DSR Quick Stats

Sector: industrial

5 Year Revenue Growth: -4.73%

5 Year EPS Growth: -31.80%

5 Year Dividend Growth: 14.87%

Current Dividend Yield: 3.06%

What Makes General Electric (GE) a Good Business?

First, a company with an emblematic founder named Thomas Edison. Second, a company that has been around for over one hundred years and that has been paying dividend for a century to its shareholders. Third, a company with an enormous portfolio of products and services operating across the world. The company counts 8 division among their “GE Store”:

- Power: combustion science and services, installed base.

- Energy connections: electrification, controls and power conversion technology.

- Renewable energy: sustainable power systems and storage.

- Oil & Gas: services & technology.

- Transportation: engine technology and localization in growth regions.

- Lighting: LED bulbs.

- Healthcare: diagnostics technology.

- Aviation: advanced materials, manufacturing and engineering products.

Which such a resume, you would think that GE should be the perfect holding for any dividend growth investors, right? The company is certainly a big player in several markets, but the drop of 31% of its earnings over the past 5 years concern me. Let’s dig further.

Revenue

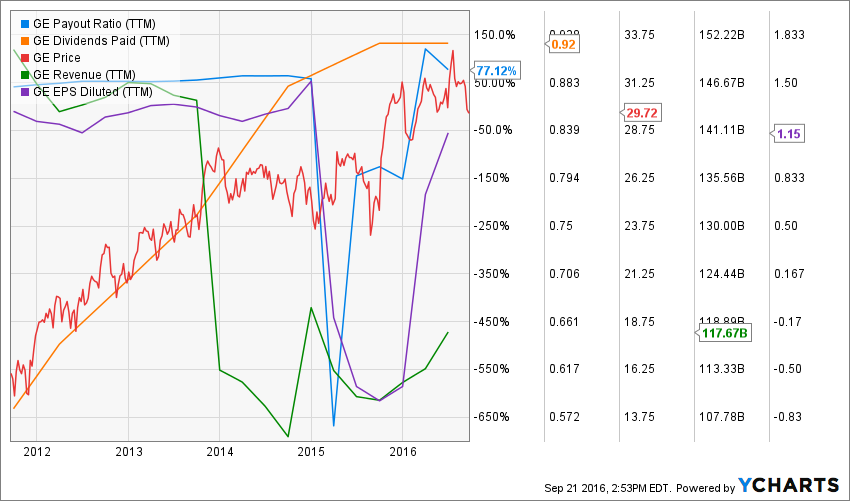

Revenue Graph from Ycharts

Since its record year in 2009, the company has been suffering greatly. The problem is that GE has become definitely too big to being handled properly. Several segments underperformed and wasted cash and human resources. Management has finally woke up and put effective measure to reposition their massive brand portfolio and show interesting perspective in the past couple years.

How GE fares vs My 7 Principles of Investing

We all have our methods for analyzing a company. Over the years of trading, I’ve been through several stock research methodologies from various sources. This is how I came up with my 7 investing principles of dividend investing. Let’s take a closer look at them.

Source: Ycharts

Principle #1: High Dividend Yield Doesn’t Equal High Returns

My first investment principle goes against many income seeking investors’ rule: I try to avoid most companies with a dividend yield over 5%. Very few investments like this will be made in my case (you can read my case against high dividend yield here). The reason is simple; when a company pays a high dividend, it’s because the market thinks it’s a risky investment… or that the company has nothing else but a constant cash flow to offer its investors. However, high yield hardly come with dividend growth and this is what I am seeking most.

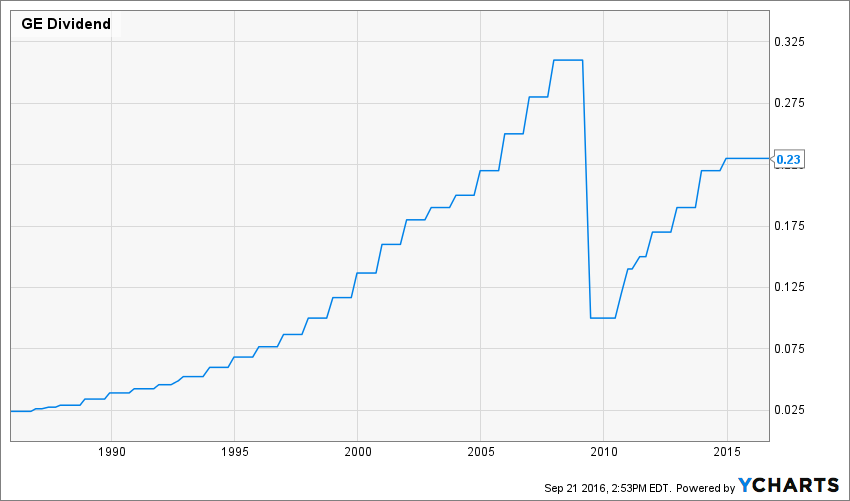

Source: data from Ycharts.

