Genuine Parts Co (GPC) is a service organization engaged in the distribution of automotive replacement parts, industrial replacement parts, office products and electrical & electronic materials. This dividend aristocrat has an interesting growth model combining small but recurring acquisitions added to internal growth.

-Seven Year Revenue Growth Rate: 3.80%

-Seven Year EPS Growth Rate: 5.72%

-Seven Year Dividend Growth Rate: 5.00%

-Current Dividend Yield: 2.33%

-Balance Sheet Strength: Strong

Overview

Genuine Parts (GPC) was founded in 1928 and is part of the dividend aristocrats. The company has increased its dividend payout for 58 consecutive years. The company shows around 37,500 employees across 2,600 operation sites.

Business Segments

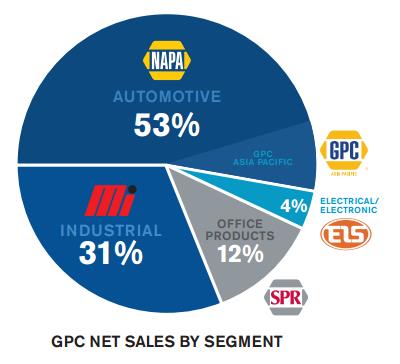

The company is divided into four business segments:

The automotive segment is the most important with 53% of overall sales. The company offers over 427,000 different parts through its UAP NAPA stores. They also market and distribute their replacement parts. GPC is also present in Asia under GPC Asia Pacific.

The industrial segment is operated under the Motion Industries brand. They distribute a variety of industrial parts such as bearings, mechanical and electrical power transmission, hose and hydraulic components. They are present in all kinds of industries from food and beverage to forest as well as healthcare industries.

The Office Products segment is headquartered in Atlanta and operates under the name of S. P. Richards Company. The company is engaged in the wholesale distribution of a broad line of office and other business related products through a diverse customer base of resellers.

The Electrical / Electronic Materials Group is the smallest GPC business division with only 4% of overall sales. It provides distribution services to OEM’s, motor repair shops, specialty wire and cable users, and a variety of industrial assembly markets.

Ratios

Price to Earnings: 21.86

Price to Free Cash Flow: 21.94

Price to Book: 4.31

Return on Equity: 20.88%

Revenue

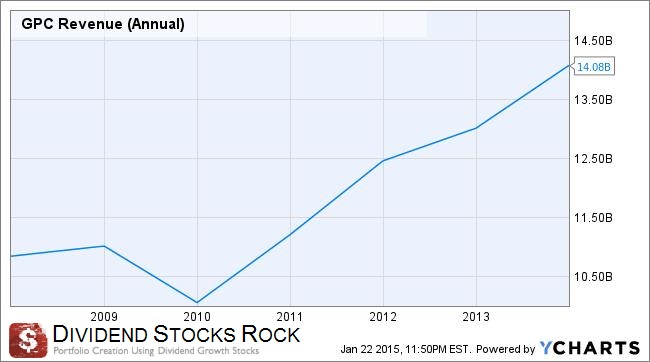

Revenue grew at a rate of 3.80% per year on average over this period. Since 2010, we have a steady uptrend as the economy strengthened. The automobile industry went through an important recession since 2008 but sales are now increasing. The automotive parts business is linked to the automobile industry and this is why GPC benefits from the current economic environment. The bulk of GPC’s revenue growth comes from its automotive part business while other segments have faced various challenges. The company has acquired smaller players in the industrial parts industry to boost their sales in the upcoming years.

Earnings and Dividends

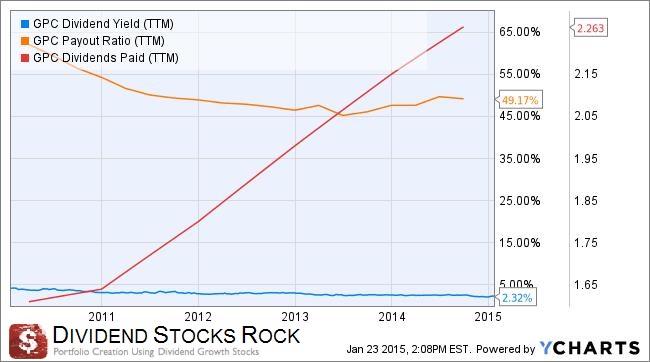

The previous graph explains how EPS growth is strong at GPC. While we have a continuously increasing dividend paid (red line), the dividend payout ratio slowly decreases (orange line). We also see how the dividend yield is slowly decreasing as well. This is a result of the stock price continuously increasing on strong quarterly announcements throughout the past five years.

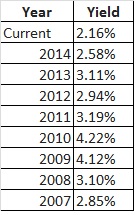

Approximate historical dividend yield at beginning of each year:

How Does GPC Spend Its Cash?

Genuine Parts shows a balanced model of acquisitions, shares repurchased and dividend growth. Their business model is based on buying small competitors each year. GPC benefits from exceptional integration abilities, turning their acquisitions into strong assets. In 2014, they bought Garland C. Norris, EIS, Electro-Wire and Impact products. GPC continually looks for companies to buy with revenues in the range of $25M to $125M. Small acquisitions ensure external growth each year without hurting the balance sheet too much.

The company also considers its investors. In 2013 it has repurchased 1.5 million shares and approved a 10.7 million share buyback program on December 31, 2013. In addition to stock buyback programs, the company also increases its dividend year after year.

