Summary

Harleysville Group Inc. (HGIC) is primarily an insurer of small businesses that operates in many states across the US.

Five Year Revenue Growth: <1% EPS Growth: Low or Negative Five Year Growth of Book Value: 7% Dividend Yield: 5.64% Five Year Annual Dividend Growth Rate: 15% Price-to-Book: 0.93 I find HGIC to be a solid value at the current price, with a sustainable and large dividend yield, and a solid financial condition. The lack of growth is a problem, but based on the trends and business model, I consider the rather low valuation to be justified and likely undervalued.

Overview

The premise behind an insurance company is that they spread risk out over a wide number of people and businesses. They collect premiums (payments) from clients and in return those clients are covered in case of a serious loss. From an insurance business standpoint, it’s ideal to collect more in premiums than you pay out for losses. This is not the primary form of earnings, though. An insurance business, after collecting all of the premiums, holds a great deal of assets that, over time, are paid out for client losses. An insurance company constantly receives premiums and pays out for losses, so as long as they are prudent with their business, they get to constantly keep this large sum of stored-up assets. As any investor reading this knows, a great sum of money can be used to generate income from investments, and that’s how an insurance company really makes money. HGIC invests its stored up collection of assets (approximately $3.3 billion in assets) primarily in fixed income securities, some of which are tax exempt.

The company consists of a collection of smaller, regional insurers under a common brand and a common risk pool. This means that HGIC’s companies benefit from the economies of scale that the larger company provides but also are streamlined and small to efficiently operate in regional markets.

HGIC primarily writes insurance for small and medium businesses (77% of premiums) but also has personal insurance business (23% of premiums). Industries range from car insurance to flood insurance to worker’s comp.

Revenue, Earnings, Book Value, and Metrics

HGIC is conservatively run, but has encountered similar issues to all other insurers over the last several years.

Revenue Growth

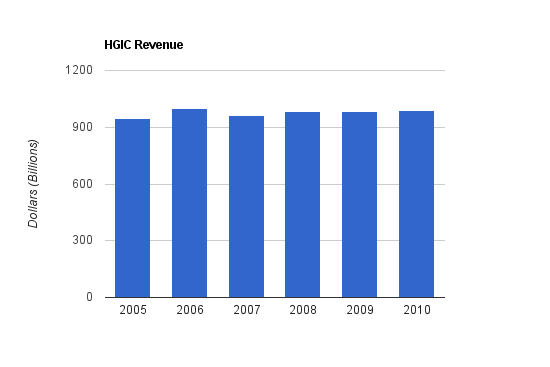

| Year | Revenue |

|---|---|

| 2010 | $986 million |

| 2009 | $981 million |

| 2008 | $985 million |

| 2007 | $962 million |

| 2006 | $999 million |

| 2005 | $948 million |

Revenue includes premiums written and investment income, among other factors. Revenue has had slow growth of less than 1% annually over the past 5 years, and the numbers for 2011 so far are worse than 2010, which will be discussed in the thesis section below.

Income Growth

| Year | Income |

|---|---|

| 2010 | $66.9 million |

| 2009 | $86.3 million |

| 2008 | $42.3 million |

| 2007 | $100.1 million |

| 2006 | $111.1 million |

| 2005 | $61.4 million |

Net income has grown by less than 2% annually over the past five years. Investment income is rather stable, but the subtraction from investment income from the insurance business, which varies depending on the profitability of that quarter or year, adds volatility to it.

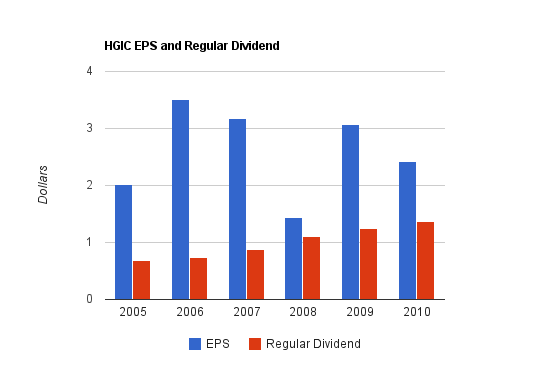

EPS has “grown” from $2.01 in 2005 to $2.42 in 2010, representing about 3.75% annual growth (along with the healthy dividend throughout this period), but EPS peaked in 2006 at $3.51, so depending on what time period one uses, EPS growth could be negative. EPS is well under $2 over the trailing twelve month period due to a major loss in the second quarter of 2011.

