investors. For example, should the earnings multiple decrease over this period even if the company remains on track for its road map, then the share repurchases will buy back more shares for the same amount of money spent, which results in extra EPS and dividend growth.

While I considered IBM to be a reasonable buy in the last report, I view it as a slightly stronger buy this time around, because the overall market provides fewer good opportunities. There seems to be a significant number of rich stock valuations out there, and while IBM is not a deeply undervalued stock, it does appear to be a fair price for solid returns going forward.

Full Disclosure: As of this writing, I have no position in IBM.

You can see my dividend portfolio here.

Strategic Dividend Newsletter:

Sign up for the free dividend and income investing newsletter to get market updates, attractively priced stock ideas, resources, investing tips, and exclusive investing strategies:

One of the things I have had to overcome is looking at the actual price of a stock compared to its actual value. At $200/share the average investor might look at IBM as expensive. Thank you for your analysis. It’s my belief that we’ll see a 10% decline within a couple months in the S&P 500 in which I will look at purchasing some shares of IBM. Additionally IBM is positioning itself as a database powerhouse.

IBM actually had a rather huge (nearly 5%) stock price drop today after a somewhat disappointing earnings report. More specifically, revenue was lackluster while earnings were okay.

Thanks for your insights on IBM. Your style of analysis ( I have read couple now ) is clear and simple ( it shows how well your understand the company ).

I have worked at IBM before and have been following the company ( with more interest after Warren Buffet took a 6+% stake in the company ).

You have rightly highlighted the struggle the company is facing in growing it’s topline. It’s a valid concern however as Buffet suggested one of the strong moats of IBM is “Switching Cost” and a positive feedback loop between it’s product group and services group resulting in informed and strategic acquisition and new product development.

thanks

Hari