Intel Corporation, the largest producer of advanced processors, has transitioned to being a dividend and value stock over the last several years.

-Seven Year Revenue Growth Rate: 6.7%

-Seven Year EPS Growth Rate: 10.8%

-Dividend Yield: 3.03%

-Balance Sheet: Very Strong

Overall, I think that the risks to Intel appear to be factored into the valuation, and that the fair Intel stock value is at or above the current price in the mid-to-high $20’s. I find that their growth opportunities, coupled with their fairly low stock valuation, outweigh the risks associated with their lack of mobile exposure and competition from ARM Holdings.

Overview

Intel Corporation (NASDAQ: INTC), founded in 1968, is the largest semiconductor company in the world. Their products are mainly processors, but also include chipsets, motherboards, memory, software, and other elements. The company has market share dominance in server computing and personal computing, but their processors have not been particularly energy efficient, and so it is ARM rather than Intel that has the dominant position in smart phone and tablet processors.

Geographically, over two thirds of Intel revenue comes from Asia/Pacific, while the rest comes mainly from the Americas and Europe.

By segment, nearly three-quarters of revenue comes from the PC client group (which is the area facing the most scrutiny for lack of growth, at least in developed markets), another fifth or so comes from the data center group (which has solid growth prospects), and the remainder comes from elsewhere.

Stock Metrics

Price to Earnings: 11.6

Price to Free Cash Flow: 14.6

Price to Book: 3.3

Return on Equity: 27%

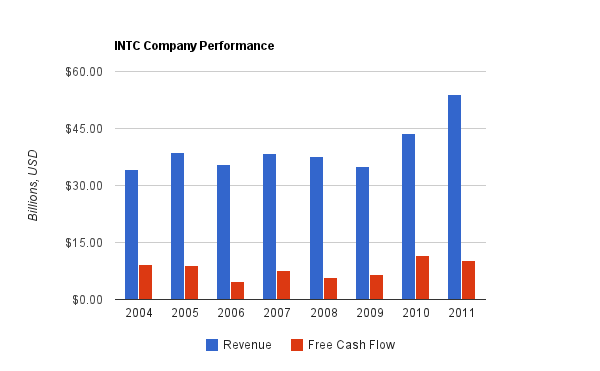

Revenue and Free Cash Flow

Intel has been in a period of erratic growth. Between 2004 and 2011, the company grew revenue by an annualized rate of over 6.7%, and free cash flow by an annualized rate of less than 2%.

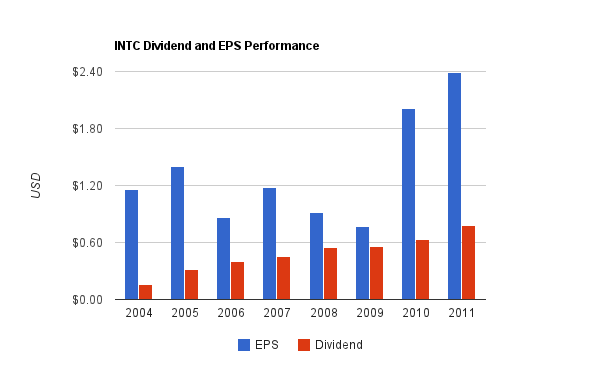

Earnings and Dividends

Intel has similarly had erratic earnings growth over this period, but averaged an annualized EPS growth rate of 10.8%.

The company consistently grew the dividend every year without fail in this period, and averaged annualized dividend growth of over 25%. The most recent quarterly increase in the period was 18%. Intel has stated that they target a 40% dividend payout ratio from free cash flow, and expect to grow the dividend at approximately the same pace as EPS, which is a more realistic and sustainable dividend growth rate going forward. The high dividend growth rate up to this point was due to the dividend catching up to a reasonable payout ratio from EPS.

The current dividend payout ratio from earnings is a bit under 35%, and the dividend yield is 3.03%. This is a rather high dividend yield for the technology sector, and the company’s consistent stretch of dividend growth is becoming rather mature.

