Summary:

In 2016 YUM! Brands will spin-off its Chinese division into YUM! China for the benefits of investors.

The New YUM! will rely on a very strong cash flow generation business model with 96% of its restaurants operated by franchisees.

Since the transformation is not yet completed, there is still a buying opportunity that has presented itself.

DSR Quick Stats

Sector: Consumer Cyclical – Restaurants

5 Year Revenue Growth: 2.93%

5 Year EPS Growth: 3.63%

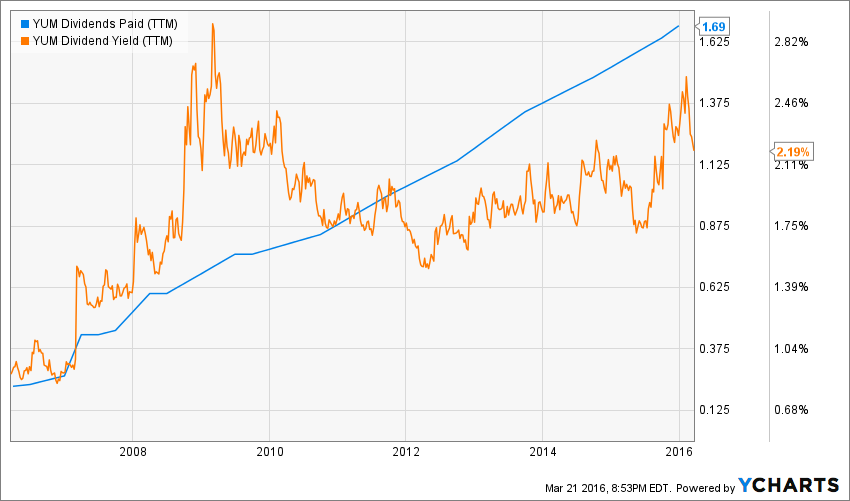

5 Year Dividend Growth: 13.94%

Current Dividend Yield: 2.19%

What Makes YUM! Brands (YUM!) a Good Business?

In three words, you can resume what YUM! Brands is… Tacos, Chicken, Pizza:

Source: YUM! website

YUM! Brands operates the brands of Kentucky Fried Chicken, Taco Bell, and Pizza Hut, with over 42,500 restaurants in over 125 countries. The company was spun off from Pepsico in 1997, and maintains a partnership with that company. Ironically, the company now plans to spin-off its Chinese division by the end of 2016. At the moment, this is like saying goodbye to 52% of its revenues, but will also leave lots of problems behind in exchange for a perpetually increasing dividend (more on this plan later).

Although not the largest in terms of revenue, YUM! Brands is the largest restaurant operator in the world in terms of the number of locations. YUM wants to positioned its company as a pure franchise play after the transformation with 96% of its restaurants operated by franchisees. The best part of franchise business models is their ability to generate a constant cash flow for investors.