Book Value Growth

| Year | Book Value Per Share |

|---|---|

| 2010 | $28.42 |

| 2009 | $27.98 |

| 2008 | $23.18 |

| 2007 | $25.03 |

| 2006 | $22.49 |

| 2005 | $20.07 |

Book value per share has increased at an annual rate of over 7% over the past 5 years. Over this time period, the company increased its assets from $2.905 billion to $3.278 billion, which is an annual increase of two and a half percent annually. Total shareholder equity for the company increased from $614.4 million to $768.6 million, which represents an annually compounded rate of growth of four and a half percent. Book value per share has grown more quickly, because this growth of shareholder equity was accompanied by significant share repurchases, which divide the total company shareholder equity over a smaller and smaller number of outstanding shares.

Metrics

Price to Earnings: 15.3

Price to Book: 0.93

Combined Ratio: 102.5%

Dividend Growth

HGIC has increased the regular dividend for 25 consecutive years. The dividend yield is 5.64%.

Dividend Growth

| Year | Dividend | Yield |

|---|---|---|

| 2011 | $1.48 | 5.60% |

| 2010 | $1.37 | 3.40% |

| 2009 | $1.25 | 4.03% |

| 2008 | $1.10 | 3.05% |

| 2007 | $0.88 | 2.80% |

| 2006 | $0.73 | 2.35% |

Over the past 5 years, HGIC has increased its annual dividend by approximately 15% annually. The 2011 figure projects that their newly increased dividend will be paid again in the end of the year, which is a safe assumption. As can be seen from the table, the dividend yield is close to its high point of the past 5 years. The most recent increase, from $0.36 to $0.38, was a 5.5% increase, and is a more realistic figure going forward.

In addition to the regular dividends, HGIC paid out a special dividend of $1.44 in 2010, which more than doubled the dividend yield for that year. The most likely reason for this was that an expiration of US dividend tax cuts was coming at the end of 2010 unless extended, and there was uncertainty. The top dividend tax rate could have potentially increased from 15% to nearly 40%, so HGIC seems to have wanted to send money out when it was sure of what the tax rate would be. The tax cut ended up being extended for 2 years, however. But I’m sure investors appreciated the extra income.

Calculating the payout ratio for HGIC is a bit tricky. This is because, in 2011, they had an atypically bad quarter, which paints an unrealistic picture of EPS. In 2010, the company’s special dividend resulted in the total dividend exceeding EPS. But I believe a fair proxy for reviewing the payout ratio is to use the regular dividend and EPS for 2010, which works out to be a payout ratio of under 60%, which is reasonable for such a high yield. HGIC’s payout ratio has risen over time, so dividend growth going forward is not likely to be in the double digits, but the dividend appears to be rather safe. The company normally has extra cash to buy back shares, to grow the business, and in 2010, to pay a one-time large special dividend.

Share Repurchases

HGIC generally has significant net share repurchases, but so far in 2011 has not repurchased shares. They have instead raised the dividend for the 25th consecutive year despite having substantial storm losses, plus they drained some cash at the end of 2010 with that large special dividend, which benefited shareholders more than repurchases would have (unless the dividend was reinvested).

Portfolio

HGIC holds a conservative portfolio. As previously mentioned, an insurance company makes a lot of its earnings by generating income on its common pool of held money. Harleysville Group Inc holds most of its money in rated A investments.

48% of portfolio assets are held in Aaa rated investments.

39% of portfolio assets are held in Aa rated investments.

12% of portfolio assets are held in A rated investments

Only 1% of portfolio assets are held in investments rated below A.

The portfolio consists of:

43% tax-exempt municibles

25% corporates

14% mortgage backed securities

10% equity securities

5% US treasury debt

3% Cash equivalents

Investment Thesis

HGIC is currently attractively valued in my opinion. This is a difficult time for insurance companies, but HGIC is well-run and owns a conservative portfolio allowing it to weather the storm.

