Dover Corporation (NYSE: DOV) is a collection of several businesses that develop engineered components and systems.

-Seven Year Revenue Growth Rate: 4.8%

-Seven Year EPS Growth Rate: 10.4%

-Seven Year Dividend Growth Rate: 10.0%

-Current Dividend Yield: 2.30%

-Balance Sheet Strength: Moderately Strong

The current price for Dover stock in the low $60’s appears reasonable for an expectation of 10% long-term returns. The yield is low at only 2.30%, but this dividend stock has the third-largest stretch of consecutive dividend increases on the market.

Overview

Dover Corporation (NYSE: DOV) is a $8+ billion revenue business that acts as a conglomerate of several smaller business units.

In the 2011 annual report, the company is described as existing as four operating groups.

Communication Technology

In this segment, Dover manufactures electro-mechanical devices for communications. The end users of these products are roughly balanced between the five industries of Communication, Life Science, Aerospace/Industrial, Telecom/Other, and Defense. Slightly more than half of revenues come from Asia, and the key brands/companies for this segment are Knowles Electronics, CPC, Sargent, Vectron International, Airtomic, K&L, and Sound Solutions. This segment as a whole contributes 17% of Dover’s total revenue.

Energy

Dover manufactures a variety of products for the energy industry, ranging from diamond cutters to winches to valves. Key brands/companies include Norris, Quartzdyne, TWG, OPW, and US Synthetic. More than three quarters of revenue of this segment comes from North America. Dover’s Energy segment contributes 24% of total Dover revenue.

Engineered Systems

This segment focuses primarily on fluid products and refrigeration products. Warn, Hill Phoenix, and Wilden are some major brands/companies. Nearly 70% of the revenue is from North America. This is Dover’s largest segment, since it contributes 39% of Dover’s total company revenue.

Printing and Identification

Dover produces bar code printers and other devices in this segment. Electronics, fast moving consumer goods, and Industrial are the three end-markets. Only a quarter of revenue comes from North America, with both Europe and Asia providing a larger amount of revenue to this segment than North America. Everett Charles Technologies, Dek, and Multitest are major brands/companies. 20% of Dover’s revenue comes from this segment.

These operating segments were valid as of a year ago, but more recent information on the company, as of November 2012, is that certain product lines serving electronic assembly and test markets will be divested, and the five operating segments of the company will be Energy, Refrigeration and Food Equipment, Communication Components, Product Identification, and Fluids.

Ratios

Price to Earnings: 13

Price to Free Cash Flow: 15

Price to Book: 2.1

Return on Equity: 18%

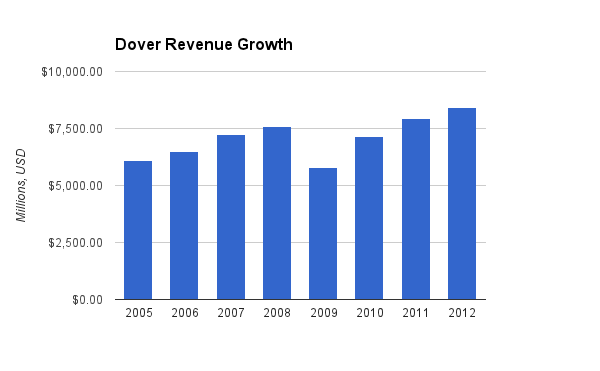

Revenue

(Chart Source: DividendMonk.com)

For these two charts, the 2012 figures are the trailing twelve month (TTM) figures (nine months of 2012 and the last three months of 2011). The average revenue growth over this seven year period is 4.8% per year. The recession brought on a large decrease in revenue, but apart from these macroeconomic conditions, Dover’s revenue growth performance has been consistent.

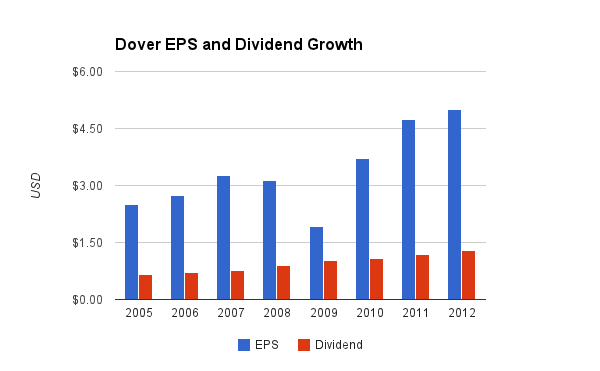

Earnings and Dividends

(Chart Source: DividendMonk.com)

Dover doubled their EPS figures over this seven year period, which translates into an annualized growth rate of 10.4%.

The dividend yield is rather low, at only 2.30%. Many engineering companies such as Dover Corporation, Emerson Electric, and Illinois Tool Works have some of the longest stretches of dividend growth in the world, despite being in a cyclical industry, because they keep their dividend payout ratios manageable. This allows them to weather recessions even when earnings temporarily fall dramatically. In fact, I’m only aware of two companies in the world with longer stretches of consecutive annual dividend growth than Dover Corporation at 56 years.

The dividend growth rate over the last seven years averaged 10%, which leads nearly to a doubling of the dividend every seven years. Reinvesting dividends accelerates total dividend growth for the shareholder.

