DSR Quick Stats

Sector: Utilities (Electric)

5 Year Revenue Growth: 4.09%

5 Year EPS Growth: 6.91%

5 Year Dividend Growth: 7.96%

Current Dividend Yield: 2.96%

What Makes Idacorp (IDA) a Good Business?

IDACORP, Inc. is an electricity holding company, incorporated in Idaho with headquarters in Boise. The company provides services through its principal operating subsidiary Idaho Power Company. Idaho Power is the parent of Idaho Energy Resources Co. (IERCo), a joint venture in Bridger Coal Company (BCC), which mines and supplies coal to the Jim Bridger generating plant owned in part by Idaho Power. It also owns natural gas-fired power plants and coal-fired generating stations.

Idacorp has over $5.9 billion in assets and serves over half a million clients with electricity provided by its 24 facilities split as follow:

| Resources | Facilities | MW |

| Hydro | 17 | 1709 |

| Coal | 3 | 1118 |

| Natural Gas | 3 | 762 |

| Diesel | 1 | 5 |

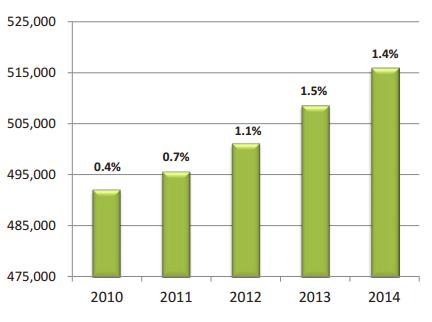

The company shows a small, but steady growth customer base year after year:

Ratios

Price to Earnings: 14.79

Price to Free Cash Flow: 42.84

Price to Book: 1.565

Return on Equity: 10.84%

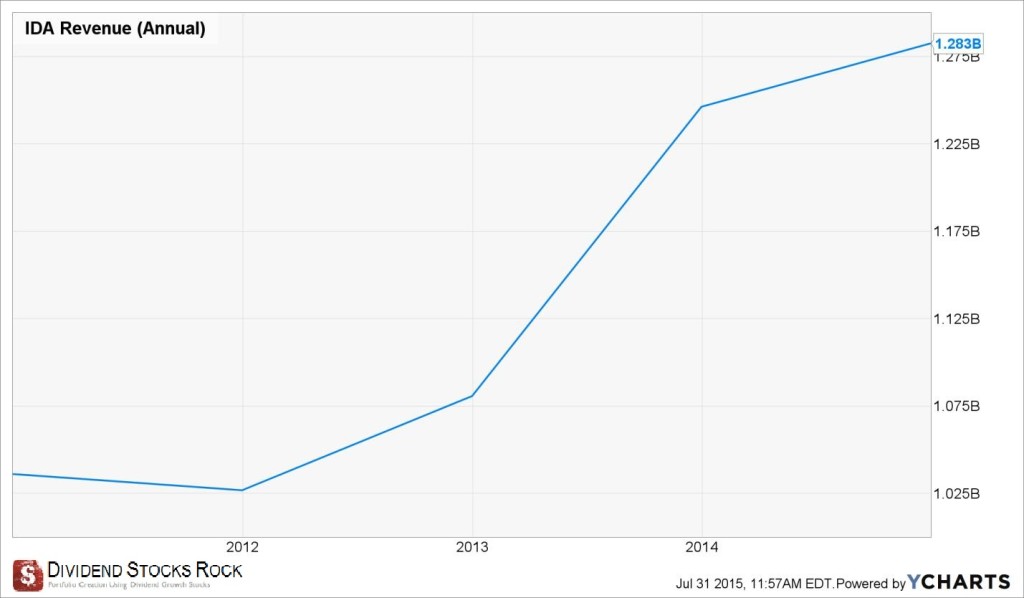

Revenue

Idacorp benefits from a strong economy in Idaho where the unemployment rate is well below the US average. The demand for electricity keeps increasing in this state and therefore should see better volume in the upcoming year.

How IDA fares vs My 7 Principles of Investing

We all have our methods for analyzing a company. Over the years of trading, I’ve gone through several stock research mrthodoligies from various sources. This is how I came up with my 7 investing principles of dividend investing. The first four principles are directly linked to company metrics. Let’s take a closer look at them.

Principle #1: High dividend yield doesn’t equal high returns

Many income seeking investors will look at utilities to complement their portfolio’s income. Utilities usually have a relatively high dividend yield because they don’t show important growth potential. I’m not chasing high yielding stocks as they usually don’t offer anything else but their dividend payment. I would rather pick a company that will provide me with both dividends and stock value growth.