Over the Last Five Years

The numbers over the last five years look pretty dismal- essentially nonexistent growth of revenue and EPS, with modestly increasing book value. But in this period, there was the financial crisis, which hit almost all insurance companies hard financially. Their ROE is currently lower than the historical average, and revenue growth has stalled.

Taking a look at the details of the lack of premium growth can shed a bit of light. Between 2008 and 2010, net commercial premiums written decreased from approximately $779 million to $679 million, representing a decrease of nearly 13%. Of this, premiums for worker’s compensation took the biggest hit, which was an approximately 26% decrease. Meanwhile, over the same two year period, net personal premiums written increased from approximately $171 million to $203 million, which is an increase of more than 18%. Of this, personal automobile insurance had the best growth, of 27%.

The conclusion I derive from this that the lack of premium growth is not due to poor management. The company has grown where it has been possible to grow, which is the personal segment, but widespread poor economic conditions have reduced their commercial premiums, which represent more than three quarters of their business. In particular, increased unemployment has significantly reduced premiums for worker’s compensation, which is often more focused in blue collar areas which have been the hardest hit employment area. What this tells me is that as the housing inventory is gradually reduced, and economic growth hopefully returns along with mildly decreased unemployment, HGIC’s commercial premiums should stabilize and optimistically start to modestly grow, while personal premiums should continue to grow. The lack of premium growth is an economic problem rather than a business problem.

Storm Losses

If the above five-year charts don’t look good, the most recent numbers are worse. Revenue has had a moderate decline, while net income has decreased from about $67 billion in 2010, to only about $49 billion over the trailing twelve month period. This was due to a very bad recent quarter, where unprecedented storm damages caused $0.83 per share in catastrophic losses, which when balanced by the net gain from investment income, resulted in a quarterly loss of $0.43. The combined ratio for this quarter was a poor 125.2%. Per-share book value continued to inch up, and the company raised the dividend on schedule.

For what it’s worth, analysts currently predict HGIC to have fairly low EPS for 2011, due to these storm damages, but that 2012’s EPS will exceed EPS from 2010.

The Valuation

Overall, my thesis is this: There’s no evidence that anything is wrong with the business model, and based on the valuation, HGIC is a reasonable buy.

The trailing EPS has been reduced by this particularly bad quarter, and the stock now has a P/E of over 15, which is high for its peers. Normally HGIC has a slightly higher valuation compared its peers due to its superior quality (although still at a reduced valuation compared to the general market). But this isn’t the realistic price to earnings ratio, because EPS has taken a dip. Long-term investors care about what the long-term sustainable EPS and EPS growth is. Substituting 2010 EPS to check the current P/E, it’s around 11. Checking the forward P/E for 2012’s estimated EPS, which is unreliable but worth noting, is a bit over 9. The dividend yield is hitting a high note as well, but over the long term, the dividend is covered by earnings.

On a quantitative note, HGIC is selling at a historically low book multiple. The chart below shows, over the last decade, what the P/B ratio for HGIC was at year-end.

HGIC Price-to-Book

| Year | Price-to-Book |

|---|---|

| Current | 0.93 |

| 2010 | 1.29 |

| 2009 | 1.14 |

| 2008 | 1.50 |

| 2007 | 1.41 |

| 2006 | 1.55 |

| 2005 | 1.32 |

| 2004 | 1.22 |

| 2003 | 1.04 |

| 2002 | 1.25 |

| 2001 | 1.19 |

| 2000 | 1.50 |

Currently, the market is willing to pay less than book value for a company that, over the long term, makes money. HGIC has had a positive net income for 10 out of the 11 past years.

Over the last five years, HGIC stock has been fairly flat, but volatile. And the same is true over the last 12 months; the company hit a high of around $37/share at the end of 2010 after a sustained bull period when business was strong and when HGIC rewarded investors with a large special dividend in addition to their regular dividend and net share repurchases. Now in 2011, when market values have fallen across the board, and when financials were especially hard hit, and when HGIC had an atypically bad quarter (which does happen from time to time), HGIC is trading for under $27/share, despite the fact that essentially nothing about the business changed from a long term view.

That’s how the insurance business works. There are good years, and bad years, and the losses are tempered by the investment income. A well-managed insurer, which HGIC has proven itself to be over the years with its solid combined ratio, can weather some bad quarters.

