The spinoff of Phillips 66 by ConocoPhillips has been a strong shower for dividend investors who held onto their holdings through the process.

COP Dividend Yield: 4.45%

PSX Dividend Yield: 1.91%

Seven Year Dividend Growth Rate: 13.5%

Balance Sheets: Fairly Strong for Both

Currently, I view COP as a reasonable income holding at a price of $60, but not with any significant margin of safety. PSX appears to be reasonably valued despite the price-run up, but is subject to volatility. Rather than buying the stock outright, selling puts to enter PSX at a lower cost basis may be a more prudent investment decision for 2013.

Overview

In May, ConocoPhillips (COP) spun off its downstream business into a separate entity Phillips 66 (PSX). ConocoPhillips focuses on exploration and production, while Phillips 66 focuses on refining and transporting.

PSX has 15 refineries with a combined capacity of 2.2 million barrels a day, plus 15,000 miles of pipelines, and 7.2 bcf/day natural gas gathering capacity.

COP has been focusing on selling assets recently, including assets in Kazakhstan, Algeria, and Nigeria. Their capital budget plan for 2013 includes an estimate of $15.8 billion in spending, with 60% of that being in North America.

Dividends

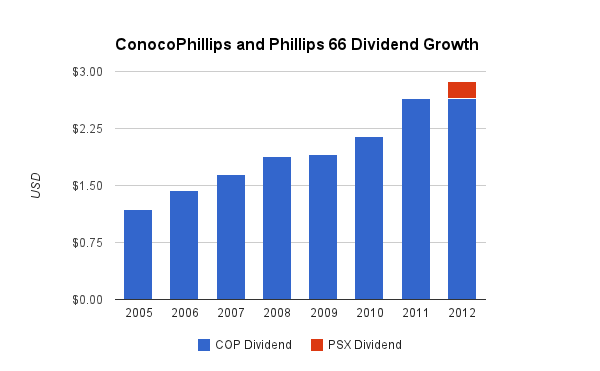

(Chart Source: DividendMonk.com)

The above chart shows adjusted dividend growth for a COP investor. It adjusts for the fact that an investor received 1 share of PSX for each 2 shares of COP, and therefore shows the dividend growth rate from the perspective of owning 1 COP share over the last seven years.

So far, the separation of the companies has turned out as management projected for income investors. The combined payouts have resulted in an annual dividend growth rate of 13.5%.

The dividend payout ratio from median analyst estimated forward earnings of COP is approximately 45%, and the yield is very attractive for this industry at 4.45%. The payout ratio for PSX is even lower, but downstream operations are a highly volatile business. The yield is only 1.91% for PSX.

Returning Value to Shareholders:

Going forward, the board of PSX announced a dividend increase of 25% for 2013, and a doubling of their share repurchase plan from $1 billion to $2 billion.

COP has been going a similar route, spending twice as much on share buybacks as on dividends, despite the nearly 4.5% yield. The current shareholder yield for COP is very high at over 15%, but this shouldn’t be assumed to continue at this magnitude indefinitely, due to the impact of their current asset sales.

Balance Sheets

With a total debt/equity ratio of approximately 45% and an interest coverage ratio of above 25, ConocoPhillips is in good financial shape, but is more leveraged than XOM and CVX.

PSX is in a similar position, with a debt/equity ratio of 40% and a high interest coverage ratio.

Investment Thesis

In my opinion, one of the strongest pieces of news recently was the announcement of Phillips 66 to form a Master Limited Partnership in 2013. The announcement was made on December 13th and is available on their site here.

“We expect to use the master limited partnership as an efficient vehicle to fund growth investments in the transportation and midstream sectors,” said Phillips 66 Chairman and CEO Greg Garland. “We believe the proposed MLP will enable us to enhance value for our shareholders and increase the transparency of our business.”

Placing some of their transportation assets into an MLP can allow for continued issuance of new capital to fund growth, and an above average rate of return for PSX on these particular assets if managed well. The specific assets are not yet identified, but they may include NGL assets, rail assets, and pipelines, and the IPO is expected to raise $300 million to $400 million for the company according to the announcement.

Risks

Separating the company into two halves has unlocked value for shareholders and may result in overall better returns going forward. The downside is that each individual company is less diversified. In the integrated upstream and downstream scenario, during years of low margins for the refining business, COP could maintain its dividend growth due to strong performance from its upstream business. Now that the companies are split, each company’s individual dividend payout is slightly more at risk than previously, since there’s no shared risk pool.

Like all large energy companies, COP and PSX face risks of changing oil prices and refining margins, respectively. They face litigation and political risk simply by nature of their industry.

Conclusion and Valuation

Based on the Dividend Discount Model, COP only needs to increase the dividend by an average growth rate of 5.5% going forward in order to justify the current share price of around $60 with a 10% discount rate. Considering their large share buybacks and low earnings multiple, no core company growth is even needed for this outcome. The main threat to this outcome would be a significant decrease in oil prices. The volatile nature of energy gives oil companies a rather low set of earnings multiples, as an industry. I believe holding COP shares represents a decent investment at this price, albeit without a margin of safety.

As for PSX, I viewed the company as becoming a bit overweight after this hefty run-up, but the announcement of the intention to form an MLP has slightly increased my view of the business value. I believe a more conservative way to play PSX, if one is interested in entering a long-term position based on the fundamentals, is to sell Jan 2014 puts at a strike price of $50. This would mean committing to a cost basis in the stock of around $43.20, which would give a discount of over 15% compared to the current share price. If not exercised, this would result in annualized returns of over 15% for the next year.

Full Disclosure: As of this writing, I have no position in COP or PSX.

You can see my dividend portfolio here.

Strategic Dividend Newsletter:

Sign up for the free dividend and income investing newsletter to get market updates, attractively priced stock ideas, resources, investing tips, and exclusive investing strategies:

That is a good overview of both companies following the split. Frankly, I do not like either. COP has been selling assets, but I think they have some of the worst reserve replacement ratios relative to the other majors. Without finding new reserves, what are they going to do once their wells run dry ( i know this is an extreme example but still). That being said, the yield is pretty good for COP vs CVX and especially XOM. I am wondering if it would make sense to replace XOM with COP..

PSX has had a nice run-up.. My main concern is that the refinery business is very volatile – a few years of losses are followed by a few short years of profitability. I am not sure if a cyclical model like that can support long term dividend growth. Now the MLP sounds like an interesting idea..

I agree for the most part.

For the refinery business, the good news is that the earnings multiple is so low, and the payout ratio is so low, that the cyclical nature of the business appears to be factored in. I think PSX is the type of business that can offer decent returns over the long-run if well managed, but it’s not a great pick for income stability.

I hadn’t seen the announcement about the MLP for PSX. I’ll have to read more about it but it sounds like a pretty good deal that can help both the company and shareholders. I’m a little worried about COP because of all the assets they’ve had to sell off. Hopefully if they pull back on the buybacks and DG for a year or two that will put them in a much better position going forward.

Thanks for the analysis on COP and PSX.