Balance Sheet

Genuine Parts shows a strong balance sheet. GPC has a Debt to equity ratio of 1.385 and a current ratio of 1.536. Despites its history of acquisitions, goodwill counts for 10% of total assets.

Investment Thesis

Genuine Parts is a leader in auto parts and should benefit from the current positive economic environment in the US. The company is able to grow both from internal sources and through acquisitions. The low interest rate environment improves acquisition terms and facilitates GPC’s crusade to grow ever bigger.

While the auto part industry will continue to ride alongside US automotive growth, the industrial segment will benefit from a growing US GDP. Studies have shown that when the price of oil drops significantly, it has a positive correlation to US GDP growth. Since we expect a growth around 3.9% in 2015, the industrial segment will certainly strengthen.

You can buy GPC for its strong dividend growth as it continues to show potential. The automobile industry should continue to grow in 2015-2016.

Risks

While I like the numbers, I don’t like the fact that GPC fails to meet analysts’ estimates from time to time. They were too optimistic at the beginning of 2013 and raised their guidance to disappoint 9 months later with lower than expected results. Then again, the stock shows a low dividend yield around 2.25%, this might turn off some investors.

Also, longer manufacturer warranties prevent GPC from acquiring clients with relatively new cars. Since warranties are extended for several years, many car buyers tend to go directly to the dealership instead of buying parts from UAP NAPA.

Conclusion and Valuation

When you look at the metrics, you can see that sales, earnings and dividend payments are all going in the same direction. We also believe in the car industry for 2015. GPC is another strong dividend aristocrat that should continue to raise its dividend this year. The company shows a strong balance sheet and the ability to increase its dividend for years. GPC not only shows good results but it also grows by acquisition. Their ability to integrate new companies is reflected in their earnings which show a steep uptrend. GPC will continue to be a leader in its industry and we won’t lack for car parts in the near future. Now, we have to determine if GPC is trading at a good value.

Using the Discounted Cash Flow Analysis, we look at GPC as a simple money making machine. The point is to assess the value of the company by considering its cash flow generation capacity. Consider the EPS to continuously grow by 5% for the next five years and then by 4% and a discount rate of 9%, we have a stock value of $97.78 which is very close to the current value on the market.

The Gordon Growth Model can be used to estimate ranges of fair value for the stock. The dividend growth rate averaged 5% over the last seven years and we can expect the company will continue in that range. Due to the strong nature of the balance sheet, a conservative discount rate can be used to focus the fair value assessment on risk-adjusted returns.

Using an expected 5.5% dividend growth rate and a 9% discount rate, the fair value is only $69.33, which is under the current share price of around $98.50. Due to the low yield, the model is particularly sensitive, and reducing the discount rate to 8% boosts the fair value to $102. On the other hand, if the company was able to grow its dividend by 6.5% per year instead of 5.5% we would reach the current value ($97.98 with a discount rate of 9%).

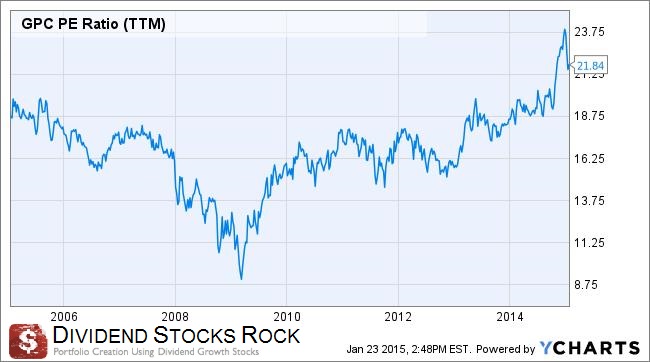

Finally, we can use the Price Earnings Ratio method. As we can see, GPC is not only trading over the S&P 500 historical average (between 16 and 17) but also around its highest valuation over the past ten years:

Considering the Gordon Growth model and the P/E ratio valuation, I tend to agree that GPC is currently overpriced. An investor could wait for a dip in the market before acquiring a position in GPC.

Full Disclosure: As of this writing, GPC is part of our DSR Portfolios.

Great analysis, very detailed and it spelled out your thought process very well. I agree with the final conclusion of the stock is over-valued and I have had my eye on GPC for a while now waiting for the dip in the price. The question is do you think the stock falls in the PG, PEP, JNJ, etc. class that you can always purchase at a premium and be okay. While it is a great company with a strong balance sheet and dividend growth history, I just do not see how it fits that mold. For me, it is just too low of a yield to purchase at a premium. But overall, I love the company and the industry, so you bet your bottom dolalr that I will be buying some GPC during their next pullback!

Again, great analysis! Keep up the great work.

Bert, One of the Dividend Diplomats.

Hey Bert,

thx for stopping by!

I think GPC yield is smaller because the company grows faster than it increase its dividend payment. While a dividend growth of 5% over the past 7 years is more than acceptable, the stock value did +121% over the past 5 years. Compare this to PG (+29%), PEP (+43%) and JNJ (+53%), GPC has been the best stock to hold over the past 5 years regardless if the yield is a bit smaller.

The fact they grow both internally and through acquisition makes GPC close to a growth stocks and not just a dividend payer. PG can’t really grow actively through acquisition as its industry is not as fragmented as auto part is. There are still plenty of small players waiting for an offer (Uni-Select UNS.TO just sold their US activity to the Icahn group in February).

Cheers,

Mike