Now that the U.S. election is over, the “Fiscal Cliff” dominates American news.

Now that the U.S. election is over, the “Fiscal Cliff” dominates American news.

This article provides a quantitative overview of the American economy as it relates to this event, a bearish (but constructive) outlook for your portfolio, and an example of some potentially good stocks to buy and personal finance decisions to take.

What is the Fiscal Cliff?

The ‘Fiscal Cliff’ refers to an upcoming simultaneous set of events at the start of 2013 where taxes will go up on just about everyone and large and disorganized across-the-board federal spending cuts will kick in. Lawmakers from both the Republican and Democratic parties publicly wish to avert this, but are locked in gridlock on how to address it and stop it from occurring. If Congress does nothing, the Fiscal Cliff happens, because the various laws are already in place to expire. To avoid it, Congress and the President would have to agree on a delay or a real solution.

Here’s a breakdown of the main events that would occur:

Bush Tax Cuts Expire

The tax cuts enacted during Bush’s presidency will expire, which means income tax rates across all brackets will go back up to where they were a decade ago, and capital gains and dividend taxes will go back up to where they were a decade ago. This affects everyone, but it has a larger impact on wealthier citizens, because capital gains taxes would revert back to 20% from the current position of 15%, and dividend taxes would revert back to your ordinary income tax rate (up to around 40% in the highest tax bracket) from the current low point of 15%. The estate tax exemption would shrink as well. The expiration of the Bush tax cuts is the single largest part of the Fiscal Cliff, accounting for over a third of the total changes.

Obama Tax Cuts Expire

There were tax cuts enacted during Obama’s first term that reduced payroll taxes for the middle class. These would expire at the same time. This is another large part of the Fiscal Cliff.

Sequestration

Back in 2011, the United States Congress imposed a crisis on itself by potentially refusing to increase the debt ceiling unless actions were taken to reduce the deficit. Ultimately, no real compromise was agreed on by the Republicans and Democrats, and so their last-moment decision was to give themselves more time. The debt ceiling was allowed to go up to avoid a government shutdown, but $110 billion per year in across-the-board cuts to discretionary spending were agreed upon to occur unless the deficit could be reduced in the meantime, split evenly between defense and non-defense spending.

Neither party actually wanted these cuts to occur: they picked cuts that neither party wants to occur in order to make compromise desirable to avoid them. Republicans as a group don’t want defense cuts, and Democrats as a group don’t want these non-defense cuts. Even those that do want to cut both of those things generally agree that these particular cuts are undesirable due to how sloppy they are. Rather than targeted elimination of wasteful spending, they’re across-the-board cuts that were determined in the final hours of an agreement. The discretionary defense spending consists of various projects, but the specific projects to cut are not known. The discretionary non-defense spending consists of various cuts to organizations such as the Department of Transportation or Department of Agriculture. Disorganized sequestration cuts of $110 billion are the other one of the top three big parts of the Fiscal Cliff.

There also a variety of other things that would change that each make up a smaller component of the Cliff, including an end to federal emergency unemployment insurance and a reduction in Medicare payment rates for physicians.

The federal deficit is currently over $1.2 trillion. The Congressional Budget Office estimates that if the Fiscal Cliff does not occur, the deficit will remain high and the economy will grow by 1.3% in 2013. If the Fiscal Cliff does occur, the deficit would be reduced by around $500 billion, but the economy would shrink by 0.5% into a recession and would cause unemployment to increase to over 9%.

Why Can’t Congress Agree?

In general, most Democrats want a mix of tax increases and spending cuts to fix the deficit, while most Republicans are in favor only of spending cuts to fix the deficit.

From the Democrats perspective, the president wants what has been coined as a ‘Grand Bargain’. Back in 2011, in an attempt to avert the debt ceiling crisis, President Obama proposed the $4.7 trillion ten-year package to reduce the deficit, which consisted of a combination of spending cuts and expirations of tax cuts. Since it had more than 2x as much spending cuts as tax cut expirations, some Democrats were not in favor of the idea but overall it had Democratic party support. The Republicans rejected it due to its inclusion of tax increases. Now in late 2012, the president and many Democrats are again in favor of a mix of revenue increases and spending cuts, with Obama insisting this time that he will veto a bill that does not include some expirations of tax cuts for the wealthy. The primary position for the Democratic party is that they’d prefer the tax cuts for wealthier citizens to expire while preserving some of the tax cuts for the middle class.

