Summary:

CSX corporation has been severely hit by a slowing coal industry.

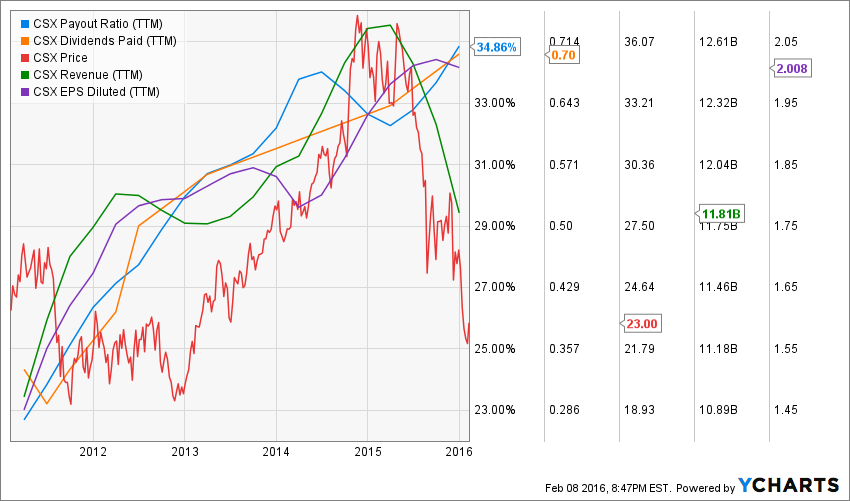

The dividend growth greatly outpaced revenue and EPS growth over the past 5 years.

CSX’s relatively high payout ratio for its industry makes me doubt there will be strong dividend payment rise in the future. Fortunately, current cash flow is strong enough to support existing payments and future raises.

DSR Quick Stats

Sector: Industrial railroads

5 Year Revenue Growth: 2.12%

5 Year EPS Growth: 8.11%

5 Year Dividend Growth: 16.47%

Current Dividend Yield: 3.04%

What Makes CSX Corporation (CSX) a Good Business?

CSX Corporation (NYSE: CSX) is a large railroad company with over 21,000 miles of track in 23 states. The company had a period of poor management and performance, but in the last several years has rebounded to become a strong performer as a Class I railroad. The company serves several segments:

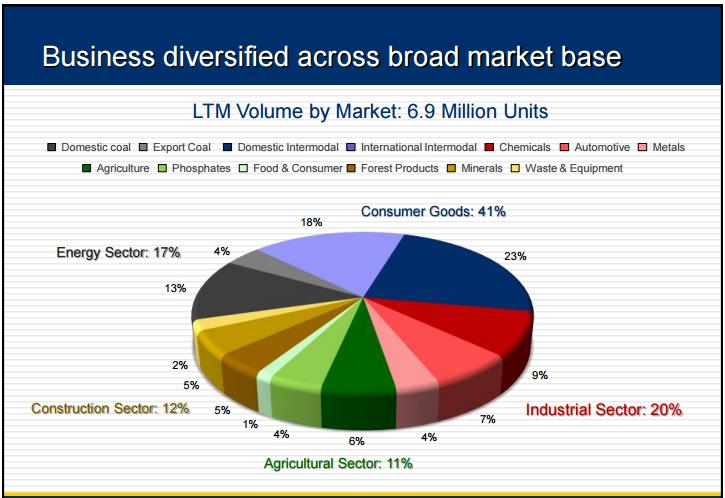

source: CSX Investors presentation

Consumer Goods

General merchandise is the largest segment, accounting for 43% of total revenue. This is further divided into Automotive, Metals, Chemicals, Phosphates, Agriculture, Food and Consumer, Forest, and Exports.

Coal

Coal is a large individual component of revenue, with 13% of total revenue coming from domestic coal transport, and 4% of total revenue coming from exported coal transportation, for a total of 17%. Domestic coal is currently facing strong headwinds.

Intermodal

For CSX, 41% of revenue came from intermodal shipping.

In numbers, the company…

- Operates an average of 1,500 trains per day.

- Transports an average of 20,000 carloads per day.

- Transports more than 6.5 million carloads of products and raw material annually.

- Maintains a fleet of more than 4,000 locomotives.

- Maintains a fleet of approximately 70,000 freight cars.