Ratios

Price to Earnings: 27.25

Price to Free Cash Flow: 27.89

Price to Book: 35.69

Return on Equity: 85.53%

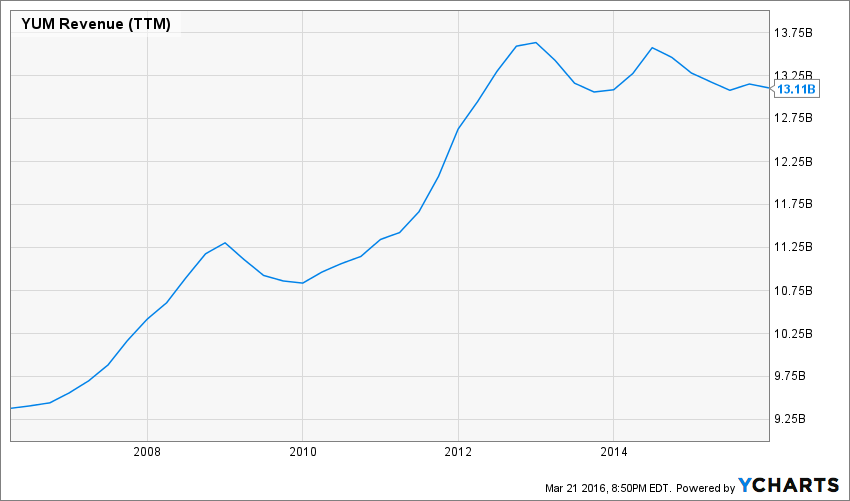

Revenue

Revenue Graph from Ycharts

As the number of restaurants in China skyrocketed from 1,792 in 2005 to 3,906 in 2010 and then over 7,000 by the end of 2015, the currency impact and recent bad press events in China (2014 and 2015) has hit their revenue growth.

After the spin-off, revenues are expected to grow in a more stable and predictable way as the company will sell the Chinese volatile operations in exchange for a 3% licence fee to give YUM! China the exclusive right to operate KFC, Pizza Hut and soon Taco Bell. The search for low-volatility revenues is the first reason to spin-off the Chinese restaurants.

How YUM! fares vs My 7 Principles of Investing

We all have our methods for analyzing a company. Over the years of trading, I’ve been through several stock research methodologies from various sources. This is how I came up with my 7 investing principles of dividend investing. Let’s take a closer look at them.

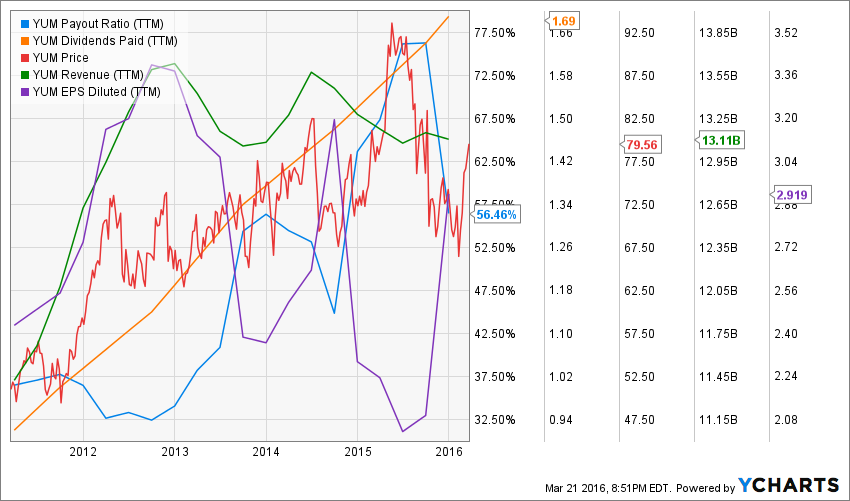

Source: Ycharts

Principle #1: High Dividend Yield Doesn’t Equal High Returns

My first investment principle goes against many income seeking investors’ rule: I try to avoid most companies with a dividend yield over 5%. Very few investments like this will be made in my case (you can read my case against high dividend yield here). The reason is simple; when a company pays a high dividend, it’s because the market thinks it’s a risky investment… or that the company has nothing other than a constant cash flow to offer its investors. However, high yield hardly come with dividend growth and this is what I am seeking most.

Source: data from Ycharts.

When I created my portfolios at DividendStocksRock back in 2013, the company yield wasn’t interesting enough for a company in the consumer cyclical industry. You can find many other higher yielding company in this sector. However, by looking at the constant dividend growth trend and the recent push of the yield over 2%, I started to look into the company a bit more. YUM meets my 1st investing principle.

Principle#2: Focus on Dividend Growth

My second investing principle relates to dividend growth as being the most important metrics of all. It not only proves management’s trust in the company’s future but is also a good sign of a sound business model. Over time, a dividend payment cannot be increased if the company is unable to increase its earnings. Steady earnings can’t be derived from anything else but increasing revenues. Who doesn’t want to own a company that shows rising revenues and earnings?

Since the company started to pay dividends only in 2004, the company can’t have a 50 year dividend history. However, in 2015, YUM! has achieved its 11th consecutive year with double digit dividend growth. This is quite impressive for any type of company. This is the kind of statistic that makes you understand why you can’t ignore a low dividend yield payer, right? There is no question that YUM meets my 2nd investing principle.