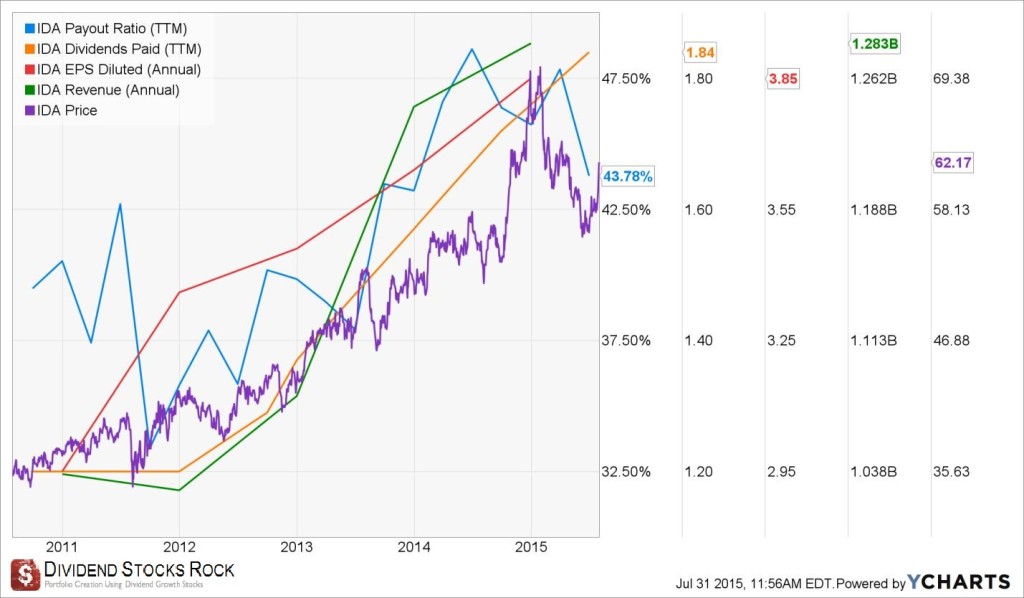

Historically, IDA’s dividend yield has been around 3% since 2011. Considering its recent dividend growth and the fact the yield has stayed consistent, this tells me the company is able to provide investors with both types of growth. IDA passes my first investing principle.

Principle #2: If there is one metric, it’s called dividend growth

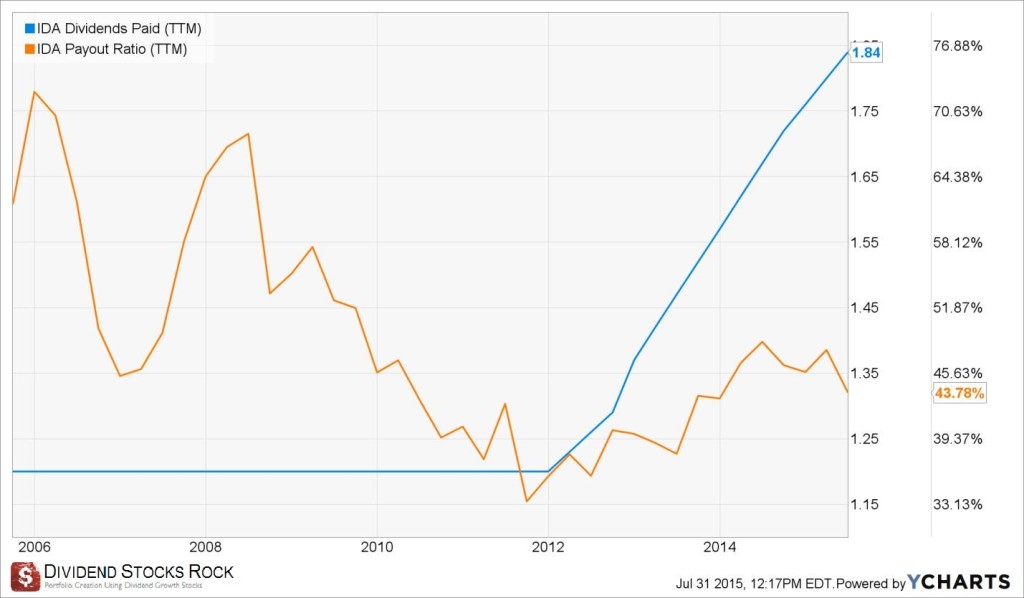

While the dividend payment was stagnant for several years in the 2000s, the company started to increase its dividend payment in 2012. The 5 year dividend growth rate is interesting (over 8%) and management expects to keep increasing the payment by 5% or more per year as long as the dividend payout ratio remains under 60%.

The dividend growth in the upcoming years will not be astounding, but we can expect to see a dividend payment increase nonetheless.

Principle #3: A dividend payment today is good, a dividend guaranteed for the next ten years is better

I like to cross reference the dividends paid and the dividend payout ratio to see if the company will be able to maintain and eventually increase its dividend in the years to come.

As previously mentioned, the dividend payment remained the same for several years. However, the company was stuck with a higher payout ratio and wanted to reduce it to a more manageable level. Now that this objective has been achieved, we see IDA dividend payment increasing at very good rate while keeping a strong control over its payout ratio.

Principle #4: The Foundation of dividend growth stocks lies in its business model

IDA business model is pretty simple and its growth will ultimately depend on how the economy in the state Idaho goes. For now, we can expect stronger electricity demand stimulated by a strong economy. I like the fact IDA has various facilities generating energy from various sources.