Approximate historical dividend yield at beginning of each year:

| Year | Yield |

|---|---|

| Current | 2.30% |

| 2012 | 2.2% |

| 2011 | 1.9% |

| 2010 | 2.3% |

| 2009 | 2.9% |

| 2008 | 1.7% |

| 2007 | 1.5% |

| 2006 | 1.6% |

| 2005 | 1.6% |

How Does Dover Spend Its Cash?

During the fiscal years 2009, 2010, and 2011, Dover brought in a cumulative total of over $2.25 billion in free cash flows. Nearly $1.2 billion was spent on acquisitions over this period. A bit over $600 million ($0.6 billion) was spent on dividends, and over $350 million ($0.35 billion) was spent on share buybacks.

Balance Sheet

Dover’s balance sheet is solid. The total debt/equity ratio is only 40%, which is below average. However, 75% of the existing shareholder equity consists of goodwill due to the acquisitions that Dover does.

The total debt/income ratio is under 2.5x, and the interest coverage ratio is around 10x. These numbers are rather strong; the company can pay its interest on debt ten times over with operating income.

The overall view of Dover’s balance sheet is that it’s rather strong. The only comparatively weak spot is the large amount of goodwill from their acquisitions, which balances against their other strong debt metrics.

Investment Thesis

The primary business approach of Dover is to make targeted acquisitions and then to use the size and scale of the company to develop additional efficiency and earnings. With its scale, the company can reduce duplication, standardize its processes, and increase volumes from its acquired companies. For nine out of ten dividend stocks out there, I don’t usually view large acquisition expenditure with a pleasing eye, but this industry of engineering companies like Dover is one set of businesses that historically performs acquisitions very well.

Small and medium businesses have the advantage of flexibility which can allow for substantial growth, but their weakness is that they don’t have the large diversification and capital for economic or business setbacks. Large businesses have the advantage of diversification and a strong financial position, but have less flexibility and growth. Dover runs a set of fairly independent businesses that share the common pool of capital, which spreads risk out.

During the fiscal years 2009, 2010, and 2011, Dover made 21 acquisitions, although approximately half of that was spent on Sound Solutions, which was their largest acquisition in history. Dover occasionally buys these medium-sized businesses, but usually performs smaller acquisitions that can be considered add-ons to existing companies in the organization.

In November 2012, the company announced that it will divest non-core businesses serving the electronic assembly and test markets. They will then use proceeds from these divestitures along with free cash flow to buy back $1 billion worth of common stock over the next 12-18 months.

Dover doesn’t have a history of large share repurchases, since they primarily use cash for acquisitions and dividends instead. However, in the 2007-2008 period, they did spend considerable value on share repurchases and it resulted in a reduction of the share count of 203 million down to 189 million. The upcoming repurchase plan, if enacted, should considerably reduce the share count and boost the EPS for this year.

Risks

Dover, like most engineering companies, is a cyclical business. Their products are purchased mainly by businesses rather than consumers, so purchases can be delayed during bad economic times. Dover’s revenues and earnings drop considerably during periods of economic weakness, only to rebound once again when the economy improves. During all times and through these periods, Dover keeps a moderately low dividend payout ratio so that the dividend can be sustained during periods of low earnings. For this reason, despite existing in a cyclical industry, the company has built the third longest stretch of dividend increases that I’m aware of in the world.

Due to the diverse collection of businesses operated by Dover, most threats to the company appear to be macroeconomic rather than business-specific. No single customer represents 10% or more of Dover revenues, and no single customer even represents 10% or more of the revenues from any of Dover’s four segments. Double-dip recessions and weak business spending negatively can affect Dover, however.

Conclusion and Valuation

Dover Corporation is a strong collection of smaller businesses that have produced great returns for the past five decades. The company’s business model focuses on making consistent small and medium acquisitions with good valuation methods as well as growing existing businesses organically. Remaining cash is paid in dividends or occasionally used to buy back shares.

The usual Dividend Discount Method isn’t ideal here due to the low yield. Nonetheless, at the current price in the low $60’s based on the model, the dividend growth rate only has to be sustained at around an 8% annualized rate or higher in order to allow for 10% long-term returns. Compared to the current dividend growth rate of 10%, and the latest increase of over 11%, Dover is well on this path.

Discounted Cash Flow Analysis, based on the current figure of around $750 million per year in free cash flow, an estimate of $300 million per year spent on acquisitions, and 5-6% annualized FCF growth (based on recent trends), reveals a somewhat more conservative fair value in the range of $50-$65.

Taking the two methods into account, the current price at under $61 appears to offer a reasonable value for long term returns. If the company continues to manage capital well to produce at least high single digit dividend growth coupled with a low single digit dividend yield, and the company does not face unexpectedly problematic macroeconomic conditions outside of its control, then double digit returns can be expected over the long term. As a cyclical engineering business, the stock should be moderately volatile.

Full Disclosure: As of this writing, I have no position in DOV. I am long EMR.

You can see my dividend portfolio here.

Strategic Dividend Newsletter:

Sign up for the free dividend and income investing newsletter to get market updates, attractively priced stock ideas, resources, investing tips, and exclusive investing strategies:

[…] The five operating segments of the company are Energy, Refrigeration and Food Equipment, Communication Components, Product Identification, and Fluids. The full analysis from a few months ago is available here. […]