Principle #3: Find Sustainable Dividend Growth Stocks

Past dividend growth history is always interesting and tells you a lot about what has happened with a company. As investors, we are more concerned about the future than the past. this is why it is important to find companies that will be able to sustain their dividend growth.

Source: data from Ycharts.

Being able to propulse your dividend payment into double digits year after year doesn’t mean you will be able to maintain it. Interesting enough, the company has been able to maintain a relatively stable payout ratio over the years. Even better, the payout ratio is around 56% and the cash payout ratio is at 62%. Therefore, the cash flow generation is able to maintain such strong dividend growth in the future. It will become even easier to plan after the spin-off completion at the end of 2016. YUM meets my 3rd investing principle.

Principle #4: The Business Model Ensure Future Growth

YUM! Shows an impressive number of restaurants spread among three distinct brands. The business is the global leader in chicken, pizza and mexican style restaurants in terms of number of restaurants. This gives it a unique economic moat that is very hard to cross.

The new YUM! Business model will be solely based on a franchise model which enables predictable and continuously increasing cash flow generation. The number of Chinese restaurants will continue to grow at a very fast pace, following the growth of the middle-class. This will lead to ever bigger franchising fees without having the problem to deal with Chinese market volatility. For these two reasons, YUM meets my 4th investing principle.

Principle #5: Buy When You Have Money in Hand – At The Right Valuation

I think the perfect time to buy stocks is when you have money. Sleeping money is always a bad investment. However, it doesn’t mean that you should buy everything you see because you have some savings put aside. There is some valuation work to be done. In order to achieve this task, I will start by looking at how the stock market has valued the stock over the past 10 years by looking at its PE ratio:

Source: data from Ycharts.

YUM seems to have generated much hype recently as the company used to trade around a 20 PE ratio for the majority of the past 10 years. Recently, it has gone up to 45 and it is now down to 27. Obviously, the best moment to buy YUM would have been at the beginning of 2016 since the stock is now up close to 9% ytd. Does it mean it’s too late to join the party? Let’s use the dividend discount model (DDM) to see if the company is trading at a fair value.

In order to do so, I will use a 10% dividend growth rate for the first 10 years. This seems quite generous, but if you consider the company has increased its payment in the double digit range for the past 11 years and they are about to create even more cash flow, it seems almost too low. Keep in mind the 5 year average dividend increase is 13% at the moment. After the first 10 year period, I expect the company to drift to a more conservative level of 7% growth rate. Since the company is evolving in a cyclical market, I can’t use a 9% discount rate. I would rather play conservative and use a 10% discount rate. After all, the stock is trading at a PE ratio of 27.25.

| Input Descriptions for 15-Cell Matrix | INPUTS |

| Enter Recent Annual Dividend Payment: | $1.84 |

| Enter Expected Dividend Growth Rate Years 1-10: | 10.00% |

| Enter Expected Terminal Dividend Growth Rate: | 7.00% |

| Enter Discount Rate: | 10.00% |

Here are the results of my calculations:

| Calculated Intrinsic Value OUTPUT 15-Cell Matrix | |||

| Discount Rate (Horizontal) | |||

| Margin of Safety | 9.00% | 10.00% | 11.00% |

| 20% Premium | $152.65 | $100.83 | $74.97 |

| 10% Premium | $139.93 | $92.43 | $68.72 |

| Intrinsic Value | $127.21 | $84.03 | $62.47 |

| 10% Discount | $114.49 | $75.62 | $56.23 |

| 20% Discount | $101.77 | $67.22 | $49.98 |

Source: Dividend Monk Toolkit Excel Calculation Spreadsheet

As you can see, even by being conservative with my assumptions, I still get a 5% discount on the current price. There will also be some speculation in regards to what is coming next. I think there will be more cash flow generated leading to a higher dividend growth rate in the first 10 years. In any case, YUM meets my 5th investing principle.