Intel also typically spends considerably more on net share repurchases than dividends, which reduces the number of shares and increases the value of each share. Considering that Intel is a tech company, has a 3+% yield, and is at a reasonable stock valuation, I find this to be acceptable. Sending much of the free cash flow back to shareholders makes per-share growth more predictable.

Balance Sheet

Intel has a very strong balance sheet. The total debt/equity ratio is only 16%, and the interest coverage ratio is over 100. The total debt/income ratio is considerably below 1, and goodwill is a rather small portion of the balance sheet. The company has around $15 billion in cash, which far exceeds their total debt.

Overall, what this means is that Intel could pay off its debt at any time. They recently increased debt slightly, but the balance sheet is rock solid.

Investment Thesis

The three primary variables for processor competitiveness are price, performance, and power consumption. All three of these variables, among others, matter in every environment, but in certain environments, some matter more than others.

-In data centers, it’s mainly about price and performance, and less about power consumption. Users would generally prefer more processing power from fewer machines, and their overall level of power consumption for the whole data center is very important, but not so much for individual chips. It’s about the overall ratio of performance to power.

-In client PCs, there’s a rather broad spectrum between price and performance, and power consumption isn’t quite as important. When was the last time you checked power consumption when buying a desktop PC?

-In mobile computing, such as in tablets and smart phones, power consumption is of primary importance, with a reasonable level of performance and price. It doesn’t usually make sense to have a very powerful device that can only go a few hours on a battery charge.

Intel is highly competitive in terms of power and price, but in terms of power consumption, they have lagged behind ARM designs. ARM Holdings has captured most of the mobile market share with their energy efficient designs, while Intel’s Atom processors haven’t kept pace.

Tick Tock

Intel spent over $8 billion on research and development in 2011, and stated plans to spend over $10 billion on research and development in 2012. More than $10 billion was spent on capital expenditure in 2011, which was considerably higher than in any previous year.

Intel’s moat has been created over these years due to their unrivaled scale of research, development, and capital expenditure. Their process is called the “tick tock” method. Over a two-year cycle, one year is a “tick” and the other year is a “tock”. On a tick year, Intel advances manufacturing technology to decrease the size of transistors and get more of them on a chip. In 2003, they had 90 nanometer technology, in 2005, it was 65 nanometer, in 2007 it was 45 nanometer, in 2009, it was 32 nanometer, and in 2011, it became 22 nanometer. On a tock year, Intel advances micro-architecture technology based on the previous tick year, delivering better performance and efficiency, and adding new features and capabilities. The result is a pattern of continued, predictable improvement in their processor offerings that other companies generally cannot match. Smaller competitors generally have to take shortcuts to compete with Intel in any given year, which they cannot sustain.

The ARM Threat

A considerable threat to Intel is intellectual property from ARM Holdings, which is licensed to producers like Qualcomm and Texas Instruments. Rather than competing with Intel directly, ARM provides designs to other producers, and collects licenses and royalties.

Intel has dominance in the PC market, which is rather saturated. ARM, however, has been outperforming Intel in mobile computing dramatically, and therefore Intel stock has been stuck with a low valuation. ARM’s designs are rather different than Intel’s, and are far more efficient in terms of power. Intel’s are more powerful, but not as energy efficient. Their Atom line of processors has been unable to capture any serious mobile market share, although new power efficient designs are promising.

ARM would like to grow by moving upstream into some of the simpler personal computers, while Intel would like to grow by breaking into the mobile area. This represents both considerable potential and considerable risk, as Intel could remain locked out of the mobile processor market, or even lose market share in low end personal computers, or in another scenario, they could potentially develop a competitive enough design to break into the mobile arena and bring in substantial revenue and income streams.

So far, Intel’s lack of mobile market share and the current ARM threat is what is keeping Intel stock value fairly low.

Growth Opportunities

Their core area of personal computers in developed markets is rather saturated, but Intel has multiple avenues for growth:

1) Data centers continue to be a medium-paced growth opportunity for Intel if they can retain market share in that area. Intel expects data centers to grow as much in the next five years as they did in the last ten years.

