Summary

Hasbro (HAS) is a major toy and game company with several powerful brands including Transformers, Nerf, G.I. Joe, My Little Pony, and Monopoly.

-Seven year revenue growth: 6%

-Seven year EPS growth: 16%

-Dividend Yield: 3.66%

-Dividend Growth Rate: 27%

-Balance Sheet Strength: Medium

With a P/E of 11.2, a P/FCF of 16.5, a dividend yield of 3.66%, an acceptable balance sheet, and good long term potential, I calculate Hasbro to currently be mildly or moderately undervalued.

Overview

Hasbro (NASDAQ: HAS) is among the largest toy and game companies in the world. Hasbro produces toys, games, and characters that lead to not only physical products, but movies, video games, and electronic media as well.

Major Brands:

Transformers

Avalon Hill

Wizards of the Coast (Magic the Gathering and other trading card games, Dungeons and Dragons and other role-playing games)

G.I. Joe

Playskool

Littlest Pet Shop

My Little Pony

Milton Bradley, Parker Brothers, and other games (Monopoly, Scrabble, Trivial Pursuit, Twister, Battleship, Candy Land, Operation, Cranium, Life, Jenga, Yahtzee, Clue, Risk, etc.)

Nerf

Tonka

Supersoaker

Hasbro is also involved in licensing their brands and characters to other companies, such as Electronic Arts and Universal Pictures, to produce further entertainment products.

The company operates in three main segments:

U.S. and Canada

This segment sells products to the United States and Canada, and accounted for 57% of revenue and 58% of operating profit, in 2010.

International

This segment sells products to many other countries. Hasbro is attempting to achieve strong growth in emerging markets. For 2010, this segment accounted for 39% of revenue and 35% of operating profit.

Licensing and Entertainment

This segment licenses Hasbro brands to television, movies, games, and various other media. The segment accounted for less than 4% of total revenue, and 7% of operating profit, for 2010.

Breaking down revenue in another way, 34% of revenue came from products marketed to boys, 32% came from games and puzzles, 21% came from products marketed to girls, and 13% came from products marketed towards preschool age children.

Revenue, Earnings, Cash Flow, and Metrics

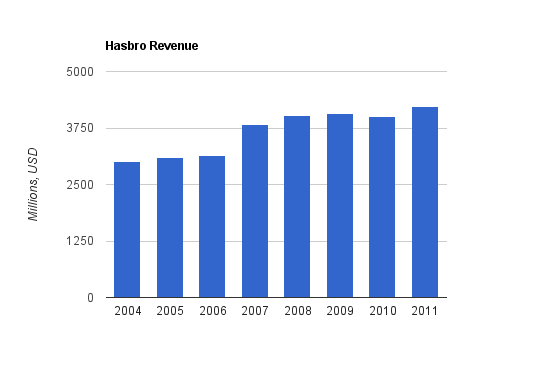

Hasbro has experienced a fair amount of revenue growth over the last several years.

Revenue Growth

| Year | Revenue |

|---|---|

| TTM | $4.235 billion |

| 2010 | $4.002 billion |

| 2009 | $4.068 billion |

| 2008 | $4.022 billion |

| 2007 | $3.838 billion |

| 2006 | $3.151 billion |

| 2005 | $3.088 billion |

| 2004 | $2.998 billion |

Over this seven year period, Hasbro has grown revenue by approximately 5% annually.

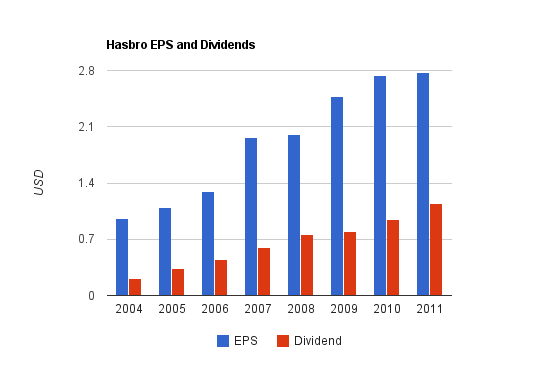

Earnings Growth

| Year | EPS |

|---|---|

| TTM | $2.78 |

| 2010 | $2.74 |

| 2009 | $2.48 |

| 2008 | $2.00 |

| 2007 | $1.97 |

| 2006 | $1.29 |

| 2005 | $1.09 |

| 2004 | $0.96 |

EPS growth for this period was over 16% annually. This is great, but don’t count on this level of growth for the future.