Principle #6: The Rationale Used to Buy is Also Used to Sell

I’ve found one of the biggest investor struggles is to know when to buy and when to sell his holdings. I use a very simple, but very effective rule to overcome my emotions when it is the time to pull the trigger. My investment decisions are motivated by the fact that the company confirms or not my investment thesis. Once the reasons (my investment thesis) why I purchased shares of a company are no longer valid, I sell and never look back.

Investment thesis

I think the investment thesis is pretty obvious by now. The company is moving towards a stable, growing and low volatility free cash flow generation stream business model. Plus, YUM will benefit from a stronger economy in the US in the upcoming years and will also earn increasing franchise licence fees from its Chinese spin-off without having to deal with its volatility. An investment in YUM at the moment is also a play on the success of the future spin-off.

Risks

The first risk I see is that the transaction doesn’t create the impact management wants us to believe. The Chinese stock market volatility might not help the elaboration of a successful spin-off and investors may be left behind.

The second risk is more related to the overall business as there is much important competition in the fast food industry. We see how McDonald’s (MCD) is struggling to find growth vectors over the past few years. YUM is no different in this sector where the switching cost for customers is near zero.

The investment thesis is strong enough to claim that YUM meets my 6th investing principle.

Principle #7: Think Core, Think Growth

My investing strategy is divided into two segments: the core portfolio built with strong & stable stocks meeting all our requirements. The second part is called the “dividend growth stock addition” where I may ignore one of the metrics mentioned in principles #1 to #5 for a greater upside potential (e.g. riskier pick as well).

Having both segments helps me to categorize my investments into a “conservative” or “core” section and a “growth” section. I then know exactly what to expect from it; a steady dividend payment or higher fluctuation with a great growth potential.

Considering the new YUM!, we can expect YUM to be part of a strong core dividend portfolio. Since the stock price is already trading at high multiples, I don’t expect to see it go through the roof in the upcoming years. However, its steadily increasing dividend is a good argument for any income seeking investor. YUM is a core holding.

Final Thoughts on YUM! – Buy, Hold or Sell?

I must admit that I’ve been somewhat seduced by YUM’s impressive dividend growth rate over the past 11 years. However, keep in mind that the new YUM! will be different and we don’t know exactly how this will reflect on the dividend payment. At the moment, I think YUM is an interesting play for more courageous investors that are willing to invest in the future cash flow generating machine this company will become.

Disclaimer: I do not hold YUM! in my DividendStocksRock portfolios.

Disclaimer: The opinions and the strategies of the author are not intended to ever be a recommendation to buy or sell a security. The strategy the author uses has worked for him and it is for you to decide if it could benefit your financial future. Please remember to do your own research and know your risk tolerance.

I think the spinoff will bring a lot more clarity to both sets of operations and I like the increase to the franchise model since it’s more stable. When the spinoff was announced the $6.2 B to be returned to shareholders prior to the spinoff seemed to be glossed over. I was hoping for a 50/50 split between buybacks and special dividends but it seems like management is preferring to go 100% buybacks. That’s very disappointing and I don’t think it’s the best use of that capital. Although my hunch is they will be rewarded with fat share bonuses for successfully navigating the spinoff so they have to negate some of the dilution. That’s something I really need to look into.

I’m curious though why you assume a 10% dividend growth rate for the next 10 years. A lot of the past growth has been fueled by payout ratio expansion although currency fluctuations have definitely played a big part as well with the payout ratio changes. Especially since revenues have been increasing more on the foreign side rather than the domestic side.

Thanks for the look at YUM because they’ve been on my list to look at more in depth with the upcoming split up.

Hello JC,

Thx for stopping by!

I’ve used a 10% dividend growth for the first 10 years as I think YUM will be able to maintain an aggressive dividend growth over a short period of time. The spin-off and the focus on the franchise business will create an additional boost of cash flow. There are still lots of growth potential over the next 10 years and this is why I think YUM will be able to keep up with such high growth rate. Then, I dropped it to 7% to make it more sustainable.

I hope it answers your question :-)

Cheers,

Mike