General Mills (NYSE: GIS) is one of the largest diversified food processors in the United States.

-Seven Year Revenue Growth Rate: 5.8%

-Seven Year EPS Growth Rate: 6.2%

-Seven Year Dividend Growth Rate: 10.2%

-Current Dividend Yield: 3.16%

-Balance Sheet Strength: Leveraged but Stable

At around $42/share, GIS appears to be an unspectacular but fair long term investment.

Overview

General Mills (NYSE: GIS), founded in Minnesota in 1866, is a large international food company. The business controls over 100 leading brands, including Cheerios, Haagan-Dasz, Betty Crocker, Green Giant, Nature Valley, Hamburger Helper, Cocao Puffs, Totinos, and more. In 2011, General Mills acquired a controlling interest in Yoplait, an international yogurt brand that General Mills had already been licensing for years.

The company is one of the largest US food processors, and particularly has a huge set of breakfast cereal brands including the top brand, Cheerios. The majority of General Mills brands, both in cereals and in other categories, hold either the #1 or #2 market position. General Mills has facilities all over the world, including in North America, Asia, Europe, and South America.

US Retail: $10.5 billion in sales

The bulk of the revenue of General Mills comes from the US. Of this $10.5 billion, 22% comes from General Mills cereals, 20% comes from meals, 18% comes from Pillsbury US brands, 14% comes from Yoplait, and the rest comes from snacks and other items.

International: $4.2 billion in sales

Of this $2.9 billion, 43% comes from Europe, 24% comes from Asia, 23% comes from Canada, and 10% comes from South and Central America.

Bakeries and Food Service: $2.0 billion in sales

In addition to selling to consumers, General Mills sells $2 billion worth of products to bakeries, restaurants, and other businesses.

Joint Ventures: $1.3 billion in sales

General Mills holds a few joint ventures. They’re part of Cereal Partners Worldwide (CPW), and also have a joint venture with ownership of part of Haagan-Dasz Japan.

Ratios

Price to Earnings: 15.5

Price to Free Cash Flow: 14.8

Price to Book: 3.9

Return on Equity: 26%

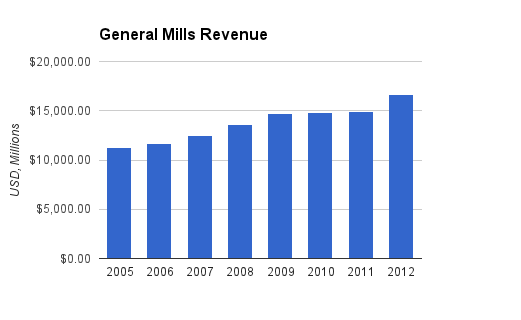

Revenue

(Chart Source: DividendMonk.com)

Revenue growth over this period has been substantial, at a 5.8% annualized pace. Some of this was due to the negative affect of significant inflation in input costs which were partially pushed through to the customer and the top line. In fiscal year 2012, their supply chain costs alone increased by 10%.

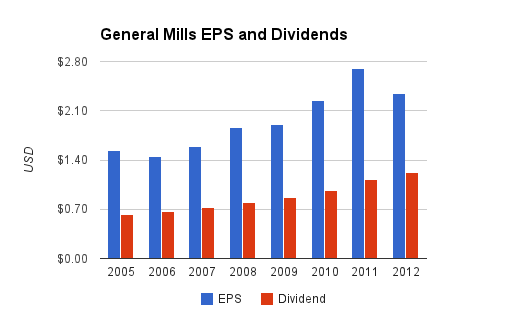

Earnings and Dividends

(Chart Source: DividendMonk.com)

These reported earnings are a bit volatile and the annual growth rate was only 6.2%. In their annual reports, GIS management provides adjusted EPS figures that exclude certain one-time items that shows a smoother growth rate, but I prefer to publish the reported figures. The EPS result from 2012 was fairly low which dragged down the annualized growth rate over this period, while the trailing twelve month EPS is back up to over $2.70. The ‘real’ EPS growth rate is therefore in the higher single digits.

Dividend growth has averaged over 10% per year over the last seven years, and the company is approaching 10 consecutive years of dividend growth. The dividend payout ratio from earnings and free cash flow are both slightly under 50% currently.

Approximate historical dividend yield at beginning of each year:

| Year | Yield |

|---|---|

| Current | 3.16% |

| 2012 | 3.0% |

| 2011 | 3.1% |

| 2010 | 2.8% |

| 2009 | 2.8% |

| 2008 | 2.8% |

| 2007 | 2.6% |

| 2006 | 2.8% |

| 2005 | 2.4% |

How Does General Mills Spend Its Cash?