General Electric has posted a steady dividend yield around 3% over the past decade (excluding the short peak in 2009 following the recession). It is important to point out the dividend cut in 2009 as GE Capital business went south due to the 2008-2009 credit crunch. After this dark year, the company has put everything in place to grow back its dividend to its previous level.

GE meets my 1st investing principle.

Principle#2: Focus on Dividend Growth

My second investing principle relates to dividend growth as being the most important metric of all. It proves management’s trust in the company’s future and is also a good sign of a sound business model. Over time, a dividend payment cannot be increased if the company is unable to increase its earnings. Steady earnings can’t be derived from anything else but increasing revenue. Who doesn’t want to own a company that shows rising revenues and earnings?

Source: ycharts

As I mentioned in the previous chart, the dividend payment as greatly cut in 2009 bringing back the distribution past the 2000’s level. Since then, GE has made a honest effort to compensate their shareholders through 14 Billions in share repurchase and 4 Billions in dividend payment. Unfortunately, as the economy has slowed down in the past 18 months, GE is struggling again to post dividend growth.

GE does not meet my 2nd principle.

Principle #3: Find Sustainable Dividend Growth Stocks

Past dividend growth history is always interesting and tells you a lot about what happened with a company. As investors, we are more concerned about the future than the past. this is why it is important to find companies that will be able to sustain their dividend growth.

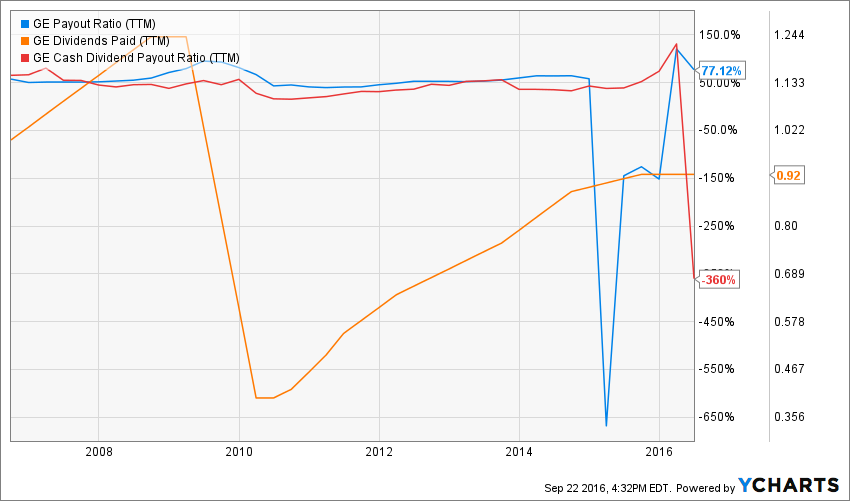

Source: data from Ycharts.

When you look at both payout and cash payout ratio, you understand why management has to remain cautious about their dividend increase. The payout ratio is steady high around 80% for year and the cash payout ratio is currently deep in the red. The company doesn’t show strong ability to sustain their payouts through the long haul.

GE doesn’t meet my 3rd investing principle.

Principle #4: The Business Model Ensure Future Growth

I think it’s unfair to judge General Electric solely on its metrics. The company still show several positive points throughout its business model. GE has made lots of effort to aligned its various segments in order to create additional synergy. GE is offering more services to its partners and customers in order to assist clients in buying and using GE products. There is definitely room for growth in this area.

The second growth vector GE presents is its strategy to develop the Chinese market. The country will continue seeking for renewable energy, more mass transportation and affordable healthcare due to the size of its population. Those are all areas GE can play a role. For this reason, the company is heavily implementing activities in this region and also works through partnerships with Chinese company.

What General Electric does with its cash?

GE management is well aware they must do something to keep their investor on board. This is not by fluke they have used 18 billions to repurchase shares and hike their dividend in the past few years. GE is also investing massively in their R&D departments in order to keep their edge against their competitor. Since they are active in various industries, it requires lots of cash flow to innovate everywhere.

GE is also using a part of its cash flow to make acquisitions. They have recently purchased Alstom to penetrate the European market as well as Arcam and SLM Solutions to use their technology and become a bigger player in Europe as well.

GE has a strong business model and therefore meet my 4th investing principle.

Principle #5: Buy When You Have Money in Hand – At The Right Valuation

I think the perfect time to buy stocks is when you have money. Sleeping money is always a bad investment. However, it doesn’t mean that you should buy everything you see because you have some savings aside. There is a valuation work to be done. In order to achieve this task, I will start by looking at how the stock market valued the stock over the past 10 years by looking at its PE ratio:

Source: data from Ycharts.