From the Republicans perspective, many want to reduce taxation as a percentage of GDP, and therefore reduce government spending. Over 90% of the Republican members of Congress have signed a pledge that says they will not under any circumstances increase taxes. This means they cannot increase tax rates, and cannot cut loopholes unless they balance those loopholes dollar for dollar with reductions in tax rates, unless they’re willing to go back on their pledge. In the post-election environment, Republican majority leader John Beohner has suggested that while they will not agree to tax rate increases, they are now open to some revenue increases from reducing loopholes.

If the parties cannot agree by early 2013, tax rates and government revenue go up and spending cuts occur. The magnitude of these tax increases is larger than the magnitude of the spending cuts. Overall tax rates would be similar to a decade ago, because it’s mostly due to an expiration of tax cuts enacted under presidents Bush and Obama.

The Bearish Argument: A Very Long Negative Trend

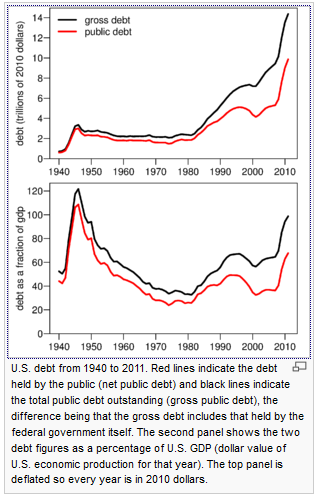

Over the last three decades, the National Debt as a percentage of the Gross Domestic Product (GDP) has been growing. In contrast, for the three decades prior to that going back to the end of World War II, absolute national debt was fairly static while the economy grew, meaning that debt as a percentage of the GDP was shrinking. But starting in the early 1980’s and continuing through most years until today, debt has been increasing wildly:

An Increase in National Debt

Image Source

The debt levels are getting to a concerning level. Fortunately, Treasury interest rates remain particularly low, the U.S. has control over its own currency (unlike the Eurozone countries in default risk), and debt as a percentage of the GDP is not yet within range of an inherently problematic level. But it’s a trend that has to reverse itself at some point.

Essentially, a government deficit is a stimulus, especially if it’s from foreign money. A stimulus (like the one under President Reagan or the one under President Obama) is basically a euphemism for a deficit, except that deficits are unfortunately a common annual thing these days and a ‘stimulus’ is a larger, intentional deficit to provide a bigger economic boost. But just about any deficit is a stimulus.

When the federal government spends more than it taxes for, it is generally providing a boost to the economy for that year. (Exactly what it is spent on determines the efficiency of it.) All of this spending on defense, health care, roads, and social security goes to millions of worker salaries: federal workers, soldiers, government contractors, employees of companies that make products consumed by this process, etc. If this spending is much larger than the amount of taxes extracted from the economy due to borrowing from foreign sources, then it’s an insertion of capital into the economy (and one that has to be paid back). The deficit spending, especially if it comes from foreign money, is a boost to the baseline natural economic conditions, since money is basically being taken from outside of the economy and put into the economy. Of course, red ink accumulates on the balance sheet when this is done; there’s no free lunch.

The Shrinking Net International Investment Position (NIIP)

This is a lesser-known figure, and it’s about foreign capital. The NIIP for the United States is a comparison of how much foreign assets are owned by Americans compared to how much American assets are owned by foreign sources. For example, if you’re an American that currently owns some Novartis stock (a Swiss company), then you currently own a chunk of Swiss assets. But if you sell your Novartis stock and buy U.S. treasuries or Coca Cola stock, then your total amount of assets have remained unchanged but America’s NIIP has been reduced slightly. This can happen with millions of individuals, and it can happen with institutions or organizations like banks or foreign governments.

Until the mid 1980’s, the NIIP was a positive figure, meaning that Americans owned a larger chunk of the rest of the world than the rest of the world owned of America. Over the last 25+ years, however, the situation has deteriorated, and as of 2011, the U.S. has a NIIP of around negative $4 trillion. This represents approximately 25% of our GDP in that year.

In some ways, the trend is worse than it appears due to the types of assets owned. Americans own more equities of other countries than foreign sources own of American equities. But U.S. treasuries are popular in other countries, which account for a significant chunk of the foreign-owned assets. In other words, the types of assets that Americans own of other countries are riskier than those owned by foreign sources and provide better long-term returns. The rate of return of American holdings of other countries has been superior to foreign-owned American assets over the last two and a half decades, and yet the overall NIIP has deteriorated. What this means is that the actual cash flows have been the driving force of the deterioration. Foreign sources are buying more and more U.S. assets while Americans are not doing the same magnitude of purchases externally.