Ratios

Price to Earnings: 11.45

Price to Free Cash Flow: 27.75

Price to Book: 1.922

Return on Equity: 17.19

Revenue

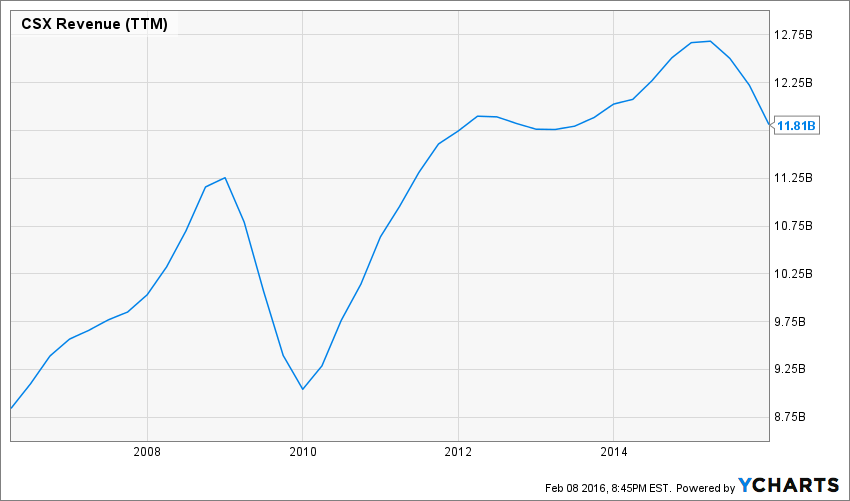

Revenue Graph from Ycharts

It is without any surprise revenues are down from its previous peak. With a slowing energy sector coupled with a low oil prices leading to more competitive truck transportation, there was no place to hide for railroads in 2015. A similar situation may happen during 2016.

How CSX fares vs My 7 Principles of Investing

We all have our methods for analyzing a company. Over the years of trading, I’ve been through several stock research methodologies from various sources. This is how I came up with my 7 investing principles of dividend investing. Let’s take a closer look at them.

Source: Ycharts

Principle #1: High Dividend Yield Doesn’t Equal High Returns

My first investment principle goes against many income seeking investors’ rules: I try to avoid most companies with a dividend yield over 5%. Very few investments like these will be made in my case (you can read my case against high dividend yield here). The reason is simple; when a company pays a high dividend, it’s because the market thinks it’s a risky investment… or that the company has nothing else but a constant cash flow to offer its investors. However, high yield hardly comes with dividend growth and this is what I am seeking most.

Source: data from Ycharts.

The company’s dividend yield has been quite hectic over the past 10 years. You can appreciate how the CSX stock price could be volatile. It went from slightly under $8 in 2006 to $23 in 2008 to drop back to $7.50 in 2009 and so on. Most recently the dividend yield became interesting (over 2%) as a consequence of both strong dividend growth and a stock price drop. CSX meets my first principle.

Principle#2: Focus on Dividend Growth

My second investing principle relates to dividend growth as being the most important metric of all. It doesn’t only prove management’s trust in the company’s future but it is also a good sign of a sound business model. Over time, a dividend payment cannot be increased if the company is unable to increase its earnings. Steady earnings can’t be derived from anything else but increasing revenue. Who doesn’t want to own a company that shows rising revenues and earnings?

As you can see on the previous graph, the company has been on a strong dividend increase trend over the past 5 years. Since 2006, the company keeps increasing its dividend year after year. The slight dip in dividends paid in 2011 is explained by a 3 for 1 split. CSX meets my second principle.

Principle #3: Find Sustainable Dividend Growth Stocks

Past dividend growth history is always interesting and tells you a lot about what happened to a company.As investors, we are more concerned about the future than the past, this is why it is important to find companies that will be able to sustain their dividend growth.

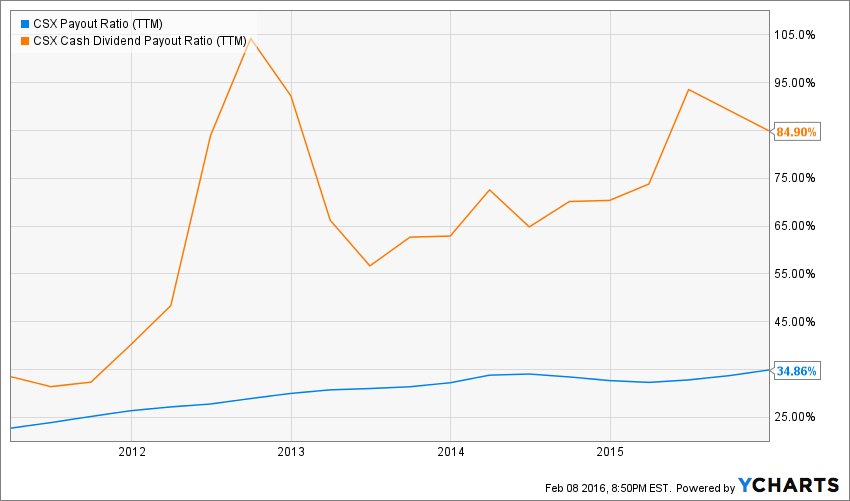

Source: data from Ycharts.

As you can see, it can be crucial to compare the classic payout ratio with the cash payout ratio. A look at the past 5 year payout ratio makes me concerned about future dividend growth. Considering an 85% payout ratio, it is almost impossible to keep double digit dividend growth as management has over the past 5 years. However, since railroads are strong cash flow generating companies, you can see that there is enough money coming in each year to let the management increase its payments in the future. Finally, it appears to me the company will not be able to keep such impressive dividend growth in the future. CSX partially meets my third principle.

Principle #4: The Business Model Ensures Future Growth

Another key leading to strong dividend growth is the company’s business model. As far as I am concerned, rail companies show among the most solid business model of all. It’s almost impossible to replicate for a new competitors and existing railroads will continue to generate cash flow for years. CSX operates (read controls) an important part of the railways in Eastern North America.