For the fiscal years 2010, 2011, and 2012, GIS brought in a total of approximately $4.1 billion in free cash flow. Over that same period, the company spent approximately $2.2 billion on dividends, approximately $2.2 billion on net share buybacks, and approximately $1.1 billion on net acquisitions.

As far as the effectiveness of the buybacks is concerned, the company reduced its share count by nearly 20% over the past seven years.

Balance Sheet

General Mills has a total debt/equity ratio of approximately 1.2, a total debt/income ratio of a bit over 4.5, and an interest coverage ratio of a bit over 7. If goodwill is removed from the balance sheet, the company would have negative shareholder equity.

So the company uses a moderately high amount of leverage in a stable industry. From an investor’s perspective, I view the company has being appropriately leveraged for its situation.

Investment Thesis

Over the long term, the company has stated that it targets low single-digit sales growth, mid single-digit segment operating profit growth (meaning improved margins), high single-digit EPS growth (meaning continued share repurchases), a 2-3% dividend yield, and therefore low double-digit total shareholder returns.

The company, like most corporate food producers, has been on a “health trend” lately. This means that they market a subset of their products to match what the public currently views as being healthy (like whole grain cereals, Greek yogurt, fiber bars, Nature Valley products, and so forth).

Risks

Like any company, General Mills has risk. Food companies are rather defensive in nature, but they are vulnerable to increasing commodity costs (food costs, transportation costs, packaging costs, etc). Consumers can also trade down from brand names to generic food items. As an international company, there is currency risk as well. General Mills is in a pretty solid area, with strong brand names and a $27 billion market cap which gives it some scale, but I don’t view the business as having a very robust economic advantage.

Huge amounts of processed corn and wheat are in virtually all American diets these days, as well as in the diets of other developed areas. The US government subsidizes corn, wheat, and soy with billions of dollars per year, which allows farmers to produce those materials cheaply and in abundance. So General Mills is indirectly subsidized by the US Federal Government, because should those farm subsidies ever be reduced, altered, or eliminated, the input costs could rise substantially for General Mills, the volume of those materials may be reduced, and it’s possible that they wouldn’t be able to pass on the full price increase to consumers.

Conclusion and Valuation

When I analyzed General Mills last year, my conclusion was that at a price of around $40, the shares were reasonable but that there were better options out there, and that a lower P/E of 15 would be more appealing.

Over the last year, revenue increased, EPS faced some restructuring and commodity issues and has since rebounded, and the dividend grew. Now that the stock price has remained fairly static over the year (under $42 currently), I believe that the company value has somewhat caught up with the price, and that it’s a slightly more appealing investment than it previously was this time last year.

Company management expects to grow EPS at a high single digit annual growth rate for the long term, which I believe is a fair target based on their historical performance and their plan of mild revenue growth, margin maintenance, and buybacks. If the payout ratio remains roughly constant, then the dividend can be expected to grow at a high single digit rate as well.

Based on the Dividend Discount Model, an expected long-term dividend growth rate of 7% and a discount rate of 10% (a decent target rate of return) results in a fair price of approximately $46. The current price of under $42 provides a nearly 10% margin of safety to this calculated price, which appears reasonable. While it wouldn’t be my first choice for an investment currently, I think it’s unlikely that an investment in GIS at these prices would be disappointing over the long term.

Full Disclosure: As of this writing, I have no position in GIS.

You can see my dividend portfolio here.

Strategic Dividend Newsletter:

Sign up for the free dividend and income investing newsletter to get market updates, attractively priced stock ideas, resources, investing tips, and exclusive investing strategies:

Thanks for your analysis. Will you be adding this stock to your portfolio? Also thanks to your charts I realized or learned about another metrics I can use when evaluating stocks (EPS – dividend). As a graph it makes a lot of sense.

Nice analysis as usual. After reading through it, I’m inclined to agree that GIS is a middling company. I might consider buying it on a big dip, but otherwise I’ll probably keep looking for better purchases.

Great analysis! I’ve got a target entry around $37 so today’s prices are a little rich right now.

Hi Matt, thanks for such a wonderful blog you have created here. I appreciate your annotation of terms and charts. Thank you very much. It made me to know about some good points. Keep posting such useful stuff. Looking forward to your next informative post!!