The summary of the NIIP here is that not only is the U.S. national debt increasing, but that it’s increasingly foreign-owned. Over the past generation, deficit spending has partially come from foreign borrowers or from reductions in the amount of foreign-owned assets that Americans would have otherwise bought.

The Modern Economy: Natural, then Artificial

If we define the ‘Modern Economy’ in the United States as being the period from after the second world war in 1946 until 2012 and counting, then we can divide it into two almost even periods. (Use the previous National Debt chart as a visual for this.)

The first period is the 35 years from 1946 through 1980, spanning presidents Truman, Eisenhower, Kennedy, Johnson, Nixon, Ford, and Carter, where federal debt was held relatively constant and where the economy grew, which resulted in a decrease in debt as a percentage of the GDP. Trade was fairly balanced, and the NIIP was positive.

Overall, this first period was a time of building a foundation of wealth. Economic expansion was largely natural.

The second period is the 32 years from 1981 through 2012, spanning presidents Reagan, Bush I, Clinton, Bush II, and Obama, where federal debt began increasing rather significantly, which resulted in an increase in debt as a percentage of the GDP. The only time during this period when there was not a significant deficit was in Democratic President Clinton’s second term with a Republican Congress, where the country had rather balanced taxation and spending, and where the internet boom provided strong economic activity.

Overall, this second period was a time of withdrawing from the previously established foundation of wealth and propping up our economy with it a little bit each year. The GDP growth each year was a natural baseline combined with an addition of an annual stimulus (federal deficits, including foreign capital infusions). But of course all of those deficits resulted in accumulation of national debt and reducing our NIIP. The debt got bigger, foreigners owned larger portions of that debt, and the ratio of American ownership of foreign assets shrank compared to foreign ownership of American assets.

The reason the Fiscal Cliff is projected to result in a double-dip recession by the CBO and so many economists if it occurs is that when we remove our deficits, we take away this artificial part of our economy. Our current economy is being propped up by deficit spending that equals about 8% of our GDP. Those deficits have to be fixed sooner or later to avoid ruin, and therefore this removal of artificial economic boost has to occur sooner or later. The Fiscal Cliff only cures about 40% of it, and does so in a disorganized, abrupt, and inefficient manner.

A precise estimate of how significant the overall long-term problem from this second period is would be difficult to determine even by a room full of experts on the subject. One way to begin an estimate of it is to extrapolate the CBO’s estimate for this Fiscal Cliff. The CBO estimated that avoiding the Fiscal Cliff and keeping the deficit high would lead to 1.3% GDP growth in 2013. They estimated that if the Fiscal Cliff occurs and the deficit is reduced by around $500 billion, then -0.5% GDP growth would occur in 2013. If reducing the deficit by 40% results in a 1.8% swing in the GDP, then extrapolating it to the full deficit results in an estimated loss of 4.5% of GDP. This doesn’t sound like much, but it’s slightly larger than the magnitude of the 2008-2009 recession.

In other words, although the exact numbers would be difficult to determine, the “artificial” portion of the U.S. economy that is fueled by unsustainable foreign capital infusions into federal deficits is at least a few percentage points of America’s cumulative GDP. There’s no telling when this would reveal itself and retract to the baseline “real” GDP, or whether it would be abrupt or gradual, because lawmakers get to decide those things based on their spending and revenue agreements, but it’s worth being aware of. The party has to end at some point in order to have a sustainable national balance sheet again, which means a time when debt as a percentage of GDP is no longer increasing.

A Corporate Example

Macroeconomics is a hugely complex subject.

To illustrate and simplify this macroeconomic phenomenon over the modern economy, we can use a corporate example to represent what America has done. This would be familiar for people who follow along with the dividend stock reports on this site.

Suppose, as an example, we have a company that sells hamburgers in 1946. It has a leveraged balance sheet but strong business operations. So from 1946 through 1980, the board of directors and CEOs work together to grow and strengthen the company. Over time, they grow revenue and earnings substantially, and they pay off as much debt as they issue, so the overall debt remains static. Since the company is growing and debt is static, their overall debt metrics such as the debt/equity ratio or debt/income ratio improve substantially. The company accumulates cash and investments on its balance sheet, pushes debt to very low levels, and grows very large.

