Summary

Exxon Mobil (NYSE: XOM) is one of the largest public companies in the world, and focuses on oil and gas exploration.

-Five-year Revenue Growth: 4.4%

-Five-year EPS Growth: 4.4%

-Dividend Yield: 2.37%

-Five-year Dividend Growth: 7.7%

-Balance Sheet: Extremely Strong

Overall, I consider the current stock price of under $80 to be a solid buy.

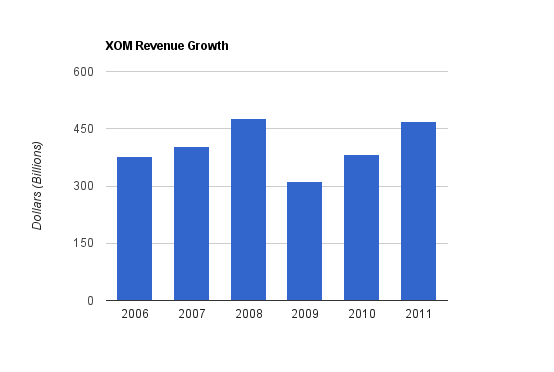

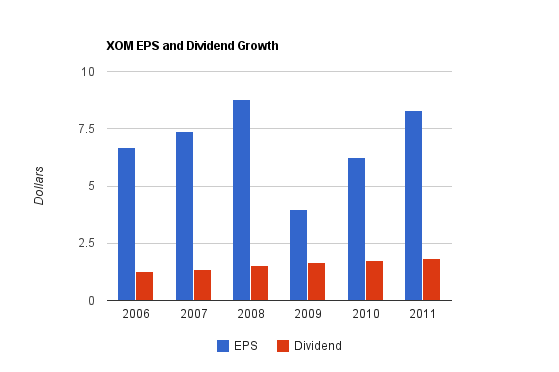

The charts below show revenue, EPS, and dividend growth over the last five years, with the most recent year, “2011” on the chart representing the trailing-twelve-month period.

Overview

Exxon Mobil (NYSE: XOM) is a well-known, extremely large, energy company. The company has upstream, downstream, and chemical components, oil, natural gas, and other businesses, and operations in countries all over the world. So Exxon Mobil is diversified by energy type, location, and industry.

The company has oil-equivalent reserves of 84 billion barrels according to its own estimates (non-proved). 14.6 billion of this was added during the 2010 fiscal year. Proved reserves increased by 3.5 billion oil-equivalent barrels in 2010, which was more than twice the amount of oil-equivalent barrels that the company produced during the year.

2010 Earnings Breakdown

Exxon Mobil reported net income of over $30 billion in 2010. Their segments are Upstream, Downstream, Chemical and Other/Corporate. Upstream, Downstream, and Chemical provide positive profits, while Corporate/Other reduces total profits somewhat due to necessary expenses.

Upstream

Upstream includes exploration, development, and production of energy sources.

In 2010, Upstream accounted for $24.1 billion in earnings. In previous years, this peaked as high as $35 billion and typically has been over $25 billion. At $14.85 in 2010, Exxon Mobil earns more per oil-equivalent barrel than their competitors. During highs and lows, Exxon Mobil has consistently outperformed competitors in this metric due to its size and efficiency.

Upstream also accounts for the highest capital expenditures, with over $27 billion spent in 2010. Key exploration captures in 2010 included acreage in Argentina, Canada, Iraq, Tanzania, Turkey, Texas, and Arkansas. The company currently owns substantial acreage on every continent.

Downstream

Downstream includes refining, marketing, power, lubricants, and specialties.

Earnings for 2010 for the downstream segment were $3.6 billion. This is higher than in 2009 but substantially lower than the mid-decade highs.

Chemical

Earnings for the chemical segment for 2010 were $4.9 billion. It was a record year for the company’s chemical business. Although all of XOM’s activities generally result in superior returns on capital compared to their competitors, it is the Chemical business that has the largest quantitative advantage in returns in 2010. In addition, the company’s 2010 report stated that it is expected that the commodity chemical market will grow by 4-5% per year over the next decade, which is higher than the expected global GDP growth rate by a substantial margin.