Cash Flow Growth

| Year | Operating Cash Flow | Free Cash Flow |

|---|---|---|

| 2011 | $363 million | $255 million |

| 2010 | $368 million | $255 million |

| 2009 | $266 million | $161 million |

| 2008 | $593 million | $476 million |

| 2007 | $602 million | $510 million |

| 2006 | $321 million | $239 million |

| 2005 | $497 million | $426 million |

| 2004 | $359 million | $279 million |

Cash flow growth has been flat over this period. In the last three years specifically, inventory, accounts receivable, and other changes in working capital have kept cash flows pretty low.

Metrics

Price to Earnings: 11.3

Price to FCF: 16.5

Price to Book: 2.6

Return on Equity: 24%

Dividends

Hasbro currently has a dividend yield of 3.66%, a solid dividend growth rate, and a payout ratio of around 40%.

Dividend Growth

| Year | Dividend |

|---|---|

| 2011 | $1.15 |

| 2010 | $0.95 |

| 2009 | $0.80 |

| 2008 | $0.76 |

| 2007 | $0.60 |

| 2006 | $0.45 |

| 2005 | $0.33 |

| 2004 | $0.21 |

Hasbro has grown the dividend by over 27% per year, on average, over this period. The most recent quarterly increase, in 2011, was from $0.25 per quarter to $0.30 per quarter, which is a 20% raise. Eventually, in order to keep the payout ratio static, the dividend growth rate will have to slow down to match earnings or FCF growth rates. Hasbro isn’t among the greatest dividend stocks, but with time, it could be a long-term dividend grower.

Over the last several years, the company has spent more money on net share repurchases than on dividends. In the first three reported quarters of 2011, for instance, the company spent three times as much money on share repurchases as they did on dividends. Shares outstanding have decreased from 204 million in 2004 to 139 million currently. I find share repurchases acceptable compliments to dividends, and based on my view of the intrinsic value for the shares, I do view this as value creation instead of value destruction, but I don’t like to see this much being spent on repurchases compared to dividends.

Balance Sheet

Hasbro has a fairly mediocre balance sheet. The total debt to equity ratio is 1.02, which is a bit high. About a third of shareholder equity consists of goodwill, which is fine. The interest coverage ratio is between 6 and 7, which is a bit low for my tastes. Total debt/income is approximately 4.

Hasbro was improving its balance sheet until 2007, when the company began taking on more debt. From 2008 to 2010, the total debt basically doubled, and it’s been rather flat from 2010 to 2011. I’d rather see an improving balance sheet than a worsening one. Overall, Hasbro’s balance sheet is safe, but it’s not as clean as I would like. They’re using some substantial leverage.

It’s interesting that the debt increase and the amount of share repurchases over these two years, is approximately equivalent. Hasbro isn’t borrowing because they need to; if they weren’t buying back shares, they could have kept debt levels static. Based on my calculated intrinsic value of the shares, the share repurchases likely do result in a higher rate of return than the interest on debt used to buy them, but I view it as an unnecessary degree of leverage.

Investment Thesis

Hasbro is more than just a toy company; it’s a brand company. Hasbro has many memorable brands which have lasted through generations and which can be converted to various media. This is why, according to management, they put brands at the center of their business model. By strengthening the core brands, Hasbro is setting up substantial, long-lasting sources of cash flow that can withstand all sorts of technology and generational shifts through time. Their games can be played on physical boards or digital boards. Their characters can be sold as action figures or in movies. Hasbro can deliver their brands across various platforms, and all of it complements itself. It builds a cycle of toys selling movies, movies selling video games, and video games and movies selling more toys. Hasbro spends approximately $200 million on research and development, and over $400 million on advertising, per year.

Transformers in particular is a very powerful brand. In 2009, that segment alone brought in nearly $600 million in revenue. This is cyclical depending on whether it’s a year for a blockbuster movie release or not. Nerf has recently been a very strong brand as well, with over $400 million in revenue in 2010.