Then from 1981 to 2012, the company is under different management. (The late seventies and early eighties were a time of recession, so they change course.) The company starts leveraging itself. They reduce assets on their balance sheet relative to the size of the company, and they accumulate debt on the balance sheet. The company is growing naturally, but they’re also boosting this growth through debt. Debt is being used to make acquisitions, perform internal capital spending to accelerate organic growth, or buy back stock. The problem is, in 2012, the company now has a very leveraged position. They keep having good growth rates, but a lot of the growth isn’t natural and sustainable; part of it is from taking money from outside of the system in the form of debt, and using it as a stimulus to their growth. But most of the employees and managers enjoy this growth obviously, and don’t want it to stop.

Eventually there’s a reckoning, and the company has to stop boosting its performance by increasing leverage, and instead focus on holding leverage stable or reducing it. They’ve tapped out their balance sheet. This would reduce the company’s growth, and maybe even set it back a few years. But it’s not because these corrective actions harmed the company; it’s because these corrective actions put a stop to the unsustainable portions of growth. Without those unsustainable injections of capital from increasing debt, genuine growth was a bit lower than it appeared to have been.

This is basically the course the United States has taken, quantitatively. During this second stage of withdrawing from our assets and increasing national leverage from foreign sources, part of our growth was unsustainable. Removal of most of the deficit, which has to happen at some point to avert ruin whether in the form of changes in taxation or spending or both, appears to harm the economy, but only because it eliminates the unsustainable and artificial part of the growth, leaving only the baseline state.

How to Prepare

I don’t know whether Congress and the President are going to smooth out and rationalize this fiscal cliff or not. We could go on deficit spending for years unfortunately accumulating more debt, or it could be addressed sooner. Regardless of when deficit reduction occurs, the two main ways to prepare for this are to invest conservatively, and invest often. While this article is somewhat bearish because it describes how fixing the deficit can provide a much-needed road bump to eventual genuine growth and stability, the upcoming issue of the dividend newsletter this weekend is going to point out some bullish aspects of the baseline natural economy.

Invest Conservatively

Any valuation of a company should take into account the observation that the current U.S. economy is being propped up by deficit spending equal to about 8% of GDP, with a part of it being directly or indirectly from foreign investments.

An increase in taxation, especially to the middle class, means that there’s less spending money to buy things (houses, furnishings, cars, candy bars, premium laundry detergent, shoes, electronics, etc.), which impacts consumer companies and then trickles to companies that do business with those companies.

A decrease in federal spending means fewer people receiving salaries directly or indirectly from deficits (fewer federal workers, fewer contractors, fewer purchases of products from any company that ever sells to the government or a government contractor, etc.), which again means less spending on things.

A lack of tax increases combined with a lack of federal spending cuts means continued accumulation of red ink on the federal balance sheet, which means interest takes up a larger and larger portion of the national budget. One, or the other, or both have to occur.

So, use the Dividend Discount Model or another valuation method to buy stocks at conservative prices. If the valuation requires too many positive assumptions to justify the price, then consider letting it go. Right now I’m interested in:

International Consumer Giants:

McDonald’s (MCD)

Yum Brands (YUM)

Index funds for International Exposure:

Vanguard FTSE All-World Ex-US ETF (VEU)

Blue-Chip Technology and Engineering Companies:

International Business Machines (IBM)

Emerson Electric (EMR)

Illinois Tool Works (ITW)

Dover Corporation (DOV)

Energy and Infrastructure:

Exxon Mobil (XOM)

Chevron (CVX)

Brookfield Asset Management (BAM)

Kinder Morgan Inc. (KMI)

Companies with High Shareholder Yields:

Chubb Corporation (CB)

Becton Dickinson (BDX)

Free analyses reports can be found on most of these businesses and others in the reports section:

Reports of the Best Dividend Stocks

(Full disclosure: Long NVS, KO, MCD, IBM, EMR, XOM, CVX, CB, BDX, VEU)

Whenever an investor is unable to find stocks at attractive valuations, several alternative investments exist:

1) Increase cash and bond positions to wait for opportunities that meet your long-term entry criteria.

2) Reduce any existing debt (student debt, mortgage, etc.)

3) Invest in rental property if real estate valuations are reasonable and if this fits your goals.