In other news, Information Week rated HGIC the 21st most innovative information technology business in the United States. HGIC has been increasing their technology usage to make it easy for their agents to do business.

Insurance is a remarkably flexible business. When they bring in income, managers have a variety of options to get a decent rate of return. They can buy more investments and increase the size of the portfolio, or spend more to try to grow their premiums, or reduce debt, or pay higher dividends, or buy back shares. Some insurers, like Chubb (CB), have stated that their best rate of return currently due to the low-interest environment is to buy their own shares back.

Insurance is a difficult business right now, but I believe HGIC is well-positioned. The company should have better quarters ahead, and can direct capital towards dividends and repurchases, and although interest rates are going to stay low for a while, they should eventually increase, which will increase yields on future security purchases. For example, their investment income peaked in 2008 at $113 million, and at the end of 2010 was down to $103 million. This should eventually rebound.

Risks

As an insurance company, HGIC’s business is all about managing risk. Compared to many other insurers, HGIC is rather conservatively managed. Their investments are primarily high quality investments with reduced return and reduced risk. Their businesses use a common pool to spread risk out among the company.

The company is small, with a market capitalization of under $1 billion, which concentrates and increases risk to some extent.

HGIC faces risk of economic softness, weather risk, portfolio risk, and interest rate risk. Their product is essentially a commodity, which makes it near impossible to establish a strong economic advantage. This is why, for insurance exposure, I own two separate insurers.

Conclusion and Valuation

Bringing it all together, I believe HGIC is undervalued based on a number of reasons. Based on research, I find that lackluster growth has been due to unavoidable economic reasons rather than poor management. I believe the premiums should eventually stabilize and grow, as their commercial segment stabilizes, and as their personal segment continues successfully. I also expect that, although not in the short term, in the long term their investment income should rebound modestly.

With a price below book value, and a large and sustainable dividend yield, I find HGIC to be a value. At minimum, I think the stock is worth at least $30.

Full Disclosure: I own shares of HGIC and CB.

You can see my portfolio here.

Further Reading:

Walmart (WMT) Dividend Stock Analysis

Waste Management (WM) Dividend Stock Analysis

Pepsico (PEP) Dividend Stock Analysis

Energy Transfer Equity (ETE) Partnership Analysis

Emerson Electric (EMR) Dividend Stock Analysis

Though I like the dividend yield, the flat line growth is a cause for concern. I’m having this in my watch list.

Great analysis Matt. Your attention to detail is amazing. I’m better at saving money than I am analyzing companies, but I wish I had your talent.

I’m long HGIC, as you know. I agree with you on many points. Before I initiated a position I was concerned with the flat earnings/revenue growth. The things I found attractive about HGIC was the impressive yield and extremely shareholder friendly policy. I also found it to be a really well-run company, as you touched on quite a few times. I agree with you that the problems afflicting this company are a result of a poor economy, and not poor management. They have had a particularly rough year in terms of weather/payouts, as you touched on.

I’m not sure where to go with HGIC. It is already 4.6% of my portfolio, which I feel to be a bit heavy for a small-cap stock. I think long-term this is a strong buy. Short-term headwinds are going to be present, as they are going to be present with most companies local and global. We are both long-term investors, so I think a chance to buy a quality company below book value with a 5.7% entry yield is wonderful. Again, my personal circumstance gives me pause less because of the company and more because of the weight in my individual portfolio. I missed the boat on this one, as my cost basis is quite a bit higher than the current market price.

One question I have for you: is HGIC the best buy in the insurance space? One that has been on my list, that I don’t have a position with yet, is Aflac. They are trading at a forward P/E ratio of just 5. That 5 does not have a 1 before it. They have a high historical yield of over 3.5%. Their investments appear to be quite a bit riskier than HGIC, but at the same time their overall size allows them to weather larger storms better. I haven’t done an in-depth look at AFL, and some people are mixed on it. My feelings on it are the fact that they have no debt, and the earnings/revenue growth have been pretty strong. The dividend growth has also been very strong with a very low payout ratio to go with their 3.5%+ yield.