2) Intel could potentially break into mobile, and capture market share from ARM with energy efficient Atom processors. There are some promising phone deals for 2012, as Intel has had some design wins. But people have an increasing number of personal computing devices, and even if Intel doesn’t gain much market share of mobile processors, they still benefit from providing processors and other hardware to the data centers that serve software as a service and other cloud offerings to those increasingly proliferated mobile devices.

3) There is less computer saturation in developing markets. Once the economics become such that a household can afford a computer with under 6-8 weeks of income, market penetration grows substantially and quickly. This fueled growth in North America and Europe in the 1990’s. Areas like China, Eastern Europe, and Brazil, are hitting that threshold at around the current time. Incomes are rising, and computer cost is decreasing. If Intel can take this market rather than AMD processors or ARM licenses, then there is considerable upside.

4) Less consistently, Intel can expand elsewhere, such as with their acquisition of McAfee anti-virus software.

Earlier this week, I published an analysis of Microsoft, and it’s worth pointing out that Microsoft stands to benefit from a number of these growth areas as well, with a similar risk profile and a similar stock valuation. Intel, however, doesn’t face the same piracy problem that Microsoft faces in these emerging markets.

Risks

Intel’s main risk so far is the widespread increase in mobile computing compared to personal computing, their lack of market share in that area compared to ARM, and the potential for mobile computers to displace some PC market share, or for ARM to break into low-end PC market share with their designs.

Intel’s products are highly complex, and although they have the unrivaled resources for research and development, nothing is guaranteed, and should the company fall behind in terms of competitive technology, market forces could move very quickly against them.

The company faces strong competition from businesses like Oracle and IBM in the data center market, Qualcomm and Texas Instruments, among others, in the mobile market, and AMD in the x86 market. Overall, while I’d say Intel has a solid position, I wouldn’t necessarily call it a safe stock.

Conclusion and Valuation

In conclusion, I’d rather bet with Intel here than against them. Intel stock already has quite a bit of risk factored into the price, and so I’d propose that the potential long-term upside looks better than the potential long-term downside, after taking into account their research and development moat, the growth in data centers, the potential for PC growth in several key developing markets, but also their mobile difficulties thus far.

If Intel can grow free cash flow by 5% annually going forward, then a 12% discount rate results in an intrinsic Intel stock value that is equal to the current price at a bit under $28. If I were interested in the stock, I’d look to buy on dips at or below the current stock price, or write put options to acquire the stock at a lower cost basis.

Full Disclosure: As of this writing, I own shares MSFT. I have no current position in INTC.

You can see my dividend portfolio here.

Dividend Stock Newsletter:

Sign up for the free monthly dividend investing newsletter to get market updates, attractively priced stock ideas, resources, investing tips, and exclusive investing strategies:

Thank you for the excellent and detailed review of Intel. I had never heard of the tick tock method of research and development. Intel is my number one holding in the Arbor Asset Allocation Model Portfolio (AAAMP). The combination of a pristine balance sheet, glowing dividends, and having one the best research and development programs makes Intel a compelling investment for every diversified portfolio.

Thanks for the reply, Ken.

It’s interesting that you have Intel as the number one holding in the model. The numbers, at least, certainly make sense. I’m always a bit wary of even the blue chip tech stocks, so while I include tech stocks, I rarely bet big on any single tech stock.

Great analysis Matt.

I agree with you that Intel’s weakness in the mobile market and a cooling PC market is baked into the stock price. I feel comfortable with a relatively small position with INTC as is, but the time to get in was when it was near $20-22. I think it’s still attractively valued now, but without a large margin of safety. I also agree that there is more upside than downside at the current price and the yield gives a bit of a “bottom” to the price. It’s a solid business with a great balance sheet, huge R&D budget and great products, but one with the concerns about it’s viability and competitiveness in the mobile market. I know it’s actively trying to make strides there, but so far not making large waves.

I’m with you on waiting for a dip in the current price before adding to or initiating a position. I’d feel comfortable around $25-26/share.

Great analysis as always Matt. A solid business for sure, but like you I don’t feel too comfortable with a large portion of my portfolio in tech, even blue chip tech. The winds change so quickly in tech.