Hasbro has not only their own ideas to benefit from, but ideas from others as well. The company makes strategic partnerships with companies like LucasFilms, Marvel, and Sesame Workshop to ensure that it is delivering the characters and entertainment that people of various ages want.

A key concern among investors, I believe, is whether Hasbro will continue to perform well in an increasingly digital age, or whether its toys will become less popular over time. This year is reported to have disappointing, but decent, holiday sales. When I analyzed Hasbro a year ago, the stock price was in the mid-$40’s, and I said it seems reasonably valued but without a margin of safety. It has since fallen to the low $30’s, and I believe it may be undervalued. I drop of this magnitude surprises me. I believe there may be too much pessimism regarding Hasbro’s future ability to adapt.

An increasingly digital age is a genuine concern, but I don’t believe kids will stop playing with Nerf guns, will stop playing with girl dolls, will stop playing trading card games, will stop with board games, and so forth. Hasbro will indeed have to make sure it keeps up with the times by licensing their content on as many digital mediums as possible (and they have been; the strategy of viewing themselves as a brand company is key), but if there becomes a time when people spend 100% of their time in front of screens instead of running around outdoors or playing with toys, then I’d have more to worry about than Hasbro, and Hasbro would have a share of that screen time anyway. This is, however, a trend to be aware of when investing.

To combat this, Hasbro’s brand strategy has meant going on several mediums. For instance, Hasbro has a joint venture with Discovery Communications for a television channel called “The Hub”, where they license their own characters as well as third-party entertainment. The Hub accounts for nearly 10% of Hasbro assets, but this venture currently operates at a loss of several million dollars per year. It’s not a huge impact on the income statement, but it ties up capital that could be spent elsewhere. It’s possible that toy sales that occurred due to channel content offset the small losses. The company also licenses its popular board games for mobile content.

It’s worthwhile to note that there’s a movie based on Hasbro’s game Battleship coming out in 2012 with a $200 million budget. It could prove successful, or it could be a disappointment. Hasbro has a deal with Universal Pictures to license at least three movies, and the success of these movies like Battleship might be a key indicator of Hasbro’s ability to monetize its brands with licenses and royalties. I’m somewhat skeptical of its chances of great performance, but then again, I’m not particularly the target audience for the film so I’m perhaps not the best judge. Hasbro also benefits when Marvel and other businesses release outperforming movies, since they can result in strong toy sales.

A last bit regarding the thesis: it’s not out of the question that Hasbro could eventually be bought out, with its market cap of a bit over $4 billion and its attractive collection of intellectual property. I wouldn’t count on this for investment purposes, however. It’s better to invest on numbers than on speculation, in my view.

Risks

Hasbro faces currency risk and commodity cost risk. The company is also reliant upon strategic partnership with both companies that they pay royalties to (such as Marvel), and companies that they license their brands to (such as Universal Pictures). These relationships are extremely important to Hasbro both financially and for the strength of their brands.

In addition, certain brands such as Transformers or Nerf make up large shares of total revenue, so the continued profitability of these brands will have an influence over total Hasbro profitability. It’s hard to say how long transformers will remain this popular; their trilogy of movies has been immensely successful, and there is discussion for more, but I’m not sure how long that can continue successfully. I’d prefer to estimate cautiously in that regard.

Also, retail has become increasingly corporate and consolidated for a while now, and Hasbro’s three largest customers, Walmart, Target, and Toys R Us, account for 23%, 12%, and 11% of Hasbro revenue these days. They collectively account for over 50% of total Hasbro revenue, and more than two-thirds of revenue in the US/Canada segment.

The longer term risk is the estimation regarding how well Hasbro products will sell in an increasingly digital age, and the extent of the digital media pie that they can capture and hold.

Conclusion and Valuation

The increase in debt and the low cash flows over the last few years worry me a bit. I do think the business model is strong, that their products (both physical and digital) will be around for a while, and that they have good global expansion prospects.