After declaring a loss in 2015, GE PE ratio has greatly jumped from its previous average. At this point, it seems to me that the market truly believe GE will be able to go against the current challenging environment and generate additional growth in the future. I’m not convinced enough to pay over 25 times its earnings…

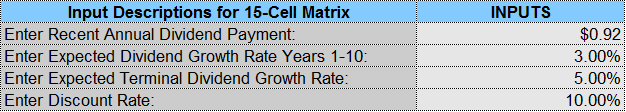

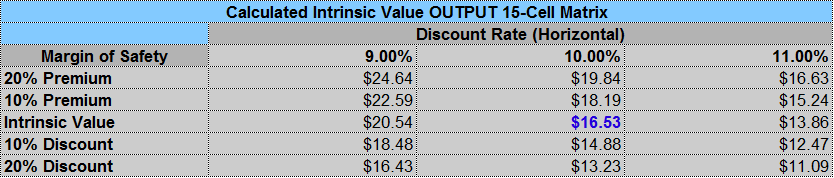

By using the dividend discount model, I will have a better idea if GE, as a money distributor, worth my money. I think GE will struggle to increase its dividend over the inflation rate for the first 10 years. For this reason, I will use a 3% dividend growth rate. As a terminal rate, I will use 5% as I think the company has a strong plan and will eventually post revenue and earnings growth. The discount rate I use is 10% since GE raises various concerns at the moment.

Here’s the detail of my calculations:

Source: Dividend Monk Toolkit Excel Calculation Spreadsheet

As you can see, GE is definitely not valued as a dividend growth stock. The market truly believes in the company and thinks it will post solid growth in the future. However, there is nothing right now justifying its current value as a dividend growth investor perspective.

GE doesn’t meet my 5th investing principle.

Principle #6: The Rationale Used to Buy is Also Used to Sell

I’ve found that one of the biggest investor struggles is to know when to buy and sell his holdings. I use a very simple, but very effective rule to overcome my emotions when it is the time to pull the trigger. My investment decisions are motivated by the fact that the company confirms or not my investment thesis. Once the reasons (my investment thesis) why I purchase shares of a company are not valid anymore, I sell and never look back.

Investment thesis

If GE is able to generate additional cross selling between its divisions and is able to benefit from future growth in China, this play will become a strong holding for many years to come. An investment in GE today is a vote of confidence in GE management team and its ability to realize its strategy. GE is big enough to reverse the current trends and post several years of growth ahead.

Risks

Unfortunately, there are a lots of “if” in my investment thesis. On the other side, the oil & gas industry is hurting GE revenue as well as the separation from GE Capital, a hectic, but highly profitable division. It will take years for others industrial segment to compensate GE Capital financial performance. Finally, GE is not generating the expected synergy with the acquisition of Alstom. It seems they have a more challenging time integrating this company to their current business model.

GE shows more risk than a strong investment thesis and doesn’t meet my 6th investing principle.

Principle #7: Think Core, Think Growth

My investing strategy is divided into two segment: the core portfolio built with strong & stable stocks meeting all our requirements. The second part is called the “dividend growth stock addition” where I may ignore one of the metrics mentioned in principles #1 to #5 for a greater upside potential (e.g. riskier pick as well).

Having both segment helps me to categorize my investments into a “conservative” or “core” section or into a “growth” section. I then know exactly what to expect from it; a steady dividend payment or higher fluctuation with a great growth potential.

At this time, I can see why there is an interest in GE shares. If all starts are aligned, GE could post solid financial results in a few years from now and reward their shareholders big time. However, it must be taken as a risky play, not a guarantee you will see your money grow.

GE is a growth holding.

Final Thoughts on GE – Buy, Hold or Sell?

In all honesty, GE is not worthy of my money. If I was holding this stock in my portfolio, I would sell it right now. In the industrial sector, I would rather purchase 3M Co (MMM) or Honeywell (HON) way before GE. There are too much uncertainties and too many “if’s” before getting my money back. GE plan to grow is seductive, but it’s just not enough. You can definitely find strong companies elsewhere.

Disclaimer: I do not hold GE in my DividendStocksRock portfolios.

Disclaimer: The opinions and the strategies of the author are not intended to ever be a recommendation to buy or sell a security. The strategy the author uses has worked for him and it is for you to decide if it could benefit your financial future. Please remember to do your own research and know your risk tolerance.

Its just really hard to grow your dividends when your earnings are going backwards, unfortunately.

GE strikes me as a collection of companies, some of which are excellent and would be better off as stand alone companies. In particular, I’ve always thought the Power and Energy connections businesses would be great standalone companies. I’d love to see what a really focused and incentivised management team could do with those businesses!

Great article.