What Idacorp Does With its Cash?

As is the case with many utilities, IDA is a dividend investor friendly stock. Management approved a 9.3% dividend payment increase toward the end of 2014 and expects a 5% increase per year or more until payout ratio reach between 50-60%.

Investment Thesis

An investment in IDA is not investing in a high growth company. However, for income seeking investors looking for a steady investment, I believe the company will keep on increasing its dividend for several years to come as the payout ratio is very low.

The dividend growth has not always been very stable, but for the moment, we can expect steady growth and the company stock should continue to go up and keep a dividend yield around 3%. This year’s results have been affected by abnormal weather and has created a buying opportunity.

Risks

Regulation, regulation, regulation. This is probably the biggest challenge all utilities using coal have to face. While the company shows positive numbers, we are not looking at a super powered growth company either. This is why a shift in regulations requiring additional costs to be incurred could hurt the share price heavily.

The good news is many facilities are generating electricity from water (hydroelectric) and this should minimize regulatory problems. This is still a small company compared to other utilities but could be a good addition to a solid core portfolio.

Should You Buy IDA at this Value?

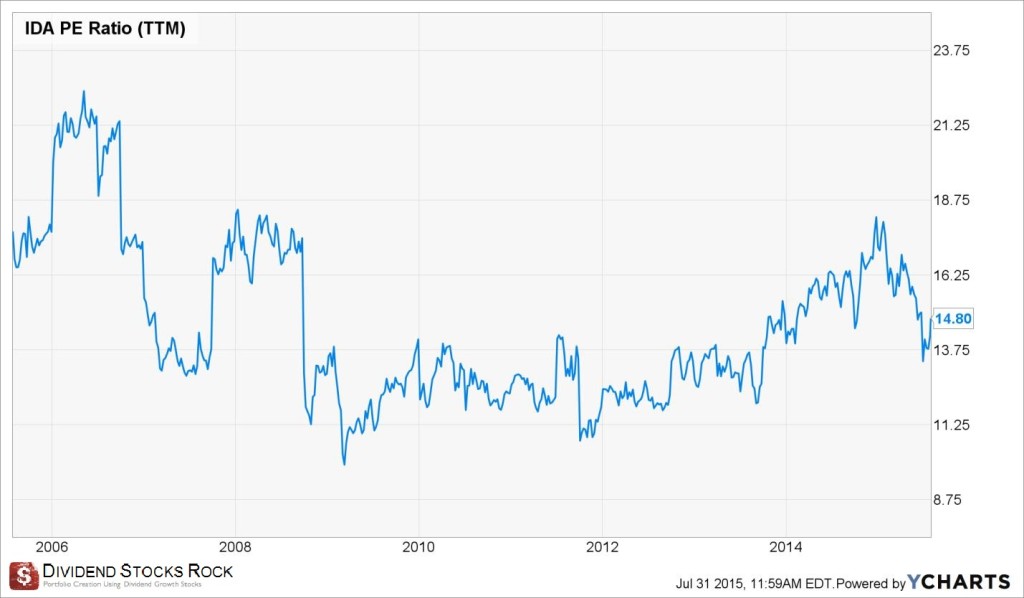

The recent stock price drop may be the start of an interesting entry point for this utility. However, I will still take a look at the 10 year PE history and use the dividend discount model to see how IDA is valued:

The company valuation started to rise again when the company increased its dividend in 2012. Recent bad weather conditions slowed down the market expectations and we now have a relatively good price for IDA if we look at the overall chart.

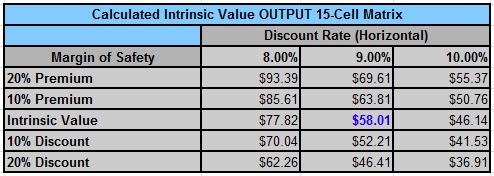

I will use a double stage dividend discount model to value IDA. For the first ten years, I will consider a 7% dividend growth rate. This number comes from what management expect to do until the payout ratio goes up to 60%. It is smaller than the previous 5 years, but we can’t expect massive growth forever. This is why I’m reducing the growth rate to 5% after the first 10 years. I will use a 9% discount rate as utilities are fairly stable dividend paying machines.

As you can see, we might have been tempted to invest in IDA after the recent stock price drop, but this is still not enough to become a bargain if we consider the future dividend growth potential of the company.

At the moment, the company doesn’t seem to be a safe trade unless you want to buy a solid dividend stock without many worries.

Final Thoughts on IDA – Buy, Hold or Sell?

I’m not too excited after looking at IDA. I think it’s the perfect fit for a conservative portfolio as it will generate an interesting dividend payment for several years. However, the current price is not interesting enough to deserve a BUY rating. I would rather say IDA is a hold for any investor who has it in their portfolio as there are many other very interesting buying opportunities right now.

Disclaimer: I do not hold shares of IDA at the moment.

Leave a Reply