While railroads are cyclical and follow the economy, we can be certain there will be more goods transported by train in the future. CSX meets my fourth principle.

Principle #5: Buy When You Have Money in Hand – At The Right Valuation

I think the perfect time to buy stocks is when you have money. Sleeping money is always a bad investment. However, it doesn’t mean that you should buy everything you see because you have some savings put aside. There is valuation work to be done. In order to achieve this task, I will start by looking at how the stock market has valued the stock over the past 10 years by looking at its PE ratio:

Source: data from Ycharts.

It seems many investors have been on a tear since 2013 and landed back on Earth last year. The stock looks cheap with a PE ratio under 12. A patient investor will definitely be able to see some return on his investment once the transportation sector picks up again.

I like to consider companies as pure dividend distribution machines. It helps me see the right value as a dividend growth investor. In order to use the dividend discount model (DDM), I will use the following inputs:

| Input Descriptions for 15-Cell Matrix | INPUTS |

| Enter Recent Annual Dividend Payment: | $0.72 |

| Enter Expected Dividend Growth Rate Years 1-10: | 5.00% |

| Enter Expected Terminal Dividend Growth Rate: | 6.00% |

| Enter Discount Rate: | 9.00% |

As you can see, I’ve used a 5% dividend growth rate for the first 10 years and 6% afterwards. I think the company will be able to generate more profit once the current cycle is over. Here’s the valuation I get:

| Calculated Intrinsic Value OUTPUT 15-Cell Matrix | |||

| Discount Rate (Horizontal) | |||

| Margin of Safety | 8.00% | 9.00% | 10.00% |

| 20% Premium | $41.97 | $28.08 | $21.13 |

| 10% Premium | $38.48 | $25.74 | $19.37 |

| Intrinsic Value | $34.98 | $23.40 | $17.61 |

| 10% Discount | $31.48 | $21.06 | $15.85 |

| 20% Discount | $27.98 | $18.72 | $14.09 |

Source: Dividend Monk Toolkit Excel Calculation Spreadsheet

It is slightly disappointing to realize that with conservative numbers, the company doesn’t appear to be undervalued. On the other hand, if the company keeps up with a dividend increase of 6.5% in stead of 6% after 10 years, the fair price goes up to $27.00. CSX barely meets my 5th principle.

Principle #6: The Rationale Used to Buy is Also Used to Sell

I’ve found one of the biggest investors’ struggles is to know when to buy and when to sell his holdings. I use a very simple, but effective rule to overcome my emotions when it is the time to pull the trigger. My investment decisions are motivated by the fact that the company confirms or not my investment thesis. Once the reasons (my investment thesis) why I purchase shares of a company are no longer valid anymore, I sell and never look back.

Investment thesis

The reason to buy CSX is quite simple. The company has made great improvements to its operations in the past couple of years. It now translates into better profitability and operating ratio. It is relatively rare to be able to buy a rail company paying such an interesting dividend yield (over 3%). The choice of railways will always be a better one compared to truck transportation businesses over the long haul. It is less expensive, doesn’t contribute to highway congestion and is better for the environment.

Risks

As long as oil prices remain low, trucking will take market share away from railroad companies. In addition to this, the coal industry keeps slowing down and CSX is one of its victims. Back in 2011, coal transportation represented almost 32% of the company’s revenue and it’s now down to 17%. This may become a problem in the future. Railroads demand a high cost of maintenance and it becomes difficult for a company to maintain both its railways and dividend growth pace with declining revenues.

CSX shows enough strong reasons to buy to meet my 6th investing principle.

Principle #7: Think Core, Think Growth

My investing strategy is divided into two segments: the core portfolio built with strong & stable stocks meeting all our requirements. The second part is called the “dividend growth stock addition” where I may ignore one of the metrics mentioned in principles #1 to #5 for a greater upside potential (e.g. riskier pick as well).

Having both segments helps me to categorize my investments into a “conservative” or “core” section or into a “growth” section. I then know exactly what to expect from it; a steady dividend payment or more volatility with a great growth potential.

Considering the conservative nature of CVX’s business, I would pick this company as a core investment. It shows a relatively stable business model where you can rest assured to see an increasing dividend coming each year. CSX would fit in a core portfolio according to my 7th investing principle.

Final Thoughts on CSX– Buy, Hold or Sell?

The overall picture seems okay, but I’m not ready to jump on this train. I personally think another railroad is more appealing. It’s Union Pacific (UNP). You can read my analysis on Seeking Alpha here.

What do you think? CSX or UNP?

Disclaimer: I do not hold CSX in my DividendStocksRock portfolios.

Disclaimer: The opinions and the strategies of the author are not intended to ever be a recommendation to buy or sell a security. The strategy the author uses has worked for him and it is for you to decide if it could benefit your financial future. Please remember to do your own research and know your risk tolerance.

Hi, with a yield 3% wouldn’t you prefer to increase an existing position in a noncyclical stock right now?

Thanks

Luca

I think buying a company in a cyclical business such as train is a good idea right now considering all stock price went down.

Cheers,

Mike