Illinois Tool Works, Inc. is a decentralized and diverse collection of manufacturing businesses that has been in business for nearly 100 years and has paid consecutively growing dividends for more than four straight decades.

-Seven Year Revenue Growth Rate: 4.8%

-Seven Year EPS Growth Rate: 9.0%

-Seven Year Dividend Growth Rate: 13.5%

-Current Dividend Yield: 2.48%

-Balance Sheet Strength: Strong

Illinois Tool Works appears to be a fair dividend growth stock at these prices, and appears to neither be undervalued or overvalued on a quantitative and qualitative basis.

Overview

Illinois Tool Works, Inc. (NYSE: ITW), was founded 100 years ago, has 60,000 employees, thousands of patents, and operates as a decentralized and diverse collection of manufacturing and industrial businesses. The company’s focus is on intelligent acquisitions, where it can add to its collection of businesses that each operate as fairly small, streamlined businesses but share the corporate structure of ITW and therefore have risk protection.

2011 Revenue Breakdown by Business Segment:

Transportation: 17%

Power Systems and Electronics: 16%

Industrial Packaging: 15%

Food Equipment: 11%

Construction Products: 11%

Polymers and Fluids: 8%

Decorative Surfaces 6%

Other: 16%

Ratios

Price to Earnings: 12

Price to Free Cash Flow: 17

Price to Book: 2.6

Return on Equity: 21%

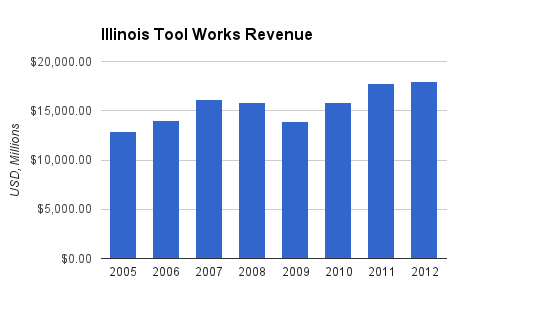

Revenue

(Chart Source: DividendMonk.com)

The revenue over this seven year period grew at an average annual rate of 4.8%, which is quite substantial.

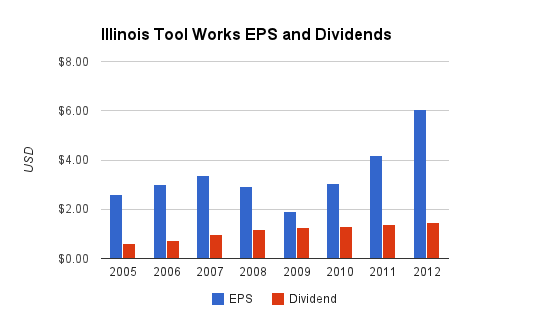

Earnings and Dividends

(Chart Source: DividendMonk.com)

Earnings grew by 12.8% per year over this period, but the 2012 figure is boosted by around $1.30 from divestitures. Accounting for this, the fairer representation of the EPS growth rate over this period is approximately 9% per year on average.

Meanwhile, the dividend grew at a 13.5% average annual rate, although the most recent quarterly dividend increase was only 5.5%.

The current dividend yield is 2.48% with a payout ratio (after subtracting one-time divestitures from EPS) of a bit over 30%.

Approximate historical dividend yield at beginning of each year:

| Year | Yield |

|---|---|

| Current | 2.48% |

| 2012 | 3.0% |

| 2011 | 2.5% |

| 2010 | 2.5% |

| 2009 | 3.4% |

| 2008 | 2.2% |

| 2007 | 1.8% |

| 2006 | 1.5% |

| 2005 | 1.2% |

How Does Illinois Tool Works Spend Its Cash?

The company generated over $4.5 billion in free cash flow over the last three years. During the same time period, management spent $2.2 billion on dividends, over $2.8 billion on share buybacks (which were boosted by over $1 billion from cash from divestitures in 2012), and over $500 million in net acquisitions.

Balance Sheet

The total debt/equity ratio is under 50%, which is rather strong. This is substantially higher than the period from around two years ago when this ratio was approximately 30%. This increase in debt/equity was due to an increase in debt of a bit over $2 billion which went to the above dividends, buybacks, and acquisitions, but with a sturdy balance sheet it’s a fair use of leverage.

The total debt/income ratio is well under 2x, and the interest coverage ratio is over 13x. Goodwill is not excessive, as it accounts for only around 50% of equity.

By every metric here, ITW is in strong financial condition. It’s worth watching the company’s balance sheet over the next few years to observe whether the increasing leverage continues, but the current numbers are solid.

Investment Thesis

ITW has a business model that is unusual for most companies of a similar size ($28 billion market cap), but not uncommon among large manufacturers. The company is highly decentralized and most growth is due to acquisitions. The company operates as basically a common pool of smaller companies.

The advantage of this decentralized acquisition-oriented business model is that risk is spread out and decentralized among numerous industries, brands, and business cultures. In addition, acquisitions, if performed smartly, can provide a regular amount of new revenue and operating income. It can be a consistent growth driver.

The disadvantage of this model is that the company does not harness substantial economies of scale, because it still mainly operates as a collection of small companies. In addition, an acquisition approach limits the rate of return that can be achieved, because acquisitions are generally more expensive than organic growth. Plus, consistent acquisitions cause goodwill to accumulate on the balance sheet.