For the trailing twelve month period, the Chemical segment has seen moderate decreases due primarily to a difference in taxes, and secondarily due to a mild decrease in volume.

Revenue, Earnings, Cash Flow, and Metrics

Exxon Mobil has experienced growth followed by a significant drop and rise in oil prices over this five-year period.

Revenue Growth

| Year | Revenue |

|---|---|

| TTM | $470.0 billion |

| 2010 | $383.2 billion |

| 2009 | $310.6 billion |

| 2008 | $477.3 billion |

| 2007 | $404.5 billion |

| 2006 | $377.6 billion |

Revenue growth has averaged about 4.4% per year over this period, although the growth was highly erratic due to the financial crisis and volatile commodity prices.

Earnings Growth

| Year | EPS |

|---|---|

| TTM | $8.29 |

| 2010 | $6.24 |

| 2009 | $3.99 |

| 2008 | $8.78 |

| 2007 | $7.36 |

| 2006 | $6.68 |

EPS has also grown by about 4.4% per year over this period, and earnings were also highly erratic.

Operating Cash Flow Growth

| Year | Cash Flow |

|---|---|

| TTM | $57.7 billion |

| 2010 | $48.4 billion |

| 2009 | $28.4 billion |

| 2008 | $59.7 billion |

| 2007 | $52.0 billion |

| 2006 | $49.3 billion |

Operating cash flow grew by a bit over 3% per year on average over this period. Free cash flow is rather strong as well, but changes significantly between years. FCF hit a peak of about $40 billion in 2008, a bottom of about $6 billion in 2009, and over the trailing twelve month period is a bit under $28 billion.

Metrics

Price to Earnings: 9.6

Price to Book: 2.6

Price to CF: 6.6

Price to FCF: 13.8

Return on Equity: 27%

Dividends

Exxon Mobil is a dividend aristocrat and has been increasing its dividend every year since 1982, making it one of the more reliable dividend stocks. The company is currently yielding 2.37% with an earnings payout ratio of under 25%.

Dividend Growth

| Year | Dividend |

|---|---|

| 2011 | $1.85 |

| 2010 | $1.74 |

| 2009 | $1.66 |

| 2008 | $1.55 |

| 2007 | $1.37 |

| 2006 | $1.28 |

Over these last five years, XOM has grown its dividend by approximately 7.6% per year, on average.

Share Repurchases

Exxon Mobil maintains a fairly low payout ratio, and puts a considerable amount of cash flow towards buying back their own shares. This has several outcomes:

1) It divides dividend payments and net income over a smaller and smaller pool of shares, therefore accelerating EPS and dividend growth.

2) Increasing EPS should result in increasing stock price unless the valuation decreases.

3) It is good for management pay packages (targets, options, etc)

4) It results in a lower dividend yield than many competitors.

5) It means a lot of capital goes into buying back the stock when oil is at a high price, and that less capital goes into buying back stock when oil is at a low price. In other words, buy more stock when the stock is expensive.

Overall, I feel that XOM does dividend repurchases better than most companies, since they do them year after year and decrease the number of shares significantly over time, but I would very much prefer an extra point of dividend yield or more in exchange for less capital put towards share repurchases. XOM’s sum of dividend yield and dividend growth barely equals 10%, and I think this figure would be a bit higher if more emphasis was placed on the dividend.

A more thorough overview of the quantitative effects of XOM’s share repurchases, along with a lively comment discussion, can be found here.

Balance Sheet

Exxon Mobil has a superb balance sheet, with a total Debt/Equity ratio of around 0.10 and an extremely high interest coverage ratio.

Investment Thesis

XOM’s 2010 energy outlook estimates that global energy demand will be 35% higher in 2030 than it was in 2005. This number takes into account both increasing energy demand, and increasing energy efficiency. The result is that while the report expects the developed world to continue to need more power, this extra power consumption will be offset by energy efficiency to result in a nearly static energy consumption rate. In the developing world, however, energy efficiency is not predicted to offset increase in consumption, and so total world energy demand is expected to increase.