4) Sell cash secured puts to get paid to wait for better stock prices.

Save and Invest Often

Specifics of portfolio maintenance are only one aspect of wise long-term wealth accumulation. The much larger role is to ensure that you have outstanding personal finance habits. It doesn’t matter if a portfolio A beats portolio B by one percentage point per year, if the person behind portfolio B is flooding their investment account with 3x as much fresh capital every year.

The main thing here, if you haven’t done so already, is to shift the career mindset towards a wealth accumulation mindset. In a globally connected world where automation and outsourcing compete with increasing numbers of jobs, the goal of working from age 18 to age 65 and then retiring comfortably just isn’t a safe bet anymore for a lot of people. Rather than letting expenditures nearly equal your income with only minor retirement savings, it’s wise to drastically accelerate this process. Aim for financial independence in your 30’s or 40’s, or within 10 years from wherever your current age is, so that work becomes optional after that point.

It’s great to have a job and career your enjoy, and it’s even better for that job to be optional due to wise saving and investing habits that lead to substantial growing passive income.

Strategic Dividend Newsletter:

Sign up for the free dividend and income investing newsletter to get market updates, attractively priced stock ideas, resources, investing tips, and exclusive investing strategies:

Fiscal Cliff….? Does everybody in America suffer from amnesia? There is no Fiscal Cliff. An agreement was made and a law was passed by our corrupt and incompetent Congress (which by the way resulted in the US losing its AAA credit rating) that spells out a list of tax changes that are to occur beginning in 2013. Its scope and stupidity is not unlike the laws passed at the end of the Clinton Administration and in the beginning of the Bush Administration that legalized financial terrorism and fraud culminating in the 2008 Financial Meltdown and Housing Industry Debacle. You voted for these people, this is what They gave you…. along with 500,000 dead Iraqis, 3,000,000 dead Vietnamese, 5,000,000 thrown out of their homes, and a plundered Social Security System just to mention a few things that may jog your memory. You may want to take a closer look at your media induced amnesia and try to get a grasp of who the real terrorists are.

I’d prefer the comment section not to be used for wide-ranging rants about politics. This site is about investing, not politics.

When people write articles about macroeconomics on the internet, even when trying to keep it as non-partisan as possible, it always pulls in people ready for a political fight.

Dear Matt….its not a rant at all. Its about the manipulation of investment sentiment and memory itself for the purpose of exploiting ordinary people perhaps like you and I. Not unlike those who were hyped into buying everything from Apple at 700 to Facebook at 38. We’re now supposed to react to the the non-existent physical cliff like good sheep, whose memories have become so impaired that we can’t think back beyond the last 15 seconds. Truth has become so distorted and obscured there is almost nothing left to rely on but occasional flickers of intuition.

If you read the article, it’s more about long term trends than any recent event.

You’re welcome to reply to the article, but so far your comments haven’t been about it.

Wow! That was one of the best written articles I have seen in a while. Well done!

Wonderful explanation. Articles like these make me glad I’m subscribed to your newsletter.

Excellent article! Thanks again for the great information you always supply. I look forward to it every week.

Epic article. Truly epic.

Really enjoyed this post. Fantastic lot of information here.

I personally plan on changing nothing. I’ll continue to invest large swaths of my income in defensive, high quality, holdings and insist on a margin of safety. Even with reduced growth rates, I believe this is truly the best way to navigate just about any macroeconomic situation.

Rocky waters doesn’t mean you abandon ship. Every day can’t be sunny and calm.

Best wishes!

I agree. I’m not changing any investment procedures.

The main purpose was to point out a three-decade trend rather than a short term stormy situation, in addition to providing a bit of info on this current event.

In fact what you’re doing- aiming to retire at 40 through accelerated investment, is absolutely correct in my view.

Outstanding read. I’m sorry I didn’t get to this sooner this week. I certainly believe infrastructure and energy companies in the U.S. stand to do VERY well after the fiscal cliff is averted.

Mark

Thank you for the thoughtful article Matt. I totally agree with your advice to buy stocks at conservative prices. We should always try to buy stocks at prices that offer a margin of safety below its intrinsic value. In addition, I like to use a tactical asset allocation where I increase my cash in times of great risk and/or high valuations.

Avoiding large portfolio drawdowns should the highest priority of investors. It’s only a little painful to not fully participate in a rally; it is DEVASTATING to a portfolio to lose a large percentage of your capital. I believe most investors invest too aggressively because they don’t fully understand the laws of compounding and how destructive losses can be.