A discounted cash flow analysis for Hasbro proves tricky, because both operating and free cash flows have been weak over the last three years. If I use the current low figure of free cash flow, assume a 4% annual growth rate and utilize an 11% discount rate, and then add in the present value of the lesser of either tangible book value or cash (which is cash), I calculate an intrinsic value for the company of only $4 billion. The sum of free cash flows between 2006 and 2010 is roughly equal to net income over those same years, so if I go by that longer trend and assume free cash flow rebounds to higher levels, then the discounted cash flow analysis with the same growth and discount rates results in an intrinsic value calculation of between $5 billion and $6 billion. Overall, since the current market cap is around $4.3 billion, and I believe Hasbro is currently reasonably well positioned, I consider Hasbro to be mildly undervalued, and find the stock price reasonably attractive under about $35/share.

Full Disclosure: At the time of this writing, I have no position in HAS.

You can see my dividend portfolio here.

Sign up for the free monthly dividend investing newsletter to get market updates, attractively priced stock ideas, resources, and investing tips:

Well written. I “discovered” Hasbro through your previous analysis. I recently analysed the company and my conclusions were similar to yours. However I seem to be more sceptical to their digital games and TV-operation as I think its outside their core competence. In the 90ths Hasbro waisted alot of money trying to diversify into TV-games. I would much rather see that Hasbro kept a more narrow focus on boardgames and analog toys. Outsource the rest.

Good analysis, Defensiven. I went and read yours now that you’ve mentioned it.

I think the strongest advantage for them is growth in emerging markets rather than domestic licensing. I think that licensing is important for their board games (my whole office plays mobile Scrabble when they should be working :)), but for action figures and other games marketed to kids, I think international growth is key, and many products are unlikely to be replaced by digital content.

I’m not a big fan of their joint venture tv channel. Internet is the future; not television, and the venture is not making money.

Great stuff Matt.

HAS has been getting a lot of attention lately among dividend growth investors due to the potential value in the share price. I’ve had some discussions with fellow dividend investors over at Seeking Alpha on this one, and it seems you either believe it’s a value play or a value trap. There are a lot of questions surrounding this company relating to their ability to grow their business for the future using products that may be outdated a bit. I agree with you that kids will still be playing with Nerf guns and card games and board games for many years into the future, but at what rate? The key to dividend growth is earnings growth and revenue growth and one does wonder how much growth this company has looking out 10-20 years. As of now, I see little innovation and progression toward embracing the digital age. The valuation is compelling, but is the business model built to keep growing?

I think there is value here, but like you said it’s likely mild due to the likely lower earnings growth going forward. I think HAS could make a smaller ancillary holding in an already strong dividend growth portfolio. I have 23 holdings and this could easily make a smaller 24th holding, but that would be about it. I was thinking about making a run at HAS before the 3.45% pop today…but now am going to wait.

I’m glad you posted this today! It’s definitely one on my radar.

Best wishes.

Great comment, Mantra.

I agree on lower earnings growth going forward. I used a 4% growth rate in my projections, which when taking into account inflation and population growth in America, is little more than breaking even, and there is emerging market possibilities on top of that. So even with little to no “real” growth; the numbers make sense at the current valuation. Any growth on top of those figures would increase the difference between current value and intrinsic value.

Now, if Hasbro’s market position were to decrease over time, and cash flow were to decrease in terms of real dollars, then all bets are off, and it ends up being a value trap.

Funny, I bought HAS for $35 days after this article was written. Truly been an all-star for me – anything but a value trap! Currently sporting a 200% gain and 6.5% Yield on Cost.

Brands are everything. Long HAS!

hi, are you worried that the amount they spend on share repurchase is almost equal (and sometimes more than) their operating cash flow?

Hi Yan,

Thanks for the comment. In the “Balance Sheet” section of the article, I pointed out that the amount of share repurchases pretty much corresponds to the recent debt increase. In other words, Hasbro is buying back those shares by issuing debt. I believe they are doing this to take advantage of temporarily low interest rates.

Obviously, over the long term, a company cannot spend more on share repurchases than operating cash flow. If Hasbro wants to take advantage of low interest rates and buy back some shares, it makes sense quantitatively, but I find the level of extra debt unnecessary. Microsoft did this too, but they have a perfect AAA rated balance sheet that could easily absorb more debt, while Hasbro was already using a bit of leverage to begin with.

Short answer: Not worried, though I’m not a fan of it. It’s something to watch.