The report also estimates that natural gas consumption will increase at an annual rate of 2.0%, which is faster than the anticipated growth of oil consumption (0.7%), and coal consumption (0.7%). If this is accurate, then natural gas will be the second largest contributor to global energy, after oil, in 2035. The company made a very large natural gas acquisition in 2010, and has turned itself into the largest producer of natural gas in the US.

XOM employees 16,000 scientists and engineers, of which over 1,000 have PhDs. The company leads in safety metrics, and has steadily decreased the number of work-related incidents over the last decade. In addition, the company has a Return on Equity metric that exceeds most competitors, despite the fact that Exxon Mobil’s balance sheet is among the least leveraged in the industry along with Chevron.

Although the company’s largest segment is Upstream, XOM is more diversified than some of its competitors, with substantial percentages of total profits coming from downstream and chemical businesses. With consistently superior metrics, such as return on equity compared to competitors, XOM showcases its economic advantage due to scale and expertise.

Risks

Exxon Mobil’s profits are largely determined by oil prices and natural gas prices, so that’s the key risk that investors take on with XOM stock. In addition there is regulatory risk, currency risk, and the ever-present risk of a major catastrophe or litigation. A long-term risk is the increasing viability of alternative energy sources, and only time will tell if Exxon Mobil can continue to reshape itself as it has in the past when dealing with a world of changing energy. In my view, XOM’s increased focus on natural gas has reduced its long term risk.

Conclusion and Valuation

Exxon Mobil has consistently maintained a higher return on capital for their upstream, downstream, and chemical segments than their competitors for the last several years through the highs and the lows of the industry. Net income has increased over the trailing twelve month period to over $40 billion; considerably higher than the reported 2010 figures.

Overall, I expect XOM to be a solid long-term investment based on consistent superior returns, growing dividends, unrivaled scale, increasing energy demand, a shift towards natural gas production thanks to the XTO acquisition (which added 60 trillion cubic feet of natural gas to XOM’s resource base and made them the largest producer of natural gas in the US), a particularly strong balance sheet, and a diversified production base.

At the current XOM stock price of under $80, I’m a buyer.

Full Disclosure: I own shares of XOM and CVX.

You can see my portfolio here.

Get the Dividend Stock Newsletter:

Sign up for the free monthly dividend investing newsletter to get market updates, attractively priced stock ideas, resources, and investing tips:

Solid post! Im also a buyer at these levels

Great stuff Matt!

I think XOM is a solid long-term bet. I wish they’d raise the dividend a bit more instead of spending so much on stock repurchases, but overall a great energy play. I’d buy more if energy wasn’t already 24% of my portfolio as I also have holdings with CVX, COP and TOT.

Excellent post. I just wish I had a few grand to invest right now. Fully-in, little cash to buy.

Is that a good thing? In another few months, I’ll have some funds.

Would have liked to own MCD, but WAY too high in price now.

I’d like to see XOM improve their dividend growth rate. If they stay in line with it’s current dividend growth rate they’ll only have a 2.6% yield next year assuming that the stock price remains at current levels. Any appreciation in the stock price obviously drives down the yield. I’m a buyer if they increase their annual dividend to $2.5 per year for 2012 and stay committed to returning more income to shareholders.

XOM is about 6% of my portfolio weighting. I bought in at $71 and doubled down at $59 last year so I’m really excited to hear you’re bullish on future prospects below $80 a share.

*Phew*

This is a lot if information it’s complete. For my part i bought

Last year @59. I would like to see payout ratio go to

40%. they can pay it. In this market i want at least a 3% yield.

Sfi

It is best not to trade penny stocks if you value your money. Having said that, pick and pcashrue at random 10 or more different stocks and watch them intently over a period of time. After a time most will not move or crash. You may be able to salvage 1 or 2 winners out of the lot. Do this on a small scale(dollar wise) and see if you can make money doing this. The trading fees can kill you if you trade too much. You can also watch a few that have demonstrated wild swing in price over a relatively short time period. You can possibly then predict when the price goes down to it’s normal level, and when it tends to have a quick, short rise. Purchase accordingly if you spot predictable patterns.References :

Thanks for finally talking about >Exxon Mobil Corporation (XOM) Dividend Stock Analysis <Loved it!