ITW has been managed well, and over the last 25 years and longer, the company has substantially grown revenue, operating income, EPS, and the dividend, and maintains a robust balance sheet. Over the last ten years, the company has developed substantial international revenue streams. In 2000, 66% of revenue came from North America, 26% came from Europe, the Middle East, and Africa, and 8% came from Asia Pacific and Other. Ten years later, in 2010, those figures respectively were 48%, 32%, and 20%.

The 80/20 Rule

The 80/20 rule, or the Pareto Principle, is an idea that often pops up as a management topic, a productivity topic, and even in the Dividend Toolkit with regards to scanning companies. Essentially, the 80/20 rule applied in various contexts means that, most often, 80% of the effects will come from the most important 20% of causes.

The company attributes much of its success to the 80/20 rule. That is, the idea that roughly 80% of a company’s total sales are or should be derived from sales to only the top 20% of customers, with the remaining 20% of sales coming from the other 80% of customers. In other words, the products being sold to key customers are what need to be focused on because that’s where almost all the money is, and other areas can potentially be cut down. ITW’s decentralized business model allows each small business unit to apply this rule rather effectively.

Illinois Tool Works pays a bit more than just lip service to the concept. It’s a core operating philosophy of the organization. Normally, when we think of a company making an acquisition, in order for it to be a cost effective purchase, we expect significant synergies and growth to occur due to that business being acquired by a larger and potentially more capable company.

For example, if a company that consists of several brands with major manufacturing, distribution, and marketing capabilities acquires a product with a strong brand, the focus would likely be on greatly expanding the reach of that brand with these capabilities of the larger company.

But in Illinois Tool Works, the opposite approach is targeted. They want growth through reduction of the business and a focus on the 20%. In a December 2012 presentation, they highlighted two example acquisitions:

Acquisition A (2005-2012)

| Metric | Before Acquisition | After Acquisition |

|---|---|---|

| Revenue | $220 Million | $390 Million |

| Operating Margin | 12% | 27% |

| ROIC | 6% | 22% |

| # Products | 4,010 | 2,328 |

| # Customers | 2,217 | 1,744 |

Acquisition B (2005-2012)

| Metric | Before Acquisition | After Acquisition |

|---|---|---|

| Revenue | $114 Million | $150 Million |

| Operating Margin | 17% | 26% |

| ROIC | 11% | 24% |

| # Products | 1,435 | 718 |

| # Customers | 1,938 | 906 |

In both of these cases, after making the acquisition, Illinois Tool Works reduced the number of products offered, reduced their customer base, and focused the business unit on their largest customers. More than just focus on the key customers, they structure their company around them. But since it’s still thousands of customers, the company as a whole remains extremely diversified.

Management of Business Units

Illinois Tool Works manages their business units like a portfolio. They classify them into the categories of “Accelerated Growth”, “Market Rate Growth”, and “Commoditizing”.

Business units that are classified as being in the first category (Accelerated Growth) benefit from not only competitive advantages and significant differentiation from competition, but also benefit from macroeconomic tailwinds or emerging market potential. Business units in the second category (Market Rate Growth) benefit from primarily just competitive advantages and differentiation. Commoditizing business units, on the other hand, are beginning to lose their advantages and are eventually divested.

Investors that read my Leggett and Platt analysis from two days ago will notice that ITW and LEG manage their business units in practically the same way. Leggett and Platt uses “Grow, Core, Fix, and Divest” as its four categories of business units. These companies operate in related industries with related business models.

Streamlining

Through 2017, the company is restructuring and simplifying its operations. In many business segments, the number of business units and the number of managers are being cut by more than half due to consolidation. Management expects to buy back a minimum of $300 million to $500 million worth of shares annually. Over the last decade, the number of shares fell from over 617 million to 473 million.

Risks

Illinois Tool Works is a business to business seller. During times of recession or uncertainty, businesses collectively sharply reduce their capital expenditures, projects, and/or inventories, which can mean sharp temporary downturns for engineering companies like ITW.

Conclusion and Valuation

Through 2017, the company is targeting 9%-11% annual EPS growth which supports a dividend growth rate of the same rate. Their low expected range is 7%-9% growth while their high range is 11%-13%.

Despite a fairly modest dividend yield, as an established company with approximately five decades of consecutive annual dividend increases, the Dividend Discount Model (DDM) is applicable. The stock’s current price is in the low $60’s, which using the DDM is justified assuming only 7.5% annualized dividend growth and a 10% discount rate (the target rate of return).

Since the last report on ITW a bit over a year ago, the stock returns including dividends would have been nearly 30%.

Overall, I view the stock as fairly valued quantitatively and qualitatively. The combination of dividend yield and expected dividend growth matches up with the current stock price, and management has a long-term plan that combines dividends, share buybacks, organic growth, and targeted acquisitions to provide what should be fairly reliable earnings growth and shareholder returns.

Full Disclosure: As of this writing, I have no position in ITW.

You can see my dividend portfolio here.

Strategic Dividend Newsletter:

Sign up for the free dividend and income investing newsletter to get market updates, attractively priced stock ideas, resources, investing tips, and exclusive investing strategies:

Glad to see you back at it Matt. Great analysis as always!

I love ITW, but I missed the chance to buy a while ago when the yield was a bit higher. I’ll probably wait around and buy some on a dip so I can grab a higher starting yield.