Again, I’m slightly hesitant on HGIC both because of the flat growth and because of the weight in my particular portfolio. I’d love to average down on it and decrease my cost basis, but I don’t want to go too crazy on a low-growth small-cap stock. I think long-term it’s a phenomenal buy because of the conservative management and very friendly shareholder remuneration. I’m thinking instead of initiating a position with AFL because of the low debt, strong growth, historically high yield and larger size.

I respect your opinion. What do you think?

Hi Mantra,

I’d say it’s difficult to compare HGIC and AFL. To be honest, I’d have to look more into AFL to have a better opinion. I’ve only analyzed it in a quick ideas article rather than an individual full analysis. https://dividendmonk.com/6-strong-companies-with-double-digit-dividend-growth/

Actually, it would probably be a good candidate for a full analysis now, since I like insurance, it’s got a 3.5% yield (much higher than two months ago when I took a look), and it has been considered a great business.

They’ve certainly got some headwinds, though. In addition to deregulation in Japan, I’ve read that they have stake in preferred shares of European banks, and sovereign European debt. I haven’t looked into how much.

I’m going to likely invest more capital into HGIC, but after that, who knows. I’m looking at NVS to put more money in, and also MSFT, INTC, and WMT as new (but familiar) positions. Plus I’m thinking of adding more capital to HCBK, since that’s also below book value (I got absolutely slammed on that one in 2011- worst performing pick in my portfolio). AFL may be interesting, and I definitely think it’s worth an analysis article. I imagine that would be a difficult one, and I think that even with a thorough analysis, some of the risks are not quantitative enough to be able to accurately sort through. Even Morningstar considers their fair value estimate to be of “very high uncertainty”, although they do give it 4/5 stars.

A big difference as far as I can tell is that in my opinion, while HGIC is facing purely economic challenges rather than fundamental business or market changes, AFL does seem to be facing a fundamental change in the form of deregulation, with the added question of European exposure which I’d have to look more into. Dealing with fundamental changes can be tricky. Actually that just makes me more interested to do an analysis article. :)

Thanks Matt. Like D. Mantra, I am long on HGIC so I appreciated the analysis. Picked it up for about $30-31 a bit ago and it’s about 5% of my portfolio so I also won’t be adding any but it would be nice to buy some at this more attractive valuation to average down. I agree that the lackluster growth and higher payout ratio are due to external factors and NOT poor internal management decisions. In general, financials are out of favor now BUT that could well represent a good buying opportunity ( Buffet’s greedy when others fearful adage comes to mind here). I agree w/ you that having two insurance stocks is prudent. Any suggestions? I’m specifically looking at SLF. A Canadian company focused on life insurance, it as a reasonable payout ratio w/ a high yield and is trading at a discount to it’s Graham Number and seems overlooked .

Hi Rock, thanks for the comment.

On Seeking Alpha, where this article was republished, I had some pretty mixed comments, as would be expected from a contrarian article. One of them in particular pointed out HGIC’s currently high payout ratio based on their bad quarter, and accused me of glossing over the problems, plus pointed out analyst views. Can’t please ’em all.

I agree with the idea of not putting more than about 5% of a portfolio into a company like HGIC that both you and Mantra pointed out. After all, it’s a smaller cap financial company, so I wouldn’t put all my eggs there.

As far as Buffett and being greedy when others are fearful, he’s been putting money where his mouth is by buying more Wells Fargo and doing a special preferred shares deal with Bank of America, and he’s also heavily in the insurance business with Geico and other companies, although his insurance is more towards consumers.

For suggestions, I can’t really make too many. I like HGIC and I like Chubb (CB), both portfolio picks of mine (people that don’t like low dividend yields and considerable share repurchases won’t like Chubb, though. However, their combined ratio is outstanding.) I also follow CINF, and while I love their moderate tilt towards equities in their portfolio, their extremely slow dividend growth and sustained high payout ratio (unlike HGIC’s current high payout ratio which is due to what should be short-term effects) are a problem. As Mantra pointed out, Aflac is interesting, but I’d have to look into it more. For SLF, I haven’t looked into it too deeply. They’ve got strong presence in Canada and US, and a bit of exposure to Asia, and as you pointed out, are trading at an appealing price based on dividend yield and price to book. Morningstar gives them 3/5 stars. I’ve seen SLF promoted by dividend investors before, so it might be a candidate for an analysis, like Aflac.

Thanx for the input Matt. Much appreciated.