This fiscal cliff is just one of many reasons to be extra careful right now.

Great post, as usual. I’m finding myself digging deep into my strategy of income investing and holding on for the long term. It seems to me that the current yo-yo of the market presents more than a few attractive opportunities for folks that are investing for quality, rather than to make a quick buck.

Thanks for the insight. Keep it up.

Excellent article. I do have a question. I’m a DG investor as you are but I have to wonder–if the government is propping up the GDP by 8%, and at some point in the future can’t continue this policy, how is investing in strong companies going to help us? In such a severe economic down turn even strong companies won’t be able to sustain dividend payments at the levels they do now. So even though the company may survive, if the dividend doesn’t, aren’t we up a creek? Especially considering that if you want to live on dividend income a significant amount of your net worth must be invested in these companies. Thoughts?

Hi Steve, a few points:

-The deficit is around 8% of GDP but not all of it is from foreign sources of capital. So I find it doubtful that eliminating the deficit would result in 8% reduction in GDP. For example, as mentioned in the article, the Congressional Budget Office expects that a 1.8% GDP reduction would occur from reducing the deficit by 40% (which translates into a -0.5% GDP change for that year as opposed to their baseline assumption of 1.3% without that reduction).

-Virtually any deficit reduction would occur gradually rather than abruptly. For example, going over the Fiscal Cliff would reduce the deficit in the ball park of 40%. If Congress reaches a deal to avert the cliff it would probably be less than that. If/when a real housing recovery occurs, that would probably take away some deficits. If they do some longer-term fixes to Medicare, or put a freeze on defense spending, that would chip away the deficit some more.

-Trying to time it would be next to impossible. This post could have been written 5 years ago with the same argument, because it’s an issue that’s been in the making for decades. I don’t know if lawmakers are going to start reducing the deficit in the near term, or if they’re going to let it go on for years. If I had knowledge of when a recession is going to occur for sure, I’d short the market right before it, but I don’t have that knowledge and virtually nobody does.

-Most dividend champions survived the previous recession without dividend reduction. Many large dividend payers have considerable international exposure. Some of them like Coca Cola or Colgate get far more revenue from abroad than from the U.S. I’d recommend holding some foreign holdings anyway, and to have some assets in other asset classes, to spread risk around.

-Nothing is guaranteed. Catastrophic disasters, warfare, damaging cosmic events, irreversible environmental degradation, major terrorist attacks, revolutions, major debt defaults, hyperinflation, can permanently disrupt an economy. I hope those things don’t happen, but there’s not many places to put money if they do. It’s not like fiat currency would hold value under those circumstances. A diversified base of real estate, equities (especially shareholder friendly companies like dividend stocks), some bonds, cash, etc. diversified across countries seems the most sensible position to me to weather any storm that’s possible to weather. Deficit reduction, in comparison, is certainly manageable.

Wow. Insights like those are why I check your blog weekly. Thanks!!

Wow Matt! Thx for the great article. This is an important topic that has an impact on our investments, but one that is difficult to discuss. It is a very complex, highly charged political subject and you do an admirable job of presenting it in an objective, non-partisan fashion that sheds “light” (insight) on it rather than generate useless “heat” (rancor). I think we need more of this in our national discourse and it is exactly the reason I would rather get this information and knowledge from your website than watch most cable news. Of course, generating that “heat” generates their ratings I guess.

Anyhow, I’m guessing that taxes on dividends will probably NOT increase for those making less than 200-250K per year. Of course, we won’t know for sure until the dust settles on the details of the negotiation. BUT, for sake of agreement, let’s assume that is the case and they increase ONLY for those above that income range. I’m suspecting that most dividend investors who write and read on DG blogs are retail investors who make less than that. They, therefore, will not be directly affected by the tax increase BUT what I am wondering is would such a tax policy discourage dividend paying companies from paying dividends and instead use that cash to do other “things” to reward investors (for ex, share repurchases, etc.). I am really curious as to your thoughts on this.

Thx again for the article and your input and have a great Thanksgiving.

Thanks for the comment.

As for tax policy discouraging dividend paying companies, I covered that exact topic in the August issue of the newsletter, so I’ll link to that here:

https://dividendmonk.com/august-2012-strategies-for-changes